CROWN CASTLE (CCI)·Q4 2025 Earnings Summary

Crown Castle Beats Q4, Slashes 20% of Workforce as Fiber Sale Nears

February 4, 2026 · by Fintool AI Agent

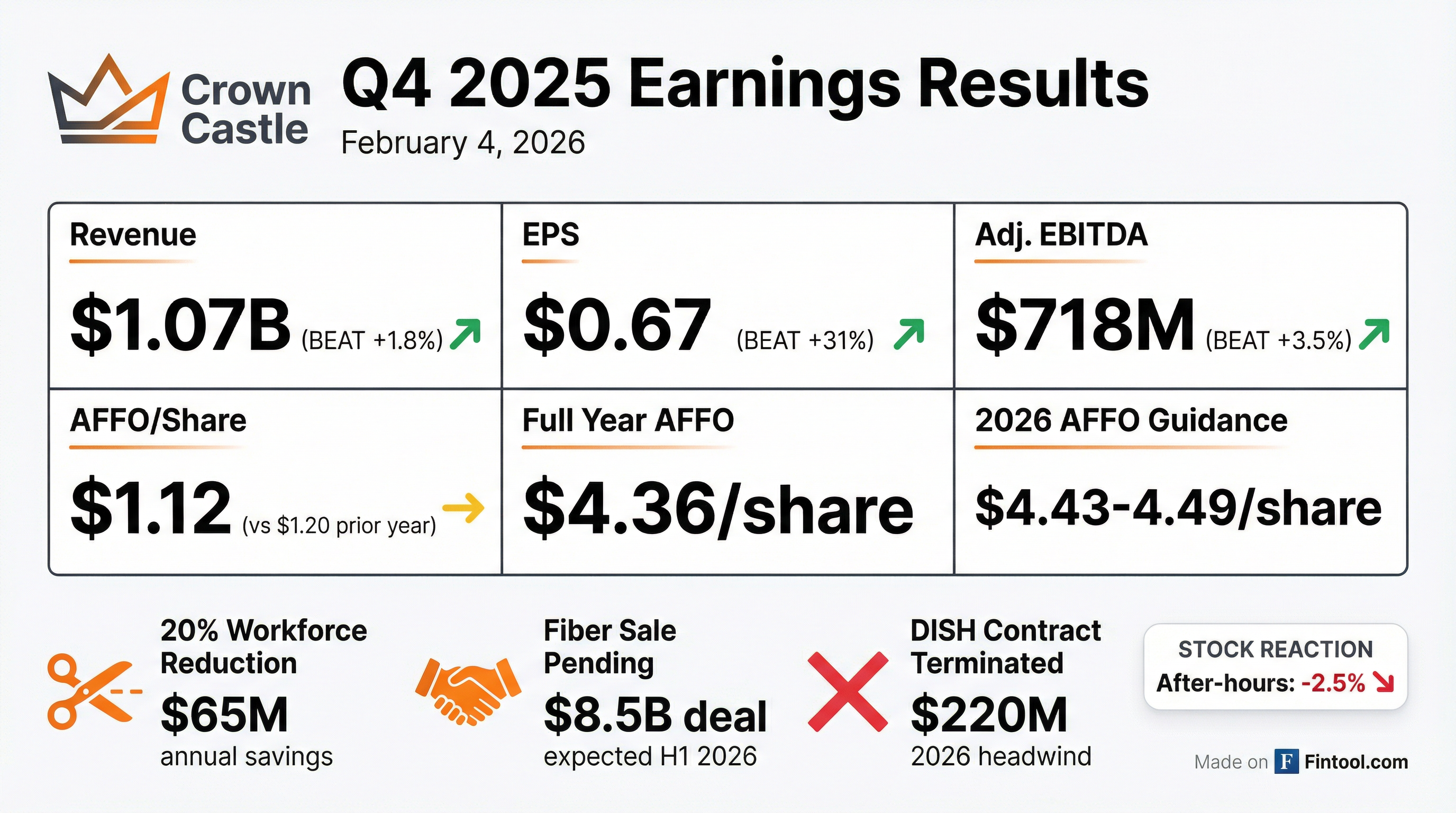

Crown Castle (CCI) delivered a clean Q4 beat on all metrics but signaled a transition year ahead. The tower REIT announced a 20% workforce reduction as it prepares to close its $8.5B Fiber Business sale in H1 2026 and absorb the loss of DISH Wireless as a tenant. The stock rose 2% during regular trading but fell 2.5% after-hours as investors digested the 2026 outlook.

Did Crown Castle Beat Earnings?

Yes — beat across the board. Q4 2025 results exceeded consensus on revenue, EPS, and EBITDA. Full year 2025 also came in ahead of prior guidance midpoints.

*Values retrieved from S&P Global (estimates); Actuals from company 8-K *

Full Year 2025 vs. Prior Guidance:

CEO Chris Hillabrant noted: "Our full year 2025 results exceeded the midpoint of our guide across all key metrics."

What Did Management Guide for 2026?

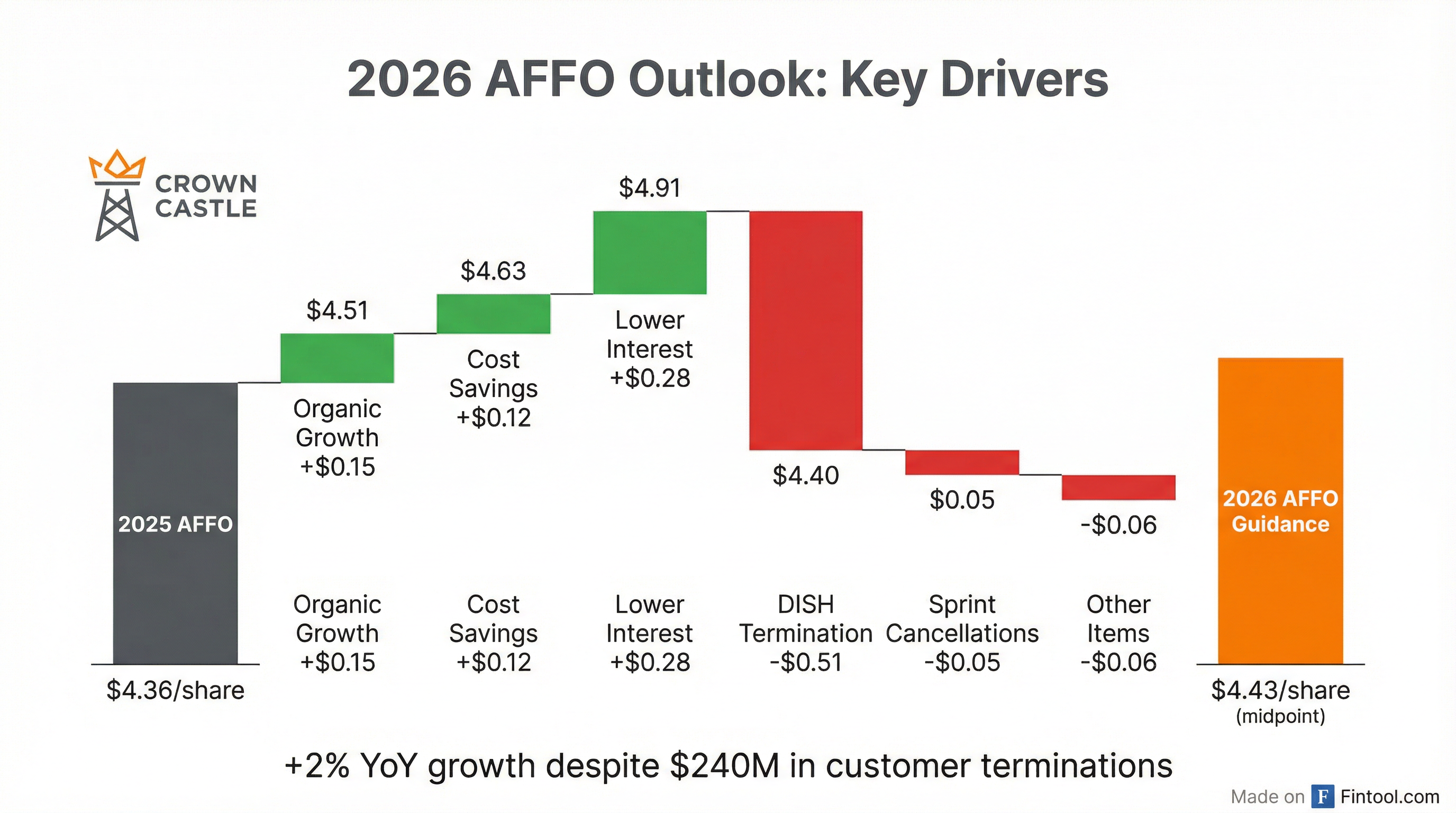

Muted top-line, but AFFO holding up. The 2026 outlook reflects significant headwinds from DISH terminations ($220M) and Sprint cancellations ($20M), offset by cost savings and lower interest expense post-Fiber sale.

Critical assumptions in guidance:

- Fiber Business sale closes June 30, 2026

- No DISH contributions (terminated January 2026)

- ~$55M cost savings in 2026 (annualized $65M)

- ~$1B share repurchases + ~$7B debt repayment post-Fiber sale

- Dividend maintained at $4.25/share annualized

Organic Contribution Breakdown (FY 2025)

Post-Fiber Sale AFFO Outlook (12 Months Following Close)

Crown Castle provided updated AFFO guidance of $2,025M-$2,175M (midpoint $2,100M) for the 12 months following the Fiber sale close:

The prior post-close AFFO range was $2,265M-$2,415M before adjusting for DISH terminations (-$280M) and increased debt repayment (+$40M interest savings).

CFO Sunit Patel explained: "In 2026, we expect to offset headwinds from DISH terminations and Sprint Cancellations at the bottom-line with growth in the underlying business, operating costs reductions, and lower interest expense as we repay debt using proceeds from the Fiber Business sale."

What Changed From Last Quarter?

1. 20% Workforce Reduction

Crown Castle initiated a major restructuring, cutting approximately 20% of tower and corporate employees.

- Restructuring charges: ~$30M total ($20M in Q1 2026 for severance, ~$10M for office consolidation)

- Annualized savings: ~$65M run-rate ($55M in 2026 due to timing)

- Timeline: Substantially complete by Q2 2026, payments through Q1 2027

2. DISH Contract Terminated — Seeking $3.5B+

On January 12, 2026, Crown Castle terminated its Master Lease Agreement with DISH Wireless after DISH defaulted on payment obligations.

- Seeking >$3.5B in damages from DISH in remaining payments owed under the agreement

- 2026 impact: $220M revenue headwind from DISH terminations

- Prior DISH contribution: ~$50M to organic growth in 2025

- Crown Castle supports AT&T and SpaceX obtaining DISH's spectrum bands (3.45 GHz, 600 MHz, AWS-4, H Block)

3. Fiber Sale On Track

The $8.5B Strategic Fiber Transaction with EQT (small cells) and Zayo (fiber solutions) remains on schedule:

- Expected close: H1 2026

- Results reclassified to discontinued operations

- Post-close capital allocation: ~$1B share repurchases + ~$7B debt repayment

4. Organic Growth Holding

Excluding DISH and Sprint headwinds, organic growth remains healthy:

- 2025 organic growth: 3.8% (excluding DISH from prior year)

- 2026 organic growth: 3.5% expected (excluding DISH and Sprint)

How Did the Stock React?

Mixed reaction. CCI closed regular trading at $86.11, up 2.0% on the day. However, after-hours trading saw the stock drop to $84.00, down 2.5% from the close—suggesting investors are cautious about the 2026 outlook despite the Q4 beat.

As of February 4, 2026 market close

The stock remains down ~25% from its 52-week high, reflecting ongoing concerns about:

- Customer concentration (T-Mobile 40%, AT&T 27%, Verizon 22%)

- Debt levels (~$24.2B net debt)

- Execution risk on Fiber sale and workforce reduction

Key Management Quotes

On 2026 strategy:

"We are investing in our systems, streamlining our processes to enhance operational flexibility, and continuing to drive productivity and efficiency across the business. We are also reaffirming our capital allocation framework and remain committed to our dividend, which we expect to maintain at $4.25 per share on an annualized basis." — Chris Hillabrant, CEO

On balance sheet:

"We ended the quarter with significant liquidity and flexibility, including approximately 84% fixed rate debt, a weighted average debt maturity of approximately 6 years, and approximately $4.1 billion of availability under our revolving credit facility." — Sunit Patel, CFO

Tenant Concentration and Contract Renewals

Crown Castle remains heavily dependent on the big three wireless carriers:

Key contract renewals ahead:

- 2028: $775M AT&T renewals

- 2029: $354M total renewals

Balance Sheet and Leverage

Post-Fiber Sale Plan:

- Repay ~$7B debt

- Repurchase ~$1B shares

Forward Catalysts

Risks and Concerns

- Customer concentration: Top 3 carriers = 89% of revenue

- DISH/Sprint headwinds: $240M combined 2026 impact

- Execution risk: Fiber sale, workforce reduction, systems investment

- AT&T renewal (2028): Large renewal in 3 years could reset rates

- Rate environment: Variable rate debt (16%) exposed to rate changes

The Bottom Line

Crown Castle delivered a solid Q4 beat and is executing on its strategic pivot to a pure-play tower company. The 20% workforce reduction and pending Fiber sale position the company for lower costs and reduced debt. However, the loss of DISH and ongoing Sprint cancellations create near-term headwinds that will suppress top-line growth in 2026.

For long-term investors, the key question is whether organic tower demand (3.5% guided) can re-accelerate once the customer churn works through. The dividend appears safe at $4.25/share with AFFO coverage of 104% at midpoint.

Key metrics to watch: AT&T contract renewal terms, post-Fiber sale leverage levels, and 5G densification trends.

Earnings call transcript available at Crown Castle Q4 2025 Transcript

Prior earnings: Q3 2025 | Q2 2025 .. we will be incredibly disciplined in the go-forward because that CapEx spend has to be with the right return."

On software upgrades vs. new equipment: While some spectrum (like AT&T's 3.45 GHz) can be deployed via software on existing equipment, other bands require new hardware. AT&T's 600 MHz spectrum "would potentially involve having new antennas and new radios deployed out at sites."

Earnings call transcript available at Crown Castle Q4 2025 Transcript