BALL (BALL)·Q4 2025 Earnings Summary

Ball Corporation Delivers Record Free Cash Flow, Beats Revenue by 7.6% in Q4

February 3, 2026 · by Fintool AI Agent

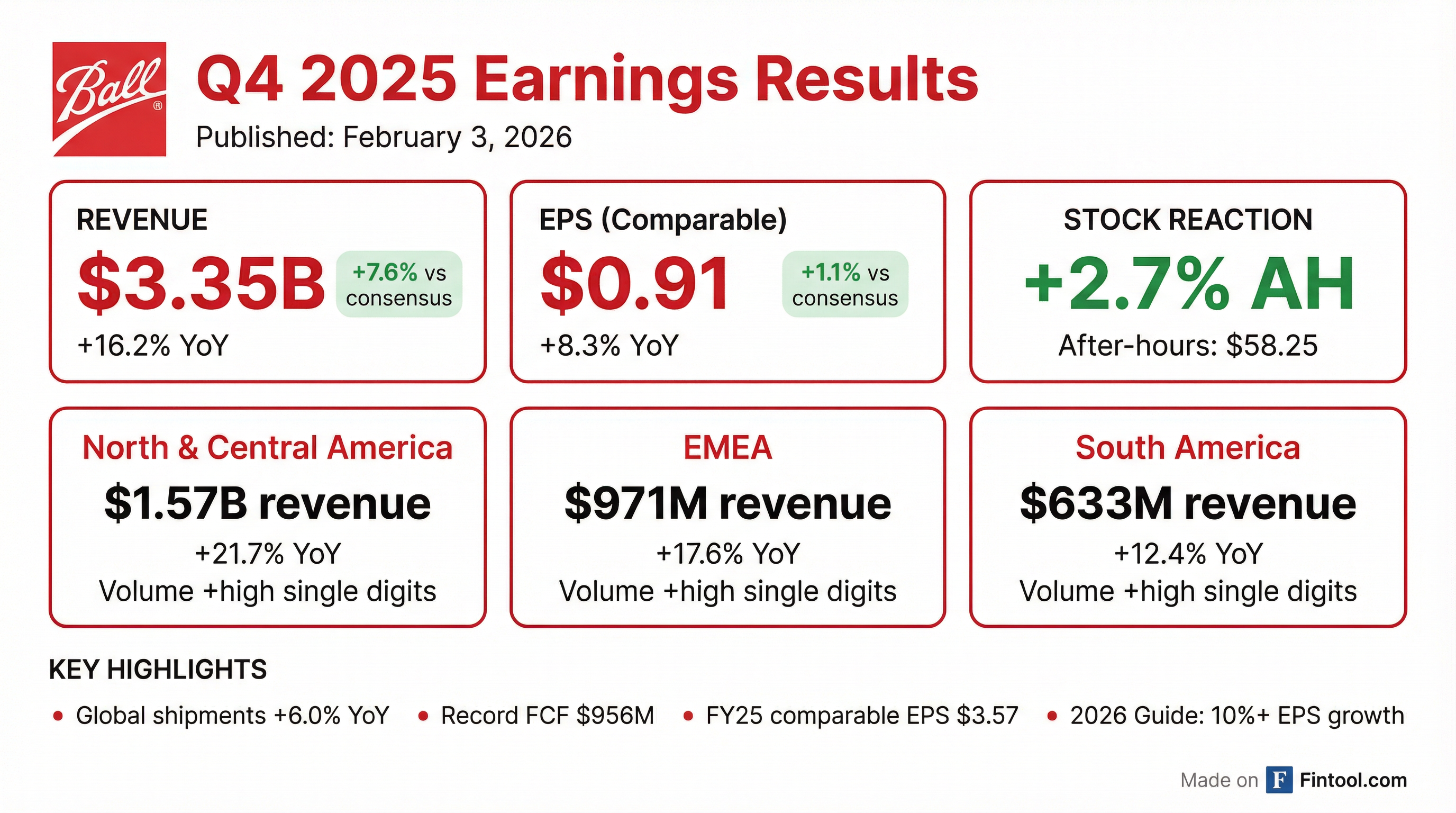

Ball Corporation (NYSE: BALL) reported strong Q4 2025 results, beating both revenue and EPS estimates while achieving record full-year adjusted free cash flow of $956 million. Global aluminum packaging shipments accelerated, rising 6.0% year-over-year in Q4, capping a year where volumes grew 4.1% overall. The aluminum packaging giant returned $1.54 billion to shareholders in 2025 through buybacks and dividends while completing a strategic acquisition to expand its European footprint.

Did Ball Beat Earnings?

Yes — Ball beat on both lines. The company delivered Q4 comparable EPS of $0.91 versus consensus of $0.90 (+1.1%), while revenue of $3.35 billion topped the $3.11 billion estimate by 7.6%.

This marks Ball's eighth consecutive earnings beat — a streak dating back to Q1 2024. The company has not missed EPS estimates since late 2023.

How Did the Stock React?

BALL shares rose +2.7% in after-hours trading to $58.25, extending the stock's rally from its 52-week low of $43.51 in early 2025.

The positive reaction reflects:

- Revenue beat significantly larger than typical (+7.6% vs avg +2-3% beats)

- Strong volume trends across all regions

- Record free cash flow demonstrating capital discipline

- Reiteration of 10%+ EPS growth algorithm for 2026

What Did Management Guide?

2026 Outlook — Reiterated confidence in long-term algorithm:

"Our strategy is clear and built for the long term: stay close to our customers, empower and motivate our people and drive operational excellence and profitable growth through the Ball Business System. As we look to 2026 and beyond, we remain confident in the growth of aluminum packaging and, viewed through our EVA mindset, we are confident in our ability to achieve our long-term algorithm of 10-plus percent annual EPS growth while continuing to return significant value to shareholders." — Ron Lewis, CEO

The shareholder returns target declines from $1.54B in 2025 to $800M in 2026 as "proceeds from the Aerospace sale [are] fully utilized."

Long-Term 2030 Volume Targets:

Ball exceeded all regional long-term volume targets in FY 2025.

Key Financial Metrics (FY 2025):

What Changed From Last Quarter?

Positive developments:

- Volume acceleration: Q4 global shipments +6.0% vs +3.9% in Q3

- Strategic acquisitions: Benepack acquisition (80% stake in European facilities in Belgium and Hungary for €184 million) and Florida Can acquisition completed and integrated in North America

- Record free cash flow: $956M adjusted FCF for full year

- North America momentum: High single-digit volume growth continued despite consumer pressures

Areas to monitor:

- GAAP vs Non-GAAP gap: Q4 GAAP EPS of $0.75 vs comparable $0.91 due to debt refinancing costs and Rexam intangibles amortization

- Gross margins compressed: Q4 gross margin 19.4% vs 20.5% in Q4 2024 due to aluminum cost pass-through

- Long-term debt increased: $7.0B vs $5.3B at year-end 2024, reflecting Benepack acquisition financing

Segment Performance

All three beverage packaging segments delivered double-digit revenue growth:

North & Central America (+21.7% revenue): High single-digit volume growth driven by energy drinks and non-alcoholic beverages. Revenue also benefited from contractual pass-through of higher aluminum costs.

EMEA (+17.6% revenue): Strongest operating earnings growth at +36.7%, reflecting volume gains and favorable currency translation. The segment posted full-year volume growth of 5.5%.

South America (+12.4% revenue): High single-digit volume growth across Brazil, Argentina, Paraguay, and Chile. Full-year segment volume increased 4.2%.

Capital Allocation Update

Ball returned substantial capital to shareholders while investing in growth:

"In 2025, we generated a record $956 million of adjusted free cash flow, kept capital expenditures below our GAAP depreciation and amortization target, and returned $1.54 billion to shareholders through share repurchases and dividends." — Dan Rabbitt, CFO

Share Count Reduction:

Ball has reduced its share count by 16% since 2023 — "a testament to our commitment to maximize shareholder value."

New Leadership: Ron Lewis's First Call as CEO

This was CEO Ron Lewis's first earnings call since assuming the role. He introduced himself with a personal touch:

"I grew up on a farm in central Montana working alongside my mom and dad, and that's where I learned the value of hard work, teamwork, and treating everyone with dignity and respect, values that define Ball today. I spent 20 years in the Coca-Cola system leading supply chains and buying cans from Ball... 6.5 years ago, I did [join Ball]. Since then, I've led our EMEA business, served as our COO, and most recently led our global supply chain and operations." — Ron Lewis, CEO

Lewis emphasized continuity: "Our strategy is intact and it is working... What we are doubling down on is how can we operate even more effectively so that we can squeeze out the fuel to grow our business."

Key Themes & Management Quotes

On the Benepack Acquisition:

"The plants are in Belgium and Hungary where we don't have plants today. So we think this is really a great opportunity for us to plug those two facilities into our European manufacturing network... We were able to acquire these assets at a really attractive price, certainly at a price below where replacement costs are." — Ron Lewis, CEO

CFO Dan Rabbitt clarified the near-term contribution: "This year, we think it's going to do around about 1.7 billion [units] of volumes. And operating earnings, the comparable operating earnings, are really projected to be pretty close to flat... we really see it as an important part of our 2027 go forward."

On the Ball Business System ($500M Savings Program):

"We will deliver the $500 million of cost savings that we projected... in the three-year timeframe versus the four-year timeframe. So that was 2024, 2025, and 2026. More than two-thirds of it has been delivered. Quite frankly, more like three-quarters of it has been delivered in the first two years. But we're not going to stop there." — Ron Lewis, CEO

On EVA-Focused Strategy: Ball's long-term growth algorithm is built on EVA (Economic Value Added) principles: 2-3% volume growth × 2x operating leverage = 10%+ EPS growth, combined with 4-6% share count reduction. Management expects 2026 to deliver "record Shipped Volume, Comparable Operating Earnings and EPS."

2025 Key Wins:

- Exceeded long-term volume targets in NCA & EMEA; South America in-line

- Secured key multi-year customer contract extensions

- Announced Benepack acquisition adding EMEA capacity (Hungary & Belgium)

- Completed & integrated Florida Can acquisition in North America

Q&A Highlights

North America Capacity Constraints: When asked about 2026 volume growth, Lewis was direct: "In 2026, for North America specifically, quite frankly, we're sold out, and we are a bit capacity constrained until we can get our Millersburg asset up and running." He noted that industry can growth was ~2% in 2025 while Ball grew 4.8%, meaning they outpaced the market by nearly 3 percentage points.

2026 Cost Headwinds ($35M): CFO Rabbitt called out specific headwinds: "We did call out that there's around $35 million of ramp-up costs to get the North America system reconfigured with the ends. And then more importantly, the Millersburg plant started up." These costs are expected to be "more back-half weighted" with operating leverage improvement coming in 2027.

Millersburg Plant Details: The Oregon facility is a "one-line plant, it's not a two-line plant," with capacity of about 1 billion cans. Volume contribution will be "relatively immaterial in 2026" as it's still starting up.

Tariffs & Aluminum Costs: Lewis addressed tariff concerns: "As we sit here today, there's no direct impact on our business beyond the ends piece... Where it shows up for us is in the Midwest Premium. That's what has really spiked for all of the aluminum industry." He noted the can remains a value proposition: "In 2025 in the U.S. [cans] grew at roughly 2%, where all other substrates declined by more than 2%."

EMEA Operating Leverage (36.7% Q4 growth): On the exceptional EMEA earnings growth, Lewis explained: "When we have the capacity... and we grow into that capacity, that's when you see real operating leverage. We had some capacity to grow into in Europe. We did that in 2025... You can expect us to deliver at least the 2x operating leverage on the volume that we will sell in Europe in 2026."

World Cup & US 250th Birthday: Lewis flagged potential demand catalysts: "This is America's 250th birthday. There are going to be an amazing amount of celebrations throughout the summer coming, and I can imagine that will also be, at the very least, neutral, and I bet it will be slightly positive for all of us that sell beverages or help to sell beverages in the U.S."

Customer Contract Visibility:

"Not only are we kind of sold out in 2026, we are well contracted into 2027, and in some cases, with our strategic customers out into the next decade." — Ron Lewis, CEO

Forward Catalysts

Near-term (1-2 quarters):

- Integration benefits from Benepack acquisition

- World Cup 2026 hosted in North America (demand boost)

- US 250th anniversary celebrations (summer 2026)

- Potential for estimate revisions following strong Q4

Medium-term (2026):

- 10%+ EPS growth target through operating leverage and buybacks

- Millersburg, Oregon plant coming online (H2 2026)

- Final $125-175M of $500M Ball Business System savings

- Sustainability tailwinds as brands shift to aluminum packaging

2027 setup:

- Full year of Millersburg production (~1B cans capacity)

- Benepack plants ramping to full contribution

- North America operating leverage improvement as startup costs roll off

Risks to monitor:

- North America capacity constraints until Millersburg online

- ~$35M in 2026 startup/tariff costs (back-half weighted)

- Midwest Premium aluminum cost volatility

- Higher interest expense from increased debt levels

The Bottom Line

Ball delivered a strong finish to 2025, beating estimates while achieving record free cash flow and returning $1.54 billion to shareholders. The +6.0% volume growth in Q4 demonstrates continued momentum for aluminum packaging despite macroeconomic headwinds. With 2026 guidance for 10%+ EPS growth and >$900M free cash flow, management remains confident in the long-term algorithm. The +2.7% after-hours move suggests the market is rewarding the execution and outlook.

Report generated by Fintool AI Agent on February 3, 2026

Related: