Earnings summaries and quarterly performance for BRISTOL MYERS SQUIBB.

Executive leadership at BRISTOL MYERS SQUIBB.

Christopher Boerner

Chief Executive Officer

Cristian Massacesi

Executive Vice President, Chief Medical Officer and Head of Development

David Elkins

Executive Vice President and Chief Financial Officer

Karin Shanahan

Executive Vice President, Global Product Development & Supply

Sandra Leung

Executive Vice President and General Counsel

Board of directors at BRISTOL MYERS SQUIBB.

Deepak Bhatt

Director

Derica Rice

Director

Julia Haller

Director

Karen Vousden

Director

Manuel Hidalgo

Director

Michael McMullen

Director

Paula Price

Director

Peter Arduini

Director

Phyllis Yale

Director

Theodore Samuels

Lead Independent Director

Research analysts who have asked questions during BRISTOL MYERS SQUIBB earnings calls.

Courtney Breen

AllianceBernstein

8 questions for BMY

David Risinger

Leerink Partners

8 questions for BMY

Mohit Bansal

Wells Fargo & Company

7 questions for BMY

Steve Scala

Cowen

7 questions for BMY

Asad Haider

Goldman Sachs

6 questions for BMY

Christopher Schott

JPMorgan Chase & Co.

6 questions for BMY

Evan Seigerman

BMO Capital Markets

6 questions for BMY

Luisa Hector

Berenberg

6 questions for BMY

Seamus Fernandez

Guggenheim Partners

6 questions for BMY

Terence Flynn

Morgan Stanley

6 questions for BMY

Akash Tewari

Jefferies

5 questions for BMY

Carter L. Gould

Barclays

5 questions for BMY

David Amsellem

Piper Sandler Companies

5 questions for BMY

Geoff Meacham

Citigroup Inc.

5 questions for BMY

James Shin

Analyst

4 questions for BMY

Matthew Phipps

William Blair

3 questions for BMY

Sean McCutcheon

Raymond James

3 questions for BMY

Chris Schott

JPMorgan Chase & Company

2 questions for BMY

Chris Shibutani

Goldman Sachs Group, Inc.

2 questions for BMY

Geoffrey Meacham

Citi

2 questions for BMY

Jason Gerberry

Bank of America Merrill Lynch

2 questions for BMY

Malcolm Hoffman

BMO Capital Markets

2 questions for BMY

Michael Yee

Jefferies

2 questions for BMY

Olivia Brayer

Cantor

2 questions for BMY

Tim Anderson

Bank of America

2 questions for BMY

Timothy Anderson

BofA Securities

2 questions for BMY

Alexandria Hammond

Wolfe Research

1 question for BMY

Chun Chen

UBS

1 question for BMY

Crypta Devarakonda

Truist Securities

1 question for BMY

Kripa Devarakonda

Truist Securities

1 question for BMY

Srikripa Devarakonda

Truist Financial Corporation

1 question for BMY

Steven Scala

TD Cowen

1 question for BMY

Trang Han

UBS

1 question for BMY

Trung Huynh

UBS Group AG

1 question for BMY

Recent press releases and 8-K filings for BMY.

- The U.S. FDA approved Sotyktu® (deucravacitinib) for the treatment of adults with active psoriatic arthritis, making it the first TYK2 inhibitor approved in this indication.

- Approval was based on Phase 3 POETYK PsA-1 and PsA-2 trials, where 54% of patients on Sotyktu achieved an ACR20 response versus 34% on placebo in PsA-1, and 54% versus 39% in PsA-2 at Week 16.

- The safety profile in psoriatic arthritis was consistent with plaque psoriasis data; most common adverse reactions included upper respiratory infections, elevated CPK, herpes simplex, mouth ulcers, folliculitis and acne.

- Prime Medicine plans to submit IND/CTA for its Wilson Disease program in 1H 2026 and for its AATD program in mid-2026, with initial clinical data from both expected in 2027.

- Full-year 2025 net loss was $201.1 million, up from $195.9 million in 2024; R&D expenses were $160.6 million and G&A expenses were $52.3 million.

- Total revenue rose to $4.63 million in 2025 from $2.98 million in 2024, driven by collaboration revenue.

- Cash, cash equivalents, investments, and restricted cash totaled $191.4 million as of December 31, 2025, providing a runway into 2027.

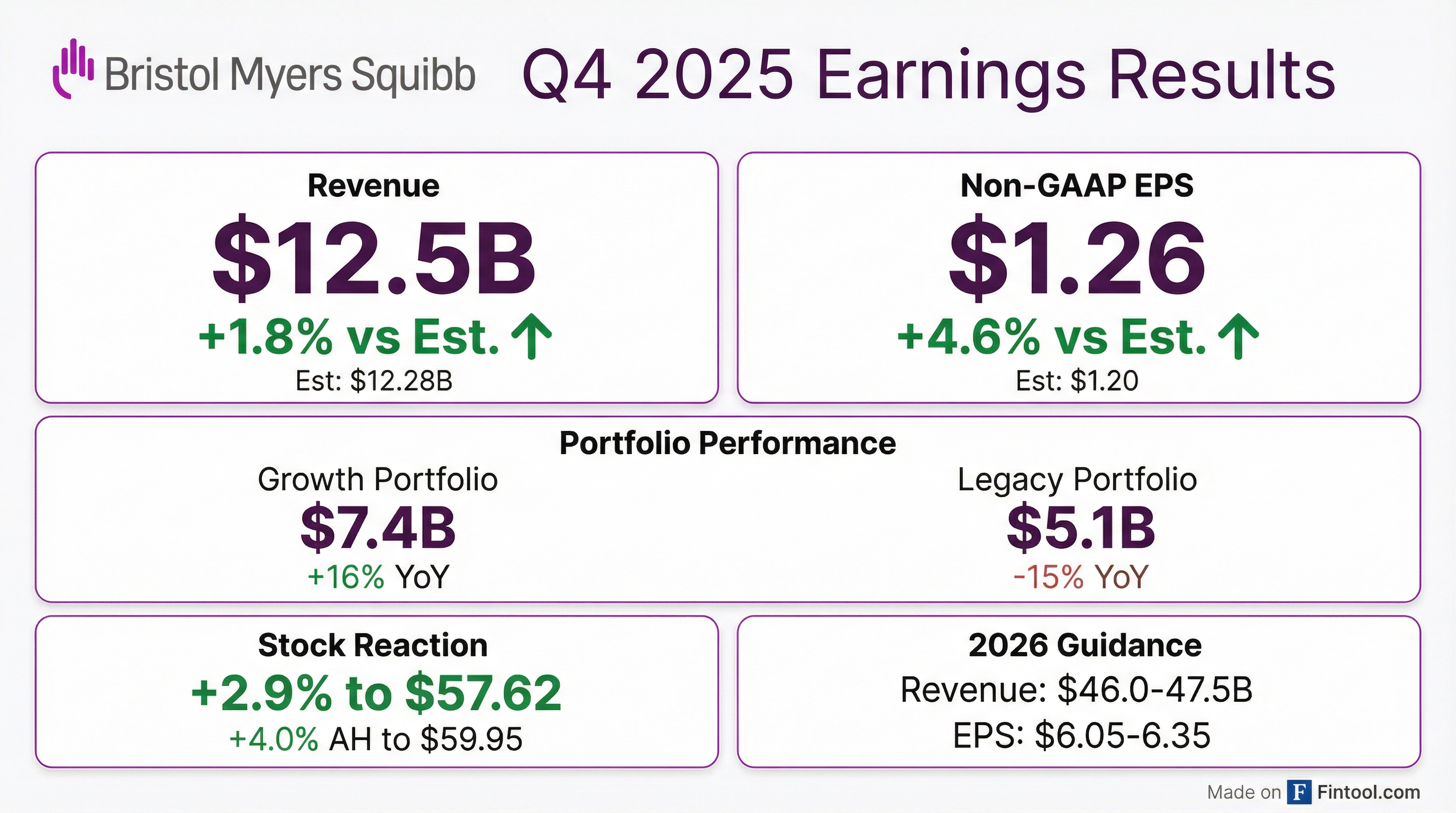

- 2025 strong performance driven by growth portfolio and disciplined OpEx; legacy REVLIMID and POMALYST generics headwinds offset by double-digit ELIQUIS growth, with Q4 oncology inventory build normalizing in Q1 2026.

- CAMZYOS annualized >$1 billion with continued weekly new prescriber gains; physician feedback indicates no meaningful differentiation between CAMZYOS and rival aficamten.

- Opdivo Qvantig SubQ launch on track for 30-40% IV-to-SubQ conversion by 2028, supported by broad reimbursement and community oncology adoption.

- Cobenfy gaining depth and breadth in schizophrenia; pivotal phase 4 switch data to be presented in March 2026, with ADEPT 1, 2, and 4 Alzheimer’s psychosis readouts expected end 2026.

- Five late-stage readouts by year-end—including Milvexin (emicavexin) in AFib/SSP, Admilprant in IPF/PPF, Iberdomide, zeygolimab, and Arloscel—underscore diversified growth pipeline.

- Bristol Myers delivered strong 2025 execution with growth portfolio momentum in REVLIMID, Breyanzi, and CAMZYOS, and expects double-digit ELIQUIS growth in 2026 despite full generics entry for REVLIMID and POMALYST.

- CAMZYOS annualized north of $1 billion in 2025, continues weekly prescriber additions, and faces no meaningful differentiation from new competitor aficamten per physician feedback.

- Opdivo Qvantig achieved broad first-year adoption, on track for 30%–40% subcutaneous conversion by 2028; Cobenfy is driving steady TRX growth ahead of a planned switch study readout at SIRS this month.

- Multiple readouts expected by year-end: ADEPT 1/2/4 Alzheimer’s psychosis trials for Cobenfy, and Milvexian Phase III SSP and AFib data, potentially establishing a new standard vs ELIQUIS.

- Late-stage pipeline includes five assets (Admilprant, Cobenfy, Iberdomide, Zongolimab, Milvexian) all reading out in 2026, with Admilprant targeting an $8–10 billion IPF/PPF market by mid-2030s.

- Strong 2025 performance set up 2026 momentum: growth portfolio products (REVLIMID, Breyanzi, CAMZYOS) delivered solid results, while generics headwinds on REVLIMID/POMALYST are offset by expected double-digit growth in ELIQUIS; U.S. oncology inventory build in Q4 2025 is normalizing in Q1 2026.

- CAMZYOS surpassed $1 billion annualized sales in 2025 and continues to add new prescribers weekly, maintaining leadership over aficamten according to physicians who see no meaningful differences between the therapies.

- Opdivo Qvantig (SubQ) is on track for 30 %–40 % conversion of IV Opdivo by 2028, supported by broad community oncology adoption across tumor types, improved practice efficiency, and patient preference for the 3-minute in-office injection.

- Cobenfy’s first full year shows steady TRX growth with expanding prescriber depth; a phase 4 switch study will be presented at SIRS in late March 2026, and three Alzheimer’s disease psychosis phase 3 readouts (ADEPT 1, 2, 4) are due by end-2026.

- Five key phase 3 data readouts are expected by end-2026—Cobenfy ADP, Milvexin in atrial fibrillation and SSP, iberdomide (PDUFA mid-August 2026), and Admilprant in IPF/PPF—where Admilprant could help expand the current $4 billion lung fibrosis market to $8 billion–$10 billion.

- The bispecific ADC candidate izalontamab brengitecan (Iza-bren) met its co-primary endpoints of progression-free survival and overall survival in a pre-specified interim analysis of the Phase III BL-B01D1-307 trial in previously treated unresectable locally advanced or metastatic triple-negative breast cancer.

- BL-B01D1-307, conducted in China by SystImmune’s parent Biokin, is the first bispecific ADC study to report dual positive PFS/OS outcomes in TNBC and the third Phase III study where Iza-bren has achieved its primary endpoint(s).

- The study compared Iza-bren against chemotherapy of physician’s choice and demonstrated statistically significant and clinically meaningful improvements in both key endpoints.

- Detailed data from this interim analysis are slated for presentation at an upcoming medical meeting, advancing Iza-bren’s development and potential regulatory filings.

- Evinova announced partnerships with Astellas Pharma, AstraZeneca, and Bristol Myers Squibb to accelerate global clinical development via its AI-native platform.

- Partners will share operational data to enhance study benchmarks and receive optimized recommendations for faster trials and improved patient outcomes.

- The platform’s products, including Study Designer, AI Authoring, and AI Digitizer, have delivered 5–7% savings per study, contributing hundreds of millions in savings for top 10 pharma companies.

- Cristian Massacesi, EVP & Chief Medical Officer at BMS, emphasized the necessity of AI to reduce development time, costs, and improve patient health outcomes.

- The FDA has accepted the new drug application for iberdomide combined with daratumumab and dexamethasone for relapsed/refractory multiple myeloma, granting breakthrough therapy designation and priority review with a PDUFA date of August 17, 2026.

- A planned interim analysis from the global, phase 3 EXCALIBER-RRMM trial showed a statistically significant improvement in minimal residual disease (MRD) negativity versus daratumumab, bortezomib, and dexamethasone.

- Iberdomide, an oral cereblon E3 ligase modulator and potential first-in-class agent, is part of BMS’s broader targeted protein degradation strategy and could significantly bolster its hematology franchise amid competition from Johnson & Johnson and Amgen.

- The U.S. FDA has accepted the New Drug Application for iberdomide in combination with daratumumab and dexamethasone for relapsed or refractory multiple myeloma, assigning a PDUFA date of August 17, 2026.

- The application received Breakthrough Therapy designation and Priority Review status.

- Filing was based on minimal residual disease (MRD) negativity rates from the Phase 3 EXCALIBER-RRMM study; progression-free survival assessment is ongoing.

- The review is being conducted under the FDA’s Project Orbis initiative for concurrent international assessment.

- Bristol Myers Squibb will deploy Evinova’s AI-native Study Designer, including the Cost Optimizer module, across its global portfolio to improve trial design and cost efficiency.

- The collaboration aims to accelerate clinical development timelines, enhance insight-driven decision making, and identify productivity opportunities.

- BMS leadership highlights the urgency of using AI to reduce drug development time, lower costs, and transform clinical trials.

- Evinova’s platform has demonstrated solutions delivering up to 60% improvement in patient experience, 6-month acceleration in trial delivery, and 32% cost reduction.

Fintool News

In-depth analysis and coverage of BRISTOL MYERS SQUIBB.

Quarterly earnings call transcripts for BRISTOL MYERS SQUIBB.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more