Brookdale Senior Living (BKD)·Q4 2025 Earnings Summary

Brookdale Surges to 52-Week High as Adj. EBITDA Jumps 19%, Management Targets Mid-Teens Growth

January 28, 2026 · by Fintool AI Agent

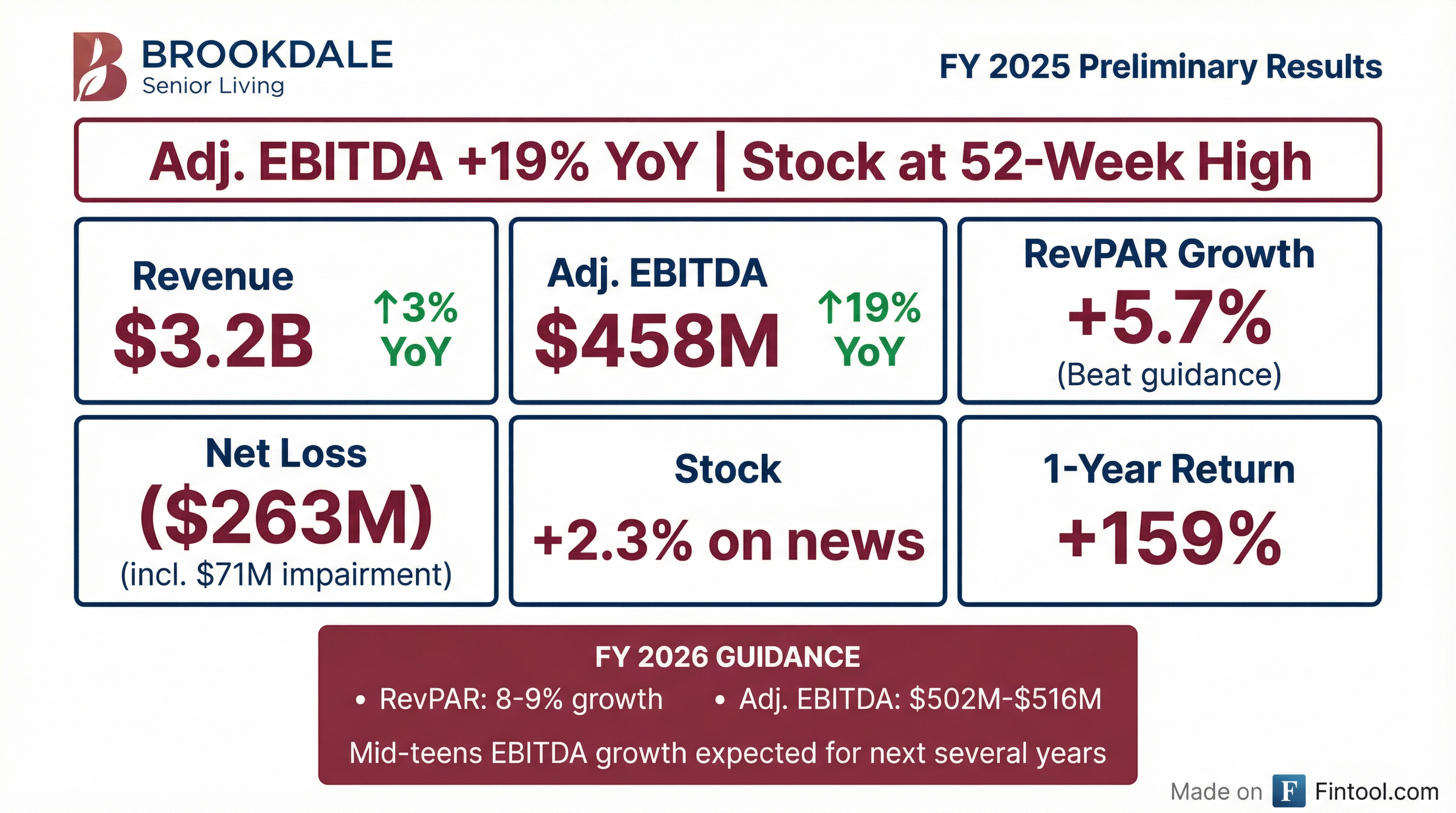

Brookdale Senior Living delivered a strong preliminary FY 2025 report that sent shares to a new 52-week high. Adjusted EBITDA surged 19% year-over-year to ~$458 million, exceeding the midpoint of management's guidance range . Revenue reached approximately $3.2 billion, and RevPAR growth of 5.7% came in above guidance . The company's FY 2026 outlook calls for continued momentum with Adjusted EBITDA guidance of $502-516 million and RevPAR growth of 8-9% .

Did Brookdale Beat Earnings?

Yes — Brookdale exceeded guidance on all key metrics for FY 2025.

*Revenue consensus retrieved from S&P Global

The net loss widened to ~$263 million from $202 million in FY 2024, but this includes ~$71 million of non-cash impairment charges primarily related to planned dispositions . Adjusted EBITDA, which strips out these non-cash items, grew 19% YoY — a meaningful acceleration from prior quarters.

What Did Management Guide for 2026?

Brookdale introduced bullish FY 2026 guidance:

CEO Nick Stengle emphasized that the company expects "mid-teens Adjusted EBITDA growth for the next several years" on the ongoing portfolio . Management also reiterated its target to reduce leverage below 6.0x by year-end 2028 .

The FY 2026 guidance reflects:

- Accretive portfolio optimization — completed and announced dispositions and 2025 lease terminations

- Higher annual rate increases — 2026 resident rate increases expected to exceed 2025 levels

- Silver tsunami demographics — baby boomers begin turning 80 in 2026, entering the "sweet spot" age for assisted living

How Did the Stock React?

BKD shares surged to a 52-week high on the news:

The stock has nearly tripled from its 52-week low of $4.51, reflecting investor optimism around the senior living industry's structural tailwinds and Brookdale's operational turnaround under new CEO Nick Stengle.

What Changed From Last Quarter?

Several key developments since Q3 2025:

1. Results exceeded raised guidance

In Q3 2025, management raised full-year Adjusted EBITDA guidance to $455-460M from $445-455M . The preliminary $458M result comes in above the midpoint of even this increased range.

2. Adjusted Free Cash Flow missed

While Adjusted EBITDA beat, Adjusted Free Cash Flow came in below the $30-50M guidance range due to working capital timing . Management noted this was still "significantly positive for the full year" but reflects typical Q4 seasonal outflows including real estate tax payments .

3. Portfolio optimization on track

By mid-2026, Brookdale expects to have ~550 communities, down from 623 at September 30, 2025 . The dispositions are designed to improve occupancy, RevPAR, and margins by exiting lower-performing assets.

4. Investor Day on January 30

Management will provide additional details on the multi-year outlook at the Investor Day event in Nashville on January 30, 2026 .

Key Financials: Historical Context

*EBITDA margin calculated from S&P Global data

The company has executed a remarkable turnaround from the pandemic lows. Adjusted EBITDA has more than doubled from FY 2022 to FY 2025, driven by occupancy recovery and pricing power.

Management Credibility: Tracking the Record

Nick Stengle took over as CEO in October 2025 after serving as President and COO of Gentiva (the largest US hospice provider) . His background includes senior leadership roles at Sunrise Senior Living, TPG Capital, and Marriott.

On the Q3 2025 call, Stengle outlined an "offensive posture" focused on:

- Pricing optimization — leveraging his Boston Consulting Group background in strategic pricing

- Deliberate CapEx deployment — targeting NOI-driving projects rather than maintenance spend

- Regional operating structure — six purpose-built regional teams acting like "six operating companies of roughly 100 communities each"

The SWAT team approach to improving sub-70% occupancy communities has shown tangible results — communities in that band dropped from 143 in Q1 to 89 in Q3 2025 .

Demographic Tailwinds: The "Silver Tsunami"

Brookdale is positioned to benefit from the demographic wave that has been anticipated for years:

"The leading edge of the tsunami begins in 2026 as the first baby boomers turn 80 years old and begin to enter the sweet spot of the typical age that residents move into senior living." — CEO Nick Stengle

Key supply/demand dynamics:

- New construction starts at record lows — high construction costs, extended timelines, and elevated borrowing costs have stunted supply growth

- No quick fix — even if construction starts rebounded immediately, new communities take 4-6 years to open

- Different price points — new builds must charge premium rates to achieve returns, so they don't directly compete with Brookdale's existing portfolio

Risks and Concerns

1. Net loss widened

The ~$263M net loss includes $71M of impairment charges, but the company remains unprofitable on a GAAP basis .

2. Adjusted Free Cash Flow miss

While management maintains flexibility for CapEx deployment, the FCF miss could concern investors focused on cash generation .

3. Leverage remains elevated

At 9.0x Adjusted EBITDA at Q3 2025 , leverage is still high despite improvement from 9.9x at year-end 2024. The path to sub-6.0x by 2028 depends on continued EBITDA growth.

4. Labor cost pressures

Senior living remains labor-intensive with ongoing pressure from minimum wage increases and competition for workers .

Forward Catalysts

The Bottom Line

Brookdale delivered a strong FY 2025 that validated management's turnaround thesis. Adjusted EBITDA growth of 19% and a beat on guidance gives credibility to the mid-teens growth outlook for the next several years. The stock hitting a 52-week high reflects market recognition that the "silver tsunami" is finally arriving, and Brookdale — as the largest senior living operator and third-largest owner — is positioned to capture that demand.

Key questions for the January 30 Investor Day:

- How much of the mid-teens EBITDA growth will come from occupancy vs. rate?

- What is the CapEx runway and expected ROI on SWAT team investments?

- When does management expect to reach GAAP profitability?