Earnings summaries and quarterly performance for NOVARTIS.

Research analysts who have asked questions during NOVARTIS earnings calls.

James Quigley

Goldman Sachs

8 questions for NVS

Peter Verdult

Citigroup Inc.

7 questions for NVS

Simon Baker

Redburn Atlantic

7 questions for NVS

Florent Cespedes

Bernstein

6 questions for NVS

Matthew Weston

UBS Group AG

6 questions for NVS

Richard Vosser

JPMorgan Chase & Co.

6 questions for NVS

Seamus Fernandez

Guggenheim Partners

6 questions for NVS

Thibault Boutherin

Morgan Stanley

6 questions for NVS

Graham Parry

Bank of America Corporation

5 questions for NVS

Rajesh Kumar

HSBC

4 questions for NVS

Emmanuel Papadakis

Deutsche Bank

3 questions for NVS

Kerry Holford

Berenberg

3 questions for NVS

Michael Leuchten

Jefferies

3 questions for NVS

Sachin Jain

Bank of America

3 questions for NVS

Steve Scala

Cowen

3 questions for NVS

Emily Field

Barclays

2 questions for NVS

James Gordon

JPMorgan Chase & Co.

2 questions for NVS

Michael Lyson

Jefferies Financial Group Inc.

2 questions for NVS

Richard Foster

JPMorgan Chase & Co.

2 questions for NVS

Richard Parkes

BNP Paribas Exane

2 questions for NVS

Sachin Dean

Bank of America Corporation

2 questions for NVS

Shirley Tan

Barclays PLC

2 questions for NVS

Steven Scala

TD Cowen

2 questions for NVS

Steven Skiena

The Toronto-Dominion Bank

2 questions for NVS

Eric Le Berrigaud

Stifel

1 question for NVS

Etzer Darout

BMO Capital Markets

1 question for NVS

Graham Parry

Bank of America

1 question for NVS

Harry Sephton

UBS

1 question for NVS

Jo Walton

UBS

1 question for NVS

Mark Purcell

Morgan Stanley

1 question for NVS

Michael Nedelcovych

TD Cowen

1 question for NVS

Naresh Chouhan

Intrinsic Health

1 question for NVS

Peter Welford

Jefferies

1 question for NVS

Shirley Chen

Barclays

1 question for NVS

Timothy Anderson

BofA Securities

1 question for NVS

Recent press releases and 8-K filings for NVS.

- Novartis shareholders approved a 29th consecutive dividend increase to CHF 3.70 per share for 2025, representing a 3.0% yield.

- Giovanni Caforio was re-elected as Chair of the Board of Directors, and Charles Swanton was newly elected as a member of the Board of Directors.

- Shareholders approved the reduction of share capital by canceling 77,602,358 shares.

- The total maximum aggregate compensation for the Board of Directors and the Executive Committee was approved in separate binding votes.

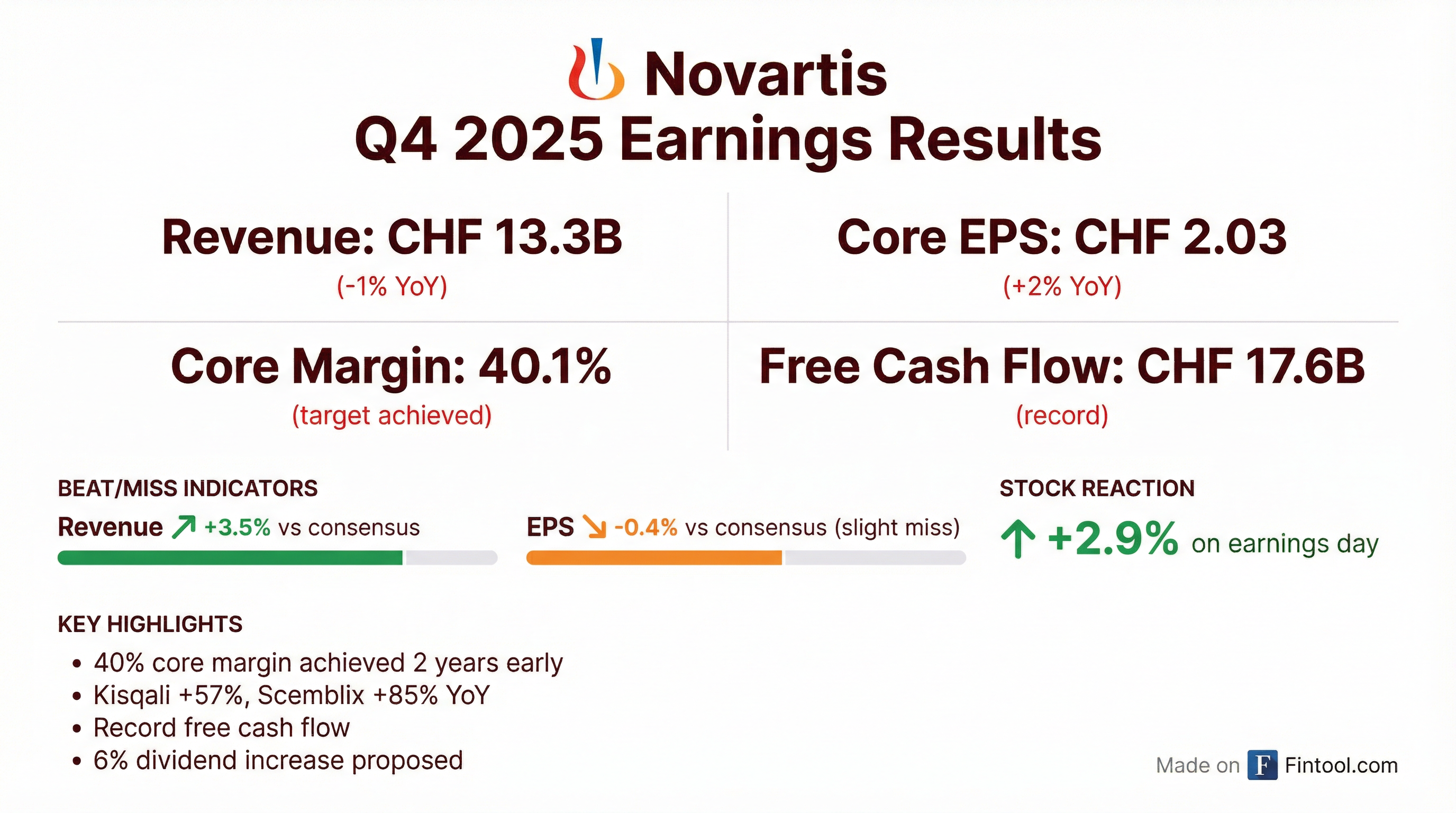

- Novartis reported strong 2025 financial results, with 8% group sales growth and 12% core net income growth at constant currencies, achieving a 40% core margin two years ahead of schedule. The company generated $17.6 billion in free cash flow, a historical high.

- The board proposed a 5.7% increase in the dividend to CHF 3.70 for 2025, marking the 29th consecutive year of dividend growth, which was accepted by shareholders. Shareholders also approved the cancellation of 77,602,358 repurchased shares from 2025, reducing share capital by CHF 38,025,155.42.

- Despite facing significant patent expirations in 2026, Novartis expects low single-digit net sales growth for 2026 and reaffirms its 2025-2030 sales guidance of 5%-6% average annual growth. The company anticipates 28 key submissions or approvals and nine key study readouts in 2026.

- Shareholders approved the 2025 compensation report and the proposed maximum aggregate compensation for the Board of Directors (CHF 8,240,000) and Executive Committee (CHF 95 million) for future periods. The CEO's compensation for 2025 was CHF 25 million, with a 188% payout from the long-term performance plan linked to an 84% shareholder return.

- Novartis reported strong 2025 financial results, with group sales rising 8% and core net income improving 12% at constant currencies, achieving a 40% core margin two years ahead of schedule. Free cash flow reached a historical high of $17.6 billion.

- The company proposed a 5.7% increase in the dividend to CHF 3.7 for 2025, marking the 29th consecutive year of dividend growth, and approved a reduction of share capital by cancelling 77,602,358 shares repurchased in 2025.

- For 2026, Novartis expects low single-digit net sales growth due to significant patent expirations, but remains confident in its 2025-2030 sales guidance of 5%-6% average annual growth rate and a return to 40%+ core margin by 2029.

- The Board of Directors will see Simon Moroney take on a combined Vice Chair and Lead Independent Director role, and Charles Swanton was proposed for election, while Daniel Hochstrasser did not stand for re-election.

- Executive compensation was a key discussion point, with the CEO earning almost CHF 25 million in 2025, though the compensation plan received 87% shareholder approval.

- Novartis reported strong financial results for 2025, with group sales rising 8% at constant currencies, core net income improving by 12% at constant currencies, and core margin reaching 40%. Net sales grew 8% in constant currencies, core operating income grew 14%, and free cash flow reached a historical high of $17.6 billion.

- The company proposed a 5.7% increase in the dividend to CHF 3.70 per share for 2025, marking the 29th consecutive year of dividend growth. Additionally, a reduction of share capital by CHF 38,025,155.42 was proposed through the cancellation of 77,602,358 own shares repurchased in 2025.

- For 2026, Novartis expects net sales to grow low single digit despite significant loss of exclusivity impacts. The company reaffirmed its 2025 to 2030 sales guidance of 5%-6% average annual growth rate and expects its core margin to return to 40%+ by 2029.

- Harry Kirsch, Chief Financial Officer for 13 years, is leaving Novartis. Charles Swanton was elected to the Board of Directors, while Daniel Hochstrasser did not stand for re-election.

- The Paroxysmal Nocturnal Hemoglobinuria (PNH) market is undergoing a transition phase, with treatment innovation accelerating over the past two years.

- A sizable population of patients is eligible for advanced second-line and later (2L+) therapy, with nearly one in four patients sub-optimally managed and approximately 30% not achieving adequate hemoglobin response on current therapy. Only 24% of PNH patients are currently treated in the second line or later, indicating a meaningful opportunity for advanced therapies.

- Despite high familiarity with newer agents, including Novartis's Fabhalta, adoption remains uneven due to persistent clinical practice, referral pathway, and payer access barriers, as well as concerns about long-term clinical data.

- However, 61% of hematologists reported making changes to their PNH management approach in the past year, primarily by increasing the use of newer agents and longer-acting therapies.

- Biosimilars are reshaping payer dynamics, with over half of physicians prescribing biosimilar eculizumab, and many anticipating biosimilars could represent roughly half of eculizumab-treated patients by year-end 2026.

- Novartis reiterated a prior commitment to invest approximately $23 billion to build or expand U.S. operations, including recent groundbreakings for manufacturing and research sites in North Carolina and California, and plans for a radioligand therapy manufacturing site in Florida.

- President Donald Trump claimed his tariff policies spurred this expansion and that Novartis would build 11 new U.S. facilities; however, Novartis's statement did not validate this specific figure or explicitly link the expansions to the administration's tariff actions, having previously announced plans for 10 U.S. facilities.

- Markets and analysts are awaiting clearer operational details before treating the announcement as a concrete shift in corporate capital allocation.

- Novartis is a significant U.S. market participant, generating roughly one-third of its global revenue in the United States and possessing robust financial strength metrics.

- Private equity firm ChrysCapital has agreed to acquire a 70.68% stake in Novartis India Ltd from Novartis AG for approximately Rs 1,446 crore.

- The acquisition includes a mandatory open offer at Rs 860.64 per share, which could increase ChrysCapital's total holding to over 96% if successful.

- Following the deal, Novartis AG will divest its entire stake in Novartis India, and the Novartis brand is expected to be phased out from the listed entity. Novartis AG will continue to operate in India through its wholly owned Novartis Healthcare Pvt Ltd.

- The global market for radioligand therapeutics in cancer treatment is projected to expand significantly, from an estimated $2.6 billion in 2025 to $4.8 billion by 2030, representing a Compound Annual Growth Rate (CAGR) of 13.1%.

- Novartis AG's Pluvicto and Lutathera have played a crucial role in catalyzing commercial momentum within the approved radioligand therapy market.

- The market is expected to see increased adoption across North America, Europe, and emerging markets, with Novartis AG anchoring the North American market through substantial sales.

- Novartis has signed a research collaboration and licensing agreement with Unnatural Products to develop orally delivered macrocyclic peptide therapeutics for cardiovascular disease.

- The deal is valued at up to $1.8 billion, with Unnatural Products eligible for up to $100 million in upfront and pre-IND milestone payments, and potentially up to $1.7 billion in development, regulatory, and commercial milestones.

- Novartis will assume responsibility for IND-enabling studies, clinical development, manufacturing, and global commercialization of the therapies.

- The partnership combines Unnatural Products' AI-enhanced macrocycle discovery engine with Novartis's global development and commercialization capabilities to pursue next-generation cardiovascular therapies.

- Novartis announced positive Phase 3 ALIGN results for Vanrafia (atrasentan) in IgA nephropathy, demonstrating a clinically meaningful slowing of kidney function decline.

- Despite narrowly missing a key statistical endpoint in the ALIGN trial, Novartis intends to pursue traditional FDA approval for Vanrafia, leveraging regulatory precedent for similar IgAN drugs.

- Vanrafia, a potent endothelin A (ETA) receptor antagonist, was acquired by Novartis in June 2023 as part of its £2.5 billion purchase of Chinook Therapeutics and received accelerated approvals in the U.S. and China in 2025.

Fintool News

In-depth analysis and coverage of NOVARTIS.

Quarterly earnings call transcripts for NOVARTIS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more