Earnings summaries and quarterly performance for Brighthouse Financial.

Executive leadership at Brighthouse Financial.

Eric Steigerwalt

President and Chief Executive Officer

Allie Lin

Executive Vice President and General Counsel

Ed Spehar

Executive Vice President and Chief Financial Officer

John Rosenthal

Executive Vice President and Chief Investment Officer

Myles Lambert

Executive Vice President and Chief Marketing and Distribution Officer

Board of directors at Brighthouse Financial.

Research analysts who have asked questions during Brighthouse Financial earnings calls.

Ryan Krueger

KBW

4 questions for BHF

Suneet Kamath

Jefferies

4 questions for BHF

Wesley Carmichael

Autonomous Research

4 questions for BHF

Alex Scott

Barclays PLC

3 questions for BHF

John Barnidge

Piper Sandler

3 questions for BHF

Thomas Gallagher

Evercore

3 questions for BHF

Jamminder Bhullar

JPMorgan Chase & Co.

2 questions for BHF

Nicholas Annitto

Wells Fargo & Company

2 questions for BHF

Wilma Burdis

Raymond James Financial

2 questions for BHF

Elyse Greenspan

Wells Fargo

1 question for BHF

Jimmy Bhullar

JPMorgan Chase & Co.

1 question for BHF

Peter Troisi

Barclays

1 question for BHF

Wilma Jackson Burdis

Raymond James

1 question for BHF

Recent press releases and 8-K filings for BHF.

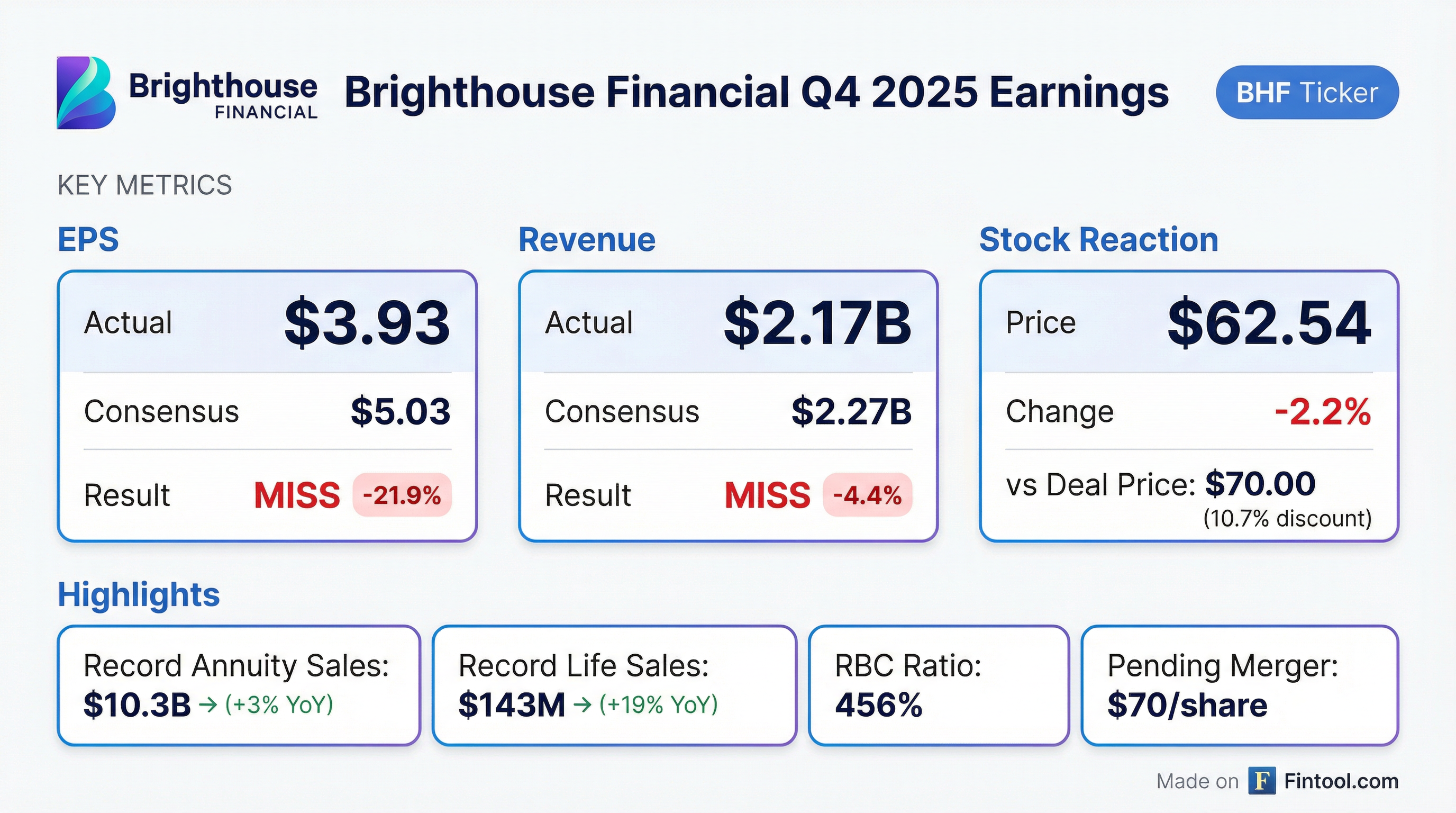

- Brighthouse Financial reported fourth quarter 2025 net income available to shareholders of $112 million ($1.93 per diluted share) and adjusted earnings, less notable items, of $227 million ($3.93 per diluted share). For the full year 2025, net income available to shareholders was $331 million ($5.71 per diluted share) and adjusted earnings, less notable items, were $931 million ($16.07 per diluted share).

- Full year 2025 saw annuity sales of $10.3 billion, a 3% year-over-year increase, and record life sales of $143 million, up 19% year-over-year.

- As of December 31, 2025, the company maintained a preliminary combined risk-based capital (RBC) ratio of 456% and holding company liquid assets of $0.9 billion.

- Brighthouse Financial stockholders adopted a merger agreement on February 12, 2026, for an affiliate of Aquarian Capital to acquire the company for $70.00 per share, valuing the transaction at approximately $4.1 billion.

- Brighthouse Financial reported net income available to shareholders of $112 million, or $1.93 per diluted share, for the fourth quarter of 2025, and adjusted earnings, less notable items, of $227 million, or $3.93 per diluted share.

- For the full year 2025, the company achieved annuity sales of $10.3 billion, an increase of 3% year-over-year, and record life sales of $143 million, an increase of 19% year-over-year.

- As of December 31, 2025, Brighthouse Financial had a preliminary combined risk-based capital (RBC) ratio of 456% and holding company liquid assets of $0.9 billion.

- Brighthouse Financial stockholders voted on February 12, 2026, to adopt a definitive merger agreement under which Aquarian Capital will acquire the company for $70.00 per share in an all-cash transaction valued at approximately $4.1 billion, with the transaction expected to close in 2026.

- Brighthouse Financial, Inc. (BHF) common stockholders have approved the definitive merger agreement under which an affiliate of Aquarian Capital LLC will acquire the company.

- Under the terms of the merger agreement, Brighthouse Financial's common stockholders will receive $70.00 in cash per share, with the transaction valued at approximately $4.1 billion.

- The merger proposal received overwhelming support, with 39,728,503 votes in favor, representing approximately 99.7% of the shares present at the special meeting held on February 12, 2026.

- The transaction is expected to close in 2026 and remains subject to customary closing conditions and regulatory approvals.

- Brighthouse Financial stockholders have approved a definitive merger agreement for an affiliate of Aquarian Capital LLC to acquire the company.

- The all-cash transaction is valued at approximately $4.1 billion.

- Common stockholders of Brighthouse Financial will receive $70.00 in cash per share.

- The transaction is expected to close in 2026 and remains subject to customary closing conditions and regulatory approvals.

- On February 12, 2026, Brighthouse Financial, Inc. held a special meeting of stockholders.

- Stockholders voted on three proposals, including the Merger Proposal to adopt the agreement and plan of merger, dated November 6, 2025, with Aquarian Holdings Six LP, Aquarian Beacon Merger Sub Inc., and Aquarian Holdings LLC.

- According to the preliminary report, all proposals, including the Merger Proposal, the Compensation Proposal related to the merger, and the Adjournment Proposal, were approved in accordance with the board of directors' recommendation.

- Brighthouse Financial held a special meeting of stockholders on February 12, 2026, to vote on proposals related to a merger.

- Stockholders approved the Merger Proposal, which involves an agreement and plan of merger dated November 6, 2025, with Aquarian Holdings Six LP, Aquarian Beacon Merger Sub Inc., and Aquarian Holdings LLC.

- The Compensation Proposal and Adjournment Proposal were also approved, with final vote totals to be filed in a Form 8-K within four business days.

- Brighthouse Financial, Inc. held a special meeting of stockholders on February 12, 2026, where three proposals were presented for a vote.

- Stockholders approved Proposal One, the Merger Proposal, to adopt the agreement and plan of merger dated November 6, 2025, with Aquarian Holdings VI L.P., Aquarian Beacon Merger Sub Inc., and Aquarian Holdings LLC.

- Stockholders also approved Proposal Two, the Compensation Proposal, an advisory vote on compensation for named executive officers related to the merger.

- All proposals, including the merger, compensation, and adjournment proposals, passed in accordance with the board of directors' recommendations.

- Monteverde & Associates PC is investigating the sale of Brighthouse Financial, Inc. (NASDAQ:BHF) to Aquarian Holdings VI L.P..

- Under the terms of the proposed transaction, Brighthouse shareholders are slated to receive $70.00 in cash per share of common stock.

- The investigation by the class action firm, announced on November 21, 2025, suggests potential concerns regarding the transaction for shareholders.

- Aquarian Capital has entered into a definitive agreement to acquire Brighthouse Financial for approximately $4.1 billion, paying $70 per share in cash, which represents a 37% premium over Brighthouse's unaffected share price.

- The acquisition is expected to close in 2026, pending shareholder, regulatory, antitrust, and insurance approvals, and will take Brighthouse private while maintaining its operations as a standalone entity.

- Brighthouse Financial's preferred stock, junior subordinated debentures, and senior notes will remain outstanding with the same terms and dividends after the acquisition closes.

- The transaction is supported by committed financing and will not add incremental debt to either Aquarian's insurance businesses or Brighthouse.

- Brighthouse Financial reported a preliminary Q3 capital snapshot with $5.4 billion total adjusted capital, a combined risk-based capital (RBC) ratio of 435%–455%, and $1.0 billion in holding-company liquid assets.

- Brighthouse Financial announced a definitive merger agreement for its acquisition by an affiliate of Aquarian Capital LLC for $70.00 per share in an all-cash transaction valued at approximately $4.1 billion.

- For the third quarter ended September 30, 2025, the company reported net income available to shareholders of $453 million, or $7.89 per diluted share, and adjusted earnings, less notable items, of $261 million, or $4.54 per diluted share.

- The estimated combined risk-based capital (RBC) ratio for Q3 2025 was between 435% and 455%.

- Annuity sales reached $2.7 billion, increasing 8% quarter-over-quarter and 5% sequentially, while life sales were $38 million, up 27% quarter-over-quarter and 15% sequentially.

Quarterly earnings call transcripts for Brighthouse Financial.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more