BRUNSWICK (BC)·Q4 2025 Earnings Summary

Brunswick Beats Q4 as Marine Market Stabilizes, Guides FY26 EPS $3.80-$4.40

January 29, 2026 · by Fintool AI Agent

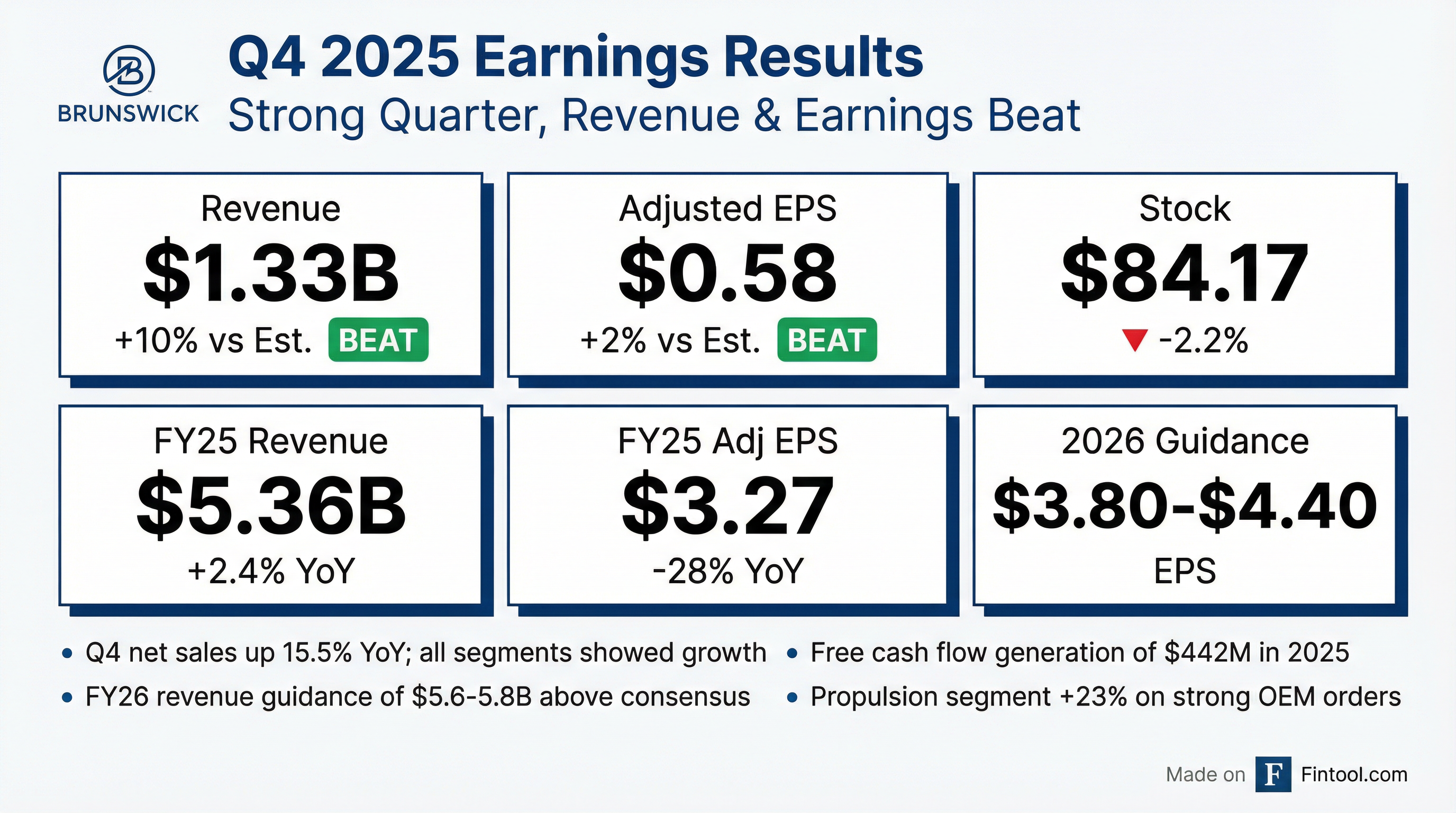

Brunswick Corporation delivered a strong finish to 2025, with Q4 revenue of $1.33B beating consensus by 10% and adjusted EPS of $0.58 exceeding estimates by 2% . All four business segments posted YoY sales and earnings growth as the U.S. marine retail market showed stabilization in the second half . Management struck an optimistic tone on the call, noting January retail is tracking double digits above prior year . The company guided FY 2026 adjusted EPS of $3.80-$4.40 on revenue of $5.6-5.8B, with the revenue midpoint above Street expectations .

Did Brunswick Beat Earnings?

Yes — double beat on revenue and EPS.

The beat was driven by improved market conditions, increased wholesale shipments, pricing actions, lower discounting, and continued strong boating participation supporting the parts and accessories business .

For the full year 2025, Brunswick delivered:

- Revenue: $5,362.8M (+2.4% YoY)

- Adjusted EPS: $3.27 (-28.4% YoY)

- Free Cash Flow: $442M (+56% YoY)

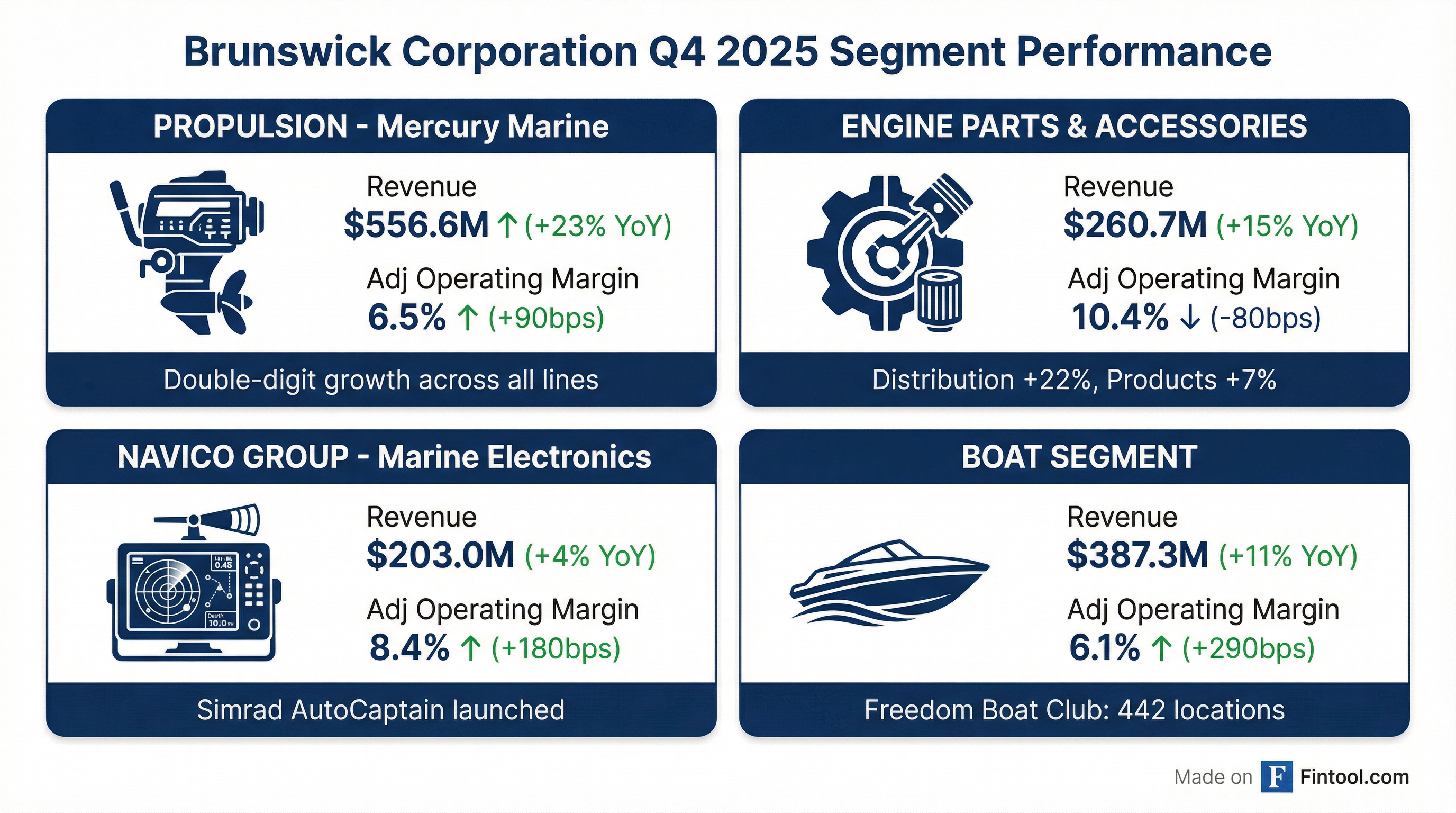

How Did Each Segment Perform?

All four segments grew revenue and earnings in Q4 — a notable achievement after a challenging year.

Propulsion (Mercury Marine) — The standout performer with 23% revenue growth driven by double-digit increases across outboard, sterndrive, and controls/rigging/propellers business lines . Strong OEM orders ahead of the 2026 retail season drove the surge. Mercury unveiled its '808' ultra-high horsepower outboard concept at CES .

Engine Parts & Accessories — Products +7%, Distribution +22% . The U.S. distribution business gained 210 bps of market share in 2025 .

Navico Group — Margin expansion of 180 bps reflects traction from the refreshed product portfolio and operational improvements . The Simrad AutoCaptain autonomous boating system was launched, co-developed with Mercury and Brunswick Boat Group .

Boat Segment — Margin expanded 290 bps as discounting improved ~100 bps over prior year . Premium brands saw 15% revenue growth at the Ft. Lauderdale Boat Show . Freedom Boat Club grew to 442 locations with 640,000+ member trips (+5% YoY), contributing ~10% of segment sales .

What Did Management Guide?

Brunswick provided FY 2026 guidance assuming a flat-to-slightly-up retail environment :

Q1 2026 guidance is notably soft: Revenue $1.2-1.4B and adjusted EPS $0.35-$0.45 , well below consensus of $0.79. This reflects typical seasonality and a cautious setup given tariff uncertainty.

CEO David Foulkes emphasized the company is "favorably set up in a range of scenarios" with record low and fresh pipeline inventories . Retail significantly outpaced wholesale in 2025 for both boats and engines, positioning Brunswick to align production more closely with retail demand .

How Did the Stock React?

Brunswick shares fell 2.2% on the day of the earnings release, closing at $84.17 after opening at $86.04.

The muted reaction despite the beat likely reflects the soft Q1 guidance and ongoing tariff concerns. The stock has rallied significantly from its 52-week low of $41, roughly doubling as the marine market stabilized.

Q&A Highlights

Key themes from the analyst Q&A session:

Early 2026 Retail Momentum — CEO Foulkes disclosed that January retail is up double digits despite inclement weather, though noted volumes are still low at this time of year .

Mercury Market Share Acceleration — Mercury finished 2025 with ~47% U.S. outboard share. More impressively, wholesale share accelerated through Q4 — up 400 bps in the quarter and 900 bps in December vs prior year . This bodes well for 2026 share gains.

Interest Rates Helping — Retail financing rates have declined to ~7.5% from a peak of ~10% in 2024 (pre-pandemic was 5.5-6%) . This benefits both consumer demand and dealer floor plan costs.

Dealer Orders Strong — Order backlog stands at 79% of Q1 wholesale forecast, up 13 percentage points from last year . This supports confidence in wholesale growth despite soft Q1 EPS guidance.

IEEPA Tariff Exposure — If the Supreme Court strikes down IEEPA tariffs, the full-year benefit would be $20-25M . The remaining tariff exposure is from 232 steel/aluminum tariffs.

Tariff Timing Impact — Q1 bears the majority of incremental tariff costs because 2025 tariffs didn't materially begin until April . Combined with accelerated product spending, this creates a ~$30M EPS headwind in Q1 that normalizes thereafter .

Mercury Investment Ramping — Brunswick hired 60 new Mercury engineers in 2025 and has 5 new outboard programs in development .

What Changed From Last Quarter?

Several notable shifts from Q3 2025:

-

Market sentiment improving — U.S. boat retail sales, while down 9% for 2025, showed stabilization in H2. Brunswick global retail was down only 5%, outperforming the industry .

-

Discounting environment better — Discounting improved ~100 bps YoY in 2025 , supporting boat segment margins.

-

Free cash flow surged — Full-year FCF of $442M vs $284M in 2024 (+56%), enabling more debt paydown than planned .

-

Dealer inventories healthy — Pipeline remains "extremely healthy" with record low and fresh inventories .

-

Variable compensation reinstated — This was called out as a headwind across all segments, along with tariff impacts .

-

Balance sheet strengthening — Debt retirement totaled ~$240M in 2025, with another $160M+ planned for 2026 ($400M total) . Interest expense to decline ~$40M in 2026 from capital strategy actions .

-

OEM momentum accelerating — Mercury signed multi-year exclusive agreements with Axopar, Saxdor, and De Antonio Yachts, adding to 100+ new/renewed OEM agreements in 12 months . Some European agreements are 5 years — unusually long .

What's the Investment Takeaway?

Brunswick delivered an encouraging quarter that exceeded expectations across the board, with all segments showing improvement. The key positives:

- Market stabilization — Retail trends improved in H2, and Brunswick outperformed the industry. January retail is up double digits

- Mercury momentum — Wholesale share up 400 bps in Q4 and 900 bps in December; 61% share at Fort Lauderdale boat show

- Operational execution — Margin expansion in 3 of 4 segments despite reinstatement of variable comp

- Cash generation — $442M FCF enables $400M debt paydown over 2025-2026 plus ~$40M interest savings

- Inventory positioning — Low field inventories and order backlog at 79% of Q1 forecast set up well for recovery

The key concerns:

- Soft Q1 guide — EPS guidance of $0.35-$0.45 is well below Street at $0.79, signaling caution

- Tariff uncertainty — Management noted the "very dynamic geopolitical and trade backdrop"

- Marine market still challenged — Industry retail down 9% in 2025; flat-to-slight growth assumed for 2026

Brunswick appears well-positioned for a market recovery with lean inventories and strong brands, but near-term visibility remains limited given macro headwinds.

New Products and Awards

Brunswick showcased significant innovation across its portfolio:

CES 2026 Debuts:

- Mercury 808 Concept — Ultra-high horsepower outboard concept based on the V12 600hp platform, signaling future direction

- Sea Ray SLX 360 — First-ever boat launch at CES, featuring Mercury propulsion and Simrad AutoCaptain autonomous boating system

- Flite Race eFoil — Collaboration with Fliteboard, capable of 30+ mph, setting new electric watercraft performance benchmark

- Simrad AutoCaptain won a CES Pick Award

Boat Show Performance:

- Fort Lauderdale: 15% revenue growth for premium brands; Mercury achieved 61% outboard share — a record

- Düsseldorf: Mercury had 50%+ share of all outboards, nearly triple the nearest competitor

Awards:

- Navan S30: Motorboat of the Year

- Sea Ray SDX 270 Surf: European Powerboat of the Year

- Princecraft Platinum 190: NMMA Innovation Award (2nd consecutive year)

- Brunswick named to Forbes America's Best Companies list for the first time

Key Quotes From Management

"We finished 2025 ahead of recent expectations, with all our businesses reporting sales and earnings growth in the quarter, leading to full-year net sales growth for the first time in three years."

— David Foulkes, CEO

"Retailers are up double digits so far this year, despite the inclement weather and a few other things going on around the country."

— David Foulkes, CEO (on early 2026 trends)

"We hired 60 new Mercury engineers in 2025... we are loading up for another product blitz in Mercury. We have 5 new outboard programs going."

— David Foulkes, CEO

"Think of it really as just growth initiative spending, which we're happy to do to continue to drive our market share and our leading products."

— Ryan Gwillim, CFO (on increased OpEx)

Brunswick will host an Investor and Analyst Event on February 12, 2026 at the Miami Boat Show, featuring a tour of exhibits and products followed by management meetings .

Related: Brunswick Company Profile | Q4 2025 Earnings Call Transcript | Q3 2025 Earnings