Earnings summaries and quarterly performance for Carter Bankshares.

Executive leadership at Carter Bankshares.

Litz H. Van Dyke

Detailed

Chief Executive Officer

CEO

BL

Bradford Langs

Detailed

President and Chief Strategy Officer

JA

Jane Ann Davis

Detailed

Chief Administrative Officer

LA

Loran Adams

Detailed

Director of Regulatory Risk Management

MS

Matthew Speare

Detailed

Chief Operations Officer

TK

Tony Kallsen

Detailed

Chief Credit Officer

WB

Wendy Bell

Detailed

Chief Financial Officer

Board of directors at Carter Bankshares.

CL

Catharine L. Midkiff

Detailed

Director

CE

Curtis E. Stephens

Detailed

Director

EL

Elizabeth L. Walsh

Detailed

Director

GW

Gregory W. Feldmann

Detailed

Lead Independent Director

JA

Jacob A. Lutz, III

Detailed

Director

JW

James W. Haskins

Detailed

Chairman of the Board

KS

Kevin S. Bloomfield

Detailed

Director

MR

Michael R. Bird

Detailed

Director

PQ

Phyllis Q. Karavatakis

Detailed

Vice Chairman of the Board

RM

Robert M. Bolton

Detailed

Director

Research analysts covering Carter Bankshares.

Recent press releases and 8-K filings for CARE.

Carter Bankshares, Inc. Reports Q4 and Full Year 2025 Financial Results

CARE

Earnings

Share Buyback

New Projects/Investments

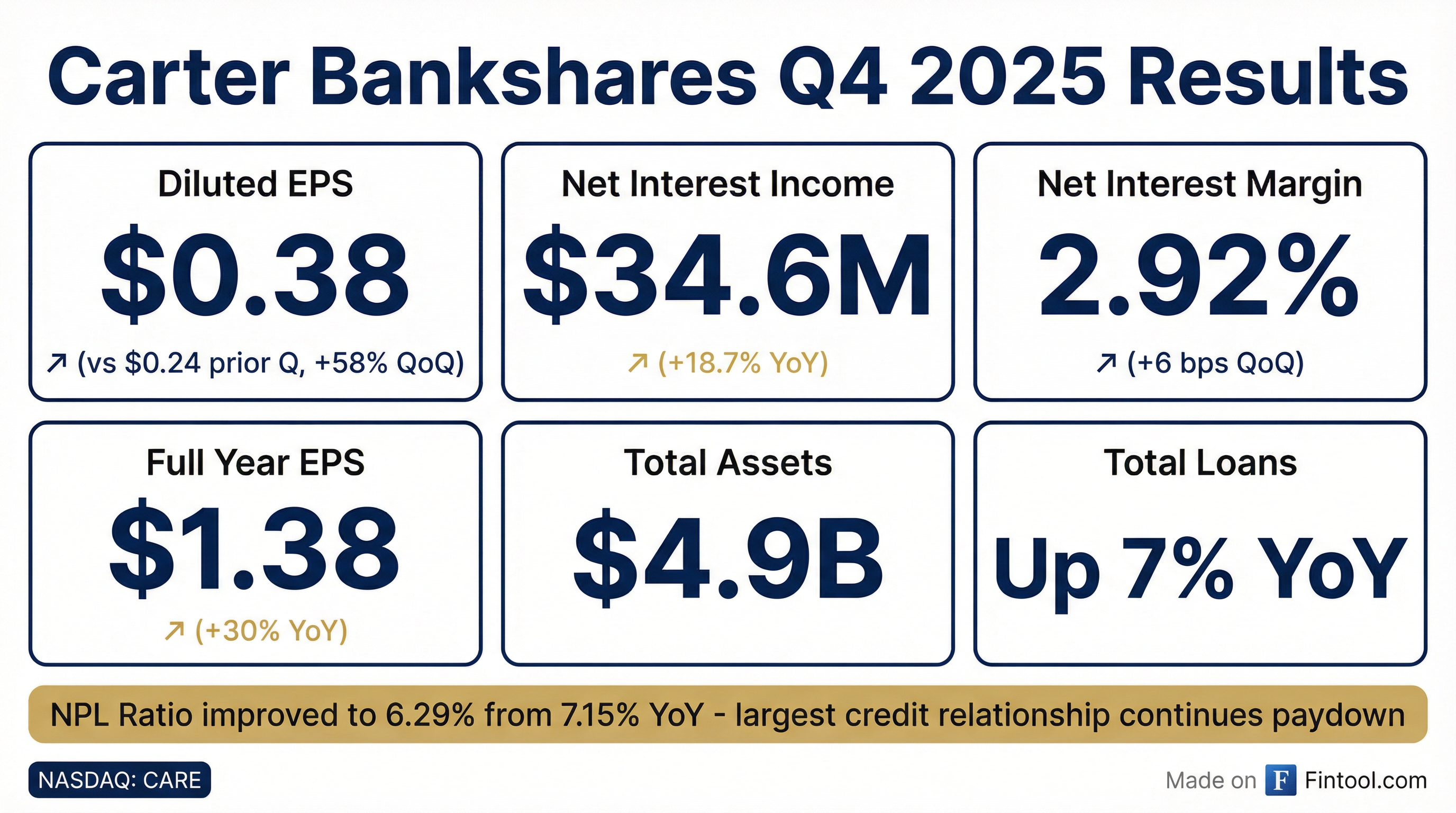

- Carter Bankshares, Inc. reported net income of $31.362 million and diluted earnings per share of $1.38 for the year ended December 31, 2025, representing year-over-year increases of $6.839 million and $0.32, respectively.

- As of December 31, 2025, total assets grew to $4.851 billion, with total portfolio loans increasing 7.0% year-over-year to $3.879 billion, and deposits reaching $4.210 billion.

- The company maintained a strong capital position with a Common Equity Tier 1 Ratio (CET1) of 10.70% and $1.2 billion in total available liquidity as of December 31, 2025.

- Asset quality metrics as of December 31, 2025, included a delinquency to portfolio loans ratio of 0.08% and a nonperforming loans to portfolio loans ratio of 6.29%, with the latter significantly impacted by a $214.0 million commercial loan relationship.

- Under its 2025 program, the company repurchased 1,124,690 shares of common stock for a total cost of $20.0 million at an average cost of $17.78 per share.

8 days ago

Carter Bankshares, Inc. Announces Fourth Quarter and Full Year 2025 Financial Results

CARE

Earnings

Share Buyback

- Carter Bankshares, Inc. reported net income of $8.5 million and diluted earnings per share (EPS) of $0.38 for the fourth quarter of 2025, and net income of $31.4 million and diluted EPS of $1.38 for the full year ended December 31, 2025.

- Net interest income increased to $34.6 million in the fourth quarter of 2025, up from $33.7 million in the prior quarter, and totaled $130.8 million for the full year 2025.

- Total portfolio loans increased by $43.9 million (4.5% on an annualized basis) to $3.9 billion at December 31, 2025, reflecting 7.0% annual loan growth from December 31, 2024.

- Nonperforming loans (NPLs) decreased by $14.7 million to $244.0 million at December 31, 2025, with the NPLs to total portfolio loans ratio improving to 6.29%.

- The company repurchased 315,089 shares of its common stock for $6.0 million during the fourth quarter of 2025, and a total of 1,124,690 shares for $20.0 million for the full year 2025.

Jan 29, 2026, 1:16 PM

Carter Bank Joins Federal Reserve Bank of Richmond as State Member Bank

CARE

New Projects/Investments

- Carter Bank, the banking subsidiary of Carter Bankshares, Inc. (Nasdaq: CARE), has received approval to become a state member bank of the Federal Reserve Bank of Richmond.

- This transition means Carter Bank will now be regulated by the Board of Governors of the Federal Reserve System through the Federal Reserve Bank of Richmond, in addition to continued regulation by the Bureau of Financial Institutions of the Virginia State Corporation Commission.

- CEO Litz Van Dyke stated that this decision is a significant step toward future strategic objectives, aiming to streamline regulatory structure and enhance operational efficiency.

- The Company also recently converted to a financial holding company, which provides greater flexibility to innovate and grow.

Nov 13, 2025, 2:00 PM

Carter Bankshares, Inc. Reports Q3 2025 Financial Results

CARE

Earnings

Share Buyback

- Carter Bankshares, Inc. reported Net Income of $5,419 thousand and Diluted Earnings Per Share of $0.24 for Q3 2025.

- As of September 30, 2025, the company's total assets reached $4,840,119 thousand, with total portfolio loans increasing by $239.8 million year-over-year to $3,835,653 thousand.

- The company maintained a strong capital position with a Common Equity Tier 1 Ratio of 10.66% and reported $1.2 billion in total liquidity sources as of September 30, 2025.

- The Nonperforming Loans to Portfolio Loans ratio was 6.74% as of September 30, 2025, which significantly reduces to 0.78% when excluding the largest nonperforming loan relationship.

- The company repurchased 809,601 shares of common stock for $14.0 million under its 2025 program as of September 30, 2025.

Nov 4, 2025, 7:35 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more