Earnings summaries and quarterly performance for Beacon Financial.

Research analysts covering Beacon Financial.

Recent press releases and 8-K filings for BBT.

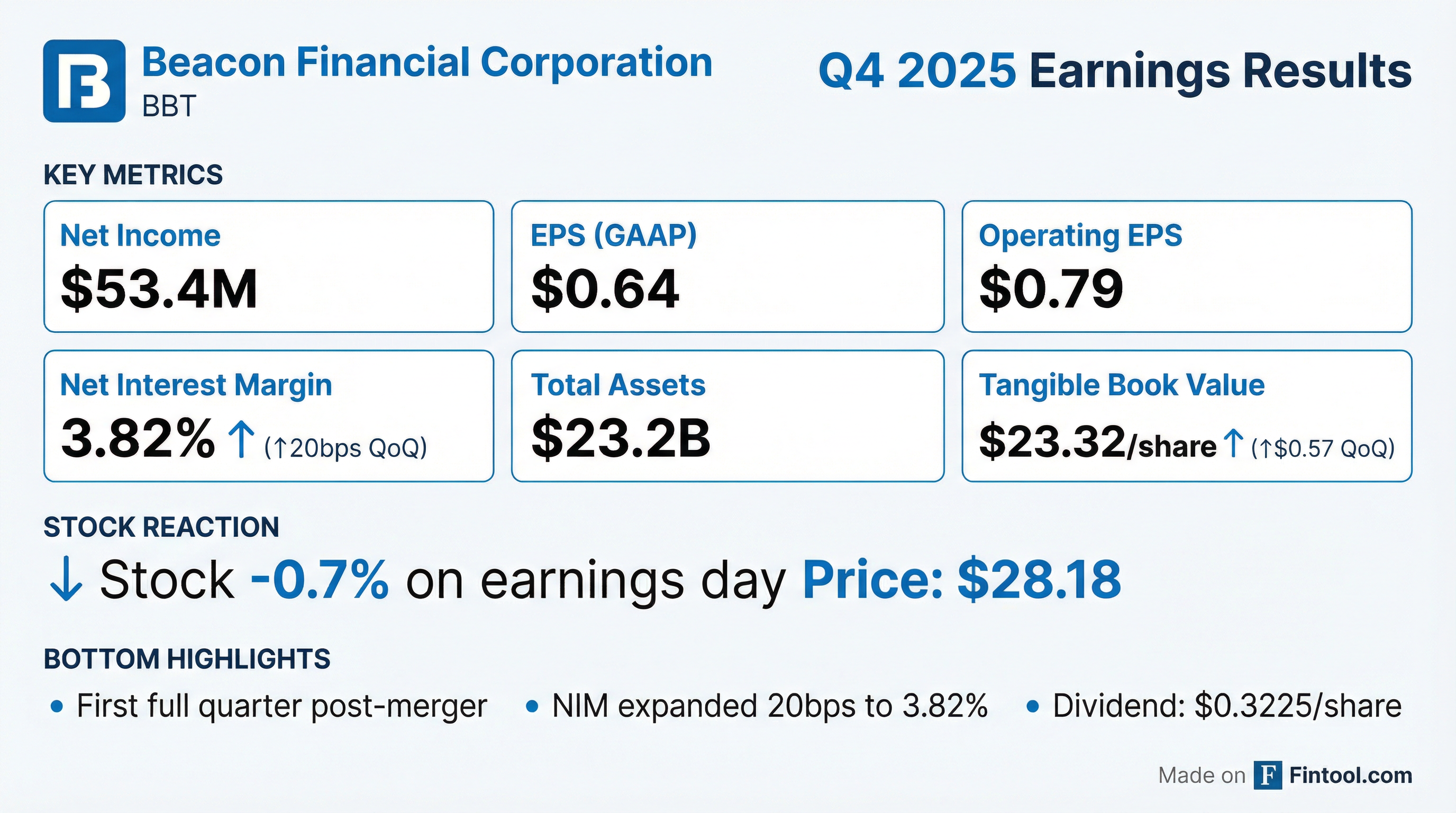

Beacon Financial Corporation Announces Q4 and Full-Year 2025 Results and Dividend

BBT

Earnings

Dividends

Accounting Changes

- Beacon Financial Corporation reported net income of $53.4 million and EPS of $0.64 for the fourth quarter of 2025, with full-year 2025 net income at $90.3 million and EPS at $1.03. Operating earnings (non-GAAP) were $66.4 million and operating EPS (non-GAAP) was $0.79 for Q4 2025.

- The company declared a regular quarterly dividend of $0.3225 per share, payable on February 27, 2026, to stockholders of record on February 13, 2026.

- Total assets increased to $23.2 billion at December 31, 2025, from $11.9 billion at December 31, 2024, and total deposits reached $19.5 billion, primarily due to assets and deposits assumed in the merger of equals.

- Net interest income increased to $199.7 million during Q4 2025 from $128.9 million in Q3 2025, and the net interest margin improved to 3.82% for the three months ended December 31, 2025, from 3.62% in the prior quarter.

- Beacon Financial Corporation early adopted ASU 2025-08 effective January 1, 2025, which eliminated the CECL "Double Count" impact on purchased non-PCD loans, resulting in a $67.2 million reduction in 3Q25 provision expense and a $48.7 million increase in capital.

Jan 28, 2026, 9:18 PM

Deacon Financial Corporation Reports Q3 2025 Results and Merger Update

BBT

Earnings

M&A

Dividends

- Deacon Financial Corporation, formed by the merger of Brookline Bancorp and Berkshire Hills Bancorp on September 1, 2025, reported Q3 2025 operating earnings of approximately $38.5 million, or $0.44 per share, before merger expenses and special charges, and a GAAP loss of $56 million, or $0.64 per share.

- The combined entity concluded Q3 2025 with $23 billion in assets, $19 billion in deposits, and $18 billion in loans.

- The board approved an increase in the quarterly dividend to $0.3225 per share, translating to an annual dividend of $1.29 per share and a 5.4% dividend yield.

- The company expects remaining deal-related charges of $22 million to $24 million for Q4 2025 and Q1 2026, and anticipates quarterly provisions for credit losses to be in the range of $5 million to $9 million.

- Management also estimates purchase accounting accretion to be $15 million to $20 million per quarter and plans to explore balance sheet and capital structure optimization, including potential sub-debt refinancing in 2026.

Oct 30, 2025, 5:30 PM

BBT Reports Q3 2025 Results Following Merger Completion

BBT

Earnings

M&A

Guidance Update

- BBT successfully closed its merger of equals in Q3 2025, leading to total assets of $22.8 billion and incurring $129.8 million in pretax, one-time costs associated with the merger.

- For Q3 2025, the company reported a GAAP EPS of ($0.64) and a Quarterly Operating EPS of $0.44, with a GAAP net loss of ($56.3 million).

- The merger significantly impacted the balance sheet, with total deposits increasing by $9,943 million to $18,904 million and total loans increasing by $8,660 million to $18,242 million compared to Q2 2025.

- The net interest margin improved to 3.72% in Q3 2025, and management expects it to expand further to 3.90-4.00%.

- The company anticipates credit costs to trend lower, ranging from $5-9 million per quarter, while merger-related charges are projected to continue through Q1 2026.

Oct 30, 2025, 5:30 PM

Beacon Financial Corporation Reports Q3 2025 Net Loss Driven by Merger Costs and Announces Merger Completion

BBT

Earnings

M&A

Dividends

- Beacon Financial Corporation reported a net loss of $(56.3) million, or $(0.64) per basic share, for the third quarter of 2025, primarily due to $129.8 million in pre-tax one-time costs associated with its merger.

- Excluding these one-time costs, operating earnings (non-GAAP) for Q3 2025 were $38.5 million, or $0.44 per diluted share.

- The company was formed through the completion of a merger of equals between Berkshire Hills Bancorp, Inc. and Brookline Bancorp, Inc., effective September 1, 2025.

- As of September 30, 2025, Beacon Financial Corporation reported total assets of $22.8 billion.

- The Board of Directors approved a quarterly dividend of $0.3225 per share for Q3 2025.

Oct 29, 2025, 9:17 PM

Beacon Financial Reports Q3 2025 Results Amid Merger of Equals

BBT

Earnings

M&A

Dividends

- Beacon Financial Corporation reported a net loss of $(56.3) million, or $(0.64) per basic share, for the third quarter of 2025, compared to net income of $22.0 million for the second quarter of 2025.

- Excluding $129.8 million in pre-tax one-time costs associated with the merger, operating earnings for Q3 2025 were $38.5 million, or $0.44 per diluted share.

- The merger of equals with Berkshire Hills Bancorp, Inc. was completed on September 1, 2025. As a result, total assets at September 30, 2025, were $22.8 billion, total loans and leases were $18.2 billion, and total deposits were $18.9 billion.

- The company declared a quarterly dividend of $0.3225.

Oct 29, 2025, 8:05 PM

Quarterly earnings call transcripts for Beacon Financial.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more