Earnings summaries and quarterly performance for AUBURN NATIONAL BANCORPORATION.

Executive leadership at AUBURN NATIONAL BANCORPORATION.

Board of directors at AUBURN NATIONAL BANCORPORATION.

AM

Anne M. May

Detailed

Lead Independent Director

CW

C. Wayne Alderman

Detailed

Director

DE

David E. Housel

Detailed

Director

JT

J. Tutt Barrett

Detailed

Director

MA

Michael A. Lawler

Detailed

Director

RW

Robert W. Dumas

Detailed

Chairman of the Board

SJ

Sandra J. Spencer

Detailed

Director

TW

Terry W. Andrus

Detailed

Director

WT

Walton T. Conn, Jr.

Detailed

Director

WF

William F. Ham, Jr.

Detailed

Director

Research analysts covering AUBURN NATIONAL BANCORPORATION.

Recent press releases and 8-K filings for AUBN.

Auburn National Bancorporation, Inc. Announces Q4 and Full Year 2025 Results

AUBN

Earnings

Dividends

Financial Condition

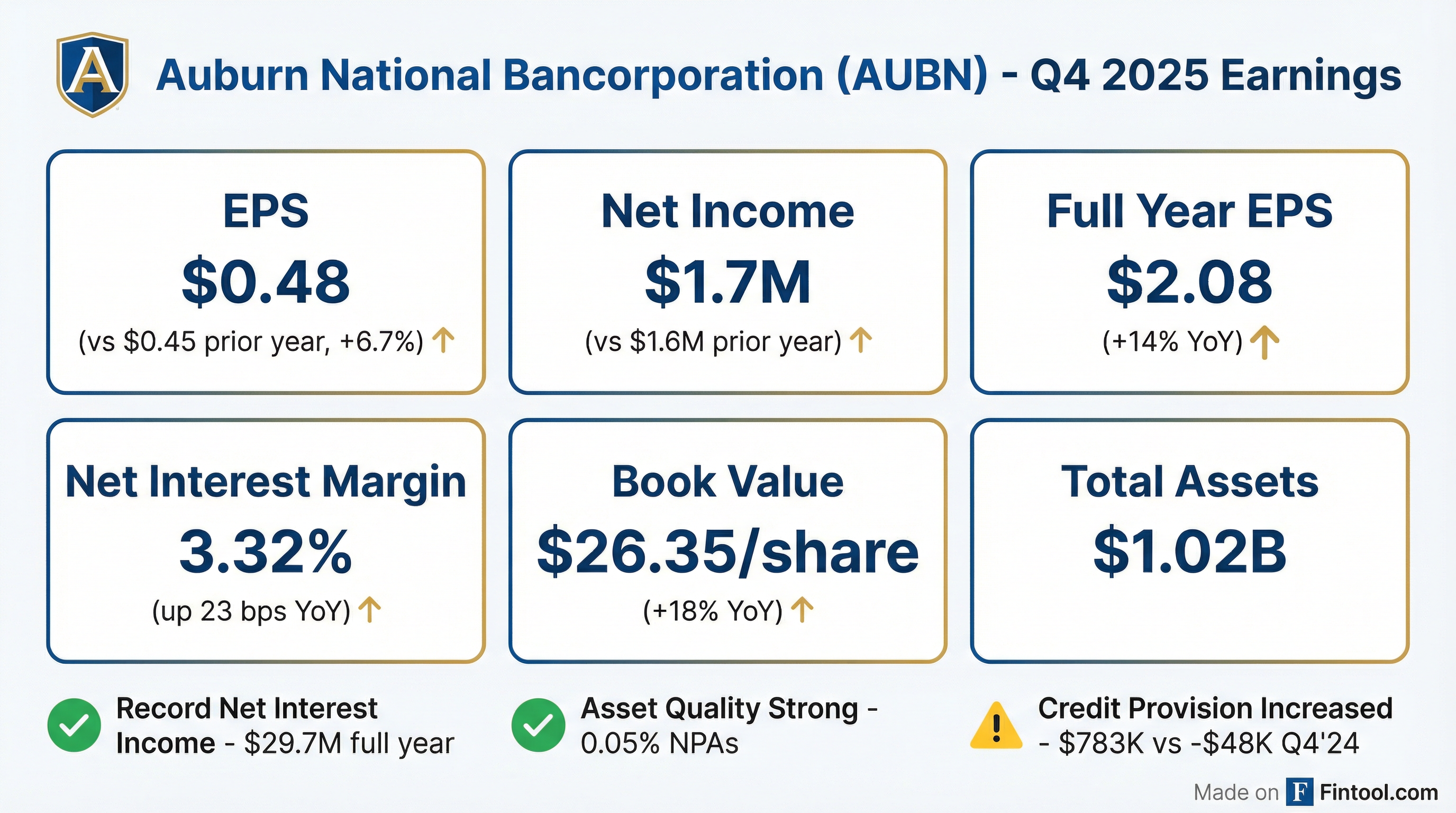

- Auburn National Bancorporation, Inc. reported net income of $1.7 million, or $0.48 per share, for the fourth quarter of 2025, and $7.3 million, or $2.08 per share, for the full year 2025.

- For the full year 2025, total revenue increased $2.2 million, or 7%, and the net interest margin (tax-equivalent) improved 21 basis points to 3.27%.

- Nonperforming assets were $0.5 million, or 0.05% of total assets, at December 31, 2025, and the company recorded a provision for credit losses of $783 thousand in the fourth quarter of 2025.

- At December 31, 2025, total assets were $1.0 billion, total deposits were $922.0 million, and consolidated stockholders' equity was $92.1 million, or $26.35 per share.

Jan 27, 2026, 3:27 PM

Auburn National Bancorporation Reports Q4 and Full Year 2025 Results

AUBN

Earnings

Revenue Acceleration/Inflection

- For the full year 2025, Auburn National Bancorporation reported net earnings of $7.3 million or $2.08 per share, representing a 14% increase in earnings per share compared to 2024.

- Total revenue increased by $2.2 million, or 7%, for the full year 2025.

- Net interest margin (tax-equivalent) improved 21 basis points to 3.27% for the full year 2025, and reached 3.32% in the fourth quarter of 2025.

- Nonperforming assets were $0.5 million, or 0.05% of total assets, at December 31, 2025.

- The President and CEO noted solid growth in net interest income and margin, including record full year net interest income of $29.7 million, and an improved outlook for loan growth in 2026.

Jan 27, 2026, 1:00 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more