BCB BANCORP (BCBP)·Q4 2025 Earnings Summary

BCB Bancorp Posts $12M Loss on Cannabis REO Write-Down, Cuts Dividend

January 30, 2026 · by Fintool AI Agent

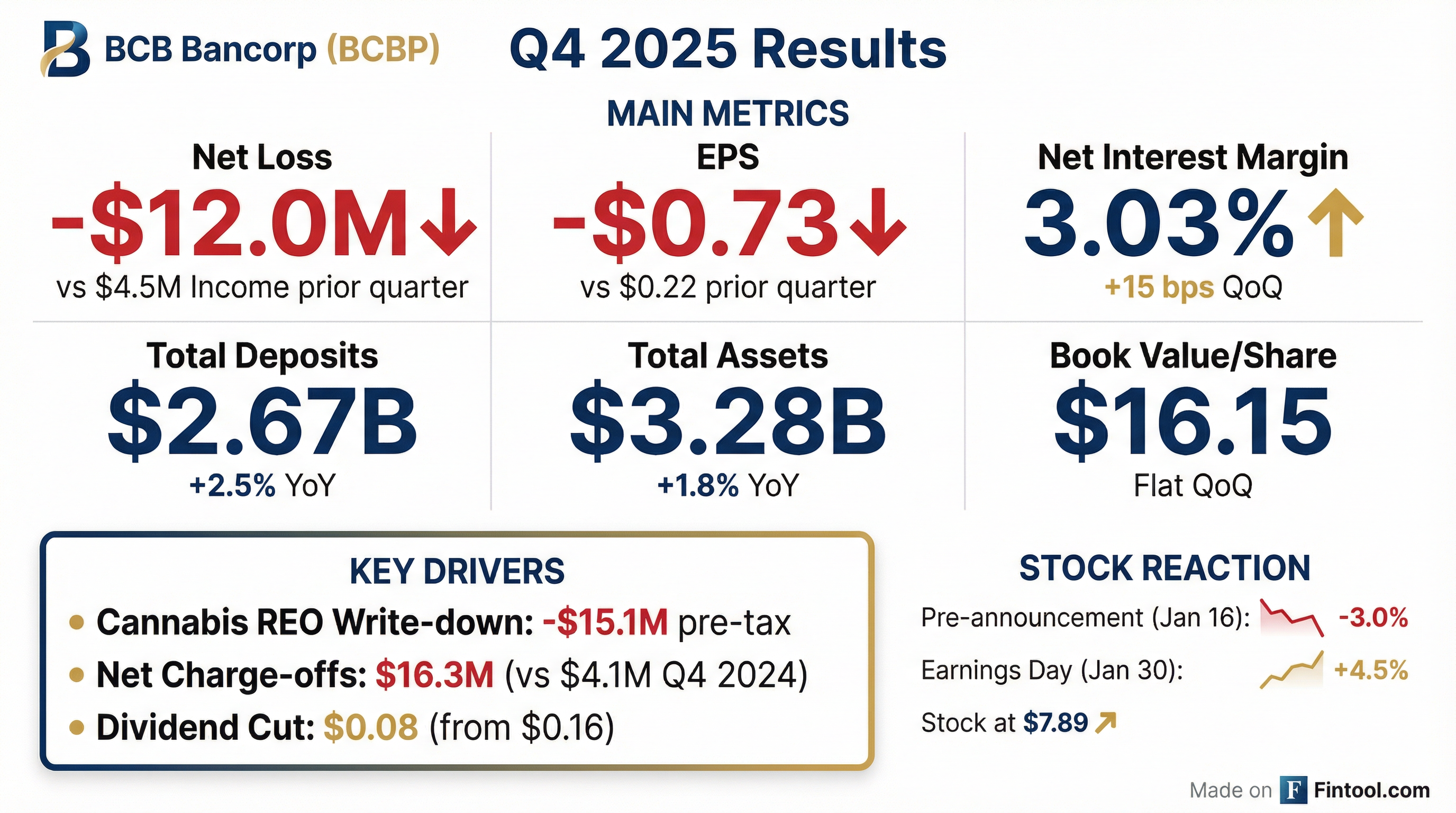

BCB Bancorp (NASDAQ: BCBP) reported a net loss of $12.0 million for Q4 2025, swinging from net income of $4.3 million in Q3 2025 . The New Jersey-based community bank's quarter was dominated by a $15.1 million pre-tax write-down on an isolated cannabis-related real estate owned (REO) property, along with $16.3 million in net charge-offs concentrated in its C&I loan portfolio . The Board responded by cutting the quarterly dividend 50% to $0.08 per share .

Did BCB Bancorp Beat Earnings?

No. BCB Bancorp reported a loss per diluted share of ($0.73), compared to earnings of $0.22 in Q3 2025 and $0.16 in Q4 2024 . Limited analyst coverage means consensus estimates are not widely available for this $136M market cap regional bank.

The loss was almost entirely driven by two factors: the $15.1M cannabis REO write-down (recorded in non-interest expense) and $12.2M in credit loss provisioning—triple the prior quarter .

What Did Management Say About the Cannabis Write-Down?

CEO Michael Shriner addressed the issue directly: "As previously noted in our Form 8-K filed on January 16, 2026, our fourth-quarter results reflect a $15.1 million pre-tax write-down on an isolated cannabis-related real estate owned (REO) property" .

Management emphasized this was an isolated incident rather than systemic exposure, and that the company had "taken decisive, proactive steps to address asset quality while simultaneously strengthening our capital position and liquidity profile" .

How Did the Stock React?

BCBP shares rose +4.5% on earnings day (January 30) to close at $7.89, likely because the bad news was already priced in from the pre-announcement on January 16, when shares dropped -3.0% following the 8-K disclosure of the cannabis write-down.

The stock is trading near its 52-week low of $7.31 (hit today intraday), down from a 52-week high of $11.07. Year-to-date, BCBP is down approximately 2.2% from its December 31, 2025 close of $8.07.

What Changed From Last Quarter?

Net Interest Margin Improvement

The bright spot was continued NIM expansion:

NIM expanded 50 basis points year-over-year, driven by a 59 bps decline in funding costs as the bank paid down higher-cost brokered deposits and FHLB advances .

Asset Quality: Mixed Picture

Non-accrual loans actually decreased sequentially from $93.5M to $63.3M, reflecting "favorable resolution of non-accrual loans" . However, net charge-offs spiked to $16.3M—four times the Q4 2024 level .

The largest charge-off was a $6.4M C&I loan, with an additional $1.4M from Business Express loans .

Balance Sheet Deleveraging

Management continued its strategic initiative to shrink the balance sheet and strengthen capital ratios:

Why Did BCB Bancorp Cut the Dividend?

The Board reduced the quarterly dividend from $0.16 to $0.08 per share . CEO Shriner explained: "The Board continues to prioritize long-term shareholder value creation, focusing on improving earnings performance and disciplined capital allocation" .

At the new rate:

- Annual dividend: $0.32 per share

- Dividend yield: ~4.1% (at $7.89 stock price)

- Payout ratio: Not applicable due to net loss

Book value per share declined to $16.15 from $17.02 in Q3 2025 , with tangible book value at $15.85 .

Full-Year 2025 Results

For the full year 2025, BCB Bancorp reported a net loss of $12.5 million, compared to net income of $18.6 million in 2024—a swing of nearly $31 million .

The elevated full-year charge-offs included $12.7M related to the cannabis relationship (recorded in Q3) and $29.2M in C&I portfolio losses, of which $9.8M were Business Express loans .

What to Watch Going Forward

-

Asset quality trajectory: Non-accruals improved sequentially, but charge-offs remain elevated. Management's ability to work through remaining problem loans will be critical.

-

NIM sustainability: The 3.03% margin is the highest in two years, but depends on continued funding cost declines.

-

Capital rebuilding: The 50% dividend cut preserves ~$1.4M per quarter. Management will need to demonstrate a path back to profitability.

-

Cannabis exposure: Management characterized the REO write-down as "isolated," but investors will scrutinize any remaining cannabis-related credits.

Key Financial Tables

Quarterly EPS Trend

Efficiency Ratio Trend

The Q4 2025 efficiency ratio spiked to 120% due to the $15.1M REO expense. Excluding that item, the adjusted efficiency ratio would have been approximately 62%.

BCB Bancorp is headquartered in Bayonne, New Jersey, with 27 branches across New Jersey and New York. The company trades on NASDAQ under the symbol BCBP.

Related Links: