Earnings summaries and quarterly performance for ASHLAND.

Research analysts who have asked questions during ASHLAND earnings calls.

John Ezekiel Roberts

Mizuho Securities

6 questions for ASH

David Begleiter

Deutsche Bank

5 questions for ASH

Michael Sison

Wells Fargo

5 questions for ASH

Bhavesh Lodaya

BMO Capital Markets

3 questions for ASH

Josh Spector

UBS Group

3 questions for ASH

Michael Harrison

Seaport Research Partners

3 questions for ASH

Chris Parkinson

Wolfe Research, LLC

2 questions for ASH

Christopher Parkinson

Wolfe Research

2 questions for ASH

Daniel Rizzo

Jefferies

2 questions for ASH

Eric Boyce

Evercore

2 questions for ASH

Jeffrey Zekauskas

JPMorgan Chase & Co.

2 questions for ASH

John McNulty

BMO Capital Markets

2 questions for ASH

Joshua Spector

UBS

2 questions for ASH

Mike Harrison

Seaport Research Partners

2 questions for ASH

Steven Haynes

Morgan Stanley

2 questions for ASH

John Spector

UBS

1 question for ASH

Kevin Estok

Jefferies

1 question for ASH

Laurence Alexander

Jefferies

1 question for ASH

Recent press releases and 8-K filings for ASH.

- Ashland's agrimer™ eco-coat polymer seed coating, based on its patented Transformed Vegetable Oils (TVO) technology, has received United States Environmental Protection Agency (EPA) approval.

- This approval allows the ingredient to be used in all food and non-food pesticide formulations under regulation 40 CFR 180.960.

- The EPA posting now enables U.S. growers to buy, sell, and test the agrimer™ eco-coat polymer seed coating, building on previous approvals in Latin America, Europe, and other regions.

- Agrimer™ eco-coat polymer is a nature-based, microplastic-free, and inherently biodegradable advanced seed coating technology.

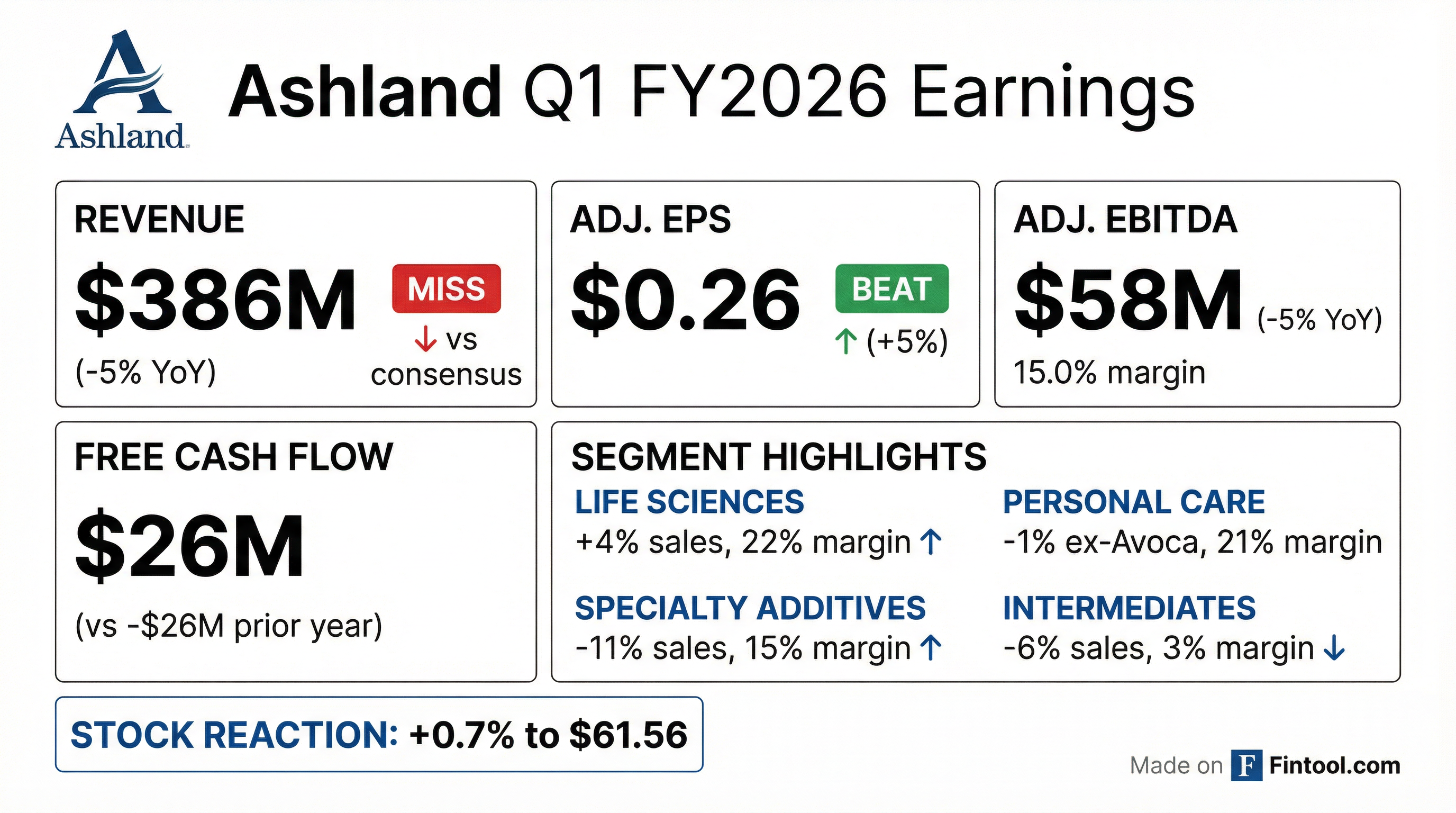

- Ashland reported Q1 FY26 adjusted sales of $386 million, a 5% decrease year-over-year, with adjusted EBITDA also down 5% to $58 million and adjusted EPS at $0.26, a 7% decline compared to the prior-year quarter.

- Segment performance was mixed, with Life Sciences sales growing 4% year-over-year, while Personal Care sales decreased 8% (or 1% organically excluding the Avoca divestiture), Specialty Additives sales fell 11%, and Intermediates sales were down 6%.

- The company generated $26 million in ongoing Free Cash Flow in Q1 FY26, a significant improvement from a negative $26 million in Q1 FY25.

- Ashland reaffirmed its FY26 outlook, projecting sales between $1,835 million and $1,905 million and adjusted EBITDA between $400 million and $420 million, with double-digit-plus adjusted EPS growth.

- Ashland reported Q1 2026 sales of $386 million, a 5% decrease year-over-year, and adjusted EBITDA of $58 million, also down 5% year-over-year, with adjusted EPS at $0.26. The quarter's adjusted EBITDA included a $10 million impact from the Calvert City outage, which led to over 250 basis points of margin compression.

- The company narrowed its fiscal 2026 adjusted EBITDA guidance to $400 million-$420 million, reflecting an anticipated $11 million impact in Q2 from the extended Calvert City startup delay and recent weather-related disruptions.

- While Life Sciences delivered healthy growth and Personal Care remained stable, Specialty Additives experienced muted demand in coatings and construction, particularly in China and export markets.

- Ashland is on track with its cost savings target of $30 million for fiscal 2026 and expects to deliver $35 million in revenue from its Globalize and Innovate platforms, which are showing strong momentum.

- The company identifies GLP-1 formulations and oral biologics as a significant opportunity for its VP&D portfolio and tablet coatings, with multiple active projects and new innovations like sodium caprate.

- Ashland reported Q1 2026 sales of $386 million, a 5% decrease year-over-year (or 3% excluding the Avoca divestiture), and adjusted EBITDA of $58 million, also down 5% year-over-year (or 3% excluding the divestiture).

- Adjusted EPS, excluding intangible amortization, was $0.26, a 7% decrease from the prior year.

- The company generated $125 million of cash from operating activities and $26 million of ongoing free cash flow in Q1 2026.

- Operational challenges, including the Calvert City outage and recent weather-related disruptions, are expected to result in approximately $11 million of temporary impacts in Q2 2026, extending the impact from Q1.

- Ashland is on track to deliver its fiscal 2026 targets for $35 million in revenue from Globalize and Innovate platforms and $30 million in total cost savings, and has narrowed its fiscal 2026 adjusted EBITDA guidance range to $400 million-$420 million.

- Ashland Inc. reported Q1 2026 sales of $386 million, a 5% decrease year-over-year, and adjusted EBITDA of $58 million, also down 5%.

- The company narrowed its fiscal 2026 adjusted EBITDA outlook to $400 million-$420 million, while other guidance elements remain unchanged.

- Operational challenges, including a $10 million adjusted EBITDA impact from the Calvert City outage in Q1, are now expected to extend into Q2 2026.

- Life Sciences sales increased 4% to $139 million, with adjusted EBITDA growing 11% to $31 million, driven by strong pharma demand and innovation.

- Ashland is on track to achieve its fiscal 2026 $35 million revenue commitment from Globalize and Innovate initiatives, having generated $3 million and $6 million in incremental sales respectively in Q1 2026.

- Ashland Inc. reported Q1 fiscal 2026 sales of $386 million, a five percent decrease from the prior-year quarter, and a net loss of $12 million, or $(0.26) per diluted share.

- Adjusted EBITDA for Q1 fiscal 2026 was $58 million, representing a 15 percent margin, which is down five percent from the prior-year quarter.

- The company narrowed its full-year fiscal 2026 Adjusted EBITDA guidance to a range of $400 million to $420 million from its prior guidance of $400 million to $430 million. This adjustment reflects approximately $11 million of temporary impacts from the Calvert City startup delay and recent weather-related disruptions, isolated to the second quarter.

- All other elements of the full-year guidance remain unchanged, including sales guidance of $1,835 million to $1,905 million.

- For the first quarter of fiscal year 2026, which ended December 31, 2025, Ashland reported sales of $386 million, a five percent decrease from the prior-year quarter.

- The company recorded a net loss of $12 million, or $(0.26) per diluted share, and Adjusted EBITDA of $58 million for the quarter.

- Ashland narrowed its full-year fiscal 2026 Adjusted EBITDA guidance to $400–$420 million, reflecting approximately $11 million of temporary impacts from the Calvert City startup delay and recent weather-related disruptions isolated to the second quarter.

- Cash flows provided by operating activities were $125 million, and Ongoing Free Cash Flow totaled $26 million for the quarter.

- Ashland reported Q4 2025 sales of $478 million, an 8% year-over-year decrease primarily due to portfolio optimization, and adjusted EBITDA of $119 million, down 4% year-over-year. On a comparable basis (excluding portfolio actions), sales declined 1% and adjusted EBITDA increased 5%, with margins expanding to 24.9%.

- Life Sciences and Personal Care segments demonstrated resilience, while Specialty Additives and Intermediates faced continued pressure from market conditions and competitive intensity.

- The company completed its $30 million restructuring program, realizing $20 million in savings in fiscal 2025, and expects an additional $12 million in fiscal 2026. The manufacturing optimization initiative is also progressing, with $5 million in savings in fiscal 2025 and $18 million projected for fiscal 2026.

- For fiscal 2026, Ashland projects full-year sales between $1,835 million and $1,905 million (1%-5% organic growth) and adjusted EBITDA between $400 million and $430 million. Adjusted EPS is expected to grow double digits plus, and free cash flow conversion is targeted at 50%.

- For Q4 FY25, Ashland reported sales of $478 million, an 8% decrease from Q4 FY24, and Adjusted EBITDA of $119 million, a 4% decrease.

- The company achieved an Adjusted EBITDA margin of 24.9% in Q4 FY25, an increase of 110 basis points compared to the prior-year quarter, driven by cost savings and mix.

- Adjusted EPS for Q4 FY25 was $1.08, down 14% from Q4 FY24, and ongoing Free Cash Flow was $52 million, a 41% decrease.

- For fiscal year 2026, Ashland anticipates sales between $1,835 million and $1,905 million and Adjusted EBITDA between $400 million and $430 million.

- The company expects double-digit-plus Adjusted EPS growth and approximately 50% ongoing Free Cash Flow conversion of Adjusted EBITDA in FY26.

- Ashland Inc. reported fourth-quarter fiscal year 2025 sales of $478 million, an eight percent decrease from the prior-year quarter, and net income of $32 million, or $0.71 per diluted share.

- Adjusted EBITDA for Q4 2025 was $119 million, down four percent from the prior-year quarter, with cash flows provided by operating activities at $40 million and Ongoing Free Cash Flow of $52 million.

- For the full fiscal year 2025, sales were $1.824 billion, a 14 percent decrease year-over-year, resulting in a net loss of $845 million, or ($18.23) per diluted share, and Adjusted EBITDA of $401 million.

- Ashland issued full-year fiscal 2026 guidance, projecting sales between $1,835 million and $1,905 million, and Adjusted EBITDA between $400 million and $430 million.

Quarterly earnings call transcripts for ASHLAND.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more