Earnings summaries and quarterly performance for Capital Bancorp.

Executive leadership at Capital Bancorp.

Edward F. Barry

Chief Executive Officer

Anguel Lindarev

Executive Vice President and Chief Information Officer

Eric Suss

Executive Vice President and Chief Human Resource Officer

Gary Kausmeyer

Executive Vice President and Chief Risk/Compliance Officer

Jacob Dalaya

Chief Financial Officer

JJ Kaye

Executive Vice President and Chief Marketing Officer

Karl Dicker

President of OpenSky™ & Fintech

Kathy Yamada

Executive Vice President and Chief Credit Officer

Michael Breckheimer

Senior Vice President, Head of Windsor

Steven M. Poynot

President and Chief Operating Officer

Board of directors at Capital Bancorp.

C. Scott Brannan

Director

Deborah Ratner-Salzberg

Director

Fred J. Lewis

Director

James F. Whalen

Vice Chairman of the Board

Jerome R. Bailey

Director

Joshua B. Bernstein

Director

Marc McConnell

Director

Mary Ann Scully

Director

Randall J. Levitt

Director

Scot R. Browning

Director

Steven J. Schwartz

Chairman of the Board

Research analysts covering Capital Bancorp.

Recent press releases and 8-K filings for CBNK.

- Redwood Capital Bancorp (RWCB) reported Net Income of $5.185 million and Earnings per share (fully diluted) of $2.77 for the full year ended December 31, 2025, reflecting a 3% growth in EPS compared to the prior year.

- The company's book value per common share increased by 14% to $29.41 as of December 31, 2025.

- The Board of Directors declared a quarterly cash dividend of $0.09 per share, equivalent to an annual rate of $0.36 per share.

- In 2025, the company repurchased 98,861 shares for $2,575,404, contributing to the earnings per share growth.

- As of December 31, 2025, total assets stood at $529 million, with total deposits of $471.7 million and net loans of $381.7 million.

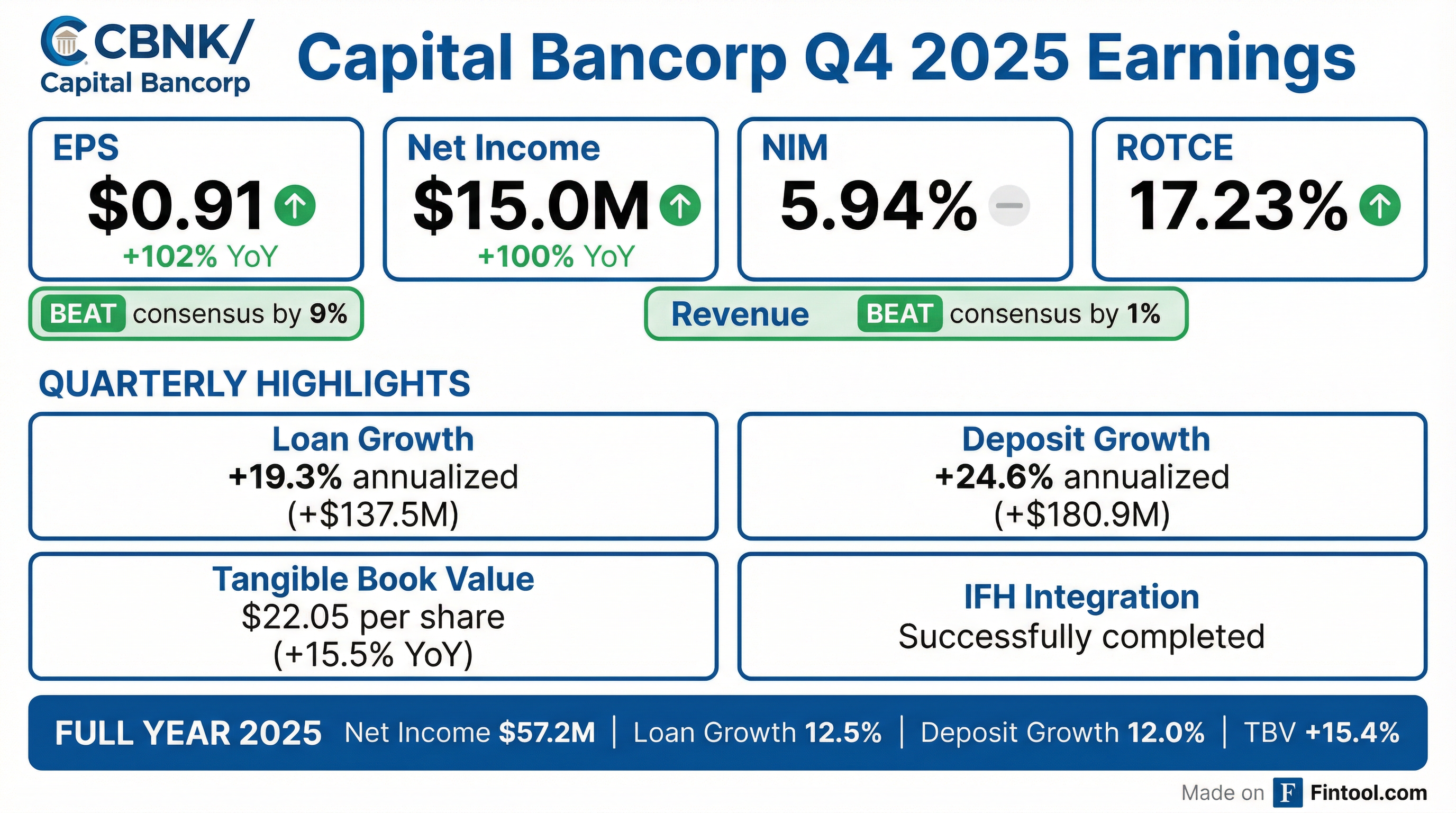

- Capital Bancorp reported GAAP net income of $15.0 million and earnings per share of $0.91 for Q4 2025, with net income flat compared to Q3 2025 but EPS increasing by $0.02.

- The company demonstrated strong balance sheet expansion in Q4 2025, with Gross Loans growing $137.5 million (19.3% annualized) and Total Deposits increasing $180.9 million (24.6% annualized) from the prior quarter.

- Book value per common share reached $24.54 and tangible book value per share grew to $22.05 at December 31, 2025, marking increases of $0.74 and $0.72, respectively, compared to Q3 2025.

- In Q4 2025, Capital Bancorp declared a cash dividend of $0.12 per share and executed a share repurchase program, buying back 304,288 shares for a total cost of $8.6 million.

- Capital Bancorp, Inc. (CBNK) reported net income of $15.0 million and diluted earnings per share of $0.91 for Q4 2025, contributing to a full-year 2025 net income of $57.2 million.

- The company demonstrated robust balance sheet expansion in Q4 2025, with loan growth of $137.5 million (19.3% annualized) and deposit growth of $180.9 million (24.6% annualized), bringing total assets to $3,606 million.

- Key profitability metrics for Q4 2025 included a Return on Average Assets (ROA) of 1.71% and a Return on Average Tangible Common Equity (ROTCE) of 17.23%, while Tangible Book Value per Share (TBV) increased to $22.05.

- Capital Bancorp, Inc. renewed Ed Barry's employment agreement through December 2027, where he will continue to serve as Chief Executive Officer of Capital Bancorp and focus on enterprise-level strategy.

- Steve Poynot, currently President and Chief Operating Officer, has been elevated to Chief Executive Officer of Capital Bank, N.A., and will continue to lead the Commercial Bank and oversee Windsor Advantage.

- This leadership alignment is designed to support the company's long-term vision as a diversified financial services enterprise, ensuring continued investment in its commercial banking franchise and maximizing growth in other business lines.

- As of September 30, 2025, Capital Bancorp, Inc. reported $3.4 billion in assets.

- Capital Bancorp (NASDAQ: CBNK) announced the appointment of Jacob Dalaya as Executive Vice President and Chief Financial Officer, effective immediately.

- Prior to this appointment, Mr. Dalaya served as the company's Chief Strategy Officer and has held leadership roles at Webster Financial Corporation, Sterling Bancorp, Keefe, Bruyette & Woods, and J.P. Morgan Securities.

- CEO Edward Barry highlighted Mr. Dalaya's instrumental role in shaping Capital Bank’s long-term strategy and strengthening its financial discipline.

- Capital Bancorp reported GAAP Net Income of $15.1 million, or $0.89 per diluted share, for 3Q 2025, an increase from $13.1 million ($0.78 per diluted share) in 2Q 2025 and $8.7 million ($0.62 per diluted share) in 3Q 2024.

- The company's profitability metrics for 3Q 2025 included a return on average assets (ROA) of 1.77% and a return on average equity (ROE) of 15.57%.

- Book value per common share increased to $23.80 at September 30, 2025, up $0.88 from 2Q 2025 and $3.67 from 3Q 2024.

- Gross Loans grew by $82.2 million, an annualized 11.9%, during 3Q 2025, contributing to a $714.5 million year-over-year increase.

- A cash dividend of $0.12 per share was declared.

- Capital Bancorp, Inc. reported GAAP net income of $15.1 million, or $0.89 per diluted share, for Q3 2025, an increase from $13.1 million ($0.78 per diluted share) in Q2 2025 and $8.7 million ($0.62 per diluted share) in Q3 2024.

- The company achieved a return on average assets (ROA) of 1.77%, a return on average equity (ROE) of 15.57%, and a Net Interest Margin (NIM) of 6.36% for Q3 2025.

- Gross Loans grew $82.2 million, or 11.9% (annualized), during Q3 2025, with significant year-over-year growth driven by the IFH acquisition. Total deposits decreased $28.7 million, or (3.9)% (annualized), from Q2 2025.

- Book value per common share reached $23.80 at September 30, 2025, and tangible book value per share was $21.27. The Board of Directors also declared a cash dividend of $0.12 per share.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more