Earnings summaries and quarterly performance for CNB FINANCIAL CORP/PA.

Research analysts covering CNB FINANCIAL CORP/PA.

Recent press releases and 8-K filings for CCNE.

CNB Financial Corporation Reports Q4 and Full-Year 2025 Results

CCNE

Earnings

M&A

Accounting Changes

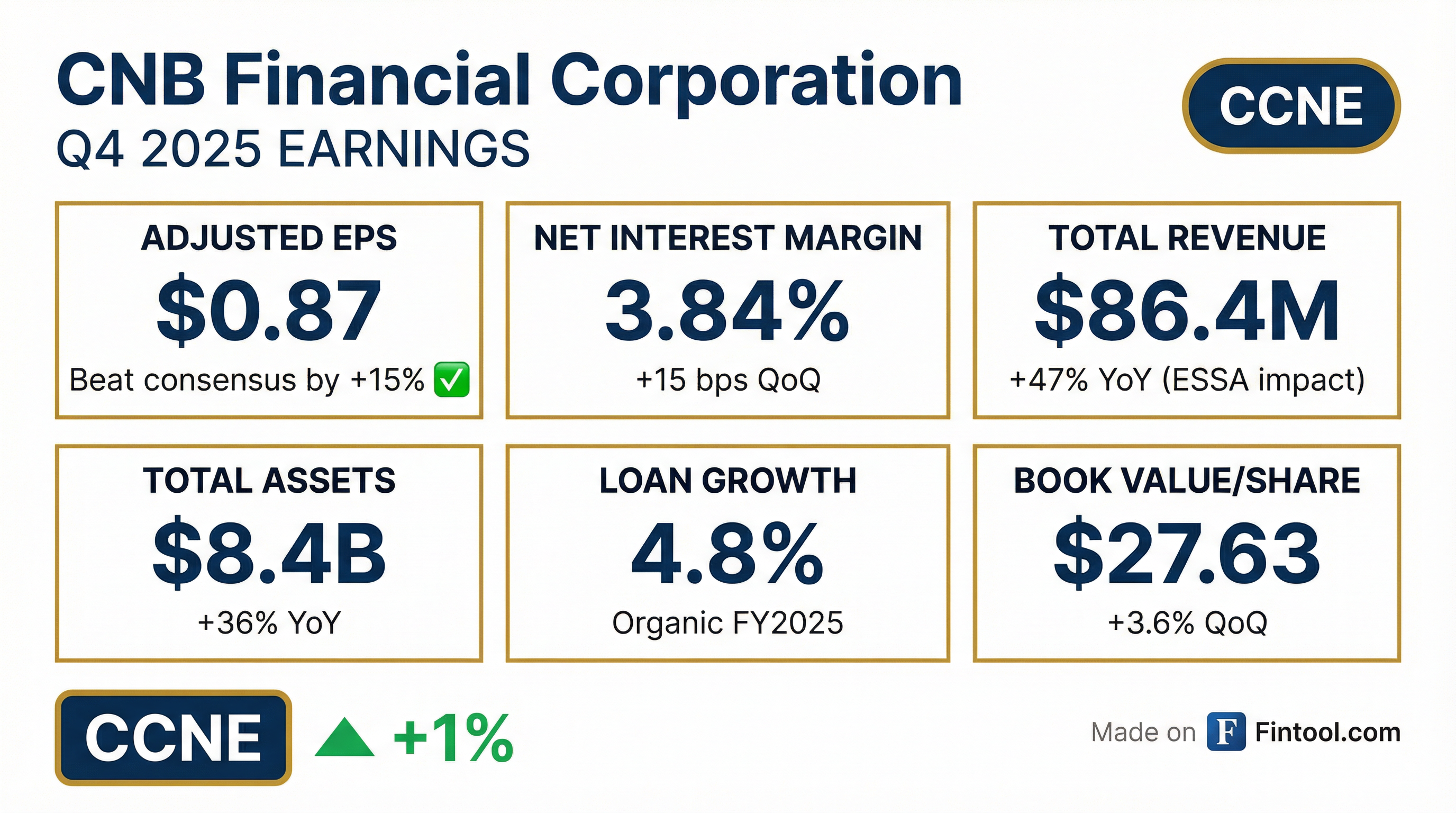

- CNB Financial Corporation reported net income available to common shareholders of $32.6 million, or $1.10 per diluted share, for the three months ended December 31, 2025. For the full year ended December 31, 2025, net income available to common shareholders was $61.8 million, or $2.49 per diluted share.

- As of December 31, 2025, total loans (excluding syndicated balances) were $6.4 billion , and total deposits were $7.0 billion. Organic loan growth for the fourth quarter of 2025 was $26.6 million, or 0.42% , and organic deposit growth was $122.1 million, or 2.21%.

- The net interest margin for the three months ended December 31, 2025, was 3.84%. Total nonperforming assets were approximately $42.2 million, or 0.50% of total assets, as of December 31, 2025.

- The provision for credit losses reflected a net reversal of $15.5 million for the three months ended December 31, 2025, primarily due to the early adoption of Accounting Standard Update (ASU) 2025-08.

Jan 27, 2026, 9:16 PM

CNB Financial Corporation Reports Q3 2025 Results and Details Largest Acquisition

CCNE

M&A

Earnings

Revenue Acceleration/Inflection

- CNB Financial Corporation completed its largest acquisition in company history, ESSA Bancorp, Inc., on July 23, 2025, which added $2.1 billion in total assets and $1.5 billion in deposits.

- For the third quarter ended September 30, 2025, net income available to common shareholders was $6.0 million, or $0.22 per diluted share, while adjusted earnings (excluding merger and integration costs) were $22.5 million, or $0.82 per diluted share.

- Total revenue for Q3 2025 increased to $77.7 million, up from $61.2 million in Q2 2025, primarily due to the ESSA acquisition.

- The provision for credit losses rose to $18.5 million in Q3 2025, largely due to a $16.4 million reserve established for non-PCD loans acquired in the ESSA acquisition.

- Net interest margin (NIM) improved to 3.69% for Q3 2025, compared to 3.60% in Q2 2025.

Oct 30, 2025, 8:10 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more