BANK OF CHILE (BCH)·Q4 2025 Earnings Summary

Banco de Chile Misses Estimates But Holds #1 Position With Industry-Leading ROE and Capital

February 5, 2026 · by Fintool AI Agent

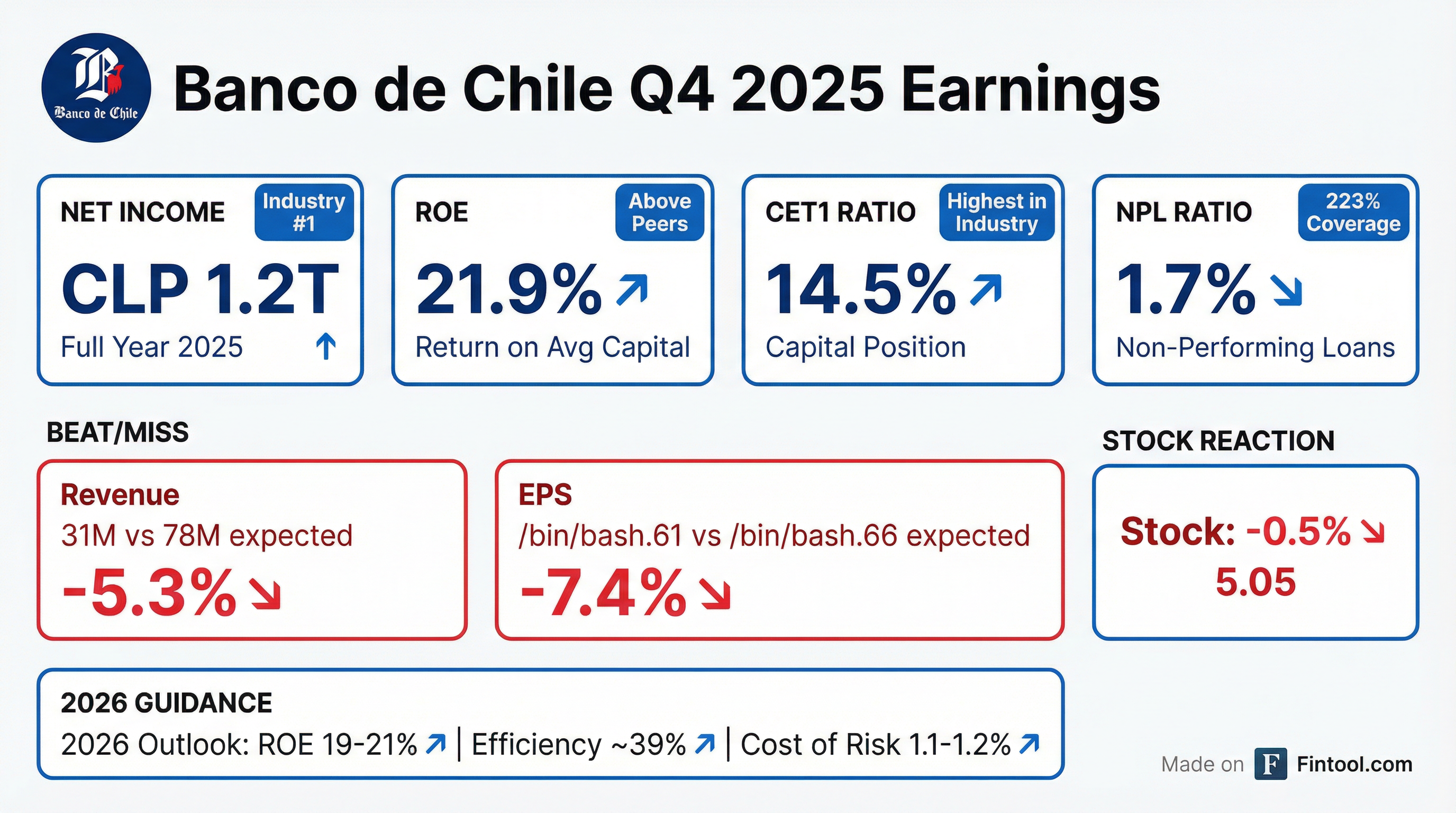

Banco de Chile (NYSE: BCH) reported Q4 2025 results that missed consensus estimates on both revenue and EPS, but the bank maintained its dominant position in Chile's banking industry with the highest net income, return on assets, and capital ratios among peers.

The stock dipped modestly (-0.5%) to $45.05 on the news, remaining near its 52-week high as investors focused on the bank's structural advantages and constructive 2026 outlook.

Did Banco de Chile Beat Earnings?

No. BCH missed on both metrics:

*Values retrieved from S&P Global

This marks the sixth consecutive quarter of revenue misses for BCH, though the magnitude is largely driven by lower inflation contributions and compressed net interest margins from monetary policy normalization in Chile—not fundamental weakness.

Full Year 2025 Performance:

- Net Income: CLP 1.2 trillion (#1 in Chilean banking industry)

- Return on Average Capital: 21.9%

- Return on Average Assets: 2.2% (vs. 1.3% industry average)

- CET1 Ratio: 14.5% (highest among peers)

- NPL Ratio: 1.7% with 223% coverage

What Did Management Guide?

BCH provided constructive 2026 guidance underpinned by expectations for Chile's above-trend economic growth:

Macro assumptions:

- Chile GDP growth: 2.4% (above-trend)

- Inflation: converging to 3% target

- Policy rate: declining to neutral 4.25%

Management noted an "upward bias" to GDP forecasts, citing strong domestic demand, improving consumer confidence (highest since 2018), and a 22% YoY surge in capital goods imports.

What Changed From Last Quarter?

Key shifts in Q4:

-

Loan growth reacceleration coming: Commercial loans dropped 5.5% YoY due to corporate prepayments and trade finance maturities, but management expects a reversal. Industry loan growth guidance is 4.5% nominal for 2026, with BCH targeting ~7% in core segments.

-

Banchile Pagos launched: The new acquiring and payment processing subsidiary positions BCH in digital payments. Already at 4% SME customer penetration, targeting 160,000 SME customers.

-

Pillar II charge removed: CMF (Chile's regulator) eliminated BCH's 0.13% Pillar II capital charge in January 2026, reflecting a positive assessment of risk profile and governance.

-

Fan digital accounts hit 2.4 million: Up 25% YoY with balances per account rising 32%. Cross-selling credit cards and microloans within this base.

-

Efficiency improved: Operating expenses fell 3.5% in real terms, with cost-to-income ratio at 37.4%—revised target down from 42% to below 40%.

How Did the Stock React?

BCH shares fell 0.5% to $45.05 on earnings day—a muted reaction that reflects investor focus on the bank's structural positioning rather than the quarterly miss.

Stock Performance:

At $45.05, BCH trades just 3.7% below its 52-week high, reflecting market confidence in the bank's ability to capitalize on Chile's improving macro environment.

Key Management Quotes

On market leadership:

"Banco de Chile ranked number one in net income and return on average assets, number one in net fee income, and number one in net interest margin among peer banks."

On capital deployment:

"We want to use the capital in order to take more growth and faster growth than the rest... we should see a return in return on average capital as we deploy this additional capital in growth."

On loan growth expectations:

"Commercial loans... we should see a pickup that's more around the 8%, which is the area that has had the highest difficulties in the over the last 5 years."

On macro outlook:

"Today we have a more positive view on the economy, especially from the domestic demand... the good news is the composition of growth, because the main driver of the activity this year will come from the domestic demand."

Segment Performance

Loan Portfolio Mix (CLP 39.2 trillion total):

Demand Deposits: 26.8% of total liabilities, giving BCH a 37% demand deposit-to-loan ratio—highest among major peers.

Asset Quality

BCH maintains one of the strongest risk profiles in Chilean banking:

Expected credit losses declined 2.5% YoY to CLP 382 billion for the full year, driven by improved wholesale banking credit profiles.

What Did Management Avoid?

Management was notably vague on:

-

Specific timeline for corporate tax reform: While a reduction from 27% to ~23% is expected under the new government (taking office March 11, 2026), management repeatedly said "we have to wait the announcement" and noted lack of congressional majority creates uncertainty.

-

Long-term ROE target: When asked about sustainable ROE after deploying excess capital, management said they "don't have a long-term figure" beyond the 1.5% capital buffer above regulatory requirements.

-

Banchile Pagos revenue contribution: Beyond noting it's "one of the drivers for fee growth" and expense growth, no specific revenue or margin targets were provided.

Forward Catalysts

Bullish:

- New Chilean government (March 11) expected to propose corporate tax cuts and reduce business red tape

- Loan growth reacceleration as domestic demand strengthens

- Banchile Pagos scaling to 160,000+ SME customers

- Potential interest rate cuts boosting loan spreads

- Consumer confidence at highest level since 2018

Bearish:

- ROE guidance (19-21%) below FY 2025's 21.9%

- Efficiency ratio expected to widen (~39% vs 37.4%)

- Cost of risk rising to 1.1-1.2% from 0.97%

- Global macro uncertainty affecting copper prices and trade

- Congressional gridlock could delay tax reforms

The Bottom Line

Banco de Chile missed Q4 estimates but the miss reflects macro normalization (lower inflation, flat yield curves) rather than fundamental deterioration. The bank enters 2026 with:

- Unmatched capital (14.5% CET1, no Pillar II charge)

- Best-in-class asset quality (1.7% NPL, 223% coverage)

- Industry-leading profitability (#1 in ROA, net income)

- Digital momentum (Banchile Pagos, 2.4M Fan accounts)

The constructive macro setup—improving consumer confidence, policy rate normalization, potential tax reform—positions BCH to translate its capital advantage into market share gains. The 19-21% ROE guidance is conservative if Chile's recovery exceeds expectations.

This analysis was generated by Fintool AI Agent using data from the Q4 2025 earnings call transcript, S&P Global financials, and market data.

Related: