Earnings summaries and quarterly performance for Central Bancompany.

Research analysts who have asked questions during Central Bancompany earnings calls.

MG

Manan Gosalia

Morgan Stanley

2 questions for CBC

Also covers: CADE, CFG, CFR +17 more

NR

Nathan Race

Piper Sandler & Co.

2 questions for CBC

Also covers: ALRS, BSVN, BWB +18 more

Terry McEvoy

Stephens

2 questions for CBC

Also covers: ASB, BY, CIVB +4 more

CM

Chris McGratty

KBW

1 question for CBC

Also covers: BAC, C, CFG +18 more

Christopher McGratty

Keefe, Bruyette & Woods

1 question for CBC

Also covers: ASB, BAC, BANC +35 more

Recent press releases and 8-K filings for CBC.

Central Bancompany Reports Strong Q4 2025 Financial Results

CBC

Earnings

Revenue Acceleration/Inflection

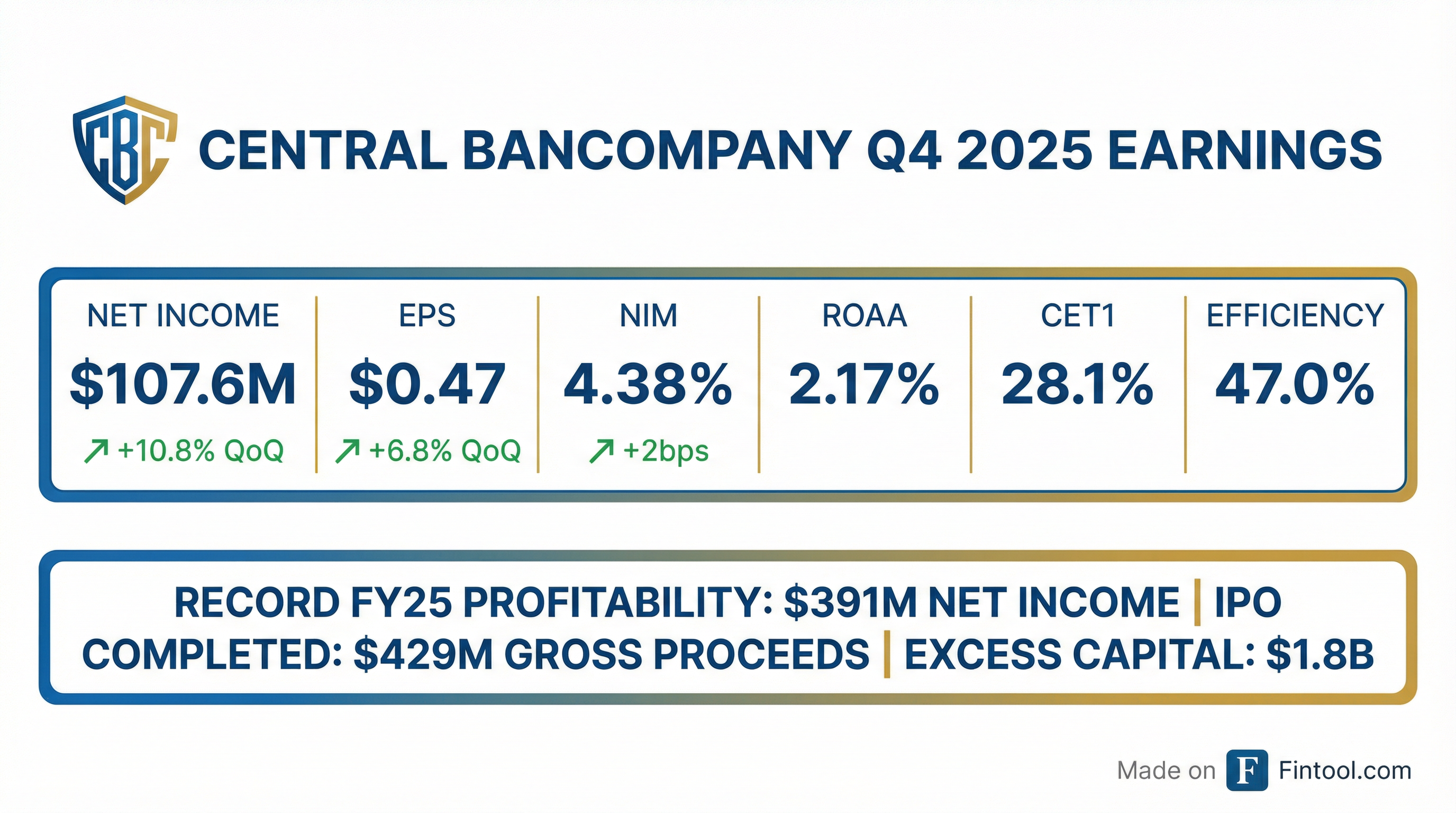

- Central Bancompany reported Net Income of $107.6 million and EPS of $0.47 for Q4 2025, with Net Income increasing by 10.8% from the prior quarter.

- The company's end of period loans held for investment grew 1.0% quarter-over-quarter to $11.4 billion, and total deposits increased 7.3% quarter-over-quarter to $15.9 billion in Q4 2025.

- Profitability metrics for Q4 2025 included a Return on Average Assets (ROAA) of 2.17%, a Net Interest Margin (NIM) of 4.38%, and an FTE efficiency ratio of 47.0%.

- Central Bancompany maintained a strong capital position with a CET1 ratio of 28.1% and Tangible Book Value per share of $14.24 in Q4 2025, also reporting excess capital of $7.50 per share.

Jan 27, 2026, 3:00 PM

Central Bancompany Reports Strong Q4 2025 Results and Outlines Growth Strategies

CBC

Earnings

M&A

New Projects/Investments

- Central Bancompany reported strong Q4 2025 financial results, including net income of $107.6 million and $0.47 per fully diluted share, a Return on average assets of 2.17%, and a Net interest margin (FTE) of 4.41%. Asset quality was solid with 10 basis points of net charge-offs.

- The company experienced a resumption of balance sheet growth, with ending loans up 1% quarter-over-quarter and non-public deposits up 1.7% quarter-over-quarter. Excess capital stands at approximately $1.8 billion, or $7.50 a share.

- M&A remains a core strategy for deploying excess capital, targeting deals of around $2 billion in assets in existing markets and potentially Texas, with active engagement with potential targets.

- The wealth management business saw assets under advice grow to $16 billion , and the company plans branch expansion in 2026, with new locations in St. Louis and Colorado (Denver).

Jan 27, 2026, 3:00 PM

Central Bancompany Reports Strong Q4 2025 Results and Outlines Capital Deployment Strategy

CBC

Earnings

M&A

New Projects/Investments

- Central Bancompany reported net income of $107.6 million or $0.47 per fully diluted share for Q4 2025, with a Return on average assets of 2.17% and a Net interest margin (FTE) of 4.41%.

- The company achieved 1% quarter-over-quarter growth in ending loans and 1.7% quarter-over-quarter growth in non-public deposits in Q4 2025.

- Capital levels remain strong, with $1.8 billion of excess capital or $7.50 per share at the holding company.

- Management reiterated its focus on M&A opportunities as the primary method to deploy excess capital, targeting high-quality institutions with approximately $2 billion in assets in existing markets or potentially expanding into Texas.

- Assets under advice in the wealth management business grew to $16 billion at the end of Q4 2025, driven by investment performance and strong net new money inflows.

Jan 27, 2026, 3:00 PM

Central Bancompany Reports Q4 2025 Results and Outlines Growth Strategy

CBC

Earnings

M&A

New Projects/Investments

- Central Bancompany reported net income of $107.6 million and $0.47 per fully diluted share for Q4 2025, with a Return on average assets of 2.17% and an efficiency ratio of 47%.

- The company experienced a resumption of balance sheet growth in Q4 2025, with ending loans up 1% quarter-over-quarter and non-public deposits up 1.7% quarter-over-quarter. Capital levels remain well above target, with approximately $1.8 billion of excess capital or $7.50 per share, primarily targeted for M&A opportunities.

- Central Bancompany plans branch expansion in 2026, with new locations coming online in St. Louis (multiple branches) and Colorado/Denver (one branch by Q2 2026). The wealth business also saw growth, with assets under advice reaching $16 billion at quarter-end.

Jan 27, 2026, 3:00 PM

Central Bancompany, Inc. Reports Fourth Quarter and Full-Year 2025 Results

CBC

Earnings

New Projects/Investments

- Central Bancompany reported GAAP net income of $107.6 million, or $0.47 per fully diluted share, for the fourth quarter of 2025, compared to $97.1 million and $0.44 in the prior quarter.

- For the full year 2025, GAAP net income was $390.9 million, or $1.75 per fully diluted share, an increase from $305.8 million and $1.39 in the prior year.

- Key financial metrics for Q4 2025 included a Return on average assets (ROAA) of 2.17%, a GAAP net interest margin (NIM) of 4.38%, and an efficiency ratio of 47.6%.

- End-of-period total loans held for investment were $11.4 billion, representing 1.0% growth from the prior quarter, while total deposits reached $15.9 billion, an increase of approximately 5.9% from the prior year.

- President and CEO John "JR" Ross highlighted record profitability in 2025 and stated the company's focus for 2026 on prudently growing the business, continuing technology build-out, and thoughtfully deploying excess capital.

Jan 27, 2026, 12:59 PM

Quarterly earnings call transcripts for Central Bancompany.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more