Earnings summaries and quarterly performance for Boot Barn Holdings.

Executive leadership at Boot Barn Holdings.

Board of directors at Boot Barn Holdings.

Research analysts who have asked questions during Boot Barn Holdings earnings calls.

Jeremy Hamblin

Craig-Hallum Capital Group LLC

6 questions for BOOT

Jonathan Komp

Robert W. Baird & Co.

6 questions for BOOT

Steven Zaccone

Citigroup

6 questions for BOOT

Ashley Owens

KeyBanc Capital Markets

5 questions for BOOT

Janine Stichter

BTIG

5 questions for BOOT

Jay Sole

UBS

5 questions for BOOT

Matthew Boss

JPMorgan Chase & Co.

5 questions for BOOT

Peter Keith

Piper Sandler & Co.

4 questions for BOOT

Corey Tarlowe

Jefferies

3 questions for BOOT

Dylan Carden

William Blair & Company

3 questions for BOOT

Maksim Rakhlenko

Cowen and Company

3 questions for BOOT

Max Rakhlenko

TD Cowen

3 questions for BOOT

Alexia Morgan

Piper Sandler

2 questions for BOOT

Chris Nardone

Bank of America Corporation

2 questions for BOOT

Christopher Nardone

Bank of America

2 questions for BOOT

Jeff Lick

Stephens Inc.

2 questions for BOOT

John Keyport

The Goldman Sachs Group, Inc.

2 questions for BOOT

Samuel Poser

Williams Trading, LLC

2 questions for BOOT

Amanda Douglas

JPMorgan Chase & Co.

1 question for BOOT

Ethan Saghi

BTIG

1 question for BOOT

Mitchel Kummetz

Seaport Research Partners

1 question for BOOT

Sam Poser

Williams Trading LLC

1 question for BOOT

Recent press releases and 8-K filings for BOOT.

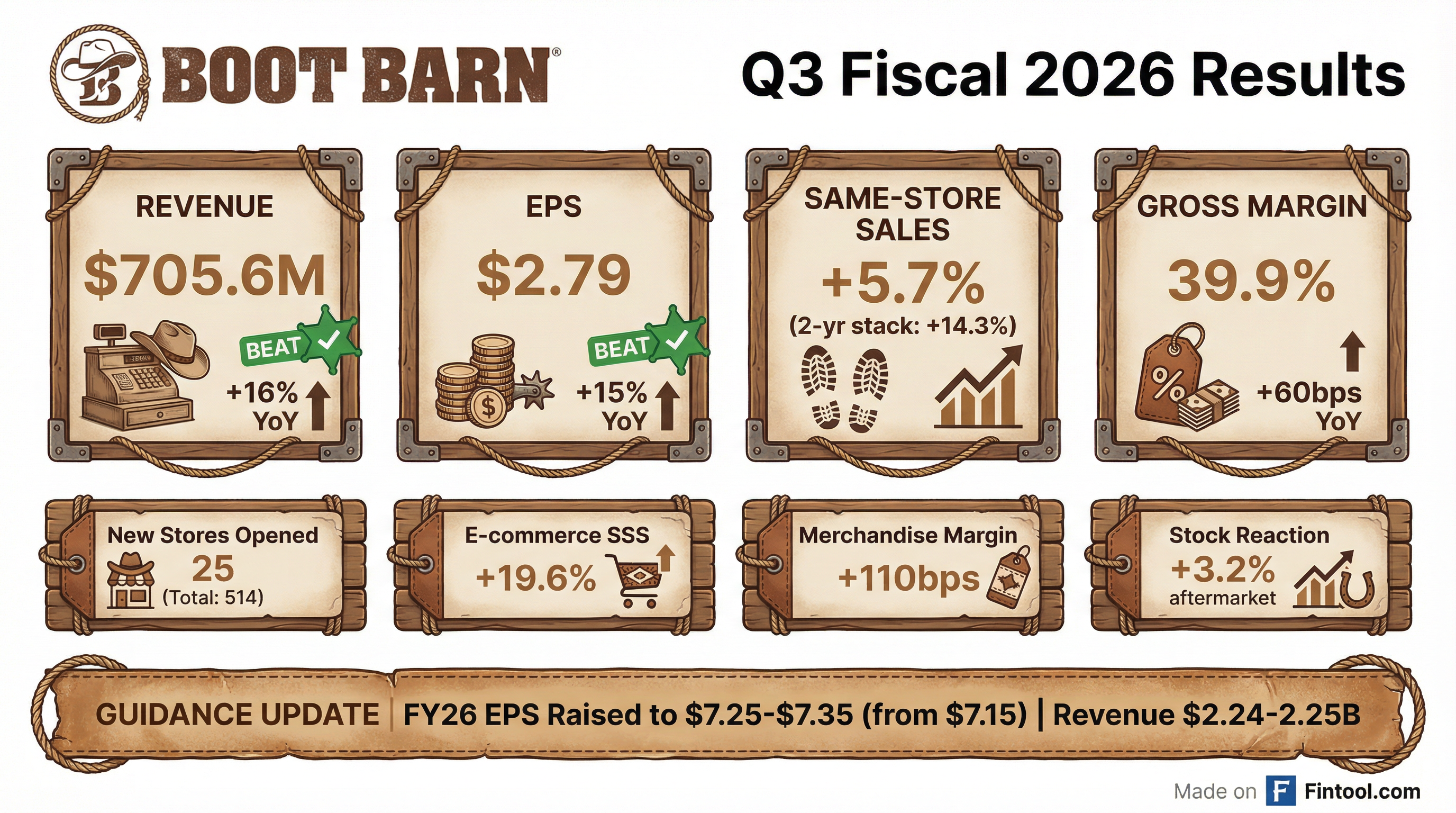

- Boot Barn Holdings Inc. reported strong Q3 2026 results, with revenue increasing 16% to $706 million and earnings per diluted share reaching $2.79. Consolidated same-store sales grew 5.7%, driven by a 3.7% increase in retail store sales and a 19.6% increase in e-commerce sales.

- The company raised its full fiscal year 2026 guidance, now expecting total sales of $2.25 billion (18% growth over fiscal 2025) and earnings per diluted share of $7.35. This implies a 25% EPS growth and 90 basis points of EBIT margin expansion for the year.

- Boot Barn continues its new store expansion, opening a record 25 stores in Q3 to reach 514 stores, with plans for 15 more in Q4 for a total of 70 new stores in fiscal 2026. New stores are performing well, generating approximately $3.2 million in annual sales in their first year and achieving payback in less than two years.

- Merchandise margin rate increased 110 basis points in Q3, primarily due to buying economies of scale, supply chain efficiencies, and 240 basis points of growth in exclusive brand penetration. However, Q4 guidance anticipates a 60 basis point decrease in merchandise margin year-over-year, mainly due to higher shrink and freight expenses compared to an unusually favorable prior year period.

- The company is actively developing its omnichannel strategy by launching dedicated websites for exclusive brands like Cody James and Hawx, which are attracting net new customers and contributing to online sales growth.

- Boot Barn reported strong Q3 fiscal 2026 results, with revenue increasing 16% to $706 million, consolidated same-store sales growth of 5.7%, and earnings per diluted share of $2.79.

- The company provided a Q4 2026 outlook, expecting total sales at the high end of $535 million and a consolidated same-store sales increase of 5%, despite an estimated $5 million negative impact from winter storms quarter-to-date. Merchandise margin is projected to be 50.5% of sales, a 60 basis point decrease from the prior year, primarily due to tough comparisons and an expected 40 basis point headwind from shrink.

- Boot Barn continues its new store expansion, opening 25 stores in Q3, bringing the total to 514 stores, with plans for 15 more in Q4 and an estimated 20 in Q1 fiscal 2027. Online comp sales grew 19.6% in Q3, supported by new exclusive brand websites that are attracting new customers.

- The company repurchased approximately 67,000 shares for $12.5 million during Q3 as part of its $200 million share repurchase program and ended the quarter with $200 million in cash and no draws on its revolving credit line.

- Boot Barn Holdings Inc. reported strong Q3 fiscal 2026 results, with revenue increasing 16% to $706 million and consolidated same-store sales growing 5.7%. Earnings per diluted share were $2.79, and merchandise margin rate increased 110 basis points compared to the prior year.

- The company raised its full year fiscal 2026 guidance, now expecting total sales of $2.25 billion (representing 18% growth over fiscal 2025), a 7% increase in same-store sales, and earnings per diluted share of $7.35.

- For Q4 fiscal 2026, Boot Barn anticipates total sales of $535 million, a 5% increase in consolidated same-store sales, and earnings per diluted share of $1.45.

- Strategic growth continued with 25 new stores opened in Q3, bringing the total to 514 stores, and plans for 15 more in Q4 to reach 70 new stores for the fiscal year. Online sales also saw significant growth, with e-commerce same-store sales increasing 19.6% in Q3.

- The company repurchased approximately 67,000 shares of common stock for $12.5 million during Q3 as part of its authorized $200 million share repurchase program.

- Boot Barn Holdings, Inc. reported third quarter fiscal year 2026 net sales of $705.6 million, an increase of 16.0% over the prior year, with diluted earnings per share of $2.79 for the quarter ended December 27, 2025.

- Consolidated same store sales increased 5.7% for the quarter, driven by a 19.6% increase in e-commerce same store sales and a 3.7% increase in retail store same store sales.

- The company updated its fiscal year 2026 guidance, projecting total sales between $2.24 billion and $2.25 billion and net income per diluted share of $7.25 to $7.35.

- Boot Barn opened 25 new stores during the quarter, bringing its total store count to 514, and repurchased $37.5 million of common stock during the thirty-nine weeks ended December 27, 2025.

- Boot Barn Holdings, Inc. reported strong third quarter fiscal year 2026 financial results, with net sales increasing 16.0% to $705.6 million and diluted earnings per share reaching $2.79 for the quarter ended December 27, 2025.

- Consolidated same store sales grew 5.7% in Q3 2026, driven by a 19.6% increase in e-commerce same store sales and a 3.7% increase in retail store same store sales.

- The company updated its fiscal year 2026 guidance, now expecting total sales of $2.24 billion to $2.25 billion and net income per diluted share of $7.25 to $7.35 for the fiscal year ending March 28, 2026.

- During the third quarter ended December 27, 2025, Boot Barn repurchased 67,279 shares of its common stock for $12.5 million, contributing to a total of 218,032 shares repurchased for $37.5 million for the thirty-nine weeks ended December 27, 2025.

- The company opened 25 new stores in Q3 2026, bringing its total store count to 514 as of December 27, 2025, and plans to open 70 new stores for the full fiscal year 2026.

- Boot Barn achieved a 110 basis point year-over-year improvement in merchandise margin, exceeding guidance, attributed to better buying economies of scale, lower markdowns, and reduced freight rates. The company expects continued merchandise margin growth.

- The Total Addressable Market (TAM) has been expanded from $40 billion to $58 billion by incorporating the "Country Lifestyle" customer and denim. This expansion supports an increased store growth target to 1,200 stores from approximately 500, with a projected 12%-15% annual growth rate for the foreseeable future.

- Under the new CEO, strategic initiatives include building a dedicated sourcing team for exclusive brands, marketing these brands as standalone entities, and reinvigorating the work boot business, which saw mid-single-digit comparable store sales growth. Digital marketing efforts involve using TikTok lives to promote stores and engaging "everyday creators" for authentic content.

- The company is targeting a mid-teens EBIT margin within three or four years, building on the current fiscal year's high-end guide of 13.4%, driven by continued merchandise margin growth and SG&A leverage.

- Boot Barn achieved 110 basis points of merchandise margin expansion for the quarter, significantly exceeding guidance, driven by better buying, lower markdowns, and reduced freight rates.

- The company has increased its Total Addressable Market (TAM) from $40 billion to $58 billion and raised its long-term store growth target from 900 to 1,200 stores, with an expected 12%-15% store growth rate for the foreseeable future.

- CEO John Hazen, appointed in May 2025, is driving strategic initiatives including building a sourcing team for exclusive brands, enhanced marketing for these brands, and reinvigorating the work business, which saw mid-single-digit comp growth.

- Boot Barn is targeting a mid-teens EBIT margin within three to four years, up from the current FY 2026 high-end guide of 13.4%, supported by continued merchandise margin growth and SG&A leverage.

- Following the holiday season, the company is implementing low single-digit price increases on exclusive brands in January to preserve margin rates, after holding prices while third-party brands raised theirs due to tariffs.

- Boot Barn achieved a 110 basis points merchandise margin expansion in the quarter, exceeding guidance, driven by better buying, volume discounts, lower markdowns, and reduced freight rates, contributing to a 700 basis points expansion over the last seven years.

- The company is targeting a mid-teens EBIT margin within three to four years, up from the current fiscal year's high-end guide of 13.4%, supported by continued merchandise margin growth and SG&A leverage.

- Boot Barn has increased its store growth target from 900 to 1,200 stores and expects to maintain a 12%-15% store growth rate for the foreseeable future, expanding into both legacy and new, denser urban markets.

- The Total Addressable Market (TAM) has been expanded from $40 billion to $58 billion, incorporating the "Country Lifestyle" customer segment and denim, supported by new marketing initiatives.

- CEO John Hazen, who became full-time in May 2025, is focusing on building an internal sourcing team for exclusive brands, marketing these brands as standalone entities, and reinvigorating the work boot business, which saw a mid-single-digit comparable sales increase.

- Boot Barn Holdings, Inc. announced preliminary third quarter fiscal year 2026 results, expecting net sales of approximately $705.6 million, representing 16.0% growth over the prior year, and same store sales growth of approximately 5.7% for the quarter ended December 27, 2025.

- The company anticipates net income per diluted share of approximately $2.79 and income from operations of approximately $114.8 million for the quarter.

- Boot Barn opened 25 new stores during the quarter, bringing its total store count to 514, and will participate in the 2026 ICR Conference on January 12, 2026.

- Boot Barn Holdings, Inc. announced preliminary net sales of approximately $705.6 million for the third quarter of fiscal year 2026 ended December 27, 2025, representing 16.0% growth over the prior year.

- The company expects to report consolidated same store sales growth of approximately 5.7% for Q3 FY26, with retail store same store sales growth of approximately 3.7% and e-commerce same store sales growth of approximately 19.6%.

- Preliminary net income per diluted share is expected to be approximately $2.79 for Q3 FY26, compared to $2.43 in the prior-year period, which included a $0.22 per share benefit related to a former CEO's resignation.

- During the third quarter, Boot Barn opened 25 new stores, bringing its total store count to 514.

- Merchandise margin for Q3 FY26 increased 110 basis points compared to the prior-year period, primarily due to buying economies of scale, supply chain efficiencies, and growth in exclusive brand penetration.

Quarterly earnings call transcripts for Boot Barn Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more