ATMOS ENERGY (ATO)·Q1 2026 Earnings Summary

Atmos Energy Posts Strong Q1 as EPS Jumps 9.4%, Boosts Dividend 15%

February 4, 2026 · by Fintool AI Agent

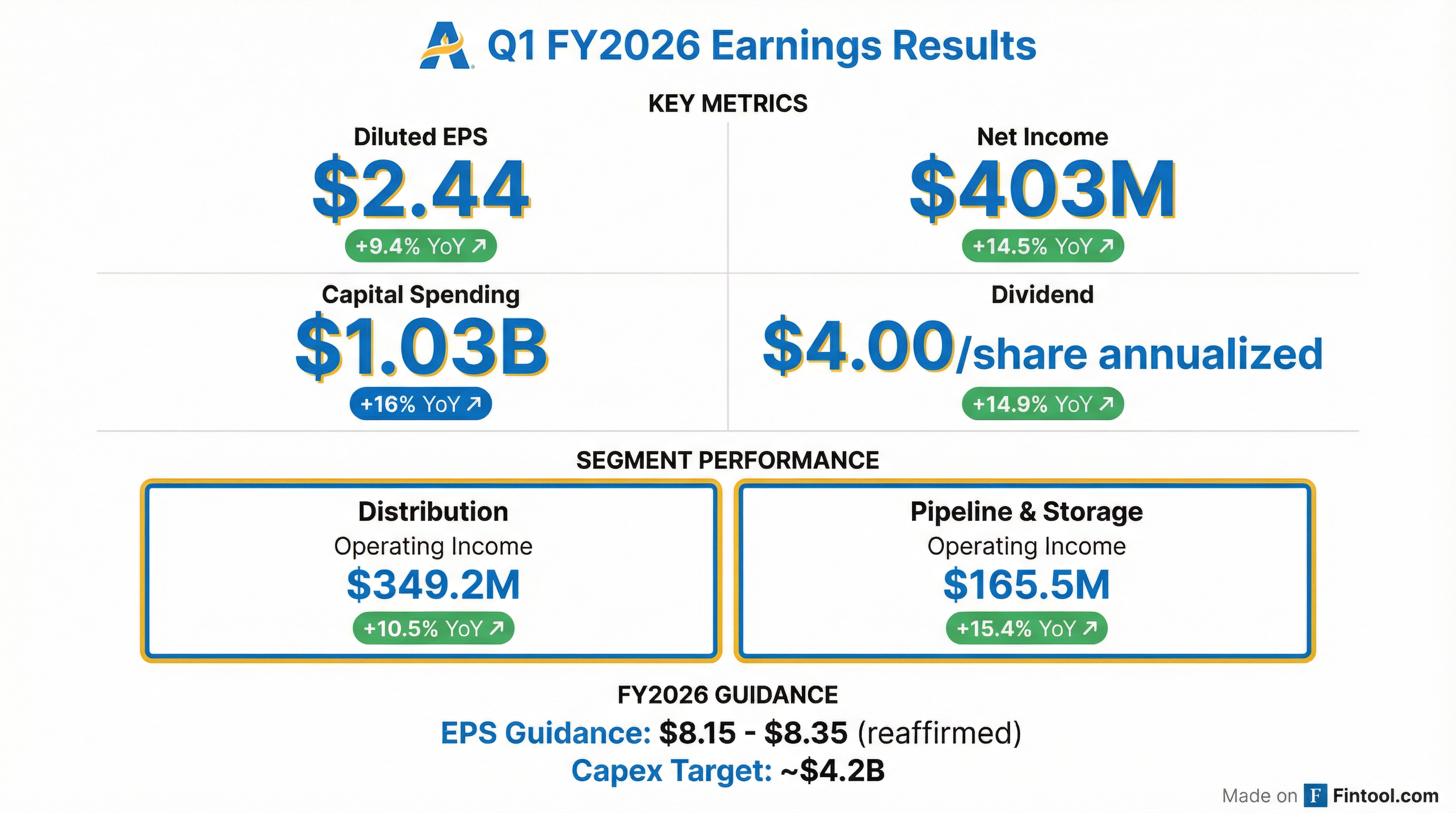

Atmos Energy (NYSE: ATO) delivered a strong start to fiscal 2026, reporting Q1 diluted EPS of $2.44, up 9.4% from $2.23 in the prior year period . Net income rose 14.5% to $403 million, driven by rate adjustments across its service territories and continued customer growth in Texas . The utility also raised its annual dividend by 14.9% to $4.00 per share—its 42nd consecutive year of dividend increases .

Did Atmos Energy Beat Earnings?

Atmos delivered solid year-over-year growth across all key metrics:

The strong quarter was driven by $122.9 million in rate adjustments implemented through February 3, 2026, with an additional $81.2 million currently in progress .

What Did Management Say About Winter Storm Fern?

CEO Kevin Akers opened the call highlighting the company's successful navigation of Winter Storm Fern, which impacted 40 states across the country:

"During Winter Storm Fern, all segments of our business—distribution, transmission, Atmos Pipeline-Texas, our underground storage systems, gas supply plans, and our customer support operations—all performed very well and to design expectations. I am very proud of our team and their efforts."

Management emphasized that unlike Winter Storm Uri in 2021, upstream supply performed well with minimal disruptions:

"The storm was not nearly as significant as Uri... Supply performed very well. We had minimal supply issues, and what we did have, we were able to backfill with storage itself to keep a steady and reliable supply of natural gas flowing."

CFO Chris Forsythe confirmed that investors should not expect Uri-like financial impacts from this storm.

What Drove Segment Performance?

Both operating segments delivered double-digit operating income growth:

Distribution Segment

Operating income rose $33.2 million (+10.5%) to $349.2 million .

Key drivers:

- +$47.7M — Net increase from rate adjustments, primarily in Mid-Tex division

- +$20.0M — Implementation of Texas HB 4384

- +$14.4M — Increase in consumption, net of weather normalization

- +$5.8M — Residential customer growth and increased industrial load

Partially offset by:

- -$24.8M — Higher depreciation and property taxes

- -$8.7M — Increased system-monitoring and compliance costs

Pipeline & Storage Segment

Operating income increased $22.1 million (+15.4%) to $165.5 million .

Key drivers:

- +$20.2M — Rate adjustments from GRIP filing (June 2025) and SSI Rider (November 2024)

- +$15.2M — Texas HB 4384 implementation

- +$7.4M — Increased through-system activities from higher spreads

- +$3.8M — Higher contracted capacity from tariff customers

Through-system spread tailwind: Waha spreads widened significantly to an average of $3.99 vs. $1.56 in the prior year quarter, driven by rising associated gas production, constrained takeaway capacity, and lower demand due to warm weather . Through-system volumes declined approximately 2 Bcf due to increased maintenance, but the wider spreads more than offset the volume decline, contributing $7 million to operating income .

How Did the Stock React?

ATO shares rose +1.4% to $168.81 on February 3, 2026, following the earnings release. The stock is trading near its 50-day moving average of $169.09.*

*Values retrieved from S&P Global

What Did Management Guide?

Texas HB 4384 benefit: The quarter included $35 million ($0.16 EPS) from Texas HB 4384 implementation—$20 million in the distribution segment and $15 million at APT . However, CFO Forsythe cautioned analysts against simply annualizing this benefit:

"It's difficult to say that you can just simply take a run rate, multiply by 3 or 4 to get through that, because the underlying operations are impacting the timing of this deferral... I would caution against just taking a simple number and multiplying by 3 or 4 at this point in time."

Atmos Energy reaffirmed its fiscal 2026 outlook:

At the midpoint, guidance implies 11% EPS growth for FY2026. The company expects O&M expenses of $865-885 million, depreciation of $785-795 million, and an effective tax rate of 19-21% .

What Changed From Last Quarter?

APT infrastructure milestones: During Q1, the company completed several major pipeline projects:

- Installed ~55 miles of 36-inch pipeline from APT Bethel Storage Facility to Groesbeck Compressor Station

- Placed 13 miles of the Line WA Loop project into service (remaining 31 miles expected this spring)

- More than doubled takeaway capacity at Bethel Salt Dome storage facility

- Completed two interconnect projects adding 700,000 MCF/day of additional natural gas supply

Capital deployment accelerating: Q1 FY2026 capex of $1,033 million was 16% higher than the prior year, with 89% allocated to safety and reliability spending . The breakdown included:

Financing activities: The company issued $600 million in 30-year senior notes at 5.45% and settled $472 million in equity forwards during the quarter . Equity capitalization stands at 60% as of December 31, 2025 .

Regulatory progress: Mid-Tex Cities RRM was implemented at $138.5 million, while the Dallas Annual Rate Review ($35.8 million requested) and Tennessee ARM ($14.7 million requested) are in progress .

Balance Sheet & Liquidity

Atmos maintains a strong financial foundation:

The company has $1.1 billion available under equity forward agreements (maturing June 2026 – March 2027) and $0.8 billion available under its ATM program .

Dividend Increases Continue

Atmos Energy raised its indicated annual dividend by 14.9% to $4.00 per share, marking the 42nd consecutive year of dividend increases . This positions the company as one of the most reliable dividend growers in the utility sector.

At current prices, the forward dividend yield is approximately 2.4%.

Customer Growth & Service Recognition

Customer growth remains robust across the service territory:

- ~54,000 new customers added in the 12 months ending December 2025

- ~42,000 of those new customers located in Texas

- 1,100+ commercial customers and 3 new industrial customers added in Q1

- 98% customer satisfaction rating for the quarter

The company was recognized by J.D. Power in December 2025 as #1 in customer satisfaction among large gas utilities in both the South and Midwest regions—the fourth consecutive year receiving this honor for the Midwest region . In January, Atmos was named an Escalent 2025 Utility Customer Champion in both regions .

Q&A Highlights

On affordability concerns (Morgan Stanley): Management noted that affordability is always top of mind in discussions with regulators, but they haven't received negative feedback. CEO Akers emphasized that reliability investments—like those that helped navigate Winter Storm Fern—must be made a year in advance .

On data center opportunities (Morgan Stanley): The company continues to receive inquiries for large loads including data centers and power generation, but declined to discuss specifics until contracts are signed. APT already serves some power generation facilities across its transmission footprint .

On Mississippi rate case (JP Morgan): Following an unfavorable rate decision, Atmos filed a public notice in January to appeal to the Mississippi Supreme Court . CFO Forsythe noted the company has filed for deferral-like mechanisms and is evaluating shifting from a forward-looking to historical test year approach . Management emphasized Mississippi represents only ~5% of the business .

On storage expansion (Citi): Management indicated they have 15 storage fields across Kentucky, Kansas, Mississippi, and Texas, plus third-party contract storage. Post-winter reviews with engineering consultants will evaluate additional storage needs based on system performance, historical weather, and customer growth .

Forward Catalysts

Near-term rate filings:

- Dallas DARR ($35.8M) — New rates expected Q3 FY2026

- Tennessee ARM ($14.7M) — New rates expected Q3 FY2026

- Kansas General Case ($12.3M) — Rates expected March 2026

- Colorado General Case ($17.6M) — New rates expected Q4 FY2026

Capex outlook: The company plans approximately $26 billion in capital spending through 2030, focused on safety and reliability infrastructure .

Key Takeaways

-

Strong Q1 execution: EPS of $2.44 (+9.4% YoY) and net income of $403M (+14.5% YoY) driven by rate adjustments and customer growth

-

Winter Storm Fern success: System performed "to design expectations" with minimal supply disruptions—no Uri-like financial impacts expected

-

Guidance reaffirmed: FY2026 EPS of $8.15-$8.35, implying ~11% growth at midpoint; management cautions against annualizing Q1 Texas HB 4384 benefit

-

Dividend aristocrat: 42nd consecutive year of dividend increases, now at $4.00/share annually (+14.9%)

-

Capital deployment on track: $1.03B deployed in Q1, 89% on safety/reliability, targeting ~$4.2B for full year

-

Customer momentum: ~54,000 new customers added in trailing 12 months; J.D. Power #1 ranking in South and Midwest

-

Mississippi appeal filed: Company pursuing Supreme Court appeal of unfavorable rate case; jurisdiction represents only ~5% of business

Analysis based on Atmos Energy Q1 FY2026 8-K filing and earnings call transcript dated February 4, 2026. Stock data as of February 3, 2026.

View ATO Company Profile | Read Full Earnings Transcript | Prior Quarter: Q4 FY2025