Boot Barn Holdings (BOOT)·Q3 2026 Earnings Summary

Boot Barn Beats Raised Guidance as Holiday Sales Surge 16%, Stock Jumps 3% Aftermarket

February 4, 2026 · by Fintool AI Agent

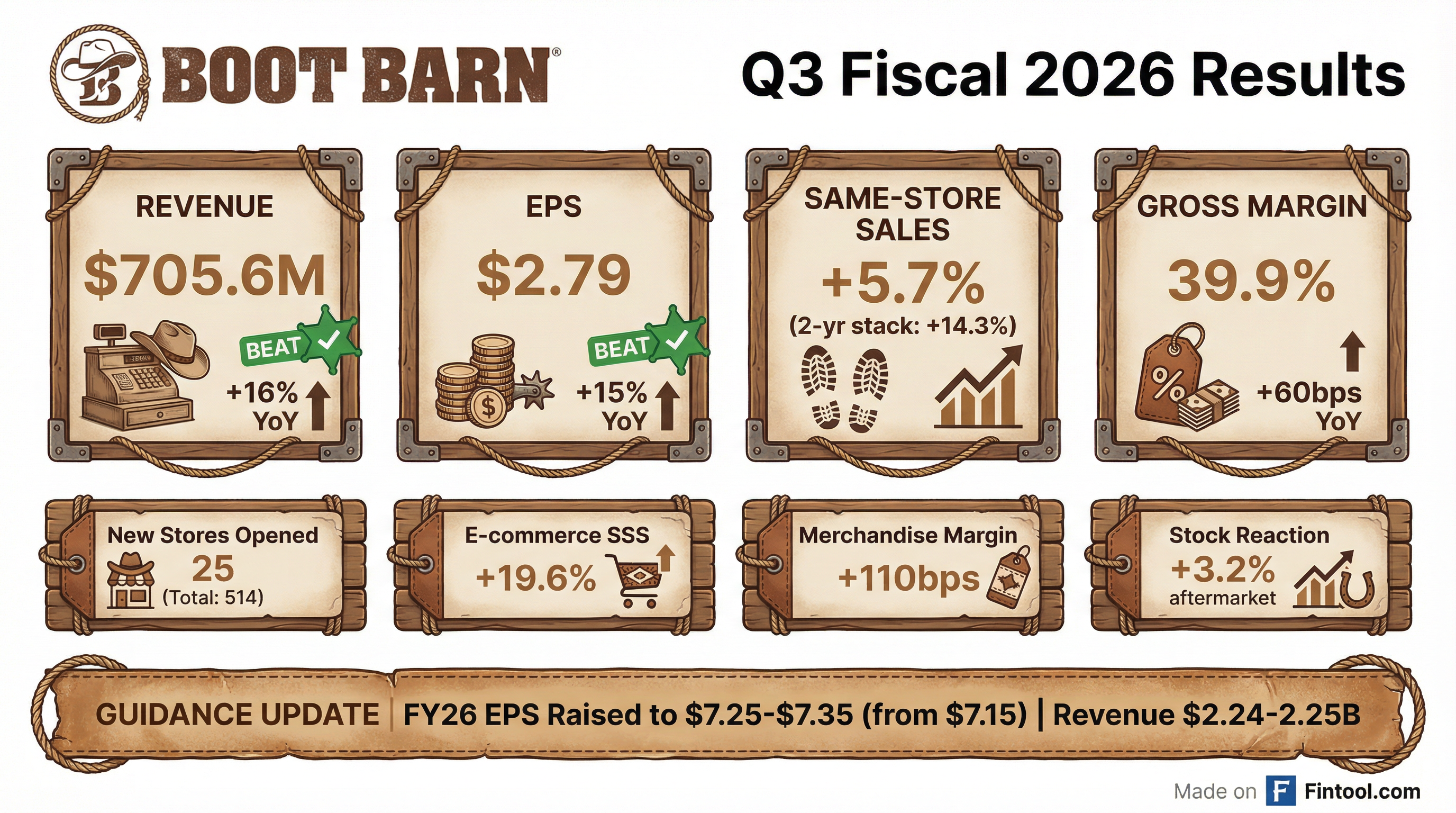

Boot Barn delivered another strong holiday quarter, reporting Q3 FY2026 EPS of $2.79 and revenue of $705.6 million—both exceeding the company's raised preliminary guidance and marking a 16% revenue increase year-over-year. The stock rose approximately 3.2% in aftermarket trading to $189, reflecting investor confidence in the company's continued execution.

CEO John Hazen highlighted the broad-based strength across the business: "Sales increased 16% year over year, reflecting broad-based demand across merchandise categories, channels, and geographies. Merchandise margin expanded by 110 basis points, and combined with solid expense control, drove strong earnings per diluted share of $2.79."

Did Boot Barn Beat Earnings?

The headline numbers tell a compelling story of execution:

Note: The prior-year Q3 FY25 included a $6.7M benefit ($0.22/share) related to the former CEO's resignation, making the underlying beat even more impressive—adjusted year-over-year EPS growth was approximately 26%.

Boot Barn pre-announced preliminary results on January 9, so today's release confirmed rather than surprised. However, the key takeaway is that the company exceeded its own raised expectations, demonstrating conservative guidance practices that investors appreciate.

What Drove the Strong Quarter?

Same-Store Sales Momentum Continues

Same-store sales grew 5.7% on top of 8.6% growth in the prior-year quarter, producing an impressive two-year stacked growth of 14.3%.

E-commerce continues to outpace stores meaningfully, now representing 12.8% of Q3 sales —a channel where Boot Barn maintains full-price discipline and avoids the promotional intensity common in online retail.

Margin Expansion Story Intact

Merchandise margin expanded 110 basis points year-over-year, driven by three key factors:

- Buying economies of scale — Volume leverage with suppliers

- Supply chain efficiencies — Continued distribution optimization

- Exclusive brand penetration — Now 41.5% of sales vs. 39.1% a year ago

Gross profit margin expanded 60 basis points to 39.9%, despite 50 basis points of occupancy deleverage from new store openings. This demonstrates the power of the exclusive brands strategy—these private-label offerings carry approximately 1,000 basis points higher margins than third-party brands.

What Did Management Guide?

Boot Barn raised full-year guidance meaningfully:

FY2026 Full Year (Updated)

Q4 FY2026 Guidance

Management noted that preliminary Q4 results through the first five weeks show consolidated SSS of +5.7%, but this includes an estimated $5 million negative impact from winter storms. Prior to the storms (first 26 days), SSS was running at +9.1%.

How Did the Stock React?

Boot Barn shares showed a mixed reaction pattern:

The aftermarket pop suggests the market views the results favorably, particularly the raised guidance and continued SSS momentum. BOOT has gained 66% over the past year, outperforming the broader retail sector significantly.

What Changed From Last Quarter?

Key deltas from the Q2 FY26 report (October 2025):

The SSS moderation from Q2's +8.4% to Q3's +5.7% was anticipated given the tougher prior-year comparison (+8.6% in Q3 FY25 vs. +4.9% in Q2 FY25). The two-year stacked growth actually accelerated slightly.

Store Expansion Continues at Pace

Boot Barn opened 25 new stores in Q3, bringing the total to 514 stores across 49 states. The company has opened 76 stores in the trailing twelve months and expects to reach 529 stores by fiscal year-end.

The new store economics remain compelling:

Management has identified a long-term U.S. store count potential of 1,200 stores—more than double the current footprint—providing a substantial runway for growth.

Capital Allocation & Balance Sheet

Boot Barn's balance sheet remains healthy with significant optionality:

The company repurchased 67,279 shares ($12.5M) in Q3 and 218,032 shares ($37.5M) year-to-date under its $200M authorization.

Q&A Highlights

On the January SSS Acceleration

Analyst Matthew Boss (J.P. Morgan) asked about the 9.1% comp seen in the first 26 days before winter storms. CEO John Hazen noted: "It was broad-based across most major merchandise categories. The one category worth calling out was the work business. The work apparel business was a little softer, given some of the warmer weather we saw in January."

The acceleration was primarily transaction-driven, with balanced performance across exclusive and third-party brands.

On Exclusive Brand Websites

Boot Barn launched standalone websites for Cody James (codyjames.com) and Hawx (hawxwork.com), with plans to launch Shyanne, Cleo & Wolf, and Rank 45 sites.

Key insights from CEO Hazen: "What has been a nice side effect is the amount of sales that we've seen on those sites... The bigger surprise was most of those customers are net new to Boot Barn. This isn't a transference that's happening from Sheplers.com or bootbarn.com or the stores."

The sites are built on Shopify with minimal CapEx investment, using social media marketing (Meta, TikTok) to drive brand awareness—a different strategy than Boot Barn's Google-focused search intent marketing.

On Pricing Strategy & Tariff Mitigation

Management outlined a style-by-style approach to exclusive brand price increases, with roughly a third split across:

- No price increase needed (factory concessions obtained)

- Price increases at factory level for new inbound product

- Re-tagging existing inventory in DCs and stores

CEO Hazen emphasized protecting psychological price points: "If we've got to take a low single-digit price increase on a boot that's gonna break it through $200, and it's sitting at $195 or something along those lines right now, I would rather hold on that."

The latest India tariff reduction to 18% was cited as a positive, with management expressing they are in "a pretty good place" with factory partners heading into next year.

On Store Maturation Timeline

CFO Jim Watkins provided detail on new store ramp: stores open at approximately 75% of mature store productivity (~$3.2M vs ~$4.2M) and take 5-6 years to reach chain average.

The path to maturity: Year 1 comps roughly in line with chain average, Year 2 comps ~5 points better than chain, subsequent years ~3-5 points better, creating approximately 100 basis points of tailwind to consolidated comps.

On Long-Term Algorithm

The 20% EPS growth algorithm remains intact, though management noted the shift to 12-15% unit growth (from original 10%) brings it closer to 18% EPS growth due to more new stores needing to comp up.

On Market Share Gains

Asked about where Boot Barn is taking share, CEO Hazen pointed to execution: "When I think of the execution from the depth of inventory, the availability from a sizing standpoint, the field team and the customer service that we offer, I think those are the pieces that make a difference versus everybody else."

He specifically called out denim as a category where Boot Barn is winning against department stores: "When you think of us becoming a bit more of a denim destination, I think we're taking market share from traditional department stores, where perhaps people bought their Wrangler or their Levi's or their bootcut jean at those stores."

Risks and Concerns

Management's forward-looking statements flagged several risk factors:

- Tariff exposure — Import tariffs and trade restrictions could impact product costs (though India tariff reduction to 18% is a positive)

- Consumer spending sensitivity — Discretionary retail remains tied to economic conditions

- Weather volatility — Winter storms already impacted $5M of Q4 sales

- Execution risk — Continued store expansion requires disciplined capital allocation

- Q4 margin pressure — Shrink (~40 bps headwind) and freight (~40 bps headwind) expected to pressure merchandise margin, partially offsetting 20 bps of product margin growth

Management noted the Q4 merchandise margin guidance of -60 bps is primarily a comparison issue, lapping 210 bps of expansion last year when shrink and freight were "abnormally favorable."

The Bottom Line

Boot Barn continues executing its playbook with precision. The Q3 results demonstrate:

- Consistent SSS growth even against tough comparisons

- Margin expansion driven by exclusive brands and scale

- Aggressive but disciplined store expansion with strong unit economics

- Conservative guidance that the company consistently beats

At $189 aftermarket ($5.8B market cap), BOOT trades at approximately 26x the new FY26 EPS midpoint of $7.30. For a retailer delivering 17% revenue growth, 25% EPS growth (adjusted), and a visible path to doubling its store base, the valuation appears reasonable relative to growth.