Earnings summaries and quarterly performance for Ventas.

Executive leadership at Ventas.

Debra A. Cafaro

Chief Executive Officer

Carey S. Roberts

Executive Vice President, General Counsel, Ethics & Compliance Officer and Corporate Secretary

J. Justin Hutchens

Executive Vice President, Senior Housing and Chief Investment Officer

Peter J. Bulgarelli

Executive Vice President, Outpatient Medical and Research; President and Chief Executive Officer, Lillibridge Healthcare Services, Inc.

Robert F. Probst

Executive Vice President and Chief Financial Officer

Board of directors at Ventas.

Joe V. Rodriguez, Jr.

Director

Marguerite M. Nader

Director

Matthew J. Lustig

Director

Maurice S. Smith

Director

Melody C. Barnes

Director

Michael J. Embler

Director

Roxanne M. Martino

Lead Independent Director

Sean P. Nolan

Director

Sumit Roy

Director

Theodore R. Bigman

Director

Walter C. Rakowich

Director

Research analysts who have asked questions during Ventas earnings calls.

Juan Sanabria

BMO Capital Markets

6 questions for VTR

Michael Carroll

RBC Capital Markets

6 questions for VTR

Ronald Kamdem

Morgan Stanley

6 questions for VTR

Austin Wurschmidt

KeyBanc Capital Markets Inc.

5 questions for VTR

Michael Mueller

JPMorgan Chase & Co.

5 questions for VTR

Michael Stroyeck

Green Street Advisors, LLC

5 questions for VTR

Omotayo Okusanya

Deutsche Bank AG

4 questions for VTR

Vikram Malhotra

Mizuho Financial Group, Inc.

4 questions for VTR

James Kammert

Evercore ISI

3 questions for VTR

Jeffrey Spector

BofA Securities

3 questions for VTR

John Kilichowski

Wells Fargo & Company

3 questions for VTR

Nicholas Yulico

Scotiabank

3 questions for VTR

Richard Anderson

Wedbush Securities

3 questions for VTR

Wesley Golladay

Robert W. Baird & Co.

3 questions for VTR

Farrell Granath

Bank of America

2 questions for VTR

Georgi Dinkov

Mizuho

2 questions for VTR

Jim Kammert

Evercore

2 questions for VTR

Julien Blouin

The Goldman Sachs Group, Inc.

2 questions for VTR

Michael Goldsmith

UBS

2 questions for VTR

Nicholas Joseph

Citigroup

2 questions for VTR

Nick Joseph

Citigroup Inc.

2 questions for VTR

Rich Anderson

Cantor Fitzgerald

2 questions for VTR

Seth Bergey

Citi

2 questions for VTR

Wes Golladay

Baird

2 questions for VTR

Elmer Chang

Scotiabank

1 question for VTR

John Kilchowski

Wells Fargo

1 question for VTR

John Killechawski

Wells Fargo & Company

1 question for VTR

John Pawlowski

Green Street

1 question for VTR

Sam

Deutsche Bank

1 question for VTR

William John Kilichowski

Wells Fargo

1 question for VTR

Recent press releases and 8-K filings for VTR.

- Ventas, Inc. entered into Amendment No. 2 to its ATM Sales Agreement on February 9, 2026.

- The amendment increases the aggregate gross sales capacity under the program from $2.25 billion to $2.5 billion.

- M&T Securities, Inc. is added as a new sales agent, with all other material terms unchanged.

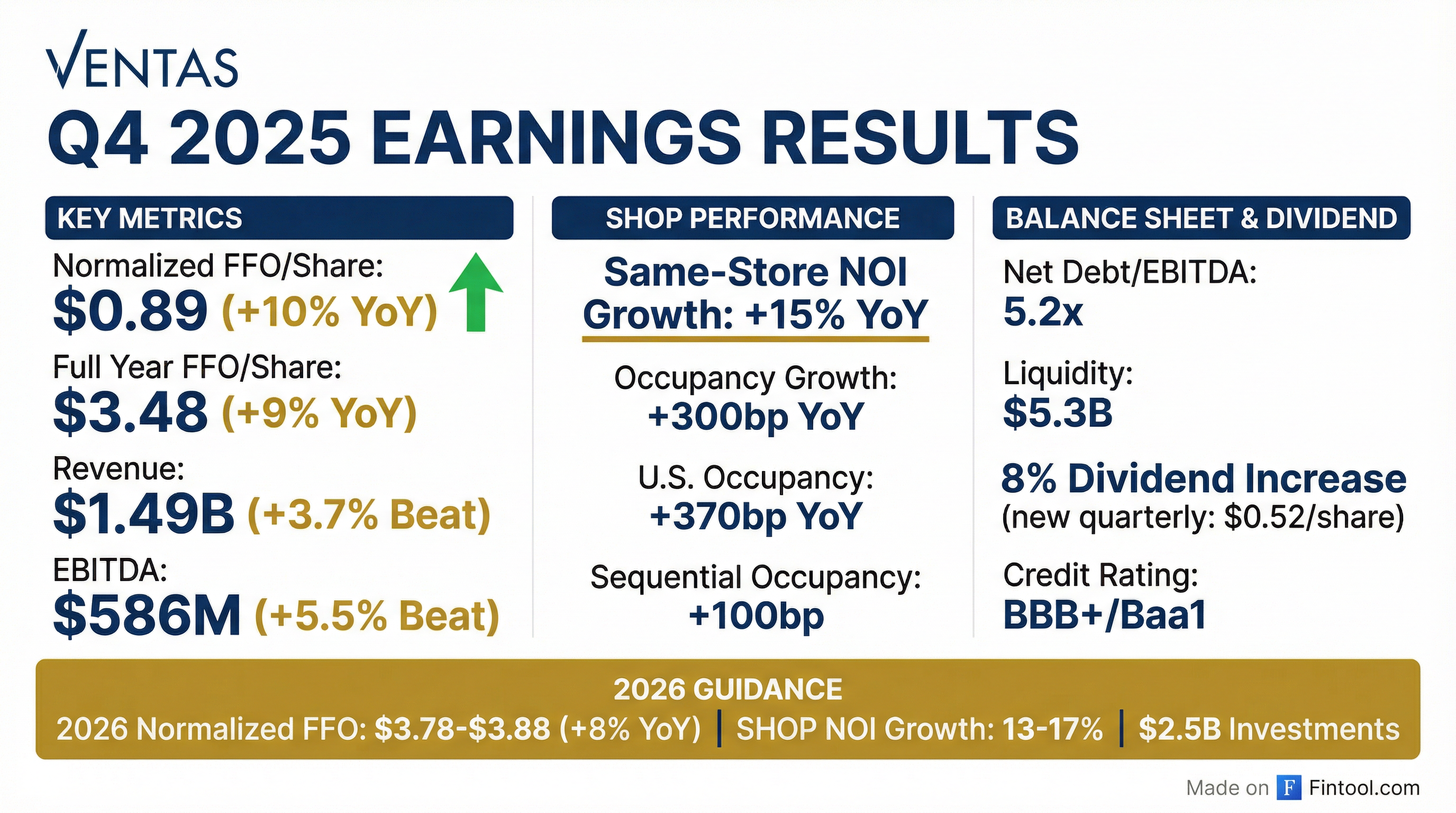

- For full-year 2025, Ventas delivered normalized FFO per share of $3.48, up 9% yoy, and total company same-store cash NOI grew nearly 10%, led by SHOP’s 15% growth.

- In Q4 2025, the SHOP portfolio achieved 15.4% NOI growth, with occupancy up 300 bps year-over-year and RevPOR up 4.7% (U.S. occupancy led at 370 bps).

- Ventas closed $2.5 billion of senior housing investments in 2025 and has already deployed $800 million in 2026 YTD, targeting $2.5 billion of senior housing acquisitions in 2026.

- 2026 guidance includes normalized FFO per share of $3.78–$3.88 (+8% yoy), total same-store cash NOI growth of nearly 10%, and SHOP NOI growth of 13%–17%.

- The board approved an 8% increase in the quarterly dividend, reflecting strong 2025 performance and confidence in the multi-year outlook.

- Delivered 10% y/y growth in Q4 normalized FFO per share and full-year normalized FFO of $3.48 per share (+9%), driven by 15% same-store SHOP NOI growth, with SHOP contributing 53% of total NOI and enterprise value exceeding $50 billion.

- Raised $7 billion of capital in 2025 (debt and equity) and closed $2.5 billion of accretive senior housing investments, owning over 83,000 SHOP units by year-end; leverage improved to 5.2× (pro forma ~5×).

- 2026 guidance calls for 8% normalized FFO per share growth to $3.83, ~10% total same-store cash NOI growth, SHOP NOI growth of 13–17% (15% midpoint), $2.5 billion of senior housing investments, and an 8% dividend increase.

- Positioned to capitalize on demographic tailwinds as the over-80 population is projected to grow 28% over five years, while senior housing starts remain at multi-decade lows, underpinning sustained demand for the SHOP platform.

- Normalized FFO per share of $0.89, up 10% YoY; 2025 normalized FFO/sh $3.48, up 9%.

- SHOP same-store cash NOI rose 15% YoY with RevPOR +4.7% and occupancy up 300 bps.

- Ended Q4 2025 at 5.2× net debt/Further Adjusted EBITDA and $5.3 B of liquidity.

- 2026 guidance: normalized FFO/sh $3.78–$3.88 (midpoint $3.83, +8% YoY) and quarterly dividend raised 8% to $0.52.

- Ventas delivered $3.48 normalized FFO per share (+9% YoY) and 15% same-store SHOP cash NOI growth in 2025

- Raised $7 billion of capital in 2025 (nearly $4 billion debt, $3.2 billion equity) with $1.2 billion unsettled equity, reducing leverage to 5.2x by year-end

- Issued 2026 guidance: normalized FFO of $3.78–$3.88 per share (+8% YoY, $3.83 midpoint), total same-store cash NOI growth ~10% (SHOP +15%), $2.5 billion senior housing investments, and an 8% dividend increase

- Strategic senior housing focus: SHOP now 53% of NOI with >83 k units, closed $2.5 billion of SHOP acquisitions in 2025 and >$800 million YTD 2026, leveraging proprietary OI platform to sustain double-digit growth

- Ventas executed a Second Amendment to its Credit and Guaranty Agreement effective January 7, 2026, increasing aggregate commitments from $500 million to $1.25 billion (via a $700 million term facility increase and a $550 million delayed-draw term loan) and granting the right to further expand facilities up to $1.75 billion.

- The amendment adds nine New Lenders, including BBVA NY Branch, Citibank, M&T Bank, Mizuho, Morgan Stanley, TD NY, UBS Stamford Branch, Banco de Sabadell and U.S. Bank, each with specified term and delayed-draw commitments.

- All terms of the existing Credit Agreement and related Loan Documents remain ratified, and Ventas Inc.’s guarantee of the Obligations continues in full force and effect.

- Ventas Realty, Limited Partnership and Ventas, Inc. will issue $500 million of 5.000% Senior Notes due 2036 under the Base Indenture dated February 23, 2018 and an Eleventh Supplemental Indenture effective December 4, 2025.

- The Notes bear interest at 5.000% per annum, payable semi-annually on February 15 and August 15, with the first payment on August 15, 2026.

- The obligations under the Notes are fully and unconditionally guaranteed by Ventas, Inc..

- Wells Fargo Securities, BBVA Securities, J.P. Morgan Securities, Mizuho Securities USA and RBC Capital Markets are acting as representatives of the underwriters for this offering.

- Ventas delivered $1.489 billion in total revenues and $68.7 million in net income for Q3 2025, up from $1.236 billion and $21.0 million in Q3 2024.

- Nareit FFO attributable to common stockholders rose 23% to $408.8 million (or $0.88 per share), compared to $331.5 million (or $0.79 per share) a year ago.

- Outpatient Medical & Research same-store cash operating revenue increased 3.2% YoY to $211.4 million, with cash NOI margin expanding to 65.4%.

- Ventas ended Q3 2025 with $4.09 billion of available liquidity and a net debt/enterprise value ratio of 28%, reflecting net debt of $12.75 billion.

- Ventas delivered $0.88 normalized FFO per share in Q3, up 10% year-over-year, driving total company same-store cash NOI growth of 8%, led by SHOP NOI growth of 16% (U.S. SHOP +19%).

- Balance sheet strengthened as net debt/EBITDA improved by 1.0× to 5.3×, supported by over $4 billion of liquidity, and the company has fully equity-funded its $2.5 billion senior housing investment plan for 2025.

- 2025 guidance was raised: full-year normalized FFO midpoint increased to $3.47 per share (9% growth), total company same-store cash NOI growth to 7.5%, and SHOP NOI midpoint to 15%; Ventas has closed $2.2 billion of senior housing acquisitions YTD and upped its investment target to $2.5 billion.

- Private-pay senior housing now represents ~50% of enterprise NOI; Ventas has completed $4.1 billion of SHOP investments since mid-2024 and finished 27 of 45 triple-net to SHOP conversions, targeting over $50 million of NOI upside.

- Ventas delivered normalized FFO per share of $0.88, up 10% year-over-year, and total company same-store cash NOI rose 8%, led by SHOP NOI growth of 16% (19% in U.S. SHOP).

- Management raised 2025 guidance, expecting 9% normalized FFO per share growth to a midpoint of $3.47, total same-store cash NOI growth of 7.5%, and SHOP NOI growth of 15%.

- Balance sheet strength improved, with net debt to EBITDA at 5.3×, $4 billion of liquidity, and $2.6 billion of equity raised to fully fund planned investments.

- Investment activities are accelerating: $2.2 billion of private-pay U.S. senior housing acquisitions year-to-date, guidance increased to $2.5 billion, and 27 of 121 triple-net communities converted to SHOP to drive further occupancy and NOI upside.

Quarterly earnings call transcripts for Ventas.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more