Earnings summaries and quarterly performance for BANK OF CHILE.

Research analysts who have asked questions during BANK OF CHILE earnings calls.

Andrés Soto

Santander Investment Securities Inc.

5 questions for BCH

Neha Agarwala

HSBC

5 questions for BCH

Yuri Fernandes

JPMorgan Chase & Co.

4 questions for BCH

Ernesto Gabilondo

Bank of America Merrill Lynch

3 questions for BCH

Lindsey Shema

The Goldman Sachs Group, Inc.

3 questions for BCH

Daer Labarta

Goldman Sachs

2 questions for BCH

Daniel Mora

Credicorp Capital

2 questions for BCH

Ernesto María Gabilondo Márquez

Bank of America

2 questions for BCH

Beatriz Bomfim de Abreu

Goldman Sachs Group, Inc.

1 question for BCH

Daniel Mora Ardila

Credicorp

1 question for BCH

Ewald Stark Bittencourt

BICE Investors

1 question for BCH

Recent press releases and 8-K filings for BCH.

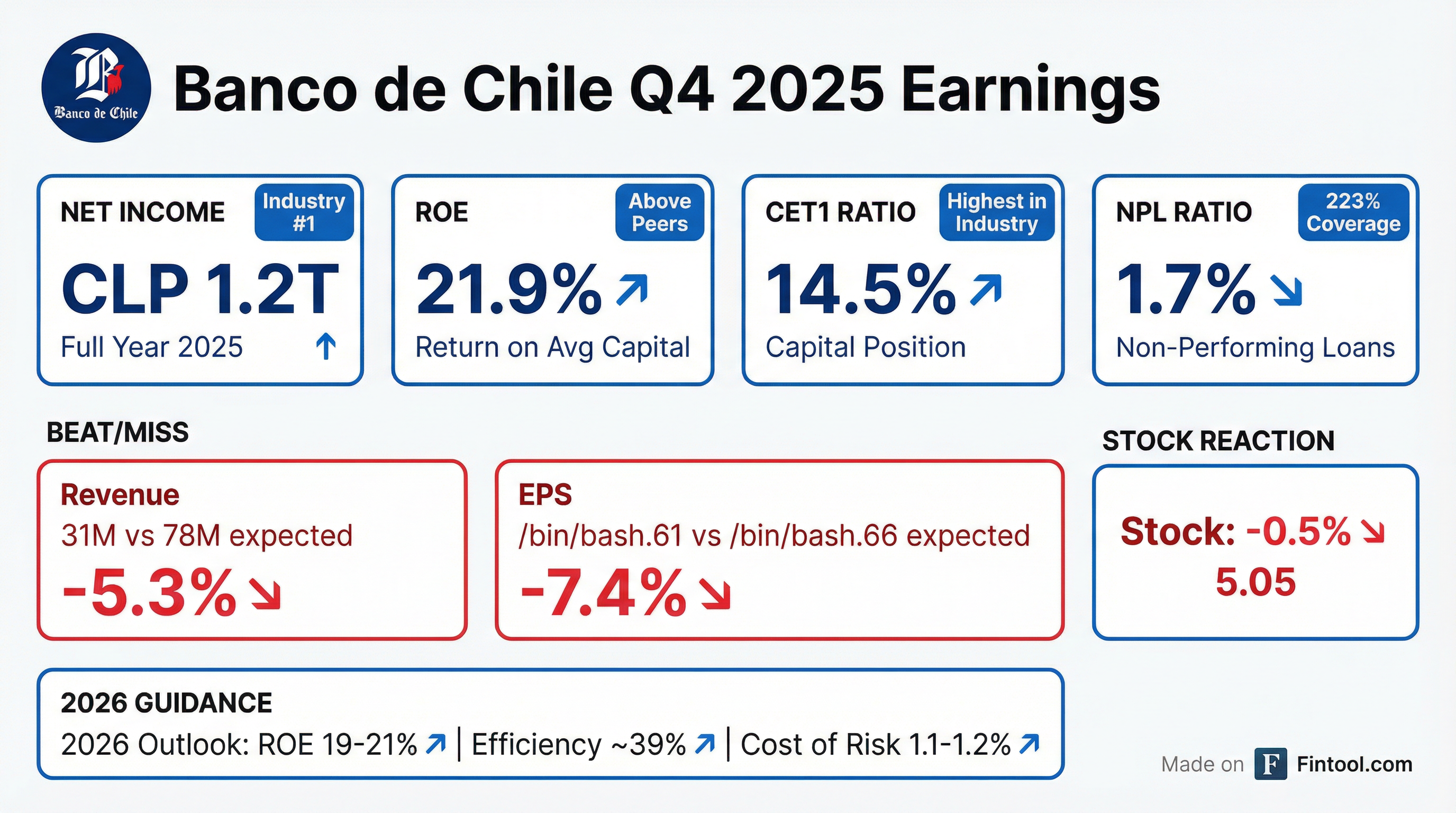

- Banco de Chile reported a net income of CLP 1.2 trillion for the full year 2025, with a Return on Average Capital of 21.9%.

- Total loans increased 0.8% year-on-year to CLP 39.2 trillion as of December 2025, driven by 5.3% growth in residential mortgage loans and 3.9% in consumer loans, while commercial loans decreased 3%.

- The bank maintained a strong financial position with a 37.4% efficiency ratio and a low past due loan ratio of 1.7% for 2025, supported by a 223% coverage ratio.

- For 2026, Banco de Chile projects a Return on Average Capital between 19% and 21%, an efficiency ratio of approximately 39%, and a cost of risk between 1.1% and 1.2%. The company anticipates its loan growth to be around 7% nominal, exceeding the industry's projected 4.5%.

- Banco de Chile reported a net income of CLP 1.2 trillion for the full year 2025, leading the local banking industry, with a 2.2% return on average assets and a 21.9% return on average capital.

- The bank maintained a robust capital position with a CET1 ratio of 14.5% and a total capital ratio of 18.3% as of December 2025, significantly above regulatory requirements.

- Total loans increased 0.8% year-on-year to CLP 39.2 trillion by December 2025, primarily driven by 5.3% growth in residential mortgage loans and 3.9% in consumer loans.

- For 2026, Banco de Chile projects a return on average capital between 19%-21%, an efficiency ratio around 39%, and a cost of risk between 1.1%-1.2%, anticipating 2.4% GDP growth for Chile.

- Strategic initiatives in 2025 included the launch of Banchile Pagos, a new acquiring and payment processing subsidiary, and an increase in Fan digital accounts to 2.4 million.

- Banco de Chile reported a net income of CLP 1.2 trillion and a 2.2% return on average assets for the full year 2025, leading the local banking industry in profitability.

- The bank maintained a strong capital position with a CET1 ratio of 14.5% as of December 2025, alongside a 3.5% real contraction in operating expenses for the year.

- Total loans increased 0.8% year-on-year to CLP 39.2 trillion by December 2025, with residential mortgage loans growing 5.3% and consumer loans 3.9%, while commercial loans decreased 3%.

- For 2026, the company expects a return on average capital between 19%-21%, an efficiency ratio of around 39%, and a cost of risk between 1.1%-1.2%.

- Banco de Chile reported a net income for the year of 1,192,262 MCh$ for FY 2025, a slight decrease from 1,207,392 MCh$ in FY 2024.

- Basic earnings per share for FY 2025 were 11.80 $, down from 11.95 $ in FY 2024.

- Total operating income for FY 2025 was 3,026,043 MCh$, a minor reduction from 3,050,285 MCh$ in FY 2024.

- The company's total liabilities and equity increased to 54,100,903 MCh$ as of December 31, 2025, up from 52,095,441 MCh$ as of December 31, 2024.

- Banco de Chile reported CLP 927 billion in net income for Q3 2025, achieving a Return on Average Capital (ROAC) of 22.3% and maintaining a CET1 ratio of 14.2%.

- The bank revised its GDP forecast for Chile in 2025 to 2.5% and provided full-year 2025 guidance, expecting ROAC around 22.5%, efficiency near 37%, and cost of risk close to 0.9%.

- Loan growth in Q3 2025 included a 7.3% year-on-year increase in mortgage loans and a 3.7% increase in consumer loans, with commercial loans growing 1.3%. The bank's midterm strategy aims for market leadership in commercial and consumer loans, driven by digital transformation and focus on high-potential segments like SMEs.

- Banco de Chile reported a net income of MCh$926,725 for the nine-month period ended September 30, 2025, an increase from MCh$909,326 in the prior year, with basic earnings per share rising to MCh$9.17 from MCh$9.00.

- Total operating income for the nine months ended September 30, 2025, reached MCh$2,277,463, a slight increase compared to MCh$2,272,133 for the same period in 2024.

- The company's total liabilities increased to MCh$49,788,548 as of September 30, 2025, from MCh$46,472,440 at December 31, 2024, while total equity grew to MCh$5,681,545 from MCh$5,623,001 over the same period.

- Credit loss expense for the nine-month period ended September 30, 2025, improved to MCh$(266,080), down from MCh$(288,458) in the comparable 2024 period.

- Net income for Q3 2025 increased by 1.7% to Ch$292,914 million, with year-to-date net income rising 1.9% to Ch$926,725 million.

- The loan portfolio grew 3.7% annually to Ch$39,607,801 million as of September 30, 2025, primarily driven by residential mortgage loans, though the company experienced a 10 bp decline in total loan market share.

- Net fee income showed strong growth, increasing 10.0% in Q3 2025 to Ch$160,249 million and 10.7% year-to-date to Ch$472,773 million, largely due to Mutual Funds and Transactional Services.

- The total past-due ratio for loans rose to 1.56% in September 2025 from 1.48% in September 2024, while the Expected Credit Losses ratio improved to 0.90% year-to-date.

- Capital adequacy ratios remained robust, with the Total Capital Ratio at 17.97% and CET 1 ratio at 14.21% as of September 30, 2025, despite slight annual decreases.

Quarterly earnings call transcripts for BANK OF CHILE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more