Earnings summaries and quarterly performance for BranchOut Food.

Executive leadership at BranchOut Food.

Board of directors at BranchOut Food.

Research analysts covering BranchOut Food.

Recent press releases and 8-K filings for BOF.

BranchOut Food Inc. Announces Record 2025 Revenue and Strategic Growth Initiatives

BOF

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

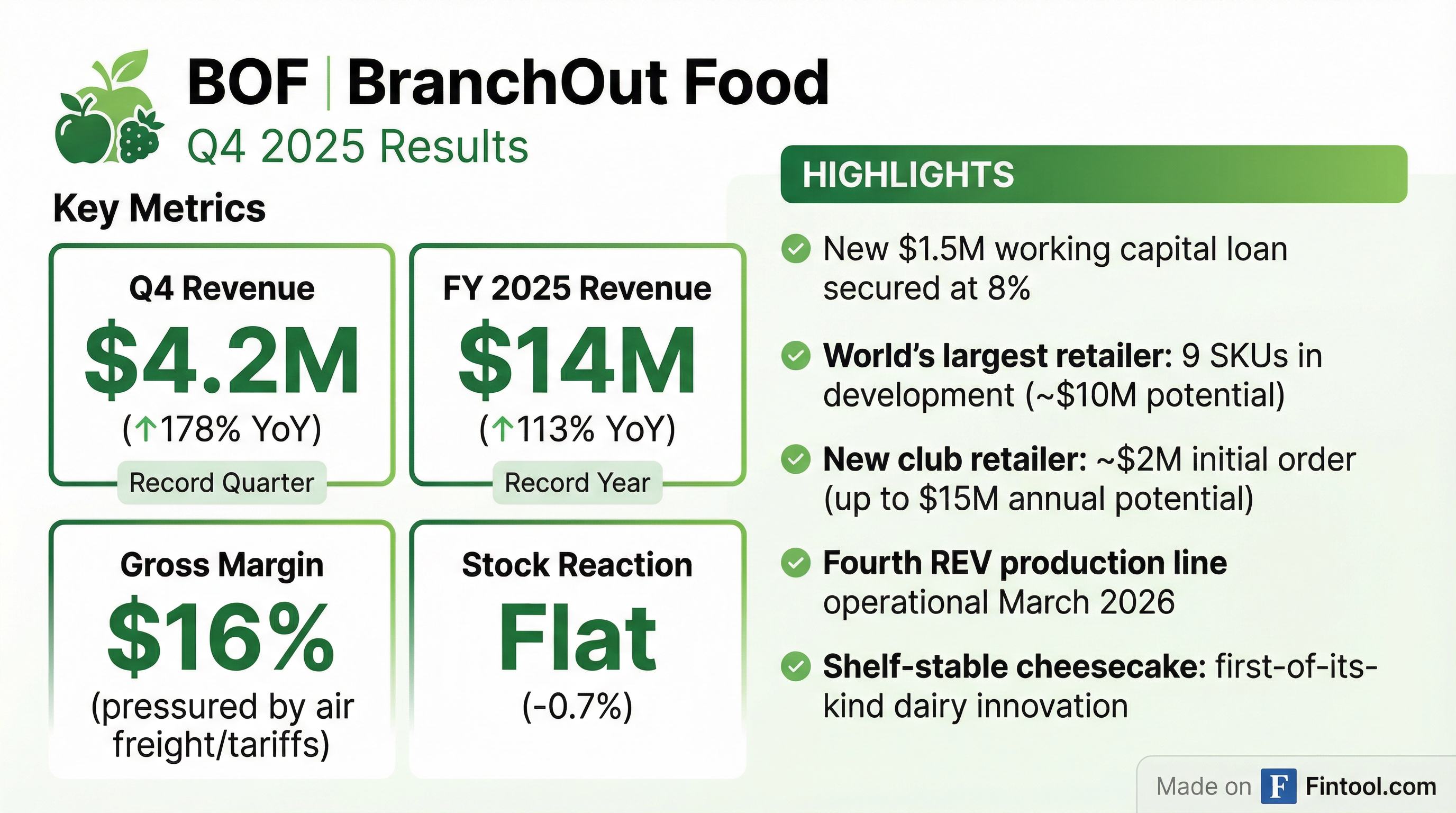

- BranchOut Food Inc. announced record net revenue of ~$14 million for 2025, representing 113% year-over-year growth, with Q4 net revenue reaching $4.2 million, an increase of over 178% year-over-year.

- The company secured a new warehouse club customer with an initial order near $2 million, with potential for up to $15 million in annual recurring revenue, and is developing up to nine new SKUs with the world's largest retailer, estimated to generate $10 million in incremental annualized revenue.

- BranchOut is installing its fourth large-scale REV drying line, scheduled to be operational by March 1, 2026, which will expand capacity and enable new dairy-based and high-protein products, including a first-of-its-kind shelf-stable dehydrated cheesecake.

- Significant gross margin expansion is anticipated for 2026, driven by expected reductions in air freight costs and tariffs, which severely impacted the 2025 gross margin of ~16%.

- To support accelerating growth, BranchOut secured a new $1.5 million senior secured promissory note and is utilizing its at-the-market (ATM) program to raise up to $1.5 million in additional working capital; Kaufman Kapital LLC also converted $500,000 of an existing convertible note into equity.

Jan 30, 2026, 9:05 PM

BranchOut Food announces $2.5 million institutional investment and record October revenue

BOF

New Projects/Investments

Revenue Acceleration/Inflection

- BranchOut Food Inc. announced the pricing of a $2.5 million institutional investment from Bard Associates, Inc., involving the sale of 1,034,600 shares of common stock at $2.50 per share.

- The company received net proceeds of approximately $2,310,000 from the offering, which closed on November 14, 2025.

- These proceeds will be used to strengthen working capital, fund growth initiatives, scale production, build inventory, and support critical capital expenditures.

- BranchOut Food achieved a record October with $1.7 million in revenue, translating to a $20 million annualized revenue run rate.

- The company plans to expand its production facility early next year with a fourth large-scale REV line and transition to an inventory-based production strategy.

Nov 14, 2025, 9:06 PM

Branch Out Foods Highlights Technology, Growth, and Retail Success at MicroCap Showcase

BOF

Revenue Acceleration/Inflection

New Projects/Investments

Guidance Update

- Branch Out Foods (BOF) utilizes a proprietary Radiant Energy Vacuum (REV) dehydration technology, licensed from EnWave, which they believe is superior to traditional freeze-drying, offering better flavor retention, texture, and lower cost.

- The company operates the world's largest REV facility in Peru, which opened in early 2025 and has a capacity of roughly 800 metric tons, with plans to add a fourth production line in early 2026 due to high demand.

- BOF projects doubling revenue every year, with an estimated $14-15 million for the current year (2025), and expects to be around breakeven currently, with new orders adding approximately 50-55% contribution margins above $15 million in sales.

- The company has strong relationships with major retailers like Costco and Walmart, with Costco sales expected to grow substantially from $7 million in the current year (2025) and individual items consistently performing at double the average sales per club per week.

- BOF has significantly reduced its debt from $6 million to $500,000 and does not currently need money for burn, but may require capital for massive growth opportunities, which would likely be debt-financed.

Oct 22, 2025, 1:00 PM

BranchOut Food Inc. Details Technology, Growth, and Financial Outlook at Conference

BOF

New Projects/Investments

Revenue Acceleration/Inflection

Product Launch

- BranchOut Food Inc. (BOF) utilizes a proprietary Radiant Energy Vacuum (REV) dehydration technology, licensed from EnWave Corporation, to produce snackable fruit and vegetable products, which they describe as "freeze-dried 2.0".

- The company operates the world's largest REV dehydration facility in Peru, which became operational in early 2025 and has a current capacity of approximately 800 metric tons. They are expanding this capacity by adding a fourth production line in early 2026.

- BranchOut Food projects $14 million to $15 million in revenue for the current year (2025) and expects to reach break-even, with incremental margins of approximately 55% on sales above $14.5 million. The company anticipates "phenomenal" growth in 2026, driven by new orders and expansion with major retailers like Costco and Walmart.

- The company's go-to-market strategy includes industrial ingredients, private label products, and its own branded line, with significant success in Costco, where sales were approximately $7 million this year. They are launching a new Kids’ Snack Packs line in 2026, aiming to disrupt a $22 million market.

Oct 22, 2025, 1:00 PM

BranchOut Food Reports Record Q3 2025 Results and Significant Balance Sheet Improvement

BOF

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- BranchOut Food Inc. reported Q3 2025 revenue of approximately $3.2 million, bringing its year-to-date revenue to $9.7 million, representing a 93% increase year over year.

- The company achieved a record production month in September 2025, producing over 38,500 kg of finished product, which translates to a $16 million annualized run rate and reaches the estimated breakeven production level.

- BranchOut Food significantly strengthened its balance sheet by reducing current notes payable from $6.39 million to approximately $0.5 million, a 92% reduction, following the completion of its At-The-Market (ATM) equity program.

- To meet anticipated 2026 demand, the company committed to purchasing an additional EnWave REV™ 120kW machine to expand production capacity and secured global exclusive rights to produce dragon fruit using EnWave’s technology.

Oct 21, 2025, 8:05 PM

BranchOut Food Inc. Enters Equipment Purchase and License Agreements

BOF

Debt Issuance

New Projects/Investments

- On September 15, 2025, BranchOut Food Inc. entered into a Fifth Amendment to License Agreement and an Equipment Purchase Agreement with EnWave Corporation.

- Pursuant to the Equipment Purchase Agreement, BranchOut Food Inc. purchased a refurbished 120kW REV vacuum microwave for $1,500,000.

- The purchase is financed by a secured promissory note with an 8% annual interest rate, payable in 24 equal monthly installments of $67,840.94 (excluding taxes), with the first installment due on April 1, 2026.

- The Fifth Amendment grants BranchOut Food Inc. a global exclusive license (subject to two existing exceptions) to manufacture Dragon Fruit products using EnWave's technology, requiring a minimum annual royalty of $25,000 starting in 2027.

Sep 19, 2025, 8:05 PM

BranchOut Food Inc. Increases ATM Offering Limit

BOF

- On February 18, 2025, BranchOut Food Inc. filed an 8-K announcing a First Amendment to its At-The-Market Issuance Sales Agreement with Alexander Capital, L.P., increasing the aggregate offering price from $3,000,000 to $5,000,000.

- The filing includes a legal opinion from Pachulski Stang Ziehl & Jones LLP confirming the validity of the share issuance, with related exhibits incorporated into the report.

Feb 18, 2025, 12:00 AM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more