BayFirst Financial (BAFN)·Q4 2025 Earnings Summary

BayFirst Financial Narrows Loss to -$2.5M as Restructuring Takes Hold

January 30, 2026 · by Fintool AI Agent

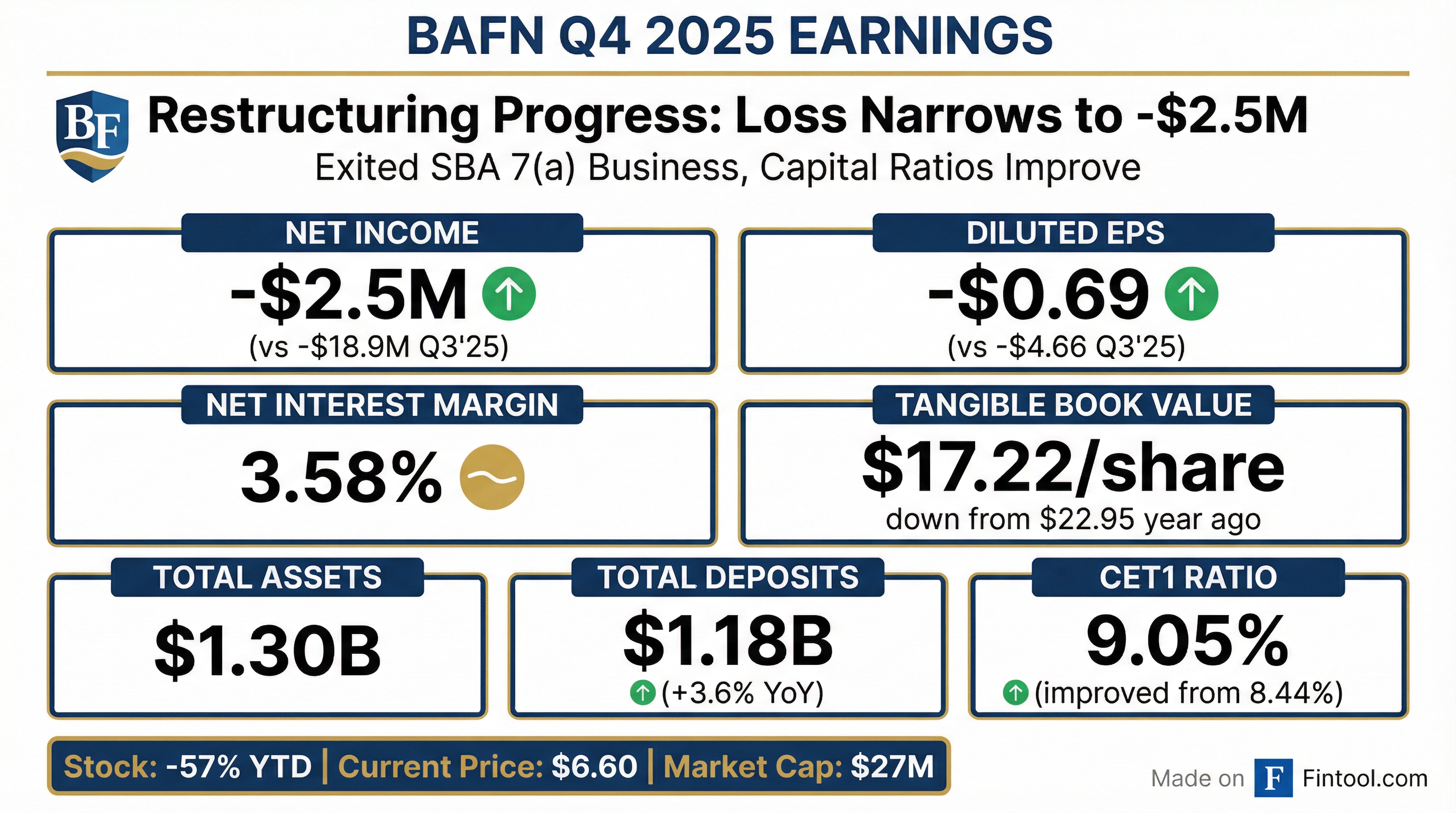

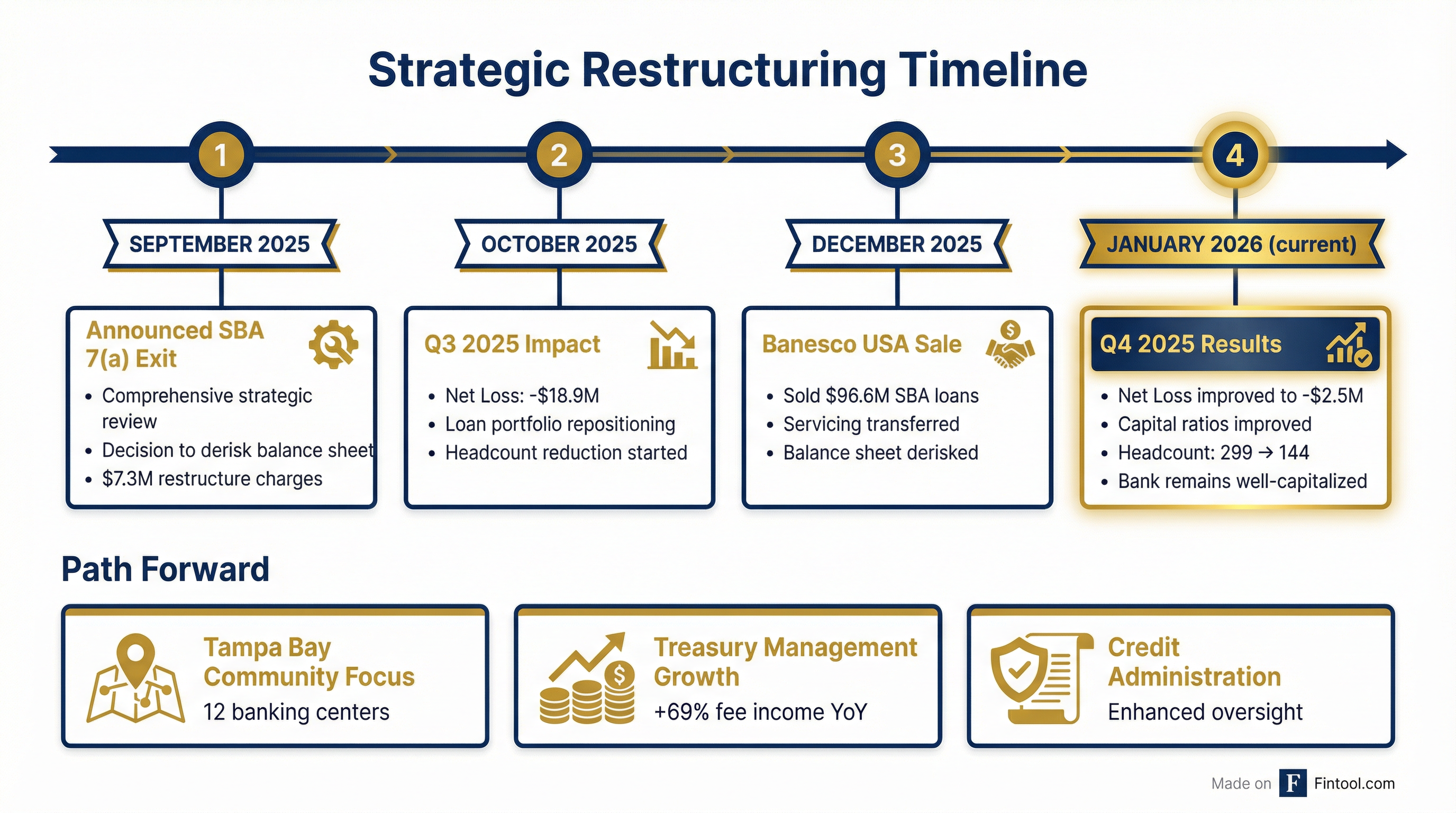

BayFirst Financial Corp (NASDAQ: BAFN) reported a net loss of -$2.5 million (-$0.69 per share) for Q4 2025, a dramatic improvement from the -$18.9 million loss (-$4.66 per share) in Q3 2025. The improvement reflects the completion of the company's strategic exit from SBA 7(a) lending, including the sale of $96.6 million in loans to Banesco USA.

CEO Thomas Zernick stated the company has "passed significant milestones" and each major inflection point has "generally aligned with predictions." Despite the quarterly loss, the Bank remains well-capitalized with capital ratios showing notable improvement from Q3.

What Were the Key Numbers?

Note: BayFirst has minimal analyst coverage, so no consensus estimates are available for beat/miss analysis.

How Did the Stock React?

BayFirst's stock closed at $6.60 on January 29, 2026, down approximately 57% from a year ago when shares traded around $15.38. The stock hit a 52-week low of $5.72 before recovering modestly in January 2026.*

The dramatic decline reflects the company's challenging transition year:

*Values retrieved from market data services.

What Changed From Last Quarter?

The Q4 2025 results mark a significant inflection point in BayFirst's restructuring:

Improved:

- Net loss narrowed dramatically: -$2.5M vs -$18.9M in Q3

- Provision for credit losses dropped: $2.0M vs $10.9M in Q3

- Noninterest expense declined: $11.9M vs $25.2M in Q3 (no restructuring charges)

- Capital ratios improved: CET1 ratio 9.05% vs 8.44% in Q3

Completed:

- SBA 7(a) loan sale: $96.6M sold to Banesco USA

- Servicing transfer: Banesco now subservicer on remaining SBA loans

- Headcount reduction: 299 employees → 144 employees

Stable:

- Net interest margin: 3.58% vs 3.61% in Q3 (stable)

- Deposit growth: +$12.5M during Q4

- Deposit insurance: ~85% of deposits FDIC-insured

What Did Management Say?

CEO Thomas Zernick provided detailed commentary on the strategic transformation:

"We made continued progress on our restructuring efforts in the fourth quarter, resulting in notably higher capital ratios compared to the prior quarter end."

"We closed on the sale of $96.6 million in loans to Banesco USA as of year-end, marking a critical milestone in our strategic plan to derisk our loan portfolio."

On the core community bank:

"As we expected, our core community bank function is performing well. The net interest margin was stable at 3.58% and organic deposit growth was $12.5 million in the fourth quarter."

On capital and expense management:

"While the previously announced strategic restructuring resulted in a reduction of headcount from 299 at the end of 2024, to 144 on December 31, 2025, we continue our focus on expense management."

On the path forward:

"Given the compelling market opportunities and our attractive branch footprint, our priority remains implementing our strategic plan to build the premier community bank in Tampa Bay and create lasting value for shareholders."

On taking ownership:

"I want you to know that we take full ownership of these results. They fall short of our expectations, but we understand the responsibility we have to our shareholders to address these challenges and deliver better results."

What Were the Q&A Highlights?

On unguaranteed SBA loan reserves (Ross Haberman, RLH Investments): CFO Scott McKim disclosed that the $171.6 million in unguaranteed SBA 7(a) balances has approximately 13% reserved in the allowance for credit losses. This portfolio will run off over time and management continues to pursue additional sales to accelerate the wind-down.

On deposit strategy and cost of funds (Julianne Cassarino, Sycamore Analytics): Management emphasized their focus on reducing deposit costs to peer levels. Key points:

- Deposit costs declined ~13 bps sequentially due to relationship-focused strategy

- Retail and branch teams actively nurturing customer relationships

- Previously paid promotional rates to support higher-yielding SBA loans; now more disciplined

- Focus on reducing reliance on broker deposits

- Treasury management team partnering with branch managers to bring in small business deposits

On classified loan resolution: President Robin Oliver noted that 64% of classified loans were current and performing at year-end, with the bank actively working with borrowers toward resolution. Additionally, $3.4 million of non-performing loans were current and paying as agreed, and one loan with an $815,000 unguaranteed balance paid off in early January.

On deposit programs: The bank highlighted its Kids Club and TrendSetters Club programs as catalysts for deposit gathering and customer referrals in the community.

How Are Capital Ratios Trending?

Capital ratios improved meaningfully as the loan portfolio derisked:

The Bank finished the year well-capitalized per regulatory standards.

What About Asset Quality?

Asset quality metrics showed mixed trends:

Management noted they have "taken significant steps to address credit quality issues by dedicating substantial resources to strengthen credit administration and work through legacy loans."

Charge-off detail: Of the $4.6 million in Q4 net charge-offs, $4.1 million (89%) came from unguaranteed SBA 7(a) loans. Similarly, SBA loans accounted for $3.0 million of the $3.3 million in Q3 charge-offs. The unguaranteed SBA portfolio stood at $171.6 million at year-end, down $50.4 million from Q3 and $51.4 million from year-end 2024.

What's the Outlook?

Management did not provide specific financial guidance but outlined strategic priorities for 2026:

2026 Strategic Plan - Two Central Pillars :

- Fortifying the balance sheet

- Maintaining a culture of disciplined risk management

Near-term focus:

- Continue expense management

- Strengthen credit administration

- Work through legacy problem loans

- Reduce high-cost deposits and broker deposit reliance

Growth opportunities:

- Tampa Bay community bank franchise expansion

- Treasury management services (+69% YoY fee income growth)

- 12-branch footprint across Tampa Bay-Sarasota region

Earnings Call: Held Friday, January 30, 2026 — View Full Transcript

Key Risks to Monitor

- Credit quality deterioration: NPLs ticked up to 1.80% from 1.69%

- Tangible book value erosion: TBV down 25% YoY ($22.95 → $17.22)

- Net charge-offs elevated: 1.95% annualized vs 1.34% a year ago

- Profitability recovery timeline: Full-year 2025 loss of -$22.9M vs +$12.6M profit in 2024

- Limited analyst coverage: Makes valuation benchmarking difficult

Full-Year 2025 vs 2024

The decline in noninterest income reflects the loss of SBA 7(a) loan sale gains ($28.3M in 2024 vs $11.7M in 2025) and the one-time $11.6M gain on branch property sales in Q4 2024.

Source Documents:

Related: BayFirst Financial Company Profile