COPT DEFENSE PROPERTIES (CDP)·Q4 2025 Earnings Summary

COPT Defense Hits 52-Week High as FFO Grows 5.8%, Defense Budget Hits $950B Record

February 6, 2026 · by Fintool AI Agent

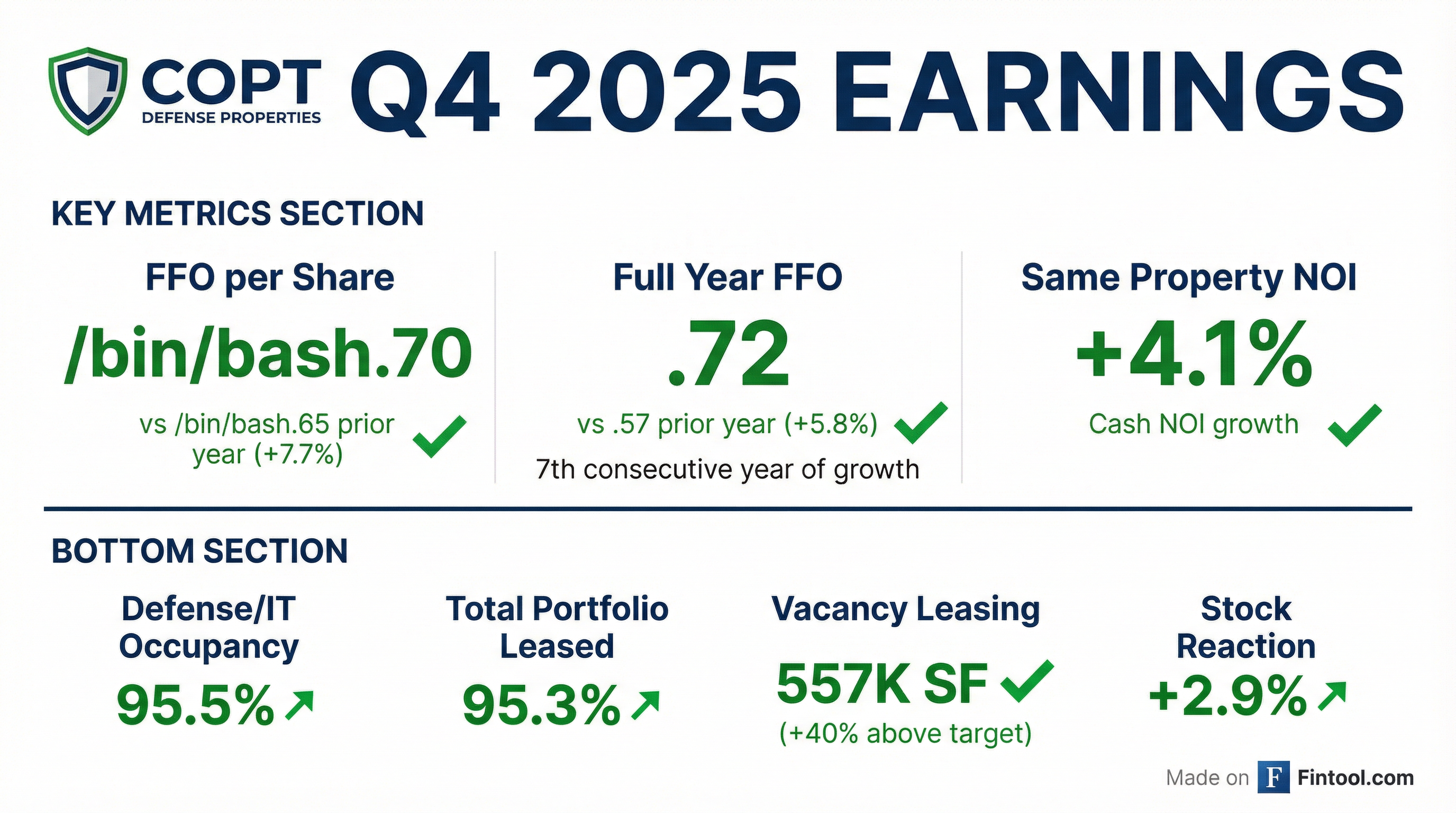

COPT Defense Properties (NYSE: CDP) delivered Q4 2025 results that sent shares to a 52-week high of $32.14, rising nearly 3% to close at $32.00 following the announcement. The defense-focused REIT reported FFO per share of $2.72 for full year 2025, up 5.8% from 2024 and 6 cents above initial guidance, marking its seventh consecutive year of FFO growth.

CEO Steve Budorick highlighted a powerful macro tailwind: President Trump signed the FY 2026 Defense Appropriations Act just three days before the call, with base budget of $841 billion plus $113 billion in allocated DOD funding—totaling over $950 billion, the largest defense budget in U.S. history and a 15% year-over-year increase.

Did COPT Defense Beat Earnings?

Full year FFO of $2.72 was 2 cents above revised guidance and 6 cents above initial guidance, driven by earlier-than-expected lease commencements, lower operating expenses, and non-recurring real estate tax refunds.

Since 2019, FFO per share has grown from $2.03 to $2.75 (2026 midpoint)—a 35% increase representing a 4.4% compound annual growth rate. Between 2023-2026, the CAGR is 4.9%, over 20% higher than originally projected.

What Did Management Guide for 2026?

COPT established 2026 FFO guidance of $2.71-$2.79 per share, implying 1.1% growth at the $2.75 midpoint.

Key guidance drivers:

- +17 cents from NOI increases (rent, lease commencements, developments)

- -9 cents from higher financing costs (October 2025 bond refinancing)

- -1.5 cents from NBP 400 delivery into operating portfolio

- -3 cents from lower investment income and higher G&A

Excluding the 9-cent financing headwind, underlying FFO growth would have been 4.4%.

"We're already off to a great start to the year with capital commitments and investment leasing."

How Big Is the Defense Budget Tailwind?

The defense funding backdrop is the strongest in the company's history:

CEO Budorick noted the FY 2026 act "enjoyed very strong bipartisan support recognizing the increasingly complex global threat environment." He cited a Wall Street Journal editorial titled "A Serious Defense Budget at Last" that highlighted emerging threats including hypersonic missiles, space and cyber weapons, drones, and the weaponization of AI.

Golden Dome Initiative: The $175 billion multi-year missile defense program, combined with the relocation of Space Command headquarters to Huntsville, is expected to "drive growth and demand from both government and contractors at the Redstone Gateway for the foreseeable future."

"The president's fiscal year 2027 budget request is expected to be submitted in the coming weeks, but he publicly announced the need for a $1.5 trillion defense budget... His comments send a strong policy signal of the president's commitment to increase investment in defense."

What's the Development Pipeline?

COPT has an active development pipeline of nearly $450 million across 880,000 square feet, with 86% pre-leased. Five of six projects are 100% pre-leased.

Recent capital commitments (since late December):

The ARLIS project will serve as the Capital Quantum Benchmarking Hub to test and evaluate quantum computing prototypes for national security, in partnership with the State of Maryland and DARPA. The University of Maryland received a $500 million DOD contract in 2024 to support ARLIS.

NBP 400 Lease Executed: Earlier this week, COPT signed a full building lease at NBP 400 for 148,000 square feet with a top 10 U.S. defense contractor for nearly 11 years.

Incremental NOI Impact: Active developments plus 2025 completions will generate $52 million of incremental cash NOI on a stabilized basis, phasing in between 2026-2029. Of this, $48 million is contractual.

How Strong Was Leasing Performance?

Leasing exceeded targets across all categories:

Vacancy leasing of 557,000 square feet represented 47% of available inventory at the beginning of the year. In the Defense/IT portfolio, the 58% conversion rate was even stronger. Half of this leasing was tied to secure space, cyber activity, or both.

Navy Support Market Turnaround: The company executed ~110,000 square feet in Navy support markets, representing 73% of available inventory. The leased rate increased nearly 200 basis points and occupancy increased over 400 basis points year-over-year.

What About Government Lease Renewals?

The government had an administrative delay in processing nearly 1 million square feet of secure full building leases in San Antonio. Management expects 100% retention as lease economics have been finalized.

"We're just waiting for the government to finish processing the paperwork. We believe this process will be completed, and this batch of leases will be renewed in the first quarter."

This delay impacted Q4 metrics:

- Tenant retention would have been 84% vs. reported 78% (+600 bps)

- Cash rent spreads would have been +2.4% vs. reported +1.1% (+130 bps)

For 2026, management expects to renew virtually all of the 2.2 million square feet of government leases expiring, with San Antonio accounting for one-third of expiring square footage and over 40% of expiring annualized rental revenue.

Q&A Highlights: What Did Analysts Ask?

On Golden Dome timing:

"Many, if not most, of [our 400,000 SF of prospects at 8500 Advanced Gateway] pertain to Golden Dome, and I believe they represent kind of initial footprints, early moves to get into the action. Subsequent down the road, you'll see larger requirements as awards are made and the contractors ramp up." — CEO Steve Budorick

On Huntsville capacity:

"We're built to 2.4 million square feet right now... Our overall capacity on the land we control without structured parking is 5.5 million square feet. So we got 3 million square feet of development runway."

On equity issuance:

"It's nice to be in a position where we could consider issuing equity, but it's kind of a last alternative... If God forbid we get so much [development opportunity] that we have to issue equity, well, that'll be a happy day for our investors."

On defense budget timing:

"From appropriation, our demand impact is 12 and sometimes 18 months down the road... It's really a very strong signal that our demand is going to remain very healthy, if not improve, over the next two years."

How Did the Stock React?

CDP shares rose +2.9% to $32.00 on February 5, touching a 52-week high of $32.14. On February 6 following the earnings call, shares traded around $31.85.

The stock has significantly outperformed traditional office REITs, trading well above both 50-day and 200-day moving averages as investors favor COPT's defense-focused, government-backed tenant base.

What About the Balance Sheet?

COPT maintains a conservative capital structure:

In October 2025, COPT issued $400 million of five-year unsecured notes at a yield to maturity of 4.6%, with credit spreads at 95 basis points—tighter than higher-rated office peers.

"Our decision not only eliminated any execution risk but also removed any underlying treasury rate risk. The five-year treasury at the time of our offering was 3.67%, and since our deal priced, the five-year has traded at or above that rate in 90% of the trading days." — CFO Anthony Mifsud

Key Takeaways for Investors

Bull case:

- 7th consecutive year of FFO growth; 4.4% CAGR since 2019

- Defense budget at record $950B with strong bipartisan support

- $175B Golden Dome Initiative driving Huntsville demand

- 96.5% leased Defense/IT portfolio with 35% government exposure

- $450M development pipeline, 86% pre-leased

- Self-funding model; no equity issuance expected

Bear case:

- Higher financing costs compress 2026 FFO growth to 1.1%

- 2.2M SF of government leases expiring in 2026

- 12-18 month lag from appropriation to realized demand

- NBP 400 delivery temporarily reduces occupancy

Bottom line: COPT Defense delivered strong results and provided conservative but positive guidance amid the most favorable defense spending environment in company history. The $950 billion defense budget and $175 billion Golden Dome Initiative provide multi-year visibility into tenant demand. While financing costs pressure near-term FFO growth, underlying operating fundamentals remain excellent.

*Values marked with asterisk retrieved from S&P Global.

Related: CDP Company Profile | Q4 2025 Earnings Transcript | Prior Earnings: Q3 2025