BIOGEN (BIIB)·Q4 2025 Earnings Summary

Biogen Beats Q4 Estimates as LEQEMBI Sales Surge 140%, Stock Near 52-Week High

February 6, 2026 · by Fintool AI Agent

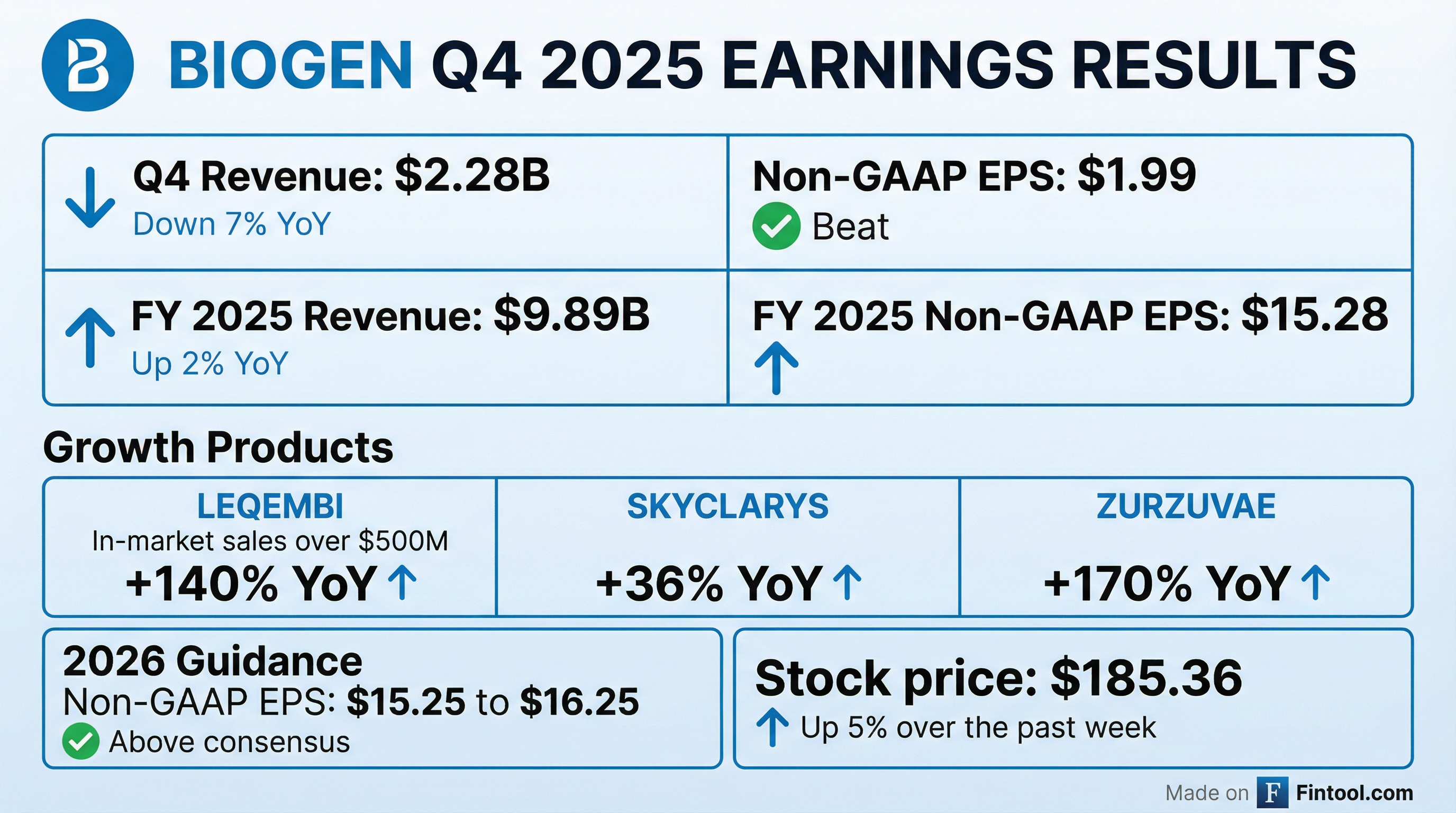

Biogen (BIIB) reported Q4 2025 results that exceeded expectations, with Non-GAAP EPS of $1.99 beating consensus by 22% and revenue of $2.28B beating by 3.4% . The stock is trading near its 52-week high of $190.20 at $185.36, up 5% over the past week heading into earnings. Growth products generated $3.3B for FY 2025, up 19% year-over-year, led by a 140% surge in LEQEMBI in-market sales .

Did Biogen Beat Earnings?

Yes — beats on both revenue and EPS. Biogen delivered a strong quarter on Non-GAAP metrics, though GAAP results showed a loss due to acquired IPR&D charges.

The GAAP loss was driven by $222M in acquired IPR&D, upfront, and milestone expenses — a ~$1.26 per share impact . This included investments to expand Biogen's early-stage pipeline.

Full Year 2025 Summary

FY 2025 Non-GAAP EPS of $15.28 exceeded the consensus estimate of $15.02.*

What Did Management Guide for 2026?

Biogen issued FY 2026 Non-GAAP EPS guidance of $15.25 to $16.25, with the midpoint of $15.75 approximately 5% above consensus of $14.95 .

Key guidance assumptions :

- MS products (ex-VUMERITY): Expected to decline mid-teens percentage

- Biosimilars: Expected to decline low double-digit percentage

- Contract manufacturing revenue: ~$300M in each half of 2026

- Gross margin: Roughly consistent with FY 2025

- No acquired IPR&D included in guidance

How Did Growth Products Perform?

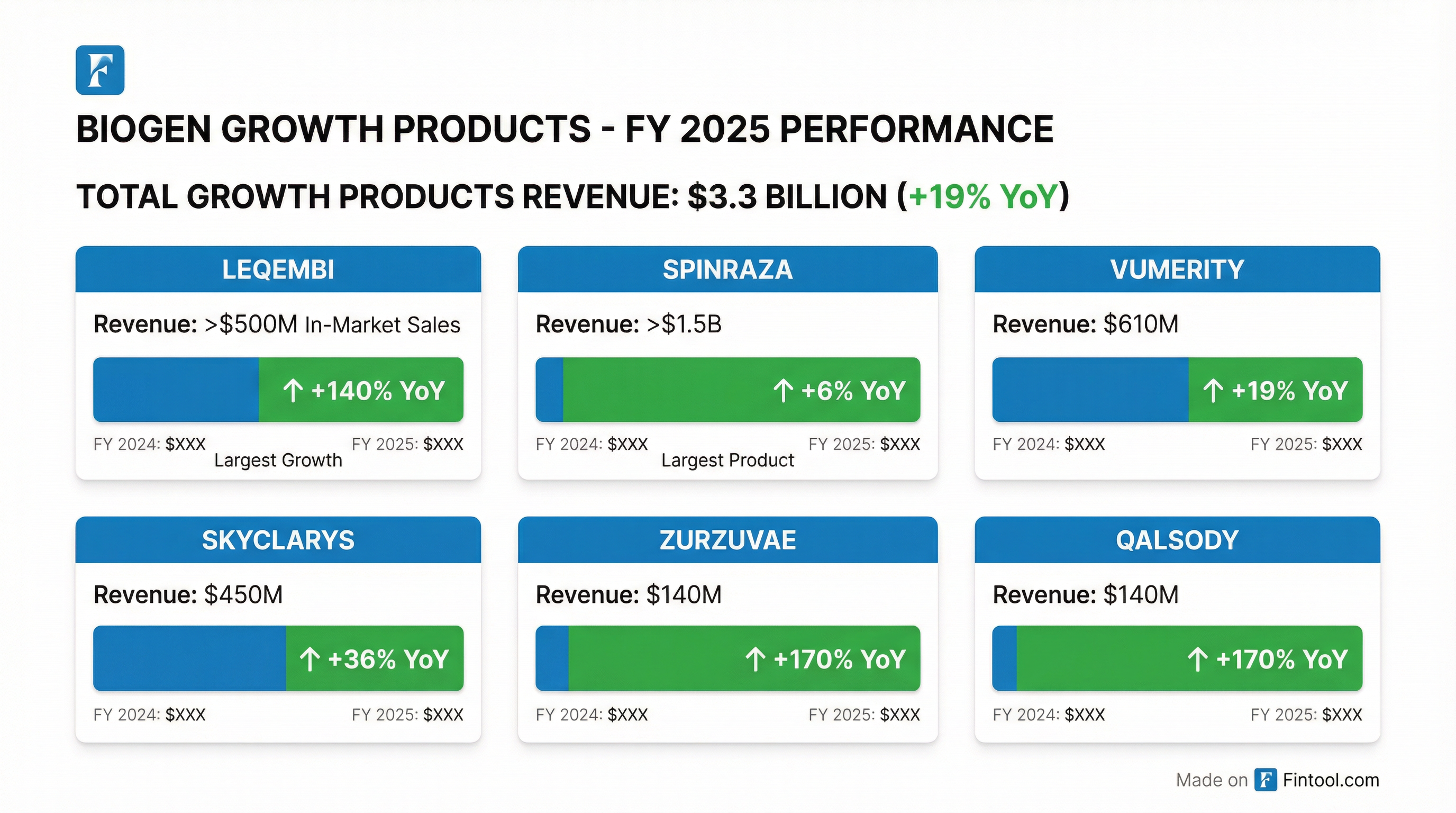

Growth products generated $3.3B for FY 2025, up 19% YoY, now representing a significant portion of Biogen's revenue mix .

Q4 2025 Growth Product Revenue

LEQEMBI Momentum

LEQEMBI (Biogen's Alzheimer's therapy in collaboration with Eisai) continues to show strong momentum :

- In-market sales >$500M for FY 2025, up ~140% YoY

- >60% market share in the anti-amyloid therapy market

- Anti-amyloid market more than doubled YoY

- IQLIK SC-AI PDUFA: May 24, 2026 — potential approval of subcutaneous autoinjector for at-home use

What Changed From Last Quarter?

Positive Developments

- Litifilimab Breakthrough Therapy Designation: FDA granted BTD for cutaneous lupus erythematosus (CLE)

- Pipeline Expansion: BIIB145 (BTK degrader) Phase 1 initiated

- Alcyone Acquisition Completed: Advancing delivery of antisense oligonucleotides

- Balance Sheet Strength: $4.2B cash, $2.0B net debt

Headwinds

- Legacy MS Decline Accelerating: MS products (ex-VUMERITY) down 18% YoY in Q4

- TECFIDERA Erosion: Down 51% YoY to $112M on generic competition

- SPINRAZA Pressure: Down 15% YoY despite overall rare disease portfolio growth

- Biosimilars Declining: Down 16% YoY

How Did the Stock React?

The stock is trading near its 52-week high of $190.20, reflecting optimism around LEQEMBI momentum and the upcoming pipeline catalysts.

Q&A Highlights

When Will Biogen Return to Top-Line Growth?

Management was asked directly about the timeline for revenue growth to return. CEO Chris Viehbacher outlined two paths :

- Organic pipeline: If Litifilimab Phase 3 is positive, launch could come in 2028. Similarly, Felzartamab (AMR) could launch in 2028 and "take off quite quickly" given the identified patient base and lack of existing treatment.

- M&A: Actively seeking acquisitions in the $5-6B range — companies post-Phase 3 and early commercialization. However, management emphasized finding deals that "generate value for shareholders" has been challenging.

"To really return to growth, I think there's two things that really need to happen. One is we do need to start seeing the positive Phase 3 results come out and the launch of products... The other, of course, is BD." — Chris Viehbacher

LEQEMBI Sales Cadence for 2026

Regarding LEQEMBI growth trajectory, management provided the following framework :

- ~70% persistency: Patients continuing on maintenance after plaque removal phase

- SC pen uptake increasing: Though full reimbursement not expected until 1/1/2027

- Blood-based diagnostics: Now validating 50%-70% of diagnosed patients as eligible (up from prior levels)

- H1 2026: Continued linear, sequential quarter-on-quarter growth expected

- H2 2026+: Potential acceleration once SC-AI approved (May 2026 PDUFA) and 2027 formulary coverage secured

BIIB080 (Anti-Tau) Commercial Opportunity

When asked about the commercial potential of BIIB080, management emphasized this is breakthrough science with no clear precedent :

- Tau is an important target — severity of Alzheimer's correlates with tau levels

- Intracellular tau (BIIB080's target) may matter more than extracellular tau (why antibodies haven't worked)

- Could potentially expand to other tauopathies if positive

- Timeline caveat: Positive Phase 2 would require Phase 3 program, meaning "several years" to potential launch

High-Dose Spinraza Japan Launch

Japan was the first country to approve high-dose Spinraza, and early results are encouraging :

- Exceeding expectations on adoption

- Seeing switchbacks from competitive products (gene therapy)

- US PDUFA in April 2026; market research suggests potential upside

Capital Deployment Priorities

On capital allocation, CFO Robin Kramer and CEO Viehbacher outlined priorities :

- Primary focus: Business development transactions for long-term shareholder growth

- Share buybacks: "Not out of the question" but not the current priority

- Balance sheet strength: $4.2B cash provides flexibility for strategic investments

Early-Stage Pipeline Strategy

Management clarified the approach to building the early-stage pipeline :

- Not large enough to be in the high-risk, high-reward business alone

- ALS less risky for Biogen: Neurofilament biomarker provides early read on efficacy

- Core therapeutic areas: Alzheimer's, ALS, and (to a degree) MS will remain focus

- Immunology expansion: Expect "probably a lot more in immunology than neuroscience" at the early stage going forward

Key Pipeline Catalysts

Biogen outlined a multi-year registrational data flow beginning in 2026 :

Near-Term (2026)

Medium-Term (2027+)

Management highlighted a more balanced portfolio across late-stage registrational assets and early-stage high-risk/high-reward programs .

Capital Allocation and Balance Sheet

Biogen maintains a strong balance sheet positioned for investment :

Management is investing in pre-launch activities for lupus (litifilimab, dapirolizumab pegol) and nephrology (felzartamab) franchises, with FY 2026 core OpEx expected to remain roughly consistent with FY 2025 .

Segment Performance

MS Franchise (Declining)

The legacy MS franchise continues its structural decline as TECFIDERA faces generic competition and TYSABRI encounters biosimilar pressure.

Anti-CD20 Programs (Growing)

Revenue from anti-CD20 therapeutic programs (OCREVUS royalties) grew 12% YoY to $521M in Q4 , providing a steady royalty stream.

Key Takeaways

- Beat & Raise: Non-GAAP EPS beat by 22%, and 2026 guidance midpoint is 5% above consensus

- Growth Inflection: Growth products at $3.3B (+19% YoY) are offsetting legacy MS decline

- LEQEMBI Momentum: >60% market share, in-market sales up 140% YoY, SC-AI approval pending May 2026

- Return to Growth Path: Management outlined 2028 as target for top-line inflection via Phase 3 launches (Litifilimab, Felzartamab) or M&A in $5-6B range

- Pipeline Catalysts: Multiple Phase 3 readouts expected 2026-2027 in lupus, nephrology, and rare disease

- Balance Sheet Strength: $4.2B cash, $2.1B annual FCF supports continued investment

The "New Biogen" strategy appears to be progressing as planned, with growth products and pipeline expansion offsetting the declining legacy MS business. The key near-term catalysts are the May 24, 2026 PDUFA for LEQEMBI's SC-AI formulation and high-dose Spinraza US approval in April 2026. Management's confidence in the late-stage pipeline is high, though they acknowledged finding value-accretive M&A has proven challenging .

*Values retrieved from S&P Global.

Sources: Biogen Q4 2025 Earnings Call Transcript, Biogen Q4 2025 Earnings Slides, Company Filings