Earnings summaries and quarterly performance for BCB BANCORP.

Executive leadership at BCB BANCORP.

Michael Shriner

Detailed

President and Chief Executive Officer

CEO

DR

David R. Garcia

Detailed

Executive Vice President and Chief Lending Officer

JC

Jawad Chaudhry

Detailed

Executive Vice President and Chief Financial Officer

RB

Ryan Blake

Detailed

Executive Vice President, Chief Operating Officer and Corporate Secretary

SL

Sandra L. Sievewright

Detailed

Executive Vice President and Chief Compliance Officer

Board of directors at BCB BANCORP.

JR

James Rizzo

Detailed

Director

JP

John Pulomena

Detailed

Director

JL

Joseph Lyga

Detailed

Director

JQ

Judith Q. Bielan

Detailed

Director

MD

Mark D. Hogan

Detailed

Chairman of the Board

MJ

Michael J. Widmer

Detailed

Director

RJ

Raymond J. Vanaria

Detailed

Director

TL

Tara L. French

Detailed

Vice Chair of the Board

VD

Vincent DiDomenico, Jr.

Detailed

Director

Research analysts covering BCB BANCORP.

Recent press releases and 8-K filings for BCBP.

BCB Bancorp, Inc. Reports Q4 2025 Net Loss and Dividend Adjustment

BCBP

Earnings

Dividends

Profit Warning

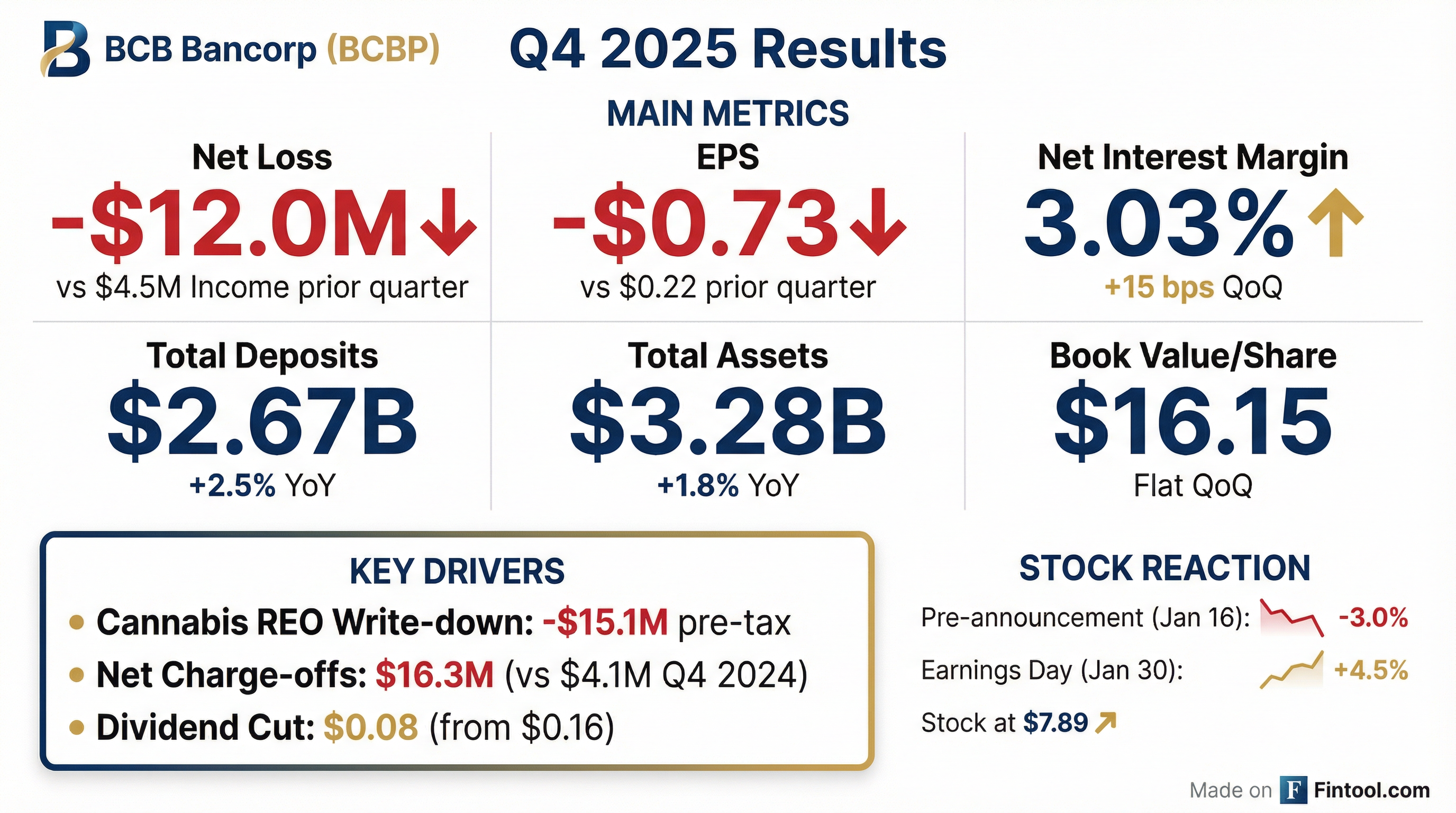

- BCB Bancorp, Inc. reported a net loss of $12.0 million and a loss per diluted share of ($0.73) for the fourth quarter of 2025, compared to net income in the prior quarter and prior year.

- The net loss was primarily driven by a $15.1 million pre-tax write-down on a cannabis-related real estate owned (REO) property and $16.3 million in additional net charge-offs, mainly within the C&I loan portfolio.

- The Board of Directors adjusted the quarterly cash dividend to $0.08 per share.

- Total assets decreased by 8.9 percent to $3.279 billion at December 31, 2025, from December 31, 2024, and stockholders' equity decreased by 6.1 percent to $304.3 million.

- The company's efficiency ratio for the fourth quarter was 120.0 percent, and non-accrual loans totaled $63.3 million at December 31, 2025.

8 days ago

BCB Bancorp Reports Q4 2025 Net Loss and Dividend Adjustment

BCBP

Earnings

Profit Warning

Dividends

- BCB Bancorp reported a net loss of $12.0 million for the fourth quarter of 2025, compared to net income of $4.3 million in the third quarter of 2025, and a loss per diluted share of ($0.73).

- The Board of Directors declared a regular quarterly cash dividend of $0.08 per share, a strategic adjustment for prudent balance-sheet management.

- The net loss was primarily due to a $15.1 million pre-tax write-down on a cannabis-related real estate owned (REO) property and $16.3 million in additional net charge-offs, mainly within the C&I loan portfolio.

- The net interest margin increased to 3.03 percent for the fourth quarter of 2025, up from 2.88 percent in the third quarter of 2025 and 2.53 percent in the fourth quarter of 2024.

- Total assets decreased by 8.9 percent to $3.279 billion at December 31, 2025, from $3.599 billion at December 31, 2024, driven by decreases in cash and cash equivalents and net loans.

8 days ago

Bitcoin Bancorp Plans Texas ATM Deployment

BCBP

New Projects/Investments

Revenue Acceleration/Inflection

- Bitcoin Bancorp (OTC: BCBC) intends to deploy up to 200 licensed Bitcoin ATMs across Texas beginning in Q1 2026.

- Texas is considered a strategically important market for the company's growth due to its business-friendly regulation, modernized money-transmitter laws, and favorable tax environment.

- This expansion aligns with Bitcoin Bancorp's long-term strategy to grow its licensed Bitcoin ATM network nationwide and introduce compliant functionalities such as digital-asset payments, stablecoin services, and Web3-enabled features, aiming to create a network of blockchain-enabled micro-bank branches.

- Eric Noveshen, Director of Bitcoin Bancorp, stated that agreements are in place that could provide for accelerated revenue growth over the coming year.

Dec 15, 2025, 12:30 PM

BCB EXCHANGE Launches U.S. Crypto Trading Platform with FinCEN MSB Registration

BCBP

Product Launch

New Projects/Investments

- BCB EXCHANGE Corp. launched its U.S. operations on November 3, 2025, introducing a new U.S. trading platform built on European institutional expertise.

- The company commences with a Money Services Business (MSB) registration from the Financial Crimes Enforcement Network (FinCEN), aiming to bring institutional-grade security and compliance to the American retail market.

- The platform will initially offer crypto-to-crypto spot trading services and has a two-phase compliance roadmap to pursue state-level Money Transmitter Licenses for fiat services and Commodity Futures Trading Commission (CFTC) registrations for digital asset derivatives.

- BCB EXCHANGE's strategic vision is to become the leading U.S. platform for Real-World Assets (RWA), bridging traditional finance with the digital asset ecosystem.

Nov 3, 2025, 12:00 PM

BCB Bancorp Reports Q3 2025 Results and Declares Quarterly Dividend

BCBP

Earnings

Dividends

- BCB Bancorp, Inc. reported net income of $4.3 million and diluted earnings per share of $0.22 for the third quarter of 2025, compared to $3.6 million and $0.18, respectively, in the second quarter of 2025, and $6.7 million and $0.36 in the third quarter of 2024.

- The company's Board of Directors declared a regular quarterly cash dividend of $0.16 per share, payable on November 24, 2025, to shareholders of record on November 10, 2025.

- The net interest margin (NIM) increased to 2.88% for Q3 2025, up from 2.80% in the prior quarter and 2.58% in Q3 2024.

- Total deposits stood at $2.687 billion as of September 30, 2025, a slight increase from $2.662 billion at June 30, 2025.

- The company recognized $16.9 million in net charge-offs during Q3 2025, which included a $12.7 million charge-off related to a previously established specific reserve for a cannabis-related relationship. Non-accrual loans totaled $93.5 million at September 30, 2025.

Oct 27, 2025, 8:28 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more