Earnings summaries and quarterly performance for Bark.

Research analysts who have asked questions during Bark earnings calls.

MR

Maria Ripps

Morgan Stanley

4 questions for BARK

Also covers: DSP, DV, ETSY +13 more

RM

Ryan Meyers

Lake Street Capital Markets

4 questions for BARK

Also covers: AKA, FTLF, GCT +13 more

Kaumil Gajrawala

Jefferies

2 questions for BARK

Also covers: BRBR, BTMD, BYND +22 more

Ygal Arounian

Citigroup

2 questions for BARK

Also covers: ANGI, BMBL, CRTO +13 more

Wayne Trinh

Citigroup

1 question for BARK

Also covers: KSPI

Recent press releases and 8-K filings for BARK.

BARK Reports Third Quarter Fiscal Year 2026 Results

BARK

Earnings

Guidance Update

Demand Weakening

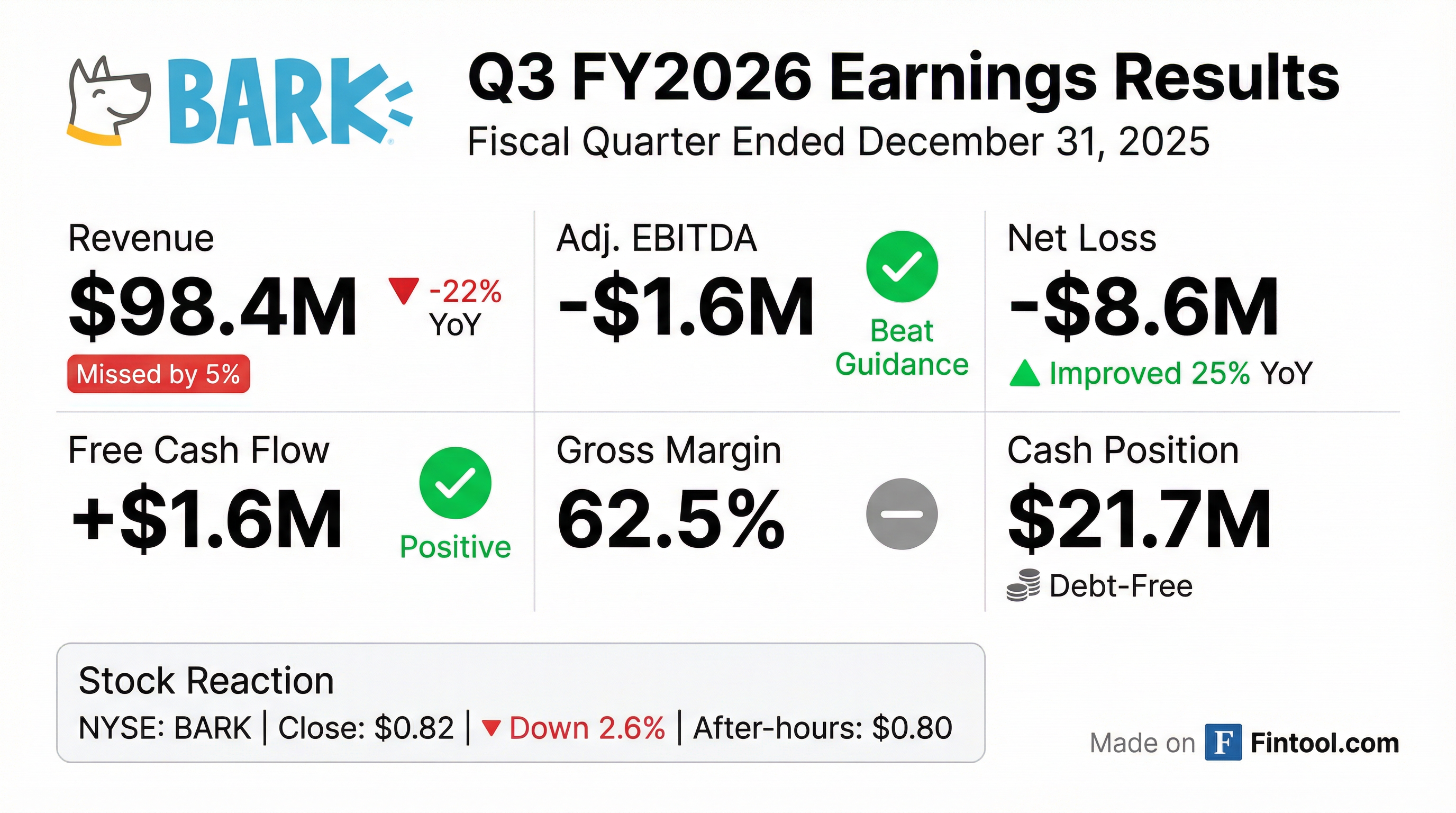

- BARK reported total revenue of $98.4 million for Q3 Fiscal Year 2026, which was below guidance and represented a 22.1% year-over-year decline, primarily due to fewer total orders and a 41.3% reduction in marketing investment.

- The company achieved a net loss of $(8.6) million and Adjusted EBITDA of $(1.6) million, which was within its guidance range.

- BARK fully repaid its outstanding 2025 Convertible Notes in cash, making the company debt-free.

- The company generated positive free cash flow of $1.6 million in Q3 Fiscal Year 2026.

- Gross margins improved year-over-year for both Direct-to-Consumer (66.4%, up 10 basis points) and Commerce (46.3%, up 230 basis points) segments.

1 day ago

BARK Reports Third Quarter Fiscal Year 2026 Results

BARK

Earnings

Demand Weakening

- BARK reported total revenue of $98.4 million for the third quarter of fiscal year 2026, which was below guidance and represented a 22.1% decrease year-over-year, primarily due to reduced marketing spend and fewer subscriptions.

- The company achieved an Adjusted EBITDA of $(1.6) million, which was within its guidance range of $(5.0) million to $(1.0) million, and a net loss of $(8.6) million, an improvement from $(11.5) million in the prior year.

- BARK became debt-free by fully repaying its outstanding 2025 Convertible Notes, repurchasing $42.9 million in principal and $2.2 million in accrued interest on November 6, 2025.

- The company generated $1.6 million in free cash flow and ended the quarter with $21.7 million in cash and cash equivalents as of December 31, 2025.

1 day ago

BARK's Special Committee Engages Advisors to Review Takeover Bids

BARK

M&A

Takeover Bid

- BARK, Inc.'s Special Committee has engaged Moelis & Company LLC as financial advisor and Sidley Austin LLP as legal advisor to review preliminary non-binding indicative proposals.

- The Company received a proposal on January 9, 2026, from Great Dane Ventures, LLC to acquire shares not already owned by them for $0.90 per share in cash.

- A subsequent proposal was received on January 14, 2026, from GNK Holdings LLC and Marcus Lemonis to acquire shares not already owned by them for $1.10 per share in cash.

- The Board cautions that there is no assurance any definitive offer or transaction will be made or consummated, as the Special Committee has not yet fully evaluated the proposals.

4 days ago

BARK Retains Advisors to Evaluate Acquisition Proposals

BARK

M&A

Takeover Bid

- BARK's Special Committee has retained Moelis & Company LLC as financial advisor and Sidley Austin LLP as legal advisor to review and evaluate preliminary non-binding acquisition proposals.

- On January 9, 2026, the Company received a proposal from the Great Dane Group (including CEO Matt Meeker) to acquire outstanding shares not already owned by them for $0.90 per share in an all-cash transaction.

- On January 14, 2026, a second proposal was received from the GNK/Lemonis Group to acquire outstanding shares not already owned by them for $1.10 per share in an all-cash transaction.

- The Board cautions that there is no assurance any definitive offer or agreement will be made, and the Company does not undertake to provide updates unless required by law.

4 days ago

BARK, Inc. receives "take private" proposal

BARK

M&A

Takeover Bid

- BARK, Inc. announced on January 9, 2026, that it received a preliminary non-binding indicative proposal from Great Dane Ventures, LLC, a group of current stockholders including CEO Matt Meeker.

- The proposal is to acquire all outstanding common stock not already beneficially owned by the Stockholder Group for $0.90 per share in an all-cash transaction.

- A special committee of independent directors has been formed by the Board to evaluate the proposal.

- The company cautions that there is no assurance that a definitive offer or agreement will be made or that the transaction will be consummated.

Jan 9, 2026, 9:59 PM

BARK Receives "Take Private" Proposal

BARK

M&A

Takeover Bid

- BARK, Inc. has received a preliminary non-binding indicative proposal to be taken private.

- The proposal, from Great Dane Ventures, LLC (a group of current stockholders including CEO Matt Meeker), offers to acquire all outstanding shares not already beneficially owned by the Stockholder Group for $0.90 per share in an all-cash transaction.

- A special committee of independent directors has been formed by the Board to consider the proposal.

- The Company cautions that there is no assurance that any definitive offer will be made or that a transaction will be approved or consummated.

Jan 9, 2026, 9:56 PM

BARK Reports Q2 Fiscal Year 2026 Results and Becomes Debt-Free

BARK

Earnings

Guidance Update

New Projects/Investments

- BARK reported total revenue of $107 million for the second quarter of fiscal year 2026, exceeding its guidance range, and an Adjusted EBITDA of negative $1.4 million, which was within its guidance range.

- The company announced it is now debt-free after paying off its $45 million convertible note using cash from its balance sheet and extended its $35 million credit line with Western Alliance Bank.

- Diversification efforts showed strong performance, with the Commerce segment generating $24.8 million in revenue (up 6% year over year) and BARK Air contributing $3.6 million (up 138% from last year).

- For Q3 fiscal year 2026, BARK expects total revenue to be between $101 million and $104 million, and Adjusted EBITDA to range from negative $5 million to negative $1 million.

Nov 10, 2025, 1:30 PM

Shay Capital Urges BARK Board to Implement Share Buyback and Inventory Financing

BARK

Share Buyback

New Projects/Investments

Revenue Acceleration/Inflection

- Shay Capital, a major shareholder, has urged BARK's Board of Directors to immediately authorize a minimum $25 million share buyback program and secure inventory financing against $98 million in paid-for inventory to unlock capital.

- The shareholder highlights BARK's strong balance sheet, including $85 million in cash reserves and $98 million in inventory, stating that the company's $150 million equity value exceeds its $137 million market capitalization as of October 21, 2025.

- Additionally, Shay Capital recommends expanding product categories to include wellness products and aggressively monetizing BARK's proprietary data on over 6 million dogs.

Oct 21, 2025, 2:30 PM

Quarterly earnings call transcripts for Bark.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more