Central Bancompany (CBC)·Q4 2025 Earnings Summary

Central Bancompany Posts Record Quarter as IPO Proceeds Supercharge Capital

January 27, 2026 · by Fintool AI Agent

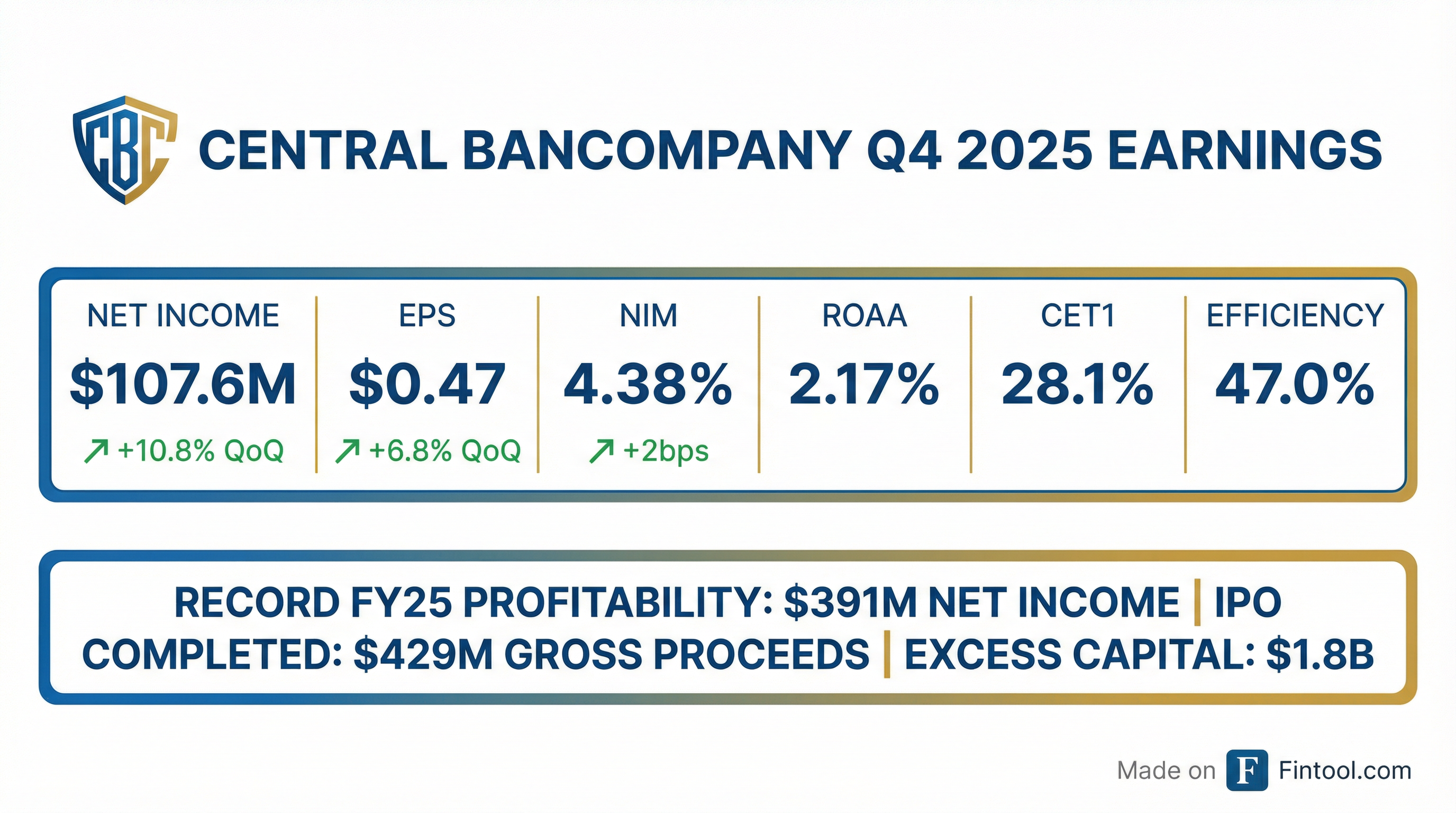

Central Bancompany (NASDAQ: CBC) delivered record quarterly profitability in its inaugural earnings call as a public company, posting net income of $107.6 million ($0.47 per share) as net interest margin expansion and disciplined expense management drove a 10.8% sequential earnings increase. The $20.8 billion Missouri-based super-community bank completed a successful IPO in November 2025, raising $429 million in gross proceeds that pushed its CET1 ratio to 28.1%—more than double peer levels—and now has $1.8 billion of excess capital ($7.50 per share) ready for deployment.

How Did Central Bancompany Perform in Q4 2025?

Source: Company filings

The quarter demonstrated broad-based strength across key banking metrics:

- Net interest income rose $7.6M (+3.8% QoQ) driven by higher earning assets from IPO proceeds and continued NIM expansion

- Noninterest income increased $1.8M (+2.8% adjusted) led by wealth management fees as AUA grew to $16.0 billion

- Efficiency ratio improved to 47.0% from 47.7%, reflecting operating leverage

How Did Net Interest Margin Perform?

NIM continues to be CBC's standout metric. At 4.38% (4.41% FTE), the company significantly outperforms the regional bank average.

Source: Company filings

Key drivers of NIM performance:

- Loan yields held steady at 6.27% despite 75bps of Fed rate cuts in 2H 2025, reflecting strong pricing discipline and a well-structured loan book

- Deposit costs declined 5bps to 1.14% as the company benefited from 36% noninterest-bearing deposits

- Securities reinvestment into higher-yielding assets lifted the portfolio yield 10bps to 4.19%

Management noted the balance sheet remains asset-sensitive, with an estimated 8-18% NII benefit from a 100bp rate increase over 2 years.

What Happened with the IPO?

Central Bancompany completed its IPO in November 2025, raising $429 million in gross proceeds. This transformed the capital position:

Source: Company filings

With CET1 at 28.1% versus a 13.5% long-term target, CBC has significant flexibility for capital deployment through M&A, organic growth, or shareholder returns.

What Did Management Say?

CEO JR Ross struck an optimistic tone on the inaugural earnings call, thanking the team for delivering 28,000+ hours of community service and improving the net promoter score 2 points to 73 consolidated.

On capital deployment and M&A:

"We outlined a list of about 30 names on that list that we think meet our criteria, and we are in a process and have been for a few years now of making introductions and having good conversations with at least half of the folks on that list... We have a currency now which makes those conversations a lot more interesting."

CFO Jim Siroli on NIM resilience:

"When you look at the loan yield, it came down like a bit, so amazingly stable in light of the 75 basis points of rate cuts that we had at the end of the year... that kind of underscores what we continue to say in terms of our sensitivity to the front end of the curve is relatively neutral."

Q&A Highlights

M&A Strategy

Management provided significant detail on acquisition plans during the Q&A:

- Track record: 47 acquisitions over the past 50 years

- Target criteria: Deals of size (~$2B+ in assets), high-quality deposit and credit franchises, compatible cultures

- Pipeline: 30 names identified, in active conversations with at least half

- Geographic expansion: Looking to grow in existing markets and potentially expand into Texas

- Timeline: "We're much more focused on doing the right deal than doing a timely deal"

Branch Expansion Plans

Dan Westhues outlined 2026 branch openings:

- St. Louis: First branch online "in the next couple of months," with at least 2 more planned for 2026, plus additional locations being negotiated

- Denver, Colorado: One branch expected online by Q2 2026

Loan Growth and Pricing

- Spreads: Consistent ~300bps over comparable treasuries across both variable and fixed-rate products (typically 2-5 year tenor)

- No spread compression: Management emphasized pricing discipline in their markets

- Growth outlook: Excluding installment loan runoff, annualized Q4 growth was "mid and maybe even a bit over mid-single digits"

- Credit discipline: "We don't really change our credit underwriting standards through the cycle. We try to be as consistent as possible."

Net Interest Income Outlook

CFO Siroli walked through the NIM sensitivity scenarios:

- Base case (static): ~6% NII growth in 2026

- Steepener scenario (2 rate cuts late 2026, long end up 50bps): ~3% NII growth, similar to IPO guidance

- Rate outlook: Forward curve shows 2 rate cuts in 2H 2026; Fed not expected to cut until second half of year

- Sensitivity: "We don't have much sensitivity to the front end of the curve. Our exposure is really more in the intermediate part of the curve."

Capital Deployment

On the IPO proceeds and excess capital deployment:

"Our primary focus is looking at M&A opportunities. We think that's probably our greatest opportunity to add shareholder wealth... But look, everything remains on the table... from dividends and buybacks."

For liquidity management, the company is keeping "appropriate powder dry" given deposit seasonality (public funds property tax collections in December typically run through Q2-Q3) and investing the rest patiently into "relatively risk-free opportunities."

Credit Quality

Chief Credit Officer Eric Holgren provided reassurance:

"We haven't really seen anything specific that I would say points to weakness or pockets of weakness in the portfolio... we're not holding or harvesting, delaying any potential resolution."

Some watchlist composition shift from criticized into classified categories was noted, but no concerning loss content identified.

Tax Rate

Q4 effective tax rate included ~40bps of unusual items (30bps out of period, 10bps native to the quarter).

How Are Fee Businesses Performing?

Wealth Management

CFO Siroli highlighted strong momentum in wealth management:

- Assets under advice grew to $16 billion at quarter-end

- Performance: Investment team beating relative benchmarks

- Net new money: Strong inflows throughout the year, especially Q4

- Competitive positioning: "Our wealth business can compete with anyone out there, and I truly mean anyone."

Treasury Management

Some Q3-to-Q4 seasonality in payments and service charges is typical. Management continues investing in the treasury management platform to sustain historical growth rates.

How Is the Deposit Franchise?

Deposit growth was strong, with important seasonal context:

- Public funds represent ~17% of deposits and grow seasonally in December due to Missouri property tax collections

- Non-public deposits grew 1.7% QoQ after adjusting for seasonality

- Year-over-year growth: ~6% including seasonal component

- Seasonality timing: Elevated balances typically persist through Q2, potentially into early Q3

How Is the Loan Portfolio Performing?

Loans held for investment reached $11.4 billion, up 1.0% sequentially as growth resumed after a flat period.

Source: Company filings

Growth drivers:

- Construction lending activity accelerated (+6.7% QoQ)

- Residential mortgage growth (+2.2%) and HELOC utilization (+5.1%) outpaced consumer installment runoff

- Commercial loan payoff activity moderated

How Is Asset Quality?

Credit metrics remain pristine:

Source: Company filings

Net charge-offs declined to $2.8M (10bps annualized), down from $3.5M in Q3. Provision expense was $3.0M, essentially flat with the prior quarter.

Full Year 2025 Results

CBC delivered record profitability for the full year:

Source: Company filings

The 28% net income growth reflected the full benefit of the rate environment, with NIM expanding 45bps year-over-year while operating expenses grew just 3.3%.

What Are the Key Risks?

- Interest rate sensitivity: While currently beneficial, the asset-sensitive balance sheet could pressure NIM if rates fall further

- CRE concentration: Non-owner-occupied CRE represents 28% of loans, a potential concern if commercial real estate faces stress

- Geographic concentration: Heavy exposure to Missouri (9 of 11 primary markets) limits diversification

- Limited trading history: As a recent IPO, the stock has limited price discovery and analyst coverage

About Central Bancompany

Central Bancompany is a $20.8 billion super-community bank headquartered in Jefferson City, Missouri, with operations primarily in Missouri, Kansas, Oklahoma, and Colorado. Founded in 1902, the bank is family-controlled and has been ranked among Forbes' Top 50 Best Banks every year since 2009. The bank operates 155 full-service offices and employs approximately 2,905 people.

Note: As a recent IPO (November 2025), Central Bancompany has limited analyst coverage. Beat/miss data versus consensus is not available.