Brookdale Targets Mid-Teens EBITDA Growth Through 2028 as First Baby Boomers Turn 80

January 30, 2026 · by Fintool Agent

Brookdale Senior Living laid out a multi-year growth trajectory at its 2026 Investor Day in Nashville, guiding for mid-teens annual EBITDA growth through 2028 as the nation's largest senior living operator positions itself to capture the long-awaited baby boomer demand wave. The stock, trading near its 52-week high, has surged 228% from its lows.

"The supply and demand dynamics are undeniable," CEO Nick Stengel told investors from Brookdale's Nashville headquarters. "First baby boomers are turning 80 this year. We've been talking about this demographic tailwind for years—it's now on our shores."

The Numbers: $509 Million EBITDA, Sub-6x Leverage by 2028

Brookdale introduced 2026 guidance of $502-516 million in Adjusted EBITDA—a mid-teens increase from the $445 million baseline after adjusting for portfolio dispositions. The company also targets RevPAR growth of 8-9%, driven by both occupancy gains and a larger in-place rate increase than 2025.

| Metric | 2024 | 2025 | 2026E | 2028 Target |

|---|---|---|---|---|

| Adjusted EBITDA | $385M* | $458M | $502-516M | Mid-teens growth |

| Same-Store Occupancy | 81.3% | 83.5% | >83% | 93%+ |

| Net Debt/EBITDA | 11x | 8.9x | 8x | <6.0x |

| Communities | 600 | 584 | 517 | 517 |

*Values retrieved from S&P Global

CFO Dawn Kussow emphasized that the "single biggest way for us to reduce leverage is to increase our Adjusted EBITDA," noting the company expects to reach sub-6x net debt-to-EBITDA by year-end 2028 through earnings growth rather than material debt paydown.

The Baby Boomer Thesis: "Undeniable" Demographics

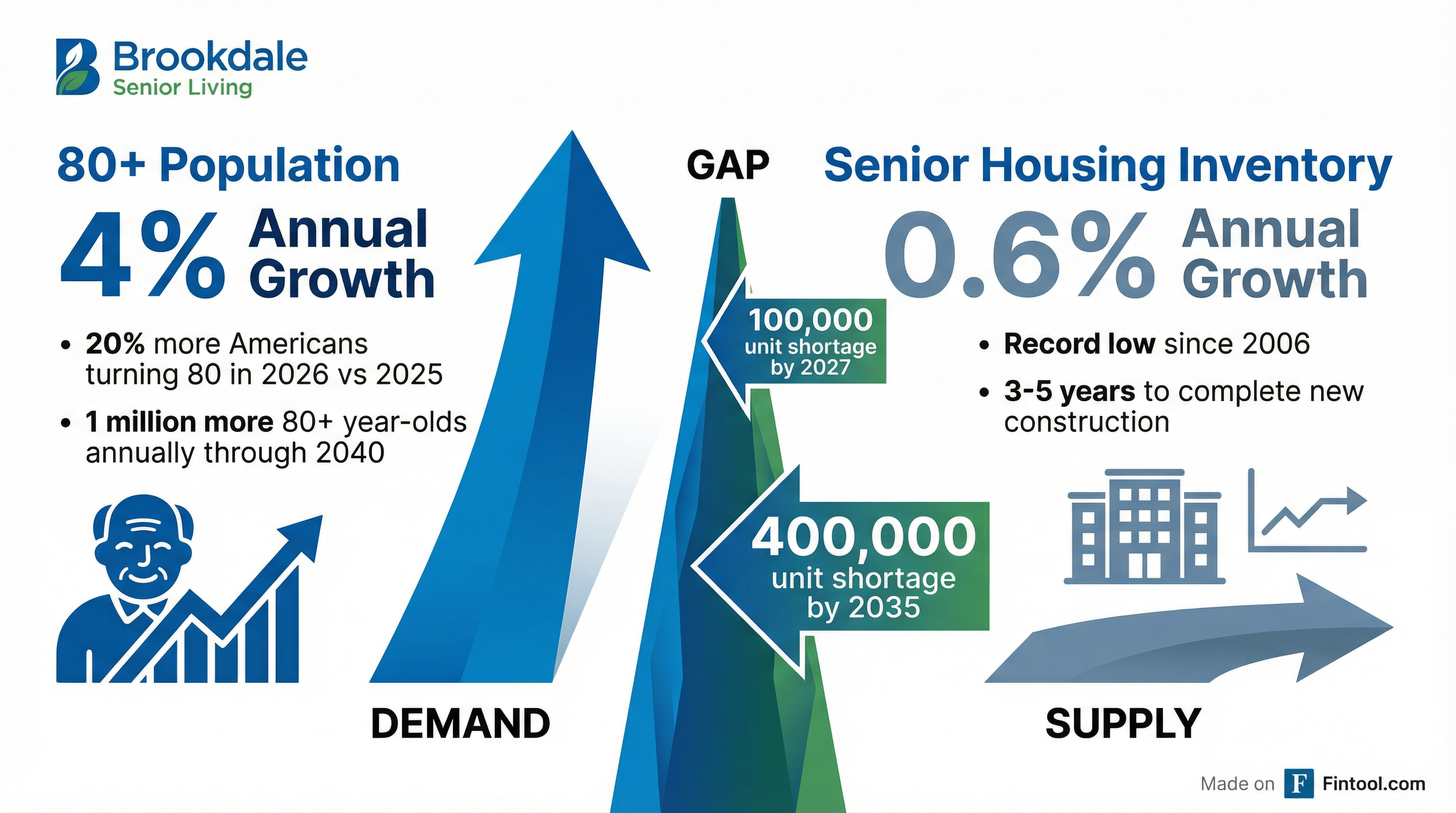

Stengel dedicated substantial time to what he called "undeniable" demographic math: the 80+ population will grow at a 4% compound annual rate through 2040, while senior housing inventory is expanding at just 0.6%—its lowest level since NIC began tracking in 2006.

"20% more Americans are turning 80 this year than turned 80 last year," Stengel noted. "For the next 10 to 15 years, there will be more folks turning 80 than were born 80 years ago." The company expects a 100,000-unit national shortage by 2027, expanding to 400,000 units by 2035.

This supply-demand imbalance is already showing up in industry data. According to NIC MAP, senior housing occupancy across primary markets hit 88.7% in Q3 2025, with independent living surpassing 90% for the first time since 2019.

Stengel highlighted one statistic repeatedly: Brookdale's average move-in age is 83.1 years, with the 80-90 age bracket representing 51% of total move-ins. That age cohort is about to explode.

The Operating Inflection Point: Why 80% Occupancy Matters

Perhaps the most important slide for investors detailed Brookdale's operating leverage. The company disclosed that communities above 80% occupancy produce operating income per unit four times greater than those below 70% occupancy.

The math is stark:

- Every 100 basis points of occupancy adds $23 million in NOI at a 70% flow-through rate

- Every 1% RevPOR-ExPOR spread (rate growth over expense growth) adds $27 million in NOI

"Because we're over that inflection point of covering our fixed costs, we expect to continue to widen the spread of RevPOR and ExPOR over the next several years," Kussow stated.

At year-end 2025, approximately 13% of Brookdale's owned units (4,000 units) were below 70% occupancy, and 28% (8,500 units) sat in the 70-80% band. Management framed this as upside: moving those 4,000 low-occupancy units up just one band would create ~$20 million in annual EBITDA; moving the 8,500 mid-band units above 80% would generate ~$80 million.

New Operating Structure: First COO in 10 Years

A central theme of the Investor Day was Brookdale's operational restructuring under Stengel, who joined as CEO in October 2025 after serving as president and COO at Gentiva, the largest hospice company in the U.S.

"It blew my mind that this company has not had a Chief Operating Officer for the last 10 years," Stengel said. He hired Mary Sue Patchett—a Brookdale veteran with 23 years of experience who previously served as COO at Horizon Bay before its acquisition—as the company's first COO in a decade.

The new structure organizes Brookdale into six regional "companies" of approximately 100 communities each, with dedicated leadership teams mirroring corporate functions. Stengel described it as capturing "the leverage of who we are as a big national company, but deploy[ing] regionally."

The regional VPs average 23 years of Brookdale experience. Each oversees dedicated teams for operations, sales, clinical, dining, and asset management—empowered to customize national strategies for local markets.

The "Bingo Card" Strategy: Targeted Acquisitions in Existing Markets

Stengel introduced what he called the "bingo card" approach to capital deployment. Rather than expanding into new geographies, Brookdale will make targeted acquisitions to fill gaps in markets where it already operates.

He illustrated with Kansas City, where Brookdale has seven communities and 88% occupancy—but all on the Kansas side of the state line. "If you're born and raised in Missouri, you will never live in Kansas," Stengel explained, noting that families frequently decline otherwise-suitable communities because they're on the wrong side of the border.

The Dallas market offered another example: 23 communities but primarily assisted living and memory care, with limited independent living presence—and just 80% occupancy versus an 89% NIC average. Management identified IL expansion and targeted CapEx remodels as priorities.

"We're not planting new flags in new markets," Stengel emphasized. "We are going to win in markets where we already are."

What's Priced In? Valuation and Risks

BKD shares closed at $14.59 on January 30, up 0.6% on the day and near the stock's 52-week high of $14.77. The stock has rallied 228% from its 52-week low of $4.45, as occupancy recovery and the demographic thesis gain traction.

| Metric | BKD | WELL | VTR |

|---|---|---|---|

| Market Cap | $3.5B | $72B* | $25B* |

| EV/EBITDA (FY26E) | 14x | 22x* | 18x* |

| Owned Real Estate | 75% | 100% | 100% |

| Asset Type | Operator + RE | Pure REIT | Pure REIT |

*Values retrieved from S&P Global

The valuation gap to healthcare REITs like Welltower and Ventas reflects Brookdale's hybrid operating company/real estate structure, historical execution issues, and leverage. Management argued the discount is unwarranted given 75% real estate ownership of an increasingly scarce asset class.

Key risks include:

- Labor costs: 65% of the cost base; while turnover is improving, wage inflation remains a margin headwind

- Execution on new structure: The regional model is untested at this scale

- Interest rates: Higher-for-longer rates pressure both Brookdale's debt costs and the broader industry's development economics

- Medicaid/Medicare policy: While 94% private pay, any senior care policy changes could have second-order effects

The Bottom Line

Brookdale is making a straightforward bet: baby boomers will need assisted living, there won't be enough supply to meet demand, and the company's 517 communities and 75% owned real estate position it to benefit.

The math is compelling. At 83.5% occupancy in a market heading toward structural undersupply, every percentage point higher adds $23 million to NOI. Rate increases should outpace expense inflation. And the company is finally investing in operational discipline after a decade without a COO.

Stengel closed with characteristic confidence: "We are in the early innings of a multi-year growth run based on macro factors and Brookdale's improved structure and our focus on operational excellence."

Investors attending the Investor Day in Nashville were invited to tour Brookdale Green Hills Cumberland—a 17-year-old community recently remodeled to demonstrate the company's comprehensive CapEx approach. For those who couldn't make it through the winter storm, the message was clear: Brookdale is betting its future on the thesis that the demographic wave has finally arrived.

Related Companies

- Brookdale Senior Living (bkd) - Largest U.S. senior living operator

- Welltower (well) - Healthcare REIT, top senior housing owner

- Ventas (vtr) - Healthcare REIT with senior housing exposure