Earnings summaries and quarterly performance for ATMOS ENERGY.

Research analysts who have asked questions during ATMOS ENERGY earnings calls.

Nicholas Campanella

Barclays

6 questions for ATO

Richard Sunderland

JPMorgan Securities LLC

5 questions for ATO

Ryan Levine

Citigroup

5 questions for ATO

Christopher Jeffrey

Mizuho Securities

4 questions for ATO

David Arcaro

Morgan Stanley

3 questions for ATO

Julien Dumoulin-Smith

Jefferies

3 questions for ATO

Aditya Gandhi

Wolfe Research

2 questions for ATO

Fei She

Bank of America

2 questions for ATO

Gabriel Moreen

Mizuho Financial Group, Inc.

2 questions for ATO

Julian Demoulin Smith

Jefferies Financial Group Inc.

2 questions for ATO

Eli

JPMorgan Chase & Co.

1 question for ATO

Eli Khaim

JPMorgan Chase & Co.

1 question for ATO

Jeremy Tonet

JPMorgan Chase & Co.

1 question for ATO

Jeremy Tornette

JPMorgan Chase & Co.

1 question for ATO

Nick Campanella

Barclays PLC

1 question for ATO

Paul Zimbardo

Jefferies Financial Group Inc.

1 question for ATO

Recent press releases and 8-K filings for ATO.

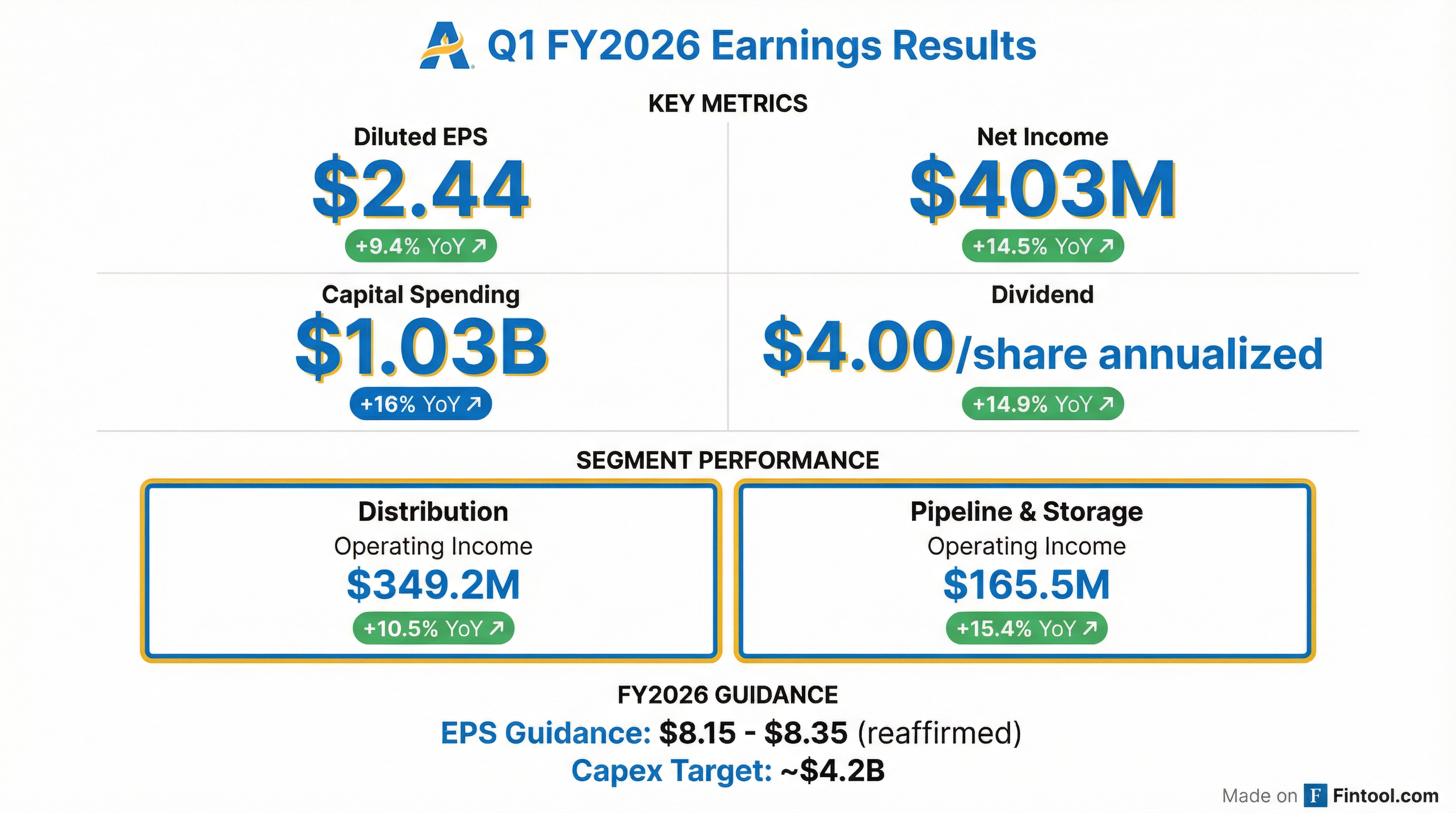

- Reported fiscal Q1 net income of $403 million and $2.44 EPS, a 9.4% increase year-over-year.

- Deployed $1 billion in capital expenditures (85%+ on safety and reliability), advancing key pipeline projects: 55 miles of 36″ pipeline to Groesbeck, 13 miles of the Line WA Loop, doubled Bethel takeaway capacity, and added 700,000 MCF/day interconnects.

- Rebased FY 2026 guidance to $8.15–$8.35 EPS and set the annual dividend at $4.00/share, targeting 6–8% annual dividend growth.

- Achieved 54,000 net customer additions (42,000 in Texas) over the 12 months ended Dec 31, 2025; Q1 customer satisfaction of 98%, ranked #1 by J.D. Power and Escalent in South and Midwest.

- CFO highlighted a $35 million benefit from Texas HB 4384, $68 million of rate increases, a $23 million rise in O&M, completed $600 million debt financing, and maintained $4.6 billion in liquidity with a 60% equity ratio.

- Net income of $403 million and diluted EPS of $2.44, up from $352 million and $2.23 in Q1 2025.

- Operating income of $349.2 million in Distribution (+10.5%) and $165.5 million in Pipeline & Storage (+15.4%).

- Capital spending of $1,033.3 million in Q1 (89% on safety & reliability), compared to $891.2 million a year earlier.

- Financing: issued $600 million 30-year senior notes at 5.45%; maintains $4.6 billion in liquidity; $472 million of equity forwards settled.

- Dividend increased 14.9% to $4.00 per share; FY 2026 guidance: net income $1,380–1,400 million, EPS $8.15–8.35, capex ~$4,200 million.

- Net income of $403 million and EPS of $2.44, up 9.4% year-over-year in Q1 2026

- Capital expenditures of $1 billion, with 85% focused on safety and reliability

- Rebased fiscal 2026 guidance to $8.15–$8.35 EPS and set annual dividend at $4, targeting 6–8% dividend growth

- Completed $1 billion of long-term debt and equity financing; equity capitalization at 60% and $4.6 billion liquidity available

- Net income of $403 million and EPS of $2.44, up 9.4% YoY; fiscal 2026 EPS guidance rebased to $8.15–$8.35 and annual dividend reset to $4.00 per share

- Capital expenditures of $1 billion in Q1, with over 85% targeted at system safety and reliability

- Added 54,000 new customers in the 12 months ending Dec 31, 2025 (including 42,000 in Texas) and achieved 98% customer satisfaction

- Completed key APT pipeline projects: 55 miles of 36″ mainline, placed 13 miles of Loop WA into service (31 miles expected this spring), doubled takeaway capacity at Bethel Salt Dome, and added 700,000 MCF/day of supply interconnects

- Secured over $1 billion in long-term financing—$600 million debt issuance, $472 million equity forwards—maintaining 60% equity capitalization and $4.6 billion in available liquidity

- Atmos Energy earned $403.0 million in net income, or $2.44 per diluted share in Q1 FY2026.

- Capital expenditures totaled $1.0 billion, with over 85% allocated to safety and reliability.

- Reaffirmed FY2026 guidance: $8.15–$8.35 earnings per share and approximately $4.2 billion in capital spending.

- Declared a $1.00 quarterly dividend (annualized $4.00, a 14.9% increase over FY2025).

- Atmos Energy posted Q4 2025 net income of $175 million and diluted EPS of $1.07, up from $134 million and $0.86, respectively, in Q4 2024.

- For FY 2025, net income was $1.199 billion with diluted EPS of $7.46, capital expenditures of $3.56 billion, and the annual dividend was raised 8.1% to $3.48 per share.

- The company ended FY 2025 with $4.9 billion in available liquidity and a 60% equity capitalization, having implemented $333.6 million of regulatory rate increases as of September 30, 2025.

- FY 2026 guidance includes net income of $1.38–1.40 billion, diluted EPS of $8.15–8.35, and capital spending of ~$4.2 billion.

- Atmos Energy delivered $7.46 diluted EPS in Q4 2025, marking the 23rd consecutive year of EPS growth and the 41st consecutive year of dividend increases.

- Fiscal 2026 EPS guidance is $8.15–$8.35, implying 6–8% annual EPS growth from the midpoint, and the board approved an annual dividend of $4.00.

- The company’s five-year (FY 2026–2030) capital plan totals $26 billion, with 85% focused on safety and reliability and 80% of spending in Texas, targeting 13–15% annual rate base growth to approximately $42 billion by FY 2030.

- Texas House Bill 4384 accelerates cost recovery, enabling over 95% of capital spending to be recovered within six months and 99% within 12 months, and contributed $0.12 to FY 2025 EPS.

- As of September 30, 2025, equity capitalization was 60% with $4.9 billion of available liquidity, including $1.6 billion of forward-priced ATM equity proceeds.

- Atmos Energy reported fiscal 2025 diluted EPS of $7.46, marking 23 consecutive years of EPS growth and 41 consecutive years of dividend growth.

- Fiscal 2026 EPS guidance is set at $8.15–$8.35, reflecting a rebased midpoint for 6%–8% annual growth off HB 4384 benefits.

- The board approved a 168th consecutive quarterly dividend, indicating a $4.00 annual dividend for fiscal 2026, a 15% increase.

- A five-year capital plan totaling $26 billion through FY2030 focuses 85% on safety and reliability, with ~80% of spending in Texas.

- Major pipeline projects, including 55 mi Bethel–Groesbeck and 44 mi WA Loop II, are nearing in-service late CY 2025.

- Atmos Energy reported FY 2025 diluted EPS of $7.46, marking the 23rd consecutive year of EPS growth and the 41st consecutive year of dividend growth.

- Consolidated capital spending rose to $3.6 billion (87% on safety/reliability); rate base increased 14% to ~$21 billion; and consolidated O&M (ex-VAT) was $874 million for FY 2025.

- Management set FY 2026 EPS guidance at $8.15–$8.35, targeting 6–8% annual EPS growth through FY 2030 (EPS of $10.80–$11.20) and approved an indicated FY 2026 dividend of $4.00, a 15% increase over FY 2025.

- A five-year capital plan through FY 2030 calls for $26 billion of investment (85% on safety/reliability), with $21 billion (80%) allocated to Texas, supporting an expected rate base of ~$42 billion by FY 2030.

- The company ended FY 2025 with 60% equity capitalization and $4.9 billion of available liquidity (including $1.6 billion of ATM equity proceeds) to fund future operations.

- Reported fiscal 2025 EPS of $7.46 on net income of $1.2 billion.

- Delivered $3.6 billion in capital expenditures, with approximately 87% focused on safety and reliability.

- Maintained a 60.3% equity capitalization and $4.9 billion in available liquidity.

- Issued fiscal 2026 guidance of $8.15–$8.35 EPS and ~$4.2 billion in capital spending.

- Increased the quarterly dividend to $1.00 per share (annualized $4.00; +14.9% over fiscal 2025).

Fintool News

In-depth analysis and coverage of ATMOS ENERGY.

Quarterly earnings call transcripts for ATMOS ENERGY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more