Earnings summaries and quarterly performance for BayFirst Financial.

Executive leadership at BayFirst Financial.

Board of directors at BayFirst Financial.

AH

Alexander Harris

Detailed

Director

AN

Anthony N. Leo

Detailed

Director

AS

Anthony Saravanos

Detailed

Chair of the Board

BJ

Barbara J. Zipperian

Detailed

Director

BW

Bradly W. Spoor

Detailed

Director

CP

Christos Politis

Detailed

Director

DR

Dennis R. DeLoach, III

Detailed

Director

DS

Derek S. Berset

Detailed

Director

MS

Mark S. Berset

Detailed

Director

SW

Sheryl WuDunn

Detailed

Director

Research analysts who have asked questions during BayFirst Financial earnings calls.

Recent press releases and 8-K filings for BAFN.

BayFirst Financial Corp. Reports Q4 2025 Net Loss and Strategic Transition Progress

BAFN

Earnings

Layoffs

Restructuring

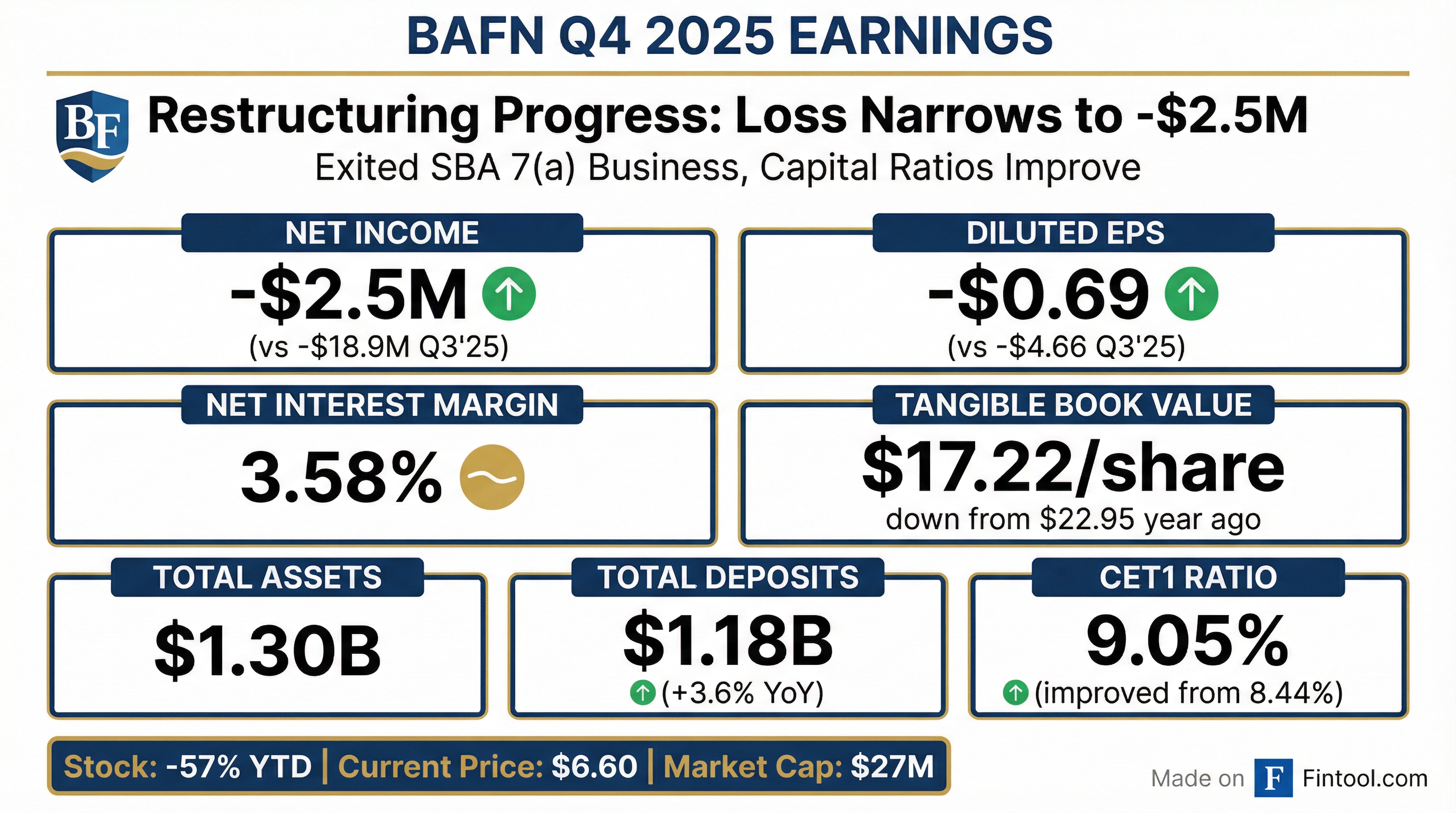

- BayFirst Financial Corp. reported a net loss of $2.5 million for the fourth quarter of 2025, an improvement from the $18.9 million net loss in the third quarter of 2025.

- The company completed several strategic initiatives, including exiting the SBA 7(a) lending business, selling substantial 7(a) loan balances, and significantly reducing headcount and expenses, with a renewed focus on its community bank.

- Deposits organically grew by $12.5 million in the fourth quarter of 2025 and increased by $40.7 million (3.6%) over the past year to $1.18 billion, with 85% of deposits insured. The net interest margin remained stable at 3.58%.

- Net charge-offs were $4.6 million in Q4 2025, with $4.1 million attributed to unguaranteed SBA 7(a) loans, which had a balance of $171.6 million at year-end. Shareholders' equity was $87.6 million, and tangible book value decreased to $17.22 per share. The company maintained a liquidity ratio over 18% at year-end.

3 days ago

BayFirst Financial Reports Q4 2025 Results Amidst Strategic Shift

BAFN

Earnings

New Projects/Investments

Demand Weakening

- BayFirst Financial Corp. reported a net loss of $2.5 million in the fourth quarter of 2025, an improvement from the $18.9 million net loss in Q3 2025, which included a $7.3 million restructuring charge and $8.1 million additional provision expense.

- The company completed its exit from the SBA 7(a) lending business, resulting in a significant decrease in non-interest income and elevated net charge-offs of $4.6 million in Q4 2025, with $4.1 million attributed to unguaranteed SBA 7(a) loans. The remaining unguaranteed SBA 7(a) loan balances were $171.6 million as of December 31, 2025.

- The community bank segment demonstrated strength with deposits increasing $12.5 million (1.1%) in Q4 2025 to $1.18 billion, with 85% insured, and a stable net interest margin of 3.58%. The company also reported a liquidity ratio over 18% at year-end.

- Shareholders' equity stood at $87.6 million at quarter-end, $23.4 million lower than the end of 2024, and tangible book value decreased to $17.22 per share from $17.90 per share at the end of Q3.

8 days ago

BayFirst Financial Corp. Reports Q4 2025 Net Loss and Completes SBA 7(a) Lending Exit

BAFN

Earnings

Layoffs

Guidance Update

- BayFirst Financial Corp. reported a net loss of $2.5 million in the fourth quarter of 2025, an improvement compared to the $18.9 million net loss in the third quarter of 2025.

- The company completed its exit from the SBA 7(a) lending business, including the sale of substantial loan balances and a significant reduction in headcount and expenses, to focus entirely on its community bank operations.

- Deposits increased by $12.5 million (1.1%) during Q4 2025, reaching $1.18 billion, with 85% of deposits insured, and the company maintained a liquidity ratio over 18% at year-end.

- Net charge-offs were $4.6 million in Q4 2025, with $4.1 million attributed to unguaranteed SBA 7(a) loans, and the remaining unguaranteed SBA 7(a) loan balances stood at $171.6 million as of December 31, 2025.

- Management expects additional charge-offs from the legacy SBA 7(a) portfolio to continue into 2026, but with a lessening impact over time, and is focused on reducing nonperforming and classified assets and improving the bank's cost of funds.

8 days ago

BayFirst Reports Q4 2025 Results with Reduced Net Loss and Strategic Progress

BAFN

Earnings

Demand Weakening

New Projects/Investments

- BayFirst Financial Corp. reported a net loss of $2.5 million in Q4 2025, an improvement from the $18.9 million net loss in Q3 2025, which included a $7.3 million restructuring charge and $8.1 million additional provision expense.

- Loans held for investment decreased by 3.5% to $963.9 million during Q4 2025, while deposits increased by 1.1% to $1.18 billion.

- The company's net interest margin was 3.58% in Q4 2025, a slight decrease of 3 basis points from the prior quarter.

- Provision for credit losses was $2 million in Q4 2025, down from $10.9 million in Q3 2025, but net charge-offs increased to $4.6 million from $3.3 million, primarily due to unguaranteed SBA 7(a) loans.

- BayFirst is actively executing strategic initiatives, including exiting the SBA 7(a) lending business, reducing headcount and expenses, and focusing on its community bank, with efforts to reduce high-cost deposits and improve the cost of funds.

8 days ago

BayFirst National Bank Reports Q4 2025 Financial Results

BAFN

Earnings

Demand Weakening

- BayFirst National Bank reported a net loss of $2.463 million for Q4 2025, an improvement from the $18.902 million net loss in Q3 2025, but a decrease from the $9.776 million net income in Q4 2024.

- Total loans decreased by $103 million over the last twelve months, primarily due to the exit of the SBA 7(a) lending business and the sale of $97 million of loan balances. Total loans held for investment (HFI) were $964 million as of Q4 2025.

- Total deposits increased by $12 million for the quarter and $41 million over the last twelve months, reaching $1,184 million as of December 31, 2025, with approximately 85% of deposits insured.

- Tangible Book Value Per Common Share decreased to $17.22 as of Q4 2025, down from $22.95 in Q4 2024.

8 days ago

BayFirst Financial Corp. Reports Q4 2025 Net Loss and Strategic Progress

BAFN

Earnings

Layoffs

- BayFirst Financial Corp. reported a net loss of $2.5 million, or $0.69 per common share, for the fourth quarter of 2025, which is an improvement compared to a net loss of $18.9 million in the third quarter of 2025.

- The company completed significant strategic actions, including the sale of $96.6 million in loans to Banesco USA and exiting the SBA 7(a) lending business during the fourth quarter of 2025.

- Capital ratios showed notable improvement, with Total Capital (to risk-weighted assets) increasing to 10.31% and Common Equity Tier 1 Capital (to risk-weighted assets) rising to 9.05% as of December 31, 2025.

- Deposits increased by $12.5 million, or 1.1%, during the fourth quarter of 2025, reaching $1.18 billion.

- As part of expense management and strategic restructuring, the company reduced its headcount from 299 at the end of 2024 to 144 on December 31, 2025.

Jan 29, 2026, 9:00 PM

BayFirst Financial Reports Fourth Quarter 2025 Results

BAFN

Earnings

Layoffs

M&A

- BayFirst Financial Corp. reported a net loss of $2.5 million, or $0.69 per common share, for the fourth quarter of 2025, significantly improving from a net loss of $18.9 million, or $4.66 per common share, in the third quarter of 2025.

- The company advanced its restructuring efforts by completing the sale of $96.6 million in loans to Banesco USA and exiting the SBA 7(a) lending business in the fourth quarter of 2025.

- Capital ratios showed notable improvement, with the Bank's CET 1 and Tier 1 capital ratios to risk-weighted assets increasing to 9.05% as of December 31, 2025, compared to 8.44% as of September 30, 2025, and the Bank concluded the year well-capitalized.

- Loans held for investment decreased by $34.8 million, or 3.5%, to $963.9 million during the fourth quarter of 2025, while deposits increased by $12.5 million, or 1.1%, to $1.18 billion.

- Book value and tangible book value per common share were $17.22 at December 31, 2025, a decrease from $17.90 at September 30, 2025.

Jan 29, 2026, 9:00 PM

BayFirst Financial Corp. Amends Debt Terms and Defers Loan Payment

BAFN

Accounting Changes

- BayFirst Financial Corp. amended its $6.0 million 4.5% Fixed to Floating Subordinated Notes Due 2031, effective December 26, 2025, to implement paid-in-kind (PIK) interest through June 30, 2026, with a potential 3% principal increase if not fully paid by that date.

- The company also deferred a $142,269.38 Principal plus Interest payment, originally due December 10, 2025, on its $1.6 million term loan with First National Bankers Bank, with payments resuming March 10, 2026.

Jan 6, 2026, 9:17 PM

BayFirst Financial Corp. Closes $94.6 Million Loan Sale and Exits SBA 7(a) Lending Business

BAFN

M&A

- BayFirst Financial Corp. closed the sale of $94.6 million in SBA 7(a) loans to Banesco USA on December 12, 2025.

- This transaction is part of a strategic review aimed at de-risking SBA 7(a) balances and has led the company to exit the SBA 7(a) lending business early in the fourth quarter of 2025.

- The loan sale is expected to improve the Bank’s proforma total capital ratio to 10.1% and its tier 1 leverage ratio to 6.8%.

- The company also anticipates closing the sale of an additional $4.5 million in loan balances to Banesco USA before the end of the year.

Dec 15, 2025, 10:24 PM

BayFirst Financial Corp. Closes $94.6 Million Loan Sale

BAFN

M&A

Guidance Update

- BayFirst Financial Corp. has closed the sale of $94.6 million in loans to Banesco USA, a transaction announced on September 29, 2025, as part of a strategic review aimed at derisking SBA 7(a) balances.

- This loan sale is projected to improve the Bank\u2019s proforma total capital ratio to 10.1% and its tier 1 leverage ratio to 6.8%.

- The company exited the SBA 7(a) lending business early in the fourth quarter and expects to close on an additional $4.5 million loan sale to Banesco USA before the end of the year.

- BayFirst Financial Corp. is now focusing on its community bank mission, aiming to expand its community bank portfolio, deposit growth, and fee income sources.

- As of September 30, 2025, BayFirst Financial Corp. reported $1.35 billion in total assets.

Dec 15, 2025, 10:18 PM

Quarterly earnings call transcripts for BayFirst Financial.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more