Bark (BARK)·Q3 2026 Earnings Summary

BARK Q3 FY2026: Revenue Misses as Marketing Pullback Prioritizes Profitability

February 5, 2026 · by Fintool AI Agent

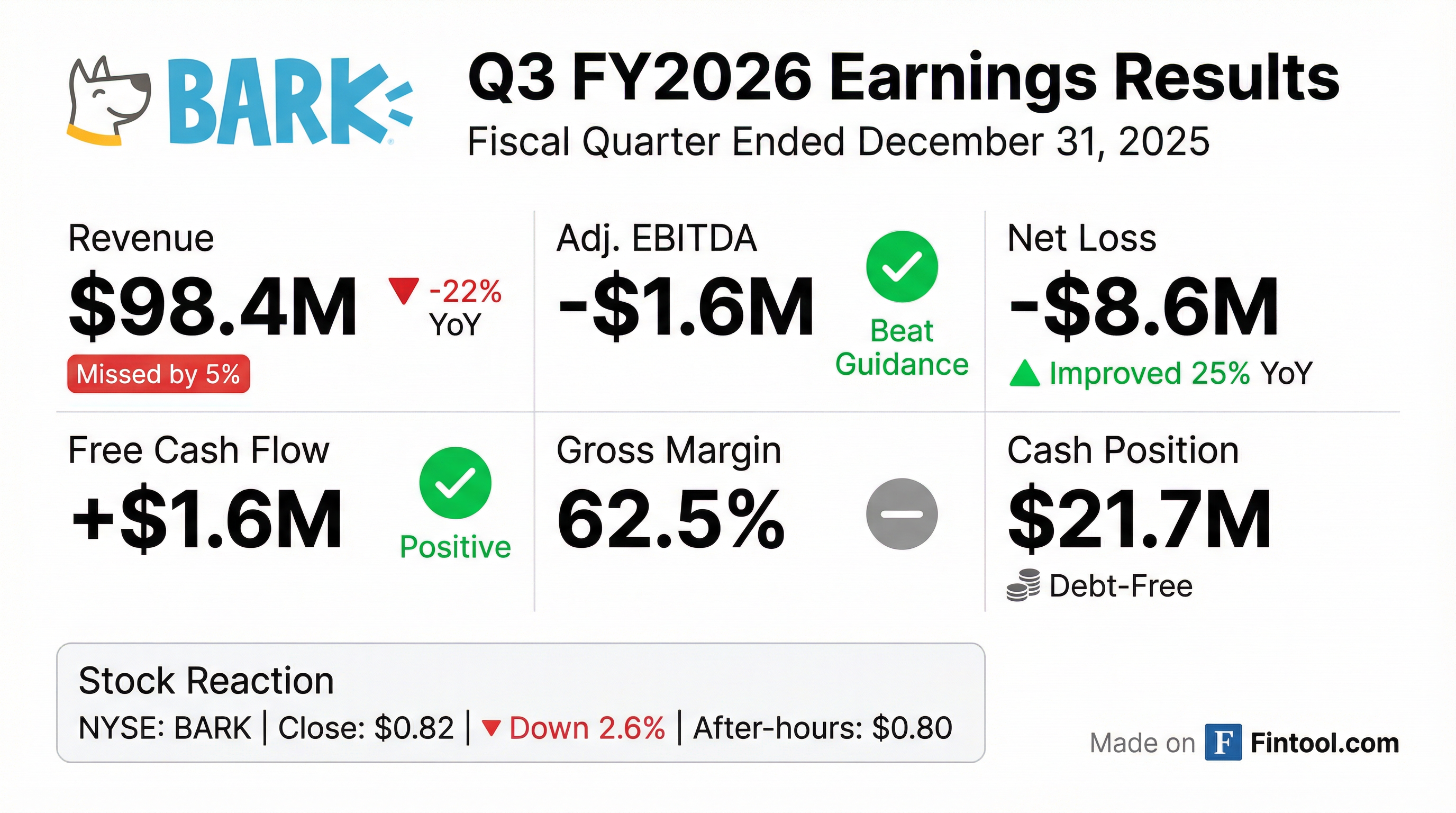

BARK, Inc. (NYSE: BARK) reported Q3 FY2026 results that reflected a strategic pivot toward profitability over growth. Revenue of $98.4 million missed consensus by 4.9% as the company slashed marketing spend by 41%, but Adjusted EBITDA of -$1.6 million came in at the high end of guidance. The company achieved a major milestone by fully repaying its $45 million convertible notes, leaving it debt-free.

Shares closed at $0.82, down 2.6% on the day, with after-hours trading at $0.80.

Did BARK Beat Earnings?

Revenue: Miss. $98.4M vs $103.6M consensus (-4.9%)

Adjusted EBITDA: Beat. -$1.6M vs guidance range of -$5M to -$1M (high end)

Adjusted EPS: Miss. -$0.03 vs -$0.015 consensus (-100% wider loss)

The revenue miss was deliberate. CEO Matt Meeker emphasized the company "reduced marketing spend to focus on profitability," cutting advertising and marketing expenses by 41.3% from $27.4M to $16.1M YoY.

What Did Management Guide?

No guidance provided. In a notable development, BARK declined to issue Q4 FY2026 guidance due to an ongoing review by the Special Committee of the Board regarding "previously disclosed preliminary non-binding indicative proposal letters" — suggesting potential acquisition interest.

The company also did not hold a Q&A session following prepared remarks, another unusual move that suggests M&A discussions are underway.

What Changed From Last Quarter?

1. Now Debt-Free: BARK repaid the remaining $42.9M principal plus $2.2M accrued interest on its 5.50% Convertible Secured Notes on November 6, 2025. This removes a significant liability and simplifies the capital structure.

2. Revenue Mix Shift: Commerce and BARK Air now represent 22.5% of total revenue, up meaningfully as the company diversifies beyond DTC subscriptions.

3. Inventory Normalization: Inventory declined $9.7M in the quarter to $91.4M, signaling improved working capital management.

4. Credit Facility Extended: The company extended its $35M line of credit with Western Alliance Bank, though only through March 2, 2026. Management intends to negotiate a longer-term renewal.

How Did the Stock React?

BARK shares closed at $0.82, down 2.6% from the prior close of $0.84. After-hours trading pushed the stock lower to $0.80, down an additional 1.7%.

The stock has traded in a wide range over the past year:

- 52-Week High: $2.04

- 52-Week Low: $0.53

- Current Market Cap: ~$140M

The muted reaction suggests investors were prepared for the revenue miss given the company's stated focus on profitability over growth. The potential M&A angle may also be providing support.

Segment Performance

DTC remains the core business but is shrinking as the company carries fewer active subscriptions. Commerce held up better, and BARK Air (the dog-first air travel service) continues to grow as a small but meaningful revenue contributor.

Both DTC and Commerce gross margins improved sequentially and YoY, demonstrating pricing power and operational efficiency even as volumes decline.

Key KPIs

The company delivered its "lowest customer acquisition cost quarter in nearly three years" despite the sharp marketing pullback, suggesting improved targeting efficiency.

Balance Sheet Highlights

Cash declined significantly due to the convertible note repayment, but the company is now debt-free with an undrawn $35M credit facility available for operational flexibility.

Management Commentary

CEO Matt Meeker on strategy:

"As we approach the end of fiscal 2026, our priorities remain—running the business with discipline, protecting profitability, and continuing to diversify the ways we serve dog parents. This quarter reflected that focus. We delivered adjusted EBITDA toward the high-end of our guidance range, generated positive free cash flow as inventory began to normalize, and continued to make progress across both Commerce and BARK Air, which now represent a meaningful and growing portion of our revenue mix."

On customer quality:

"While revenue was impacted by a deliberate pullback in marketing spend, we're seeing encouraging signs in customer quality, margin performance, and operational efficiency. Taken together, we believe these actions position BARK to exit the fiscal year as a leaner, more resilient, and more diversified company."

Risks and Concerns

-

Cash Runway: With $21.7M in cash and burning ~$22M in the first nine months of FY26 on operations, liquidity is tight. The $35M credit facility provides cushion, but only extends through March 2, 2026.

-

Revenue Trajectory: Revenue has declined from $126M to $98M over the past year (-22%). While intentional, prolonged declines could impair the business model.

-

M&A Uncertainty: The refusal to provide guidance and hold Q&A due to "preliminary non-binding indicative proposal letters" creates uncertainty. Deals often fall through.

-

Subscription Losses: Total orders declined 27% YoY, suggesting meaningful subscriber attrition that may be difficult to reverse.

What to Watch

- M&A Developments: Any update on the indicative proposals would be material

- Credit Facility Renewal: The March 2026 maturity needs extension

- Q4 Results: Will profitability gains continue as marketing remains constrained?

- Commerce/BARK Air Growth: Can these segments offset DTC declines?

Report generated by Fintool on February 5, 2026. Data sourced from company filings and S&P Global.

Related Links: