Earnings summaries and quarterly performance for BIOGEN.

Executive leadership at BIOGEN.

Christopher Viehbacher

Chief Executive Officer

Nicole Murphy

Head of Pharmaceutical Operations and Technology

Priya Singhal

Head of Development

Robin Kramer

Chief Financial Officer

Sean Godbout

Chief Accounting Officer & Global Corporate Controller

Susan Alexander

Chief Legal Officer

Board of directors at BIOGEN.

Caroline Dorsa

Chair of the Board

Eric Rowinsky

Director

Jesus Mantas

Director

Lloyd Minor

Director

Maria Freire

Director

Mene Pangalos

Director

Monish Patolawala

Director

Stephen Sherwin

Director

Susan Langer

Director

William Hawkins

Director

Research analysts who have asked questions during BIOGEN earnings calls.

Brian Abrahams

RBC Capital Markets

7 questions for BIIB

Salveen Richter

Goldman Sachs

7 questions for BIIB

Michael Yee

Jefferies

6 questions for BIIB

Philip Nadeau

TD Cowen

6 questions for BIIB

Umer Raffat

Evercore ISI

6 questions for BIIB

Evan Seigerman

BMO Capital Markets

5 questions for BIIB

Jay Olson

Oppenheimer & Co. Inc.

5 questions for BIIB

Eric Schmidt

Cantor Fitzgerald & Co.

4 questions for BIIB

Paul Matteis

Stifel

4 questions for BIIB

Chris Schott

JPMorgan Chase & Company

2 questions for BIIB

Christopher Schott

JPMorgan Chase & Co.

2 questions for BIIB

Danielle Brill

Truist Securities

2 questions for BIIB

David Amsellem

Piper Sandler Companies

2 questions for BIIB

Marc Goodman

Leerink Partners

2 questions for BIIB

Terence Flynn

Morgan Stanley

2 questions for BIIB

Alexandria Hammond

Wolfe Research

1 question for BIIB

Alex Hammond

Sidoti & Company, LLC

1 question for BIIB

Brian P. Skorney

Baird

1 question for BIIB

Brian Skorney

Robert W. Baird & Co.

1 question for BIIB

Geoffrey Meacham

Citi

1 question for BIIB

Michael DiFiore

Evercore ISI

1 question for BIIB

Mike Yee

Jefferies

1 question for BIIB

Miles Minter

William Blair

1 question for BIIB

Myles Minter

William Blair & Company

1 question for BIIB

Tim Anderson

Bank of America

1 question for BIIB

Timothy Anderson

BofA Securities

1 question for BIIB

Recent press releases and 8-K filings for BIIB.

- Biocytogen’s partner IDEAYA dosed the first patient in the Phase 1 trial of IDE034, its first-in-class B7H3/PTK7 bispecific TOP1 ADC, triggering a $5 million milestone payment.

- The Phase 1 dose-escalation/expansion study will assess safety, tolerability, and pharmacokinetics of IDE034 as monotherapy and in combination with IDEAYA’s PARG inhibitor, IDE161.

- IDE034, licensed to IDEAYA in July 2024, is designed to preferentially target tumor cells co-expressing B7H3 and PTK7, with an estimated 30–40% co-expression in major solid tumors.

- Biogen highlighted its late-stage lupus programs—litifilimab (BDCA2-targeted) and dapirolizumab (CD40-directed)—designed to address SLE heterogeneity and unmet needs.

- Litifilimab demonstrated SRI-4 efficacy in SLE and significant skin clearance in cutaneous lupus, earning FDA breakthrough designation for CLE.

- Dapirolizumab’s Phase 3 TOPAZ program showed up to 20% of patients tapered steroids to ≤7.5 mg, and its pegylation prevents placental and breast-milk transfer, suggesting potential safety in pregnancy.

- Early-stage assets include the LRRK2 inhibitor BIIB122 in a controlled Parkinson’s trial and the BTK inhibitor O91—with a Phase 2 relapsing MS study featuring an active comparator—as well as a Phase 1 BTK degrader.

- The CD38-targeted antibody felzartamab is under evaluation in autoimmune kidney disease, with next-generation CD38 therapies in development for broader autoimmune applications.

- Biologics License Application for the once-weekly 500 mg subcutaneous autoinjector of LEQEMBI (lecanemab) was accepted and granted Priority Review by China’s NMPA in January 2026, aiming to accelerate assessment timelines.

- If approved, the SC-AI (two 250 mg injections in ~15 seconds each) will enable at-home dosing versus current biweekly IV infusions in hospital settings.

- LEQEMBI was launched in China in June 2024, delivered in the private market, and included in China’s Commercial Insurance Innovative Drug List effective January 2026 to support patient access.

- Eisai leads global development and regulatory submissions, with Biogen co-commercializing and co-promoting LEQEMBI in China, where Eisai will handle distribution and medical information activities.

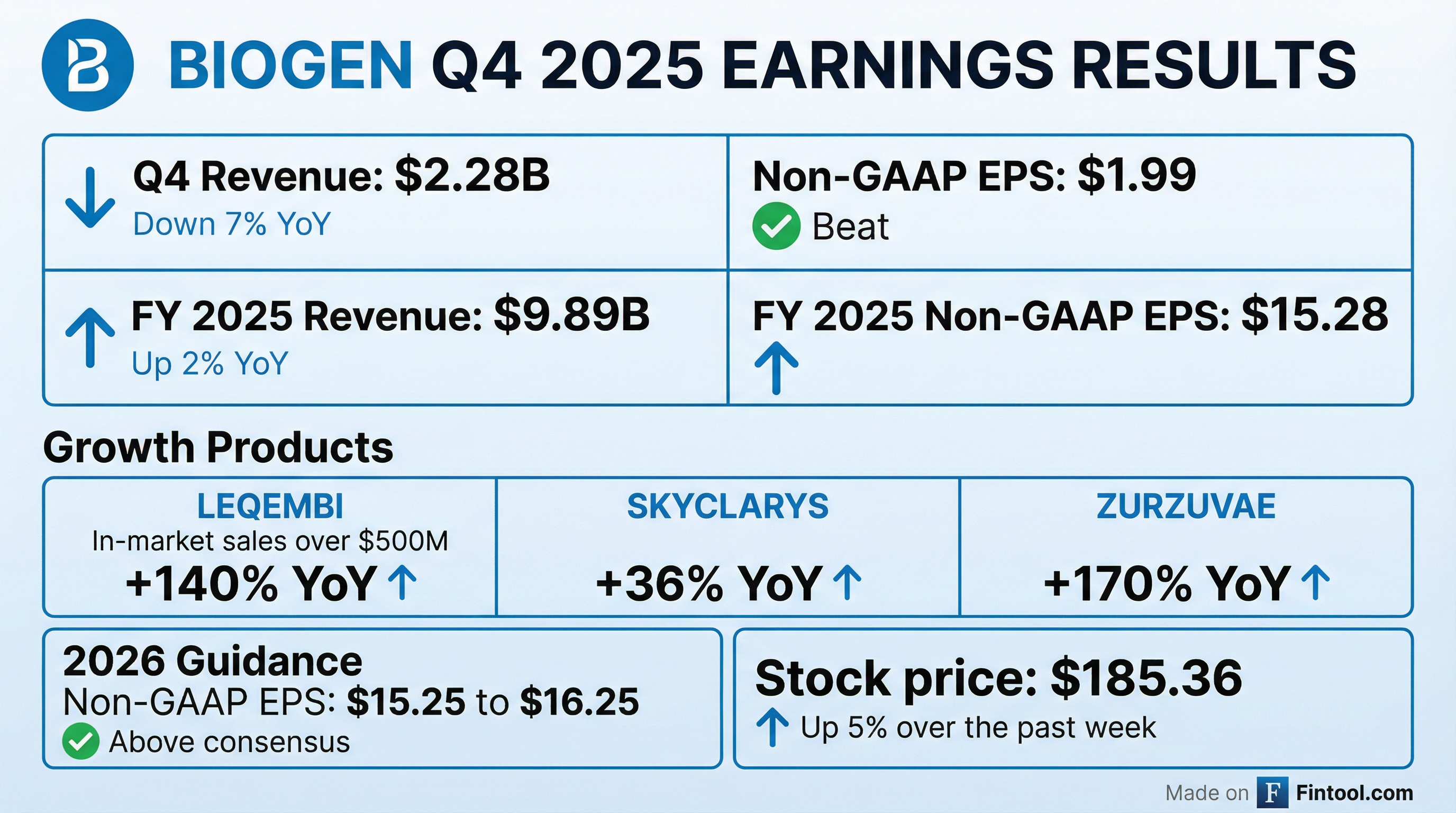

- Biogen delivered Q4 non-GAAP EPS of $1.99 and full-year non-GAAP EPS of $15.28, with total revenue of $9.9 billion, up 2% year-over-year.

- Growth products generated $800 million in Q4 (up 6% y/y) and $3.3 billion for FY2025 (up 9% y/y), including Leqembi in-market sales of $134 million (+54% y/y) and Skyclarys revenue of $133 million (+30% y/y) in Q4.

- Strong cash flow supported a $2.1 billion free cash flow in FY2025, leaving $4.2 billion in cash and marketable securities and $2 billion of net debt.

- Key pipeline milestones include a May 24 PDUFA for Leqembi subcutaneous induction , an April PDUFA for Spinraza high-dose in the US , and phase 3 readouts for litifilimab in SLE by end-2026 and felzartamab in AMR over the next 18 months.

- 2026 guidance targets non-GAAP EPS of $15.25–16.25 and a mid-single-digit percentage decline in total revenue, with core operating expenses expected to remain roughly flat versus 2025.

- Q4 total revenue was $2.28 B, down 7% YoY, with GAAP diluted EPS of ($0.33) and Non-GAAP diluted EPS of $1.99.

- Growth products generated $808 M in Q4, up 6% YoY , and $3.3 B for FY 2025, up 19% YoY.

- FY 2026 Non-GAAP diluted EPS guidance is $15.25–$16.25.

- Generated $0.5 B of free cash flow in Q4 and $2.1 B for FY 2025, ending with $4.2 B in cash and marketable securities and $2.0 B net debt.

- Key pipeline milestone: U.S. PDUFA date of May 24, 2026 for subcutaneous LEQEMBI initiation, alongside advancement of multiple late-stage programs.

- Biogen delivered Q4 2025 non-GAAP EPS of $1.99 and full-year 2025 EPS of $15.28, on $9.9 billion in revenue, up 2% year-over-year; growth products generated $800 million in Q4 (+6%) and $3.3 billion for the year (+9%).

- Key brands showed robust demand: Leqembi in-market sales of $134 million in Q4 (+10% sequential; +54% YoY), Skyclarys revenue of $133 million (+30% YoY), Spinraza at $356 million, and Vumerity at $181 million in the quarter.

- 2026 milestones include FDA decisions for Leqembi Iqlik initiation (PDUFA May 24) and Spinraza high-dose regimen (PDUFA April), Phase III litifilimab SLE readout by year-end, plus felzartamab AMR and pre-POC (BIIB122, BIIB080) data mid-year.

- Strengthened financial position with $2.1 billion free cash flow, $4.2 billion cash and marketable securities, $2 billion net debt; recorded $222 million of IPR&D charges tied to Alcyone acquisition and BD deals with Vanqua Bio and Dayra Therapeutics.

- Biogen delivered Q4 non-GAAP EPS of $1.99 and full-year non-GAAP EPS of $15.28, with FY revenue of $9.9 billion (+2% vs. 2024) and growth products generating $3.3 billion (+9%) for the year.

- In Q4, Leqembi in-market sales were $134 million (+10% Q/Q, +54% Y/Y), Skyclarys revenue reached $133 million (+30% Y/Y), and Spinraza sales totaled $356 million.

- The late-stage pipeline now includes 10 Phase 3 programs, with key readouts expected end-2026 for Litifilimab in SLE, mid-2026 for felzartamab in AMR, and a PDUFA date of May 24, 2026 for Leqembi iClick initiation.

- Strong cash generation with $2.1 billion free cash flow and $4.2 billion in cash and marketable securities at year-end; completed acquisition of Alcyone Therapeutics and collaborations with Vanqua and Deira.

- Fourth quarter 2025 total revenue of $2.3 billion, GAAP diluted EPS of $(0.33) and Non-GAAP diluted EPS of $1.99; full year 2025 total revenue of $9.9 billion, GAAP diluted EPS $8.79 and Non-GAAP diluted EPS $15.28

- Growth products revenue increased 6% year-over-year in Q4, led by LEQEMBI global in-market sales of ~$134 million (up 54% yoy) with U.S. sales of ~$78 million

- FDA Priority Review granted for LEQEMBI IQLIK subcutaneous initiation (PDUFA date May 24, 2026); Breakthrough Therapy Designation for litifilimab in cutaneous lupus, with Phase 3 systemic lupus readouts expected in Q4 2026

- 2026 guidance: Non-GAAP diluted EPS of $15.25 to $16.25; total revenue expected to decline mid-single digit versus 2025

- Biogen’s investigational antibody litifilimab (BIIB059) received FDA Breakthrough Therapy Designation for cutaneous lupus erythematosus, a chronic autoimmune skin disease with no approved targeted treatments.

- The designation is based on Phase 2 LILAC data showing litifilimab reduced CLE skin disease activity versus placebo and is intended to expedite its development and review.

- Litifilimab is a first-in-class humanized IgG1 monoclonal antibody targeting BDCA2 on plasmacytoid dendritic cells to inhibit pro-inflammatory cytokine production.

- Biogen is advancing the AMETHYST Phase 3 study of litifilimab, with a pivotal data readout expected in 2027.

- Biogen estimates approximately $222 million of acquired in-process R&D, upfront and milestone expense in Q4 2025.

- This charge is expected to reduce GAAP and non-GAAP net income per diluted share by about $1.26 for the quarter.

- The company began separately presenting IPR&D, upfront and milestone expense as a distinct line item starting Q1 2025.

- Results for the quarter ended December 31, 2025, remain preliminary and subject to adjustment upon completion of closing procedures.

Quarterly earnings call transcripts for BIOGEN.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more