Earnings summaries and quarterly performance for TEVA PHARMACEUTICAL INDUSTRIES.

Executive leadership at TEVA PHARMACEUTICAL INDUSTRIES.

Richard D. Francis

President and Chief Executive Officer

Chris Fox

Executive Vice President, North America Commercial

David McAvoy

Executive Vice President, Chief Legal Officer

Eli Kalif

Executive Vice President, Chief Financial Officer

Eric Hughes

Executive Vice President, Global R&D and Chief Medical Officer

Evan Lippman

Executive Vice President, Business Development

Mark Sabag

Executive Vice President, International Markets Commercial

Matthew Shields

Executive Vice President, Teva Global Operations

Placid Jover

Executive Vice President, Chief Human Resources Officer

Richard Daniell

Executive Vice President, European Commercial

Board of directors at TEVA PHARMACEUTICAL INDUSTRIES.

Amir Elstein

Director

Chen Lichtenstein

Director

Gerald M. Lieberman

Director

Janet S. Vergis

Director

Perry D. Nisen

Director

Roberto A. Mignone

Director

Ronit Satchi-Fainaro

Director

Rosemary A. Crane

Director

Sol J. Barer

Chairman of the Board

Tal Zaks

Director

Varda Shalev

Director

Research analysts who have asked questions during TEVA PHARMACEUTICAL INDUSTRIES earnings calls.

David Amsellem

Piper Sandler Companies

3 questions for TEVA

Jason Gerberry

Bank of America Merrill Lynch

3 questions for TEVA

Umer Raffat

Evercore ISI

3 questions for TEVA

Ashwani Verma

UBS Group AG

2 questions for TEVA

Chris Schott

JPMorgan Chase & Company

2 questions for TEVA

Dennis Ding

Jefferies Financial Group Inc.

2 questions for TEVA

Les Sulewski

Truist

2 questions for TEVA

Louise Chen

Cantor Fitzgerald

2 questions for TEVA

Ash Verma

UBS

1 question for TEVA

Christopher Schott

JPMorgan Chase & Co.

1 question for TEVA

Keonhee Kim

Morningstar, Inc.

1 question for TEVA

Leszek Sulewski

Truist Securities

1 question for TEVA

Matthew Dellatorre

Goldman Sachs Group Inc.

1 question for TEVA

Umer Rappat

Evercore ISI

1 question for TEVA

Recent press releases and 8-K filings for TEVA.

- Teva is undergoing a transformation from a biogenerics company to a world-leading biopharma company, with 2026 marked as a year of significant milestones for its innovative pipeline.

- The company announced positive Phase 2 maintenance data for Duvakitug in Ulcerative Colitis (UC) and Crohn's Disease (CD), demonstrating 58% clinical remission in UC and 55% endoscopic response in CD at the highest dose over 44 weeks.

- These results are considered highly competitive within the inflammatory bowel disease (IBD) treatment landscape, positioning Duvakitug with potential to be "best in disease" in a $38 billion market, and the program has progressed into Phase 3 studies with partner Sanofi.

- Teva announced positive Phase 2 maintenance data for duvakitug in ulcerative colitis (UC) and Crohn's disease (CD).

- The study demonstrated 58% clinical remission in UC at the highest dose and 55% endoscopic response in CD after 44 weeks of additional therapy.

- These results are considered highly competitive within the inflammatory bowel disease (IBD) treatment landscape, which represents a $38 billion market.

- Duvakitug has already progressed to Phase 3 studies (Sunscape for UC and Starscape for CD) with partner Sanofi, featuring an all-subcutaneous treatment and a favorable safety profile consistent with the induction phase.

- Teva announced positive maintenance data from its Phase II study of Duvakitug (TL1A antibody) for ulcerative colitis (UC) and Crohn's disease (CD).

- The study demonstrated 58% clinical remission in UC and 55% endoscopic response in CD at the highest dose (900mg) over 44 weeks of additional therapy, with a favorable safety profile.

- Management expressed confidence in Duvakitug's potential to be "best in disease" and its commercial competitiveness in the $38 billion IBD market, with Phase III development already underway with Sanofi.

- Teva also highlighted a year of significant pipeline milestones in 2026, including data readouts for IL-15, DARI, Remsima, and the potential launch of olanzapine.

- Teva is targeting 2031 for the filing of its IL-15-directed antibody (408) for vitiligo and 2034 for celiac disease, with proof of concept data for vitiligo expected in the first half of this year and for celiac disease in the second half of this year.

- Royalty Pharma is providing up to $500 million in R&D funding for the vitiligo development of 408.

- The company anticipates releasing longer-term maintenance data for duvakitug (TL1A) in ulcerative colitis and Crohn's disease by the end of the first quarter of this year.

- Teva plans to submit the Investigational New Drug (IND) application for its TSLP/IL-13-directed treatment by the end of this year.

- Teva reported Q4 2025 revenue of approximately $4.2 billion and non-GAAP EPS of $0.68, with full-year 2025 free cash flow reaching $1.9 billion (excluding a development milestone). The company's net debt to EBITDA ratio stood at 2.5x at year-end 2025.

- The innovative portfolio, including AUSTEDO, UZEDY, and AJOVY, demonstrated strong growth, surpassing $1 billion in Q4 2025 sales. AUSTEDO achieved $2.2 billion in full-year sales, UZEDY $191 million, and AJOVY $673 million.

- For 2026, Teva expects full-year revenue between $16.4 billion and $16.8 billion, non-GAAP EPS in the range of $2.57 to $2.77, and free cash flow between $2 billion and $2.4 billion.

- The company made significant progress on its transformation program, achieving $70 million in savings in 2025 and remaining on track to deliver $700 million in savings by 2027.

- Key pipeline advancements include the initiation of a Phase 3 study for duvakitug in UC and CD, which triggered a $500 million milestone payment in Q4 2025 , and expected results for the Anti-IL-15 program in vitiligo in the first half of 2026.

- Teva reported Q4 2025 revenue of approximately $4.2 billion and non-GAAP EPS of $0.68. For the full year 2025, EBITDA grew 12% to $5.3 billion, EPS grew 19% to $2.93, and free cash flow was $2.4 billion including milestone payments.

- The company's innovative portfolio, including AUSTEDO ($2.26 billion, up 34%), UZEDY ($191 million, up 63%), and AJOVY ($673 million, up 30%), drove significant growth, surpassing $1 billion in Q4 2025.

- For 2026, Teva expects full-year revenue between $16.4 billion and $16.8 billion, non-GAAP EPS in the range of $2.57 to $2.77, and free cash flow between $2 billion and $2.4 billion.

- Teva is on track to achieve $700 million in net savings by 2027 from its transformation program, having achieved $70 million in 2025. Key pipeline milestones for 2026 include anticipated approval of Olanzapine LAI and maintenance data for Duvakitug.

- Teva reported Q4 2025 revenue of $4.2 billion and non-GAAP EPS of $0.68, with full-year 2025 free cash flow reaching $1.9 billion, all figures excluding a $500 million Sanofi milestone payment and Japan Business Venture contributions.

- The company's innovative portfolio, including AUSTEDO ($2.2 billion, up 35%), UZEDY ($191 million, up 63%), and AJOVY ($673 million, up 30%), drove significant growth in 2025, with the total innovative portfolio reaching $3.1 billion for the year.

- For 2026, Teva expects revenue between $16.4 billion and $16.8 billion, and non-GAAP EPS in the range of $2.57 to $2.77, with free cash flow projected at $2 billion to $2.4 billion.

- Teva is on track to achieve $700 million in transformation program savings by 2027 and aims for a net debt to EBITDA ratio of 2.0x by 2027, having reached 2.5x in Q4 2025.

- Key pipeline developments include the initiation of Phase 3 for duvakitug in Q4 2025, triggering a $500 million milestone payment from Sanofi, and the anticipated approval of olanzapine LAI by the end of 2026.

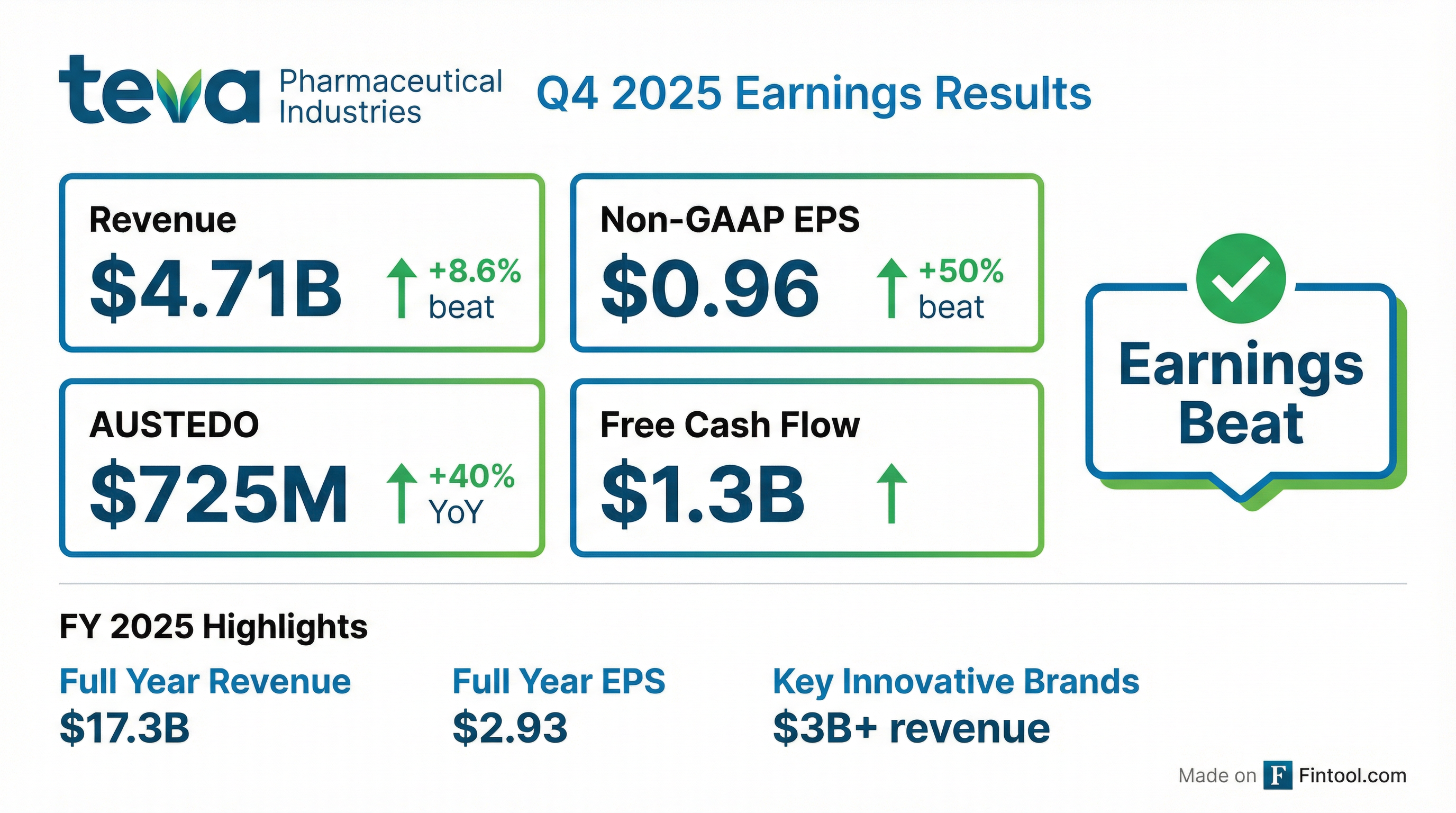

- Teva reported its third consecutive year of growth in 2025, with full-year revenues reaching $17.3 billion and Q4 2025 revenues at $4.7 billion.

- Growth was significantly driven by key innovative brands (AUSTEDO, AJOVY, UZEDY), which collectively generated over $3 billion in revenues for 2025 (up 35% YoY in LC) and approximately $1 billion in Q4 2025.

- For FY 2025, Teva achieved Non-GAAP diluted EPS of $2.93 and free cash flow of $2,396 million, while reducing gross debt to $16.8 billion by December 31, 2025.

- The company provided a 2026 outlook, projecting revenues between $16.4 - $16.8 billion, Non-GAAP diluted EPS of $2.57 - $2.77, and free cash flow of $2.0 - $2.4 billion.

- Teva is advancing its innovative late-stage pipeline, targeting 4 product submissions over the next 5 years, including the NDA for olanzapine LAI submitted in December 2025.

- Teva Pharmaceuticals is executing a "pivot to growth" strategy, transitioning to a biopharma company, and has achieved 11 consecutive quarters of growth since early 2023.

- Despite an anticipated $1.1 billion loss in generic Revlimid revenue in 2026, the company expects continued growth in EBITDA, operating margin, and free cash flow, aiming for a 30% operating margin by 2027 and net debt below two times.

- The innovative business revenue has doubled in the last three years, with a pipeline projected to generate over $10 billion in peak sales from products like Austedo, Ajovy, Uzedy, and late-stage assets such as Duvakitug and anti-IL-15. Royalty Pharma has invested $500 million in the anti-IL-15 asset.

- Teva's "pivot to growth strategy," launched three years ago, has successfully transformed the company towards a biopharma focus, achieving 11 consecutive quarters of growth since the start of 2023.

- The company projects its innovative business to achieve over $10 billion in peak sales from its pipeline, with key products like Austedo, Ajovy, and Uzedy expected to reach $3 billion, $1 billion, and $1.5-$2 billion respectively.

- Teva anticipates a $1.1 billion loss in generic Revlimid revenue, forecasting zero revenue from it in 2026, which will result in a flat to slightly down overall revenue outlook for the year despite strong innovative growth.

- Significant pipeline data readouts are expected throughout 2026, including maintenance data for Duvakitug, vitiligo and celiac disease data for anti-IL-15, and futility analysis for Anle138b.

Fintool News

In-depth analysis and coverage of TEVA PHARMACEUTICAL INDUSTRIES.

Quarterly earnings call transcripts for TEVA PHARMACEUTICAL INDUSTRIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more