Earnings summaries and quarterly performance for COPT DEFENSE PROPERTIES.

Executive leadership at COPT DEFENSE PROPERTIES.

Board of directors at COPT DEFENSE PROPERTIES.

Research analysts who have asked questions during COPT DEFENSE PROPERTIES earnings calls.

Blaine Heck

Wells Fargo Securities

4 questions for CDP

Dylan Burzinski

Green Street Advisors, LLC

4 questions for CDP

Anthony Paolone

JPMorgan Chase & Co.

3 questions for CDP

Peter Abramowitz

Jefferies

3 questions for CDP

Richard Anderson

Wedbush Securities

3 questions for CDP

William Catherwood

BTIG

3 questions for CDP

Michael Griffin

Citigroup Inc.

2 questions for CDP

Steve Sakwa

Evercore ISI

2 questions for CDP

Manus Ebeki

Evercore ISI

1 question for CDP

Manus Ibek

Evercore ISI

1 question for CDP

Seth Berge

Citigroup

1 question for CDP

Seth Bergey

Citi

1 question for CDP

Thomas Catherwood

BTIG

1 question for CDP

Recent press releases and 8-K filings for CDP.

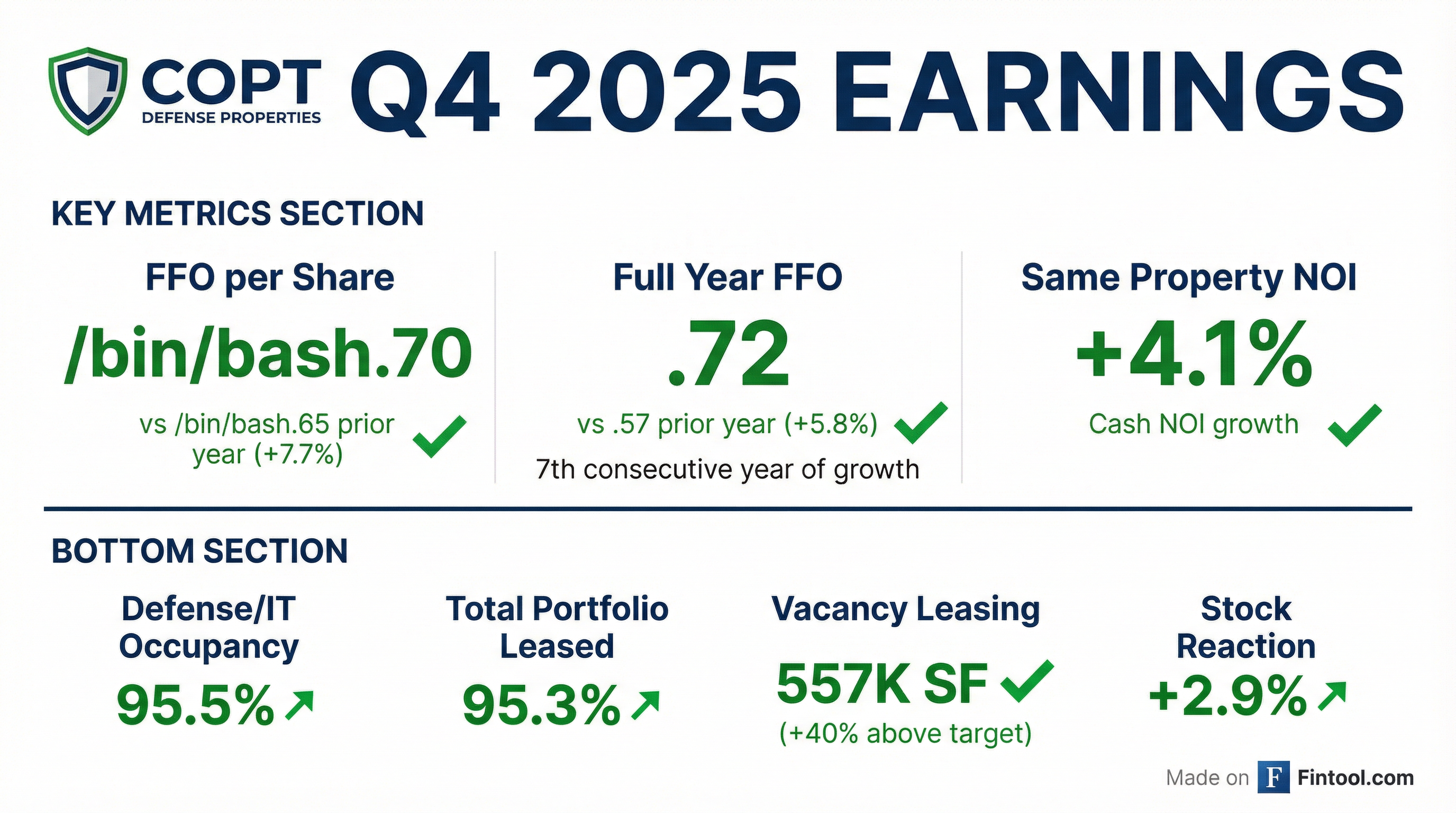

- COPT Defense Properties reported 2025 FFO per share of $2.72, a 5.8% increase over 2024, and provided 2026 FFO per share guidance with a midpoint of $2.75, implying 1.1% growth.

- The company achieved strong operational performance in 2025, including 557,000 sq ft of vacancy leasing and a 4.1% increase in Same Property Cash NOI, with total portfolio occupancy at 94%.

- CDP committed $278 million to new investments in 2025 and plans to commit $225 million-$275 million in 2026, with an active development pipeline of nearly $450 million that is 86% pre-leased.

- The recently signed FY 2026 Defense Appropriations Act, totaling over $950 billion, represents a 15% year-over-year increase and is expected to drive continued strong demand for the company's properties.

- COPT Defense Properties reported $2.72 FFO per share for 2025, a 5.8% increase over 2024, marking its seventh consecutive year of FFO per share growth. For 2026, the company established FFO per share guidance at a midpoint of $2.75, implying 1.1% growth over 2025, which absorbs a 9-cent increase in financing costs.

- In 2025, same-property cash NOI increased 4.1% year-over-year, and the company executed 557,000 sq ft of vacancy leasing, exceeding its initial target. The total portfolio occupancy stood at 94% at quarter-end.

- The company committed $278 million to new investments in 2025, with these projects being 81% pre-leased. The active development pipeline totals nearly $450 million and is 86% pre-leased. In January 2026, an additional $146 million was committed to a fully pre-leased development.

- Tenant retention for 2025 was 78%, with a 2026 guidance midpoint of 80%. Cash rent spreads were up 1.1% in 2025, with a 2026 guidance midpoint of 2%.

- COPT Defense Properties reported 2025 FFO per share of $2.72, marking a 5.8% increase over 2024, and set 2026 FFO per share guidance with a midpoint of $2.75, which implies 1.1% growth. This 2026 guidance incorporates a 9-cent increase in financing costs.

- The company achieved a 4.1% increase in same-property cash NOI in 2025, driven by a 40 basis point increase in average occupancy, and projects a 2.5% increase for 2026.

- Operational highlights for 2025 include 557,000 sq ft of vacancy leasing and 477,000 sq ft of investment leasing. For 2026, the company targets 400,000 sq ft of vacancy leasing and anticipates 80% tenant retention with cash rent spreads up 2%.

- CDP committed $278 million to new investments in 2025 and plans to commit $225-$275 million to new investments in 2026, with an active development pipeline of nearly $450 million that is 86% pre-leased.

- The recently signed FY 2026 Defense Appropriations Act, totaling over $950 billion, represents a 15% year-over-year increase and the largest defense-based budget in U.S. history, indicating strong future demand for the company's specialized properties.

- COPT Defense Properties reported full-year 2025 EPS of $1.34 and FFO per share, as adjusted for comparability, of $2.72, representing a 5.8% increase over 2024 results and marking the 7th consecutive year of FFO per share growth.

- The company achieved strong operational metrics, with its Total Portfolio 94.0% occupied and 95.3% leased as of December 31, 2025, and Same Property Cash NOI increasing 4.1% for the full year.

- COPT Defense executed 3.1 million square feet of total leasing in 2025, including 557,000 square feet of vacancy leasing that exceeded its initial target by nearly 40%. The company also committed $278 million to 5 new investments that are 81% pre-leased.

- The company proactively managed its capital structure by issuing $400 million of 4.50% Senior Notes due 2030, increasing its Revolving Credit Facility from $600 million to $800 million, and securing a $200 million revolving credit agreement for property development. As of December 31, 2025, 100% of its debt was subject to fixed interest rates.

- CDP reported Q3 2025 FFO per share of $0.69, a 6.2% year-over-year increase, and raised its 2025 FFO per share guidance by $0.03 to $2.70, representing 5.1% growth over 2024. The company also increased its 2025 same property cash NOI growth guidance by 75 basis points to 4%.

- The portfolio ended Q3 2025 at 95.7% leased, its highest level in 20 years, and the full-year vacancy leasing target was increased by 50,000 square feet to 500,000 square feet.

- In October, CDP successfully closed three financings, including a $400 million bond offering and upsizing its revolving credit facility by $200 million to $800 million, which pre-funds its 2026 bond maturity and provides additional liquidity.

- The company committed $72 million to two new external growth investments in Q3 2025 and increased its 2025 capital commitment target for new investments by $25 million to $250 million. The relocation of Space Command's headquarters to Redstone Arsenal is expected to drive future growth, with Space Command anticipated to lease approximately 450,000 square feet.

- COPT Defense Properties reported diluted EPS of $0.37 and diluted FFO per share, as adjusted for comparability, of $0.69 for the third quarter ended September 30, 2025.

- The company increased the midpoint of its 2025 FFO per share guidance by $0.03 to $2.70, implying 5.1% year-over-year growth, and also raised its target for vacancy leasing to 500,000 square feet.

- Same Property Cash NOI increased by 4.6% in Q3 2025 compared to the same period in 2024, with the total portfolio 93.9% occupied and 95.7% leased as of September 30, 2025.

- COPT Defense Properties committed $72 million of capital to new investments in September and October 2025, and issued $400 million of 4.50% Senior Notes due 2030 to pre-fund its 2026 bond maturity.

- COPT DEFENSE PROPERTIES, L.P. and COPT DEFENSE PROPERTIES entered into a Second Amendment to their Credit Agreement on October 6, 2025.

- The amendment increases the aggregate Revolving Commitments from $600,000,000 to $800,000,000.

- The maturity date for the Revolving Credit Facility is extended from October 26, 2026, to October 5, 2029, with options for two six-month extensions.

- The accordion feature was refreshed, providing $575,000,000 in additional capacity for future increases in commitments or new term loans, bringing the potential aggregate facility size to $1,500,000,000.

- Interest terms for both the Revolving Credit Facility and the Term Loan were updated, now based on the Secured Overnight Financing Rate (SOFR) or the prime rate, plus a spread determined by credit ratings.

- COPT Defense Properties, L.P. consummated an offering of $400.0 million aggregate principal amount of its 4.500% Senior Notes due 2030 on October 2, 2025.

- The Notes carry an interest rate of 4.500% per annum, with interest payable semi-annually on April 15 and October 15, commencing April 15, 2026.

- These Notes are fully and unconditionally guaranteed by COPT Defense Properties.

- The stated maturity date for the Notes is October 15, 2030.

- COPT Defense Properties reported Diluted FFO per share of $1.33 for the six months ended June 30, 2025, with Net Operating Income (NOI) from real estate operations increasing 6.6% in Q2 2025 compared to Q2 2024.

- As of June 30, 2025, the company's total portfolio occupancy reached 94.0%, marking a 40 basis point increase since Q4 2024, and the Defense/IT Portfolio occupancy stood at 95.6%.

- The United States Government represents a significant portion of the tenant base, contributing 35.8% of the total $701,089 thousand in annualized rental revenue as of June 30, 2025.

- Future demand is anticipated to be bolstered by an estimated $113 billion increase in the FY 2026E DOD Budget Request from the One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, which is a 13% increase over FY 2025 Enacted.

- The company maintains a strong balance sheet, with 97% of its consolidated debt at a fixed rate and an unencumbered portfolio accounting for 97% of total NOI from real estate operations.

- COPT Defense Properties (CDP) is a specialized REIT with over 90% of its annualized rental revenue derived from defense IT properties that support U.S. national defense activities.

- The company forecasts nearly 4% FFO per share growth at the midpoint for 2025, marking its seventh consecutive year of FFO growth, and has consistently raised its dividend, including in 2023, 2024, and 2025.

- Significant growth opportunities are anticipated from a 13% increase in the base defense budget for FY 2026 , the relocation of the U.S. Space Command headquarters to Huntsville which will involve 450,000-480,000 sq ft of development by CDP and potential for an additional 1 million sq ft from contractors , and the $175 billion "Golden Dome" anti-missile defense initiative.

- The defense IT segment was 96.8% leased at quarter-end , and the company expects to achieve its elevated full-year guidance of 450,000 square feet in vacancy leasing.

Quarterly earnings call transcripts for COPT DEFENSE PROPERTIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more