Earnings summaries and quarterly performance for BECTON DICKINSON &.

Research analysts who have asked questions during BECTON DICKINSON & earnings calls.

Patrick Wood

Morgan Stanley

8 questions for BDX

Travis Steed

Bank of America

8 questions for BDX

Larry Biegelsen

Wells Fargo & Company

7 questions for BDX

Rick Wise

Stifel Financial Corp

5 questions for BDX

Robbie Marcus

JPMorgan Chase & Co.

4 questions for BDX

Robert Marcus

JPMorgan Chase & Co.

4 questions for BDX

David Roman

Goldman Sachs Group Inc.

3 questions for BDX

Joanne Wuensch

Citigroup Inc.

3 questions for BDX

Matthew Miksic

Barclays PLC

3 questions for BDX

Matthew Taylor

Jefferies

3 questions for BDX

Jayson Bedford

Raymond James

2 questions for BDX

Joshua Jennings

TD Cowen

2 questions for BDX

Matt Miksic

Barclays Investment Bank

2 questions for BDX

Matt Taylor

Jefferies & Company Inc.

2 questions for BDX

Shagun Singh Chadha

RBC Capital Markets

2 questions for BDX

Frederick Wise

Stifel

1 question for BDX

Lawrence Biegelsen

Wells Fargo

1 question for BDX

Vijay Kumar

Evercore ISI

1 question for BDX

Recent press releases and 8-K filings for BDX.

- BD announced the pricing of tender offers to repurchase up to $2.0 billion aggregate principal across fifteen series of senior notes due 2026–2050, subject to an aggregate offer cap of $2.0 billion.

- The Total Consideration per $1,000 principal ranged from $789.44 to $1,095.99, inclusive of a $30 early tender payment.

- Aggregate principal amounts accepted include $656.047 million of 4.669% Senior Notes due 2047 and $91.153 million of 4.875% Senior Notes due 2044, determined by acceptance priority and subject to the offer cap.

- The offers were fully subscribed at the early tender date, with early settlement scheduled for February 27, 2026, and accrued interest payable up to, but not including, that date.

- Global market projected to grow from USD 9.71 billion in 2025 to USD 10.77 billion by 2026 and USD 18.08 billion by 2031 (CAGR 10.93%)

- GLP-1 obesity therapeutics demand and post-pandemic fill-finish expansions drive market growth; BD’s Neopak XtraFlow supports high-viscosity self-injection

- Polymer (COP) syringes expanding at an 11.71% CAGR, reducing silicone-oil interactions and protein aggregation versus glass

- Glass delamination in high-pH biologics prompting recalls and boosting polymer adoption, though raising testing costs

- North America held 38.40% of 2025 revenue; Asia-Pacific leads with 11.79% CAGR to 2031

- BD has increased its Aggregate Offer Cap from $1.6 billion to $2.0 billion and raised the Offer SubCap for its 4.685% Senior Notes due 2044 to $472.349 million.

- As of the early tender date (Feb. 24, 2026), the largest tenders included $698.963 million of 3.700% Senior Notes due 2027, $656.047 million of 4.669% Senior Notes due 2047 and $472.349 million of 4.685% Senior Notes due 2044.

- All conditions for the Tender Offers have been satisfied or waived, and BD will effect early settlement on Feb. 27, 2026, with holders receiving the Total Consideration plus accrued interest.

- Becton, Dickinson and Company has commenced tender offers to purchase for cash up to $1.6 billion aggregate purchase price of its senior notes due 2026–2050.

- The offers cover fifteen series of senior notes, each with an Early Tender Payment of $30 per $1,000 and fixed spreads over U.S. Treasury reference securities.

- The tender offers expire on March 11, 2026, with an early tender deadline of February 24, 2026 to qualify for the Early Tender Payment.

- Settlement is expected as early as February 27, 2026 for timely tenders or on March 13, 2026 for final settlements.

- Becton Dickinson has commenced cash tender offers to repurchase up to $1.6 billion aggregate purchase price of 15 series of its senior notes due between 2026 and 2050.

- Offers are prioritized by Acceptance Priority Level with series-specific subcaps, feature an Early Tender Payment of $30 per $1,000 and pricing based on U.S. Treasury reference yields plus fixed spreads.

- Holders validly tendering by 5:00 p.m. ET on February 24, 2026 will receive early settlement (anticipated February 27); the offers expire on March 11, 2026 with settlement (anticipated March 13) for all accepted tenders.

- BD spun off its Biosciences & Diagnostic Solutions unit and merged it with Waters Corporation; BD shareholders received 0.135 shares of Waters per BD share and BD received $4 billion in cash proceeds.

- Following the transaction, BD shareholders own 39.2 % of Waters on a fully diluted basis, and the unit was valued at $18.8 billion based on Waters’s closing price on February 6, 2026.

- BD intends to deploy $2 billion for an accelerated share repurchase program and $2 billion for debt repayment, subject to market conditions.

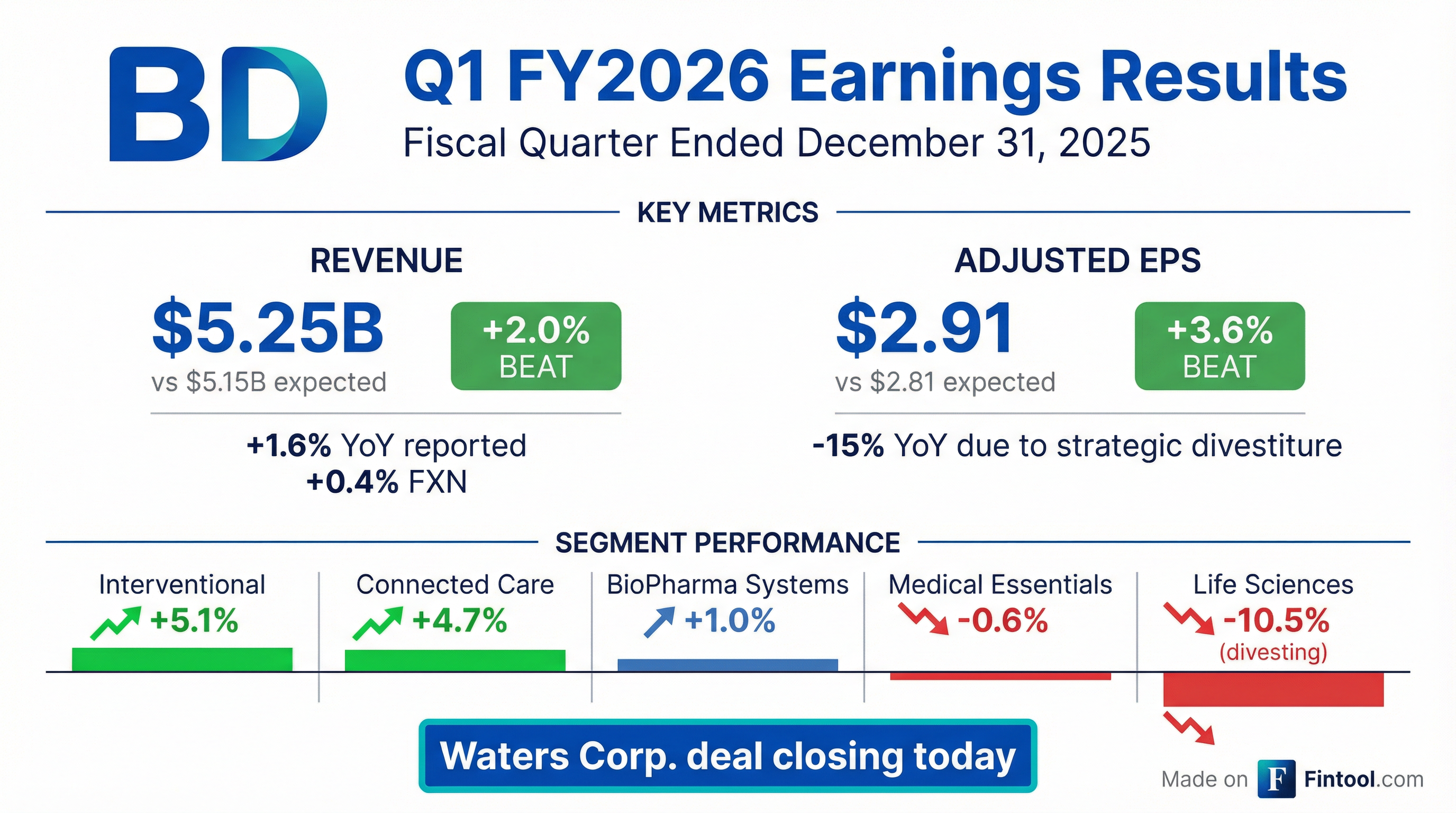

- Reported Q1 revenue of $5.3 billion, up 0.4%; New BD grew 2.5% year-over-year

- Delivered adjusted gross margin of 53.4% and adjusted EPS of $2.91, down 15.2% on tariff impacts but ahead of expectations

- Saw double-digit growth in biologic drug delivery, PureWick, advanced tissue regeneration, and pharmacy automation; high single-digit growth in APM; mid-single-digit growth across 90% of portfolio, partially offset by headwinds in Alaris and vaccines in China (10% of portfolio)

- Closed life sciences spin-off with Waters via Reverse Morris Trust, receiving a $4 billion cash distribution, with $2 billion for share repurchases and $2 billion for debt paydown

- Issued fiscal 2026 guidance on continuing operations: low single-digit revenue growth; adjusted EPS of $12.35–$12.65; Q2 revenue growth ~2% and Q2 adjusted EPS of $2.72–$2.82

- BDX reported Q1 FY26 revenue of $5.3 B, up 0.4% FXN, with an adjusted operating margin of 21.2%, down 240 bps YoY.

- Adjusted diluted EPS was $2.91, a 15.2% decline year-over-year.

- Operating cash flow was $0.7 B; free cash flow conversion improved to 66% (vs. 59% in Q1 FY25), and net leverage remained at 2.9x.

- Received a $4 B distribution from the Waters transaction, to be deployed evenly between share repurchases and debt paydown.

- FY26 New BD guidance maintained at low single-digit FXN revenue growth and adjusted EPS of $12.35–$12.65.

- BD reported Q1 revenue of $5.3 billion (up 0.4% y-o-y), with New BD revenue up 2.5%, an adjusted gross margin of 53.4%, and adjusted EPS of $2.91.

- The reverse Morris Trust transaction with Waters is officially closed, with BD receiving a $4 billion cash distribution; $2 billion will fund share repurchases and $2 billion will pay down debt.

- Fiscal 2026 guidance for New BD calls for low single-digit revenue growth, ~25% adjusted operating margin, and adjusted EPS of $12.35–$12.65 (Q2 EPS of $2.72–$2.82).

- Free cash flow was $548 million (66% conversion), net leverage ended at 2.9 times, and the company returned ~$550 million to shareholders in Q1, including $250 million of buybacks.

- Revenue of $5.3 billion (+0.4%), with 2.5% growth in new BD platforms driving broad-based gains across key segments.

- Adjusted gross margin of 53.4% and adjusted EPS of $2.91, both exceeding expectations despite a 15.2% year-over-year EPS decline.

- Free cash flow of $548 million (66% conversion), net leverage of 2.9×, and $550 million returned to shareholders, including $250 million in share buybacks.

- Fiscal 2026 guidance for new BD: low single-digit revenue growth; adjusted operating margin ~25%; adjusted EPS of $12.35–$12.65; Q2 revenue growth ~2% and EPS of $2.72–$2.82.

- Closed life sciences combination with Waters via Reverse Morris Trust ahead of schedule; received $4 billion cash distribution, deploying $2 billion to share repurchases and $2 billion to debt reduction.

Fintool News

In-depth analysis and coverage of BECTON DICKINSON &.

Quarterly earnings call transcripts for BECTON DICKINSON &.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more