Earnings summaries and quarterly performance for BALL.

Executive leadership at BALL.

Board of directors at BALL.

Aaron Erter

Director

Betty Sapp

Director

Cathy Ross

Director

Cynthia Niekamp

Director

Dune Ives

Director

John Bryant

Director

John Panichella

Director

Michael Cave

Director

Stuart Taylor II

Chair of the Board

Todd Penegor

Director

Research analysts who have asked questions during BALL earnings calls.

Anthony Pettinari

Citigroup Inc.

9 questions for BALL

Arun Viswanathan

RBC Capital Markets

9 questions for BALL

Edlain Rodriguez

Mizuho Securities

9 questions for BALL

George Staphos

Bank of America

9 questions for BALL

Ghansham Panjabi

Robert W. Baird & Co.

9 questions for BALL

Stefan Diaz

Morgan Stanley

9 questions for BALL

Christopher Parkinson

Wolfe Research

6 questions for BALL

Jeffrey Zekauskas

JPMorgan Chase & Co.

6 questions for BALL

Philip Ng

Jefferies

6 questions for BALL

Anojja Shah

UBS Group AG

5 questions for BALL

Niccolo Piccini

Truist Securities

4 questions for BALL

Michael Roxland

Truist Securities

3 questions for BALL

Richard Carlson

Wells Fargo

3 questions for BALL

Gabe Hajde

Wells Fargo & Company

2 questions for BALL

Joshua Spector

UBS

2 questions for BALL

Matt Roberts

Raymond James Financial

2 questions for BALL

Michael Leithead

Barclays

2 questions for BALL

Mike Roxland

Truist Securities

2 questions for BALL

Phil Ng

Jefferies Financial Group Inc.

2 questions for BALL

John Dunigan

Jefferies

1 question for BALL

Josh Spector

UBS Group

1 question for BALL

Recent press releases and 8-K filings for BALL.

- Ball guides to 10% EPS growth and > $900 million free cash flow in 2026; North America volume is expected at the low end of its 1–3% range, Europe at the high end boosted by inorganic Benepack acquisitions, and South America at the low end while delivering 2× operating leverage.

- Capital expenditures will be maintained at or below depreciation & amortization (~$655 million) over a rolling three-year period with all new capacity tied to long-term contracts; two Benepack plants closed in February 2026.

- A new Millersburg, Ohio can plant will start up in Q3 2026 to relieve U.S. tariff-driven constraints, expand network fringe capacity, and reduce out-of-pattern shipping.

- Ball will deploy its 4–6% share buyback algorithm annually (repurchased > 4% in 2025) and has 90% of 2027 capacity sold with over 50% committed for 2028 under multiyear contracts.

- Ball Corp guides 10% earnings growth and > $900 million free cash flow for 2026, underpinned by its Ball Business System of commercial and operational excellence.

- Regional volume outlook: North America at low-end 1%–3%, Europe at high-end 4%–6% including two Benepack plants, and South America at low-end with 2× operating leverage.

- Achieved $500 million gross cost savings ahead of schedule; expects $100–200 million annual supply-chain productivity gains and maintains a 4%–6% share buyback target.

- Enforces capital discipline with ≤ D&A spend (~$600 million) over a three-year period and targets 2.5× net debt/EBITDA leverage by year-end 2026.

- Expanding capacity via the Q3 2026 Millersburg plant to optimize U.S. network; tariff headwinds on ends begin easing in Q4 2026, fully normalizing in 2027.

- Ball forecasts 10% earnings growth and > $900 million free cash flow in 2026, with North America volume at the low end and Europe at the high end of its 1%–3% growth range; South America is expected to deliver low-end volume but achieve 2× operating leverage.

- Confident in delivering > 2× operating leverage across all regions through its Ball Operational Excellence program—Europe has already exceeded this target, South America remains on track despite seasonal headwinds, and North America will normalize tariff impacts by Q4 2026.

- Maintains capital discipline by capping annual investment at depreciation & amortization (~$655 million in 2026) and targeting 4%–6% share repurchases each year (2025 buybacks exceeded this range); aims to reduce leverage toward 2.5× net debt/EBITDA.

- Expanding capacity with a new Millersburg, Ohio can line coming online in Q3 2026 and early-February closing of two Benepack plants in Europe, underpinning 90%+ contracted sales for 2027 and over 50% for 2028.

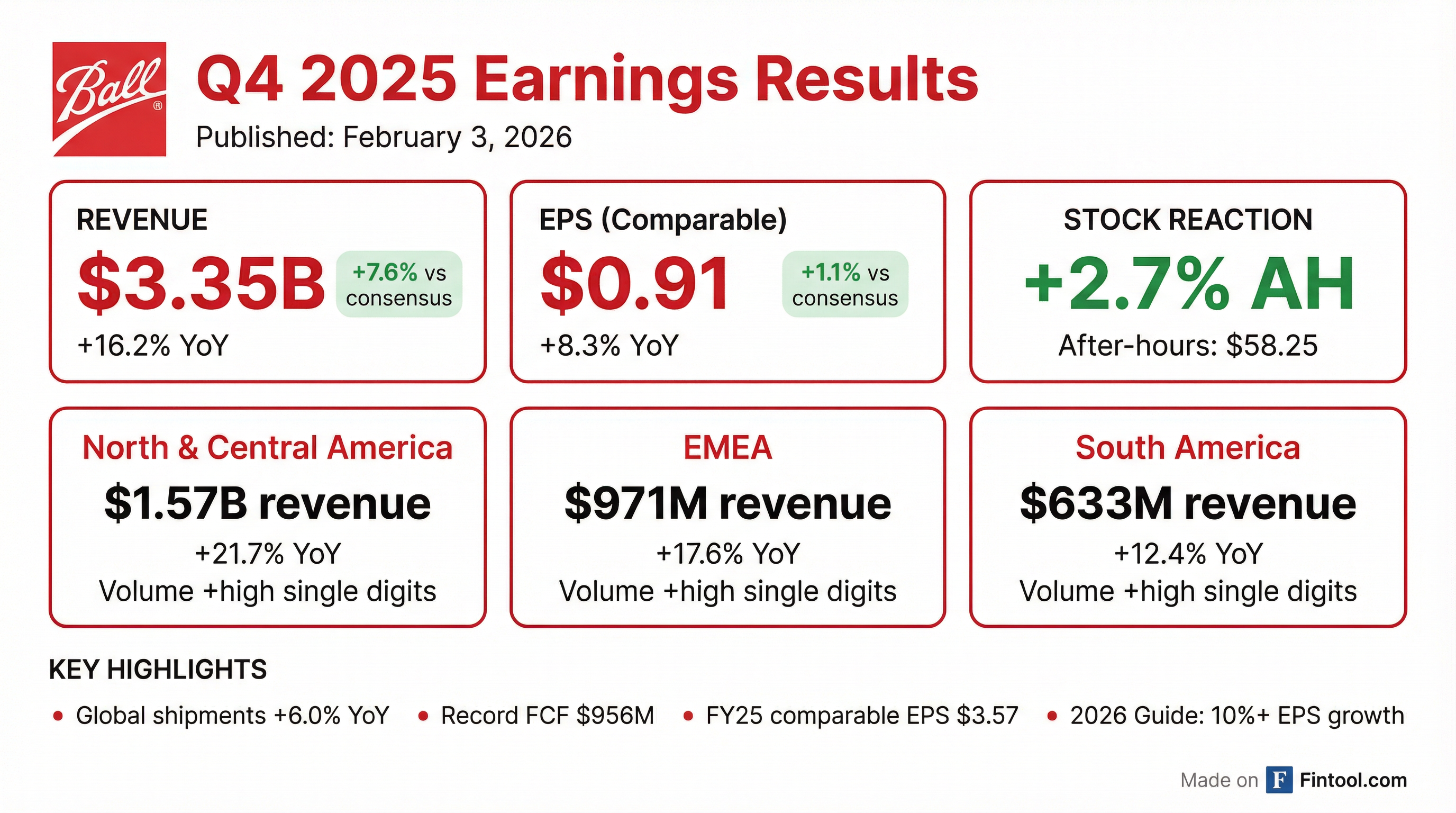

- Ball delivered 4.1% FY 2025 shipped beverage volume growth (Q4: 6.0% YoY) ahead of guidance.

- Comparable Operating Earnings rose 6% to $1,554 M, while EPS increased 13% to $3.57, a new company record.

- Adjusted Free Cash Flow reached $956 M (2.4× YoY); the company returned $1.54 B to shareholders and reduced share count by 16%.

- For 2026, Ball forecasts 10%+ EPS growth and $900 M+ free cash flow, maintaining disciplined capital allocation.

- Leadership transition and strategic focus: Ron Lewis became CEO, reaffirmed Ball’s intact strategy emphasizing operational excellence, EVA-driven capital allocation, and profitable growth across the global aluminum can market.

- Q4 2025 and full-year financial results: Comparable earnings rose 6.8% in Q4 and 5.6% for FY 2025; record comparable diluted EPS of $3.57 (+13% YoY); adjusted free cash flow reached $956 million (2.4× YoY); net debt/EBITDA at 2.8×.

- Regional performance highlights: North & Central America volume grew high-single-digit % in Q4 / +4.8% FY; comp. operating earnings +12% Q4 / +3.3% FY. EMEA volume + high-single-digit % Q4 / +5.5% FY; comp. operating earnings +36.7% Q4 / +19% FY. South America volume + high-single-digit % Q4 / +4.2% FY; comp. operating earnings +1% Q4 / +10.5% FY.

- 2026 guidance: Sees volume growth at low end of long-term ranges (1–3% NACAM, >5% EMEA, 4–6% SA); includes ~$35 million of startup and tariff headwinds; targets 10%+ EPS growth, >$900 million free cash flow, share repurchases ≥$600 million, capex ≈ depreciation, and net debt/EBITDA ~2.7×.

- Ron Rabbitt appointed CEO and Dan Rabbitt named CFO

- Delivered record comparable EPS of $3.57 (+13% YoY), record adjusted free cash flow of $956 million (+2.4×), and returned $1.54 billion to shareholders

- Global can shipment volumes up 6% in Q4 and 4.1% for full year; Q4 comparable operating earnings in North & Central America +12%, EMEA +36.7%, South America +1%

- 2026 guidance: ≥ 10% comparable EPS growth, > $900 million free cash flow, $800 million total shareholder returns (≥ $600 million share repurchases), net debt/EBITDA ~ 2.7×

- Closed acquisition of two Benepack beverage can plants in Belgium and Hungary, expanding EMEA footprint

- Ron Lewis led his first earnings call as CEO, with Dan Rabbitt named CFO, marking a major leadership transition at Ball Corporation.

- Full year 2025 delivered comparable EPS of $3.57 (+13% YoY) and a record adjusted free cash flow of $956 million (+2.4× YoY).

- Returned $1.54 billion to shareholders through dividends and share repurchases; net debt/EBITDA ended at 2.8×, with a long-term target of 2.5×.

- Closed acquisition of two Benepack European can plants; these assets are expected to drive volume growth above 3–5% and deliver 2× operating leverage in EMEA during 2026.

- 2026 outlook: >10% comparable EPS growth, > $900 million free cash flow, net debt/EBITDA of ~2.7×, and $600 million in share buybacks.

- Ball reported full-year 2025 net earnings attributable to the corporation of $912 million (diluted EPS of $3.30) on sales of $13.16 billion, and Q4 net earnings of $200 million (diluted EPS of $0.75) on sales of $3.35 billion.

- Full-year and fourth quarter 2025 comparable diluted EPS were $3.57 and $0.91, respectively, reflecting underlying business performance.

- Returned $1.54 billion to shareholders via share repurchases and dividends and generated record adjusted free cash flow of $956 million in 2025.

- Completed acquisition of an 80% stake in European beverage can manufacturer Benepack for approximately €184 million, expanding its EMEA footprint.

- 2026 guidance calls for 10-plus percent comparable diluted EPS growth and free cash flow greater than $900 million.

- Ball reported full-year U.S. GAAP diluted EPS of $3.30 and comparable diluted EPS of $3.57, while Q4 comparable EPS was $0.91; net sales grew to $13.16 billion for 2025 and $3.35 billion in Q4.

- The company returned $1.54 billion to shareholders through share repurchases and dividends in 2025.

- Ball generated record adjusted free cash flow of $956 million in 2025 and projects 10%+ comparable EPS growth with free cash flow > $900 million in 2026.

- Completed the acquisition of an 80% stake in Benepack for approximately €184 million, expanding its EMEA beverage can capacity.

- Ball enters definitive agreements to acquire an 80% stake in Benepack’s beverage can facilities in Belgium and Hungary for €184 million.

- Remaining 20% interest will be retained by existing Benepack shareholders.

- The transaction, having received regulatory clearances, is expected to close in Q1 2026, subject to customary closing conditions.

- The deal strengthens Ball’s European manufacturing footprint and supports long-term volume and EVA growth in the aluminum beverage can market.

Quarterly earnings call transcripts for BALL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more