Earnings summaries and quarterly performance for Brookdale Senior Living.

Research analysts who have asked questions during Brookdale Senior Living earnings calls.

Brian Tanquilut

Jefferies

6 questions for BKD

Also covers: ACHC, ADUS, AHCO +31 more

JG

Joanna Gajuk

Bank of America

6 questions for BKD

Also covers: ACHC, ADC, ADUS +22 more

Joshua Raskin

Nephron Research

4 questions for BKD

Also covers: AIRS, CI, CNC +13 more

Tao Qiu

Macquarie Group

4 questions for BKD

Also covers: ADUS, AMED, ENSG +5 more

Andrew Mok

Barclays

3 questions for BKD

Also covers: ACHC, ADUS, AGL +21 more

Benjamin Hendrix

RBC Capital Markets

3 questions for BKD

Also covers: ACHC, ADUS, AHCO +25 more

BH

Ben Hendricks

RBC Capital Markets

2 questions for BKD

Also covers: ACHC, ADUS, CHE +10 more

Josh Raskin

Nathron Research

2 questions for BKD

Also covers: CNC, CYH, ELV +6 more

MM

Michael Murray

RBC Capital Markets

1 question for BKD

Also covers: ADUS, AHCO, AMED +8 more

Recent press releases and 8-K filings for BKD.

Brookdale Senior Living Reports Strong Q4 and Full-Year 2025 Results, Issues 2026 Guidance

BKD

Earnings

Guidance Update

Revenue Acceleration/Inflection

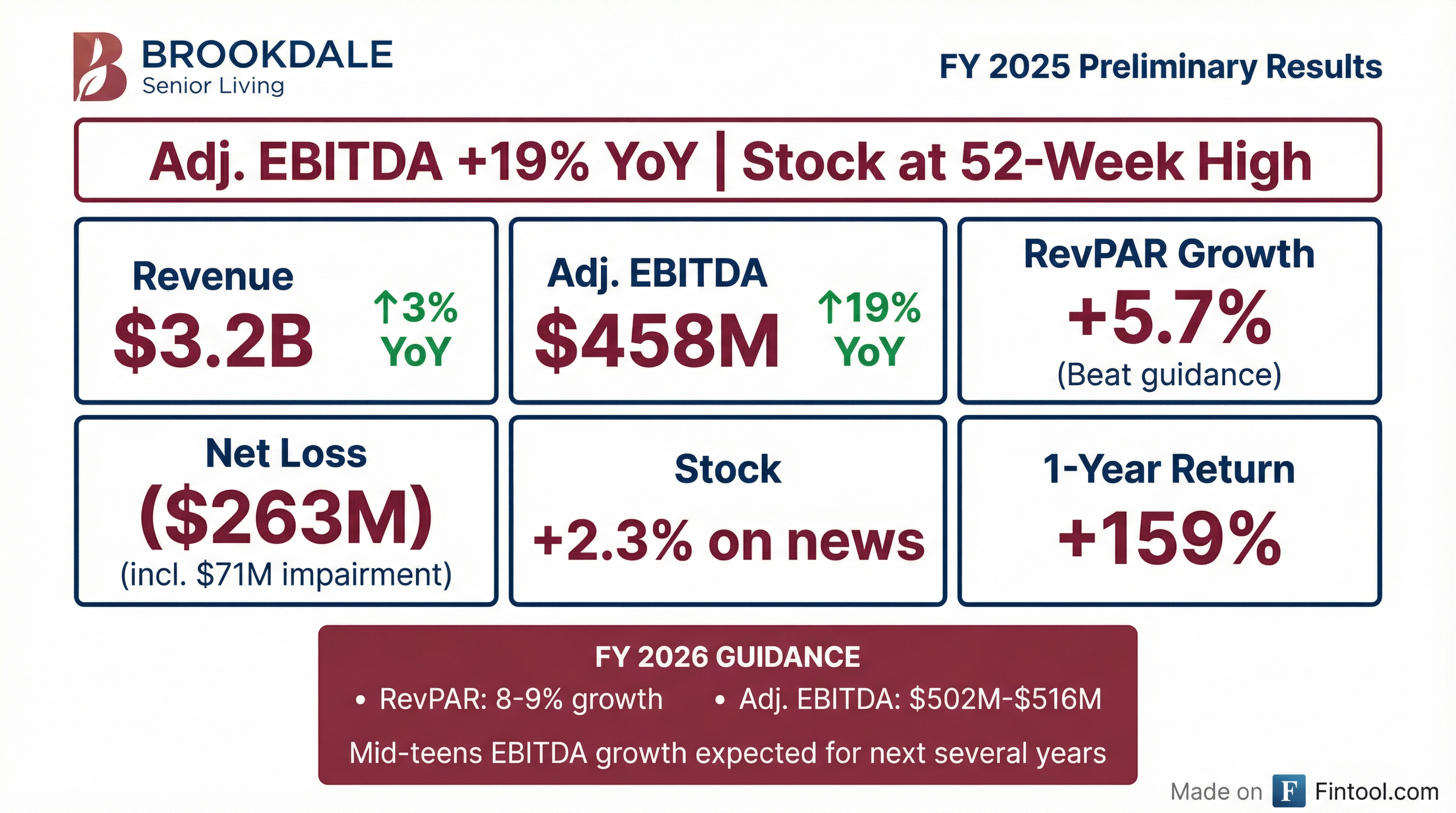

- Brookdale Senior Living reported full-year 2025 Adjusted EBITDA of $458 million, a 19% increase over 2024, and 5.7% RevPAR growth, both exceeding initial targets.

- Consolidated weighted average occupancy reached 82.5% in Q4 2025, a 310 basis point improvement year-over-year and the highest level since Q1 2020.

- The company provided 2026 Adjusted EBITDA guidance of $502 million-$516 million and projects mid-teens Adjusted EBITDA growth through 2028, aiming for under 6x leverage by the end of 2028.

- Adjusted Free Cash Flow for 2025 was $23 million, marking the first positive year since 2020.

- Brookdale is continuing its portfolio optimization, planning to sell 29 owned communities in the first half of 2026 for approximately $200 million and having exited 58 leased communities in 2025.

Feb 19, 2026, 2:00 PM

Brookdale Senior Living Exceeds 2025 Financial Targets and Provides Strong 2026 Guidance

BKD

Earnings

Guidance Update

Management Change

- Brookdale Senior Living exceeded initial 2025 Adjusted EBITDA expectations, delivering $458 million for the year, and achieved 5.7% RevPAR growth.

- The company reported a consolidated weighted average occupancy of 82.5% in Q4 2025, a 310 basis point improvement year-over-year, marking three consecutive quarters above 80%.

- For 2026, Brookdale projects RevPAR growth of 8%-9% and Adjusted EBITDA between $502 million and $516 million.

- Brookdale returned to positive Adjusted Free Cash Flow in 2025, generating $23 million, and reduced its adjusted annualized leverage to 8.9 times Adjusted EBITDA by year-end 2025.

- Strategic initiatives include optimizing its real estate portfolio with planned sales of 29 owned communities for approximately $200 million by mid-2026 and significant operational enhancements, including the appointment of a new Chief Operating Officer.

Feb 19, 2026, 2:00 PM

Brookdale Senior Living Reports Strong Q4 and Full Year 2025 Results, Provides 2026 Guidance

BKD

Earnings

Guidance Update

New Projects/Investments

- Brookdale Senior Living reported a 19% increase in Adjusted EBITDA to $458 million for full year 2025, exceeding initial expectations, and achieved $106 million in Adjusted EBITDA for Q4 2025.

- Consolidated weighted average occupancy reached 82.5% in Q4 2025, a 310 basis point improvement year-over-year, with full-year 2025 RevPAR growth at 5.7%.

- For 2026, the company projects 8%-9% RevPAR growth and Adjusted EBITDA guidance of $502 million-$516 million, with an expectation to drive leverage to under 6x by the end of 2028 from 8.9 times at the end of 2025.

- The company is optimizing its real estate portfolio, anticipating 517 communities by mid-2026 after planned dispositions, and projects non-development CapEx of $175 million-$195 million for 2026.

Feb 19, 2026, 2:00 PM

Brookdale Senior Living Inc. Announces Fourth Quarter and Full Year 2025 Results

BKD

Earnings

Guidance Update

Debt Issuance

- Brookdale Senior Living Inc. reported a net loss of $263 million and Adjusted EBITDA of $458 million for the full year 2025, with Adjusted EBITDA exceeding the midpoint of its previously announced guidance range.

- Consolidated weighted average occupancy for the fourth quarter of 2025 increased by 310 basis points over the prior year quarter to 82.5%, and full year 2025 consolidated revenue per available unit (RevPAR) increased by 5.7%.

- In December 2025, the company beneficially refinanced approximately $350 million of 2026 mortgage debt maturities and approximately $200 million of 2027 mortgage debt maturities.

- For 2026, the company provided annual guidance anticipating mid-teens year-over-year growth in Adjusted EBITDA for its ongoing portfolio and 8% to 9% RevPAR growth.

- During the fourth quarter of 2025, the company completed terminations of leases on 42 communities (4,713 units) and sold two owned communities for $18.0 million in cash proceeds; it also plans to sell 29 owned communities in 2026, expecting to generate approximately $200.0 million in proceeds.

Feb 18, 2026, 9:17 PM

Brookdale Senior Living Announces Q4 and Full Year 2025 Results and 2026 Guidance

BKD

Earnings

Guidance Update

Debt Issuance

- Brookdale Senior Living reported a full year 2025 net loss of $263 million and Adjusted EBITDA of $458 million, which was above the midpoint of its previously announced guidance range.

- For the fourth quarter of 2025, consolidated Adjusted EBITDA increased by 7.1% to $105.6 million compared to the prior year quarter, and consolidated weighted average occupancy improved by 310 basis points.

- The company provided full year 2026 guidance, expecting Adjusted EBITDA between $502 million and $516 million and RevPAR year-over-year growth of 8.0% to 9.0%.

- In December 2025, Brookdale refinanced approximately $350 million of 2026 mortgage debt maturities and approximately $200 million of 2027 mortgage debt maturities.

- During Q4 2025, the company completed lease terminations on 42 communities and sold two owned communities for $18.0 million, with plans to sell an additional 29 owned communities in 2026 for an estimated $200.0 million.

Feb 18, 2026, 9:15 PM

Brookdale Senior Living Provides 2025 Results and 2026 Outlook at Investor Day

BKD

Guidance Update

Revenue Acceleration/Inflection

New Projects/Investments

- Brookdale Senior Living reported $458 million in Adjusted EBITDA for 2025, representing a 19% increase over 2024, and achieved 83.5% fourth-quarter weighted average occupancy. The company also became adjusted free cash flow positive for the year.

- For 2026, the company guides for Adjusted EBITDA in the range of $502-$516 million and anticipates RevPAR growth of 8.0%-9.0%.

- Brookdale projects mid-teens annualized growth in Adjusted EBITDA over the next several years and aims to reduce net leverage to less than 6 turns of EBITDA by the end of 2028.

- The company has stabilized its portfolio at 517 communities and implemented a new operating structure with six regional senior living companies to enhance operational excellence and market performance.

- 94% of Brookdale's revenue is tied to private pay, emphasizing its needs-based business model.

Jan 30, 2026, 3:00 PM

Brookdale Provides 2025 Preliminary Results and 2026 Guidance at Investor Day

BKD

Guidance Update

Revenue Acceleration/Inflection

New Projects/Investments

- Brookdale reported preliminary 2025 Adjusted EBITDA of $458 million, a 19% increase over 2024, and provided 2026 Adjusted EBITDA guidance in the range of $502-$516 million.

- The company achieved 83.5% weighted average occupancy in Q4 2025, a 220 basis points increase year-over-year, and projects 8.0%-9.0% RevPAR growth for 2026.

- Brookdale plans to stabilize its portfolio at 517 communities by mid-2026 and aims to reduce net leverage to less than 6 turns of EBITDA by the end of 2028.

- The company anticipates significant demographic tailwinds, with 1 million more Americans aged 80+ annually from 2026-2028, contributing to a projected 100,000 unit shortage by 2027 in senior living supply.

- Brookdale's business model is characterized by 94% private pay revenue and estimates $23 million in NOI for every 100 basis points of occupancy gain.

Jan 30, 2026, 3:00 PM

Brookdale Senior Living Reports Strong 2025 Results and Provides Optimistic 2026 Guidance

BKD

Guidance Update

Revenue Acceleration/Inflection

New Projects/Investments

- Brookdale Senior Living reported strong 2025 results with over $3 billion in revenue and $458 million in adjusted EBITDA, exceeding the midpoint of its upgraded guidance.

- For 2026, the company projects adjusted EBITDA between $502 million and $516 million and RevPAR growth of 8.0%-9.0%.

- Brookdale anticipates mid-teen annualized adjusted EBITDA growth for several years, targeting a reduction in net leverage to below 6 times EBITDA by the end of 2028.

- This outlook is supported by favorable industry dynamics, including a 4% CAGR in the 80+ population and record low inventory growth of 0.6%, leading to a projected 100,000 unit shortage by 2027.

- The company's optimized portfolio will consist of 517 communities and 41,525 units in 2026, with almost 75% of units being owned.

Jan 30, 2026, 3:00 PM

Brookdale Senior Living Inc. Announces Preliminary Full Year 2025 Results and Full Year 2026 Guidance

BKD

Earnings

Guidance Update

- Brookdale Senior Living Inc. announced preliminary full year 2025 revenue is expected to be approximately $3.2 billion, with a net loss of approximately $263 million.

- Adjusted EBITDA for full year 2025 is expected to be approximately $458 million, representing an approximate 19% increase from the year ended December 31, 2024.

- RevPAR year-over-year growth for the year ended December 31, 2025, is expected to be approximately 5.7%.

- For the full year 2026, the company is providing guidance for RevPAR year-over-year growth of 8.0% to 9.0% and Adjusted EBITDA between $502 million and $516 million.

Jan 28, 2026, 9:17 PM

Brookdale Senior Living Announces Preliminary Full-Year 2025 Results and Full-Year 2026 Guidance

BKD

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Brookdale Senior Living announced preliminary full-year 2025 results, reporting revenue of approximately $3.2 billion, a net loss of approximately $263 million, and Adjusted EBITDA of approximately $458 million, which represents an approximate 19% increase from the prior year.

- The company expects RevPAR year-over-year growth for full-year 2025 to be approximately 5.7%.

- For full-year 2026, Brookdale introduced guidance projecting RevPAR year-over-year growth of 8.0% to 9.0% and Adjusted EBITDA between $502 million and $516 million.

- These 2025 financial results are preliminary and unaudited, with actual results potentially differing.

Jan 28, 2026, 9:15 PM

Fintool News

In-depth analysis and coverage of Brookdale Senior Living.

Quarterly earnings call transcripts for Brookdale Senior Living.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more