Earnings summaries and quarterly performance for Capitol Federal Financial.

Research analysts covering Capitol Federal Financial.

Recent press releases and 8-K filings for CFFN.

Capitol Federal Financial: HoldCo Asset Management Engages in "Soft Activism"

CFFN

Proxy Vote Outcomes

Board Change

- HoldCo Asset Management, an investment firm managing approximately $2.8 billion in regulatory assets, announced its presentation at the UBS Financial Services Conference, detailing its activist engagements.

- Capitol Federal Financial, Inc. (CFFN) is one of four banks with which HoldCo has engaged in behind-the-scenes "soft activism".

- HoldCo reported that management teams and boards of the publicly targeted banks made substantive changes, leading to the avoidance of proxy contests, and expressed encouragement regarding material changes made by the "soft activism" banks, hoping to avoid further escalation through 2026.

Feb 9, 2026, 2:00 PM

Capitol Federal Financial, Inc. Reports FY 2025 Financial Performance and Annual Meeting Outcomes

CFFN

Earnings

Dividends

Proxy Vote Outcomes

- Capitol Federal Financial, Inc. reported significant financial performance improvements for fiscal year 2025, with Net Income increasing to $68,025 thousand from $38,010 thousand in 2024, and Earnings Per Share rising to $0.52 from $0.29.

- The company declared a special dividend of $0.04 per share on December 17, 2025, payable on January 23, 2026, and a regular quarterly dividend of $0.085 per share on January 27, 2026, payable on February 20, 2026. For fiscal year 2026, the Board intends to pay a regular quarterly cash dividend of $0.085 per share, totaling $0.34 per share for the year.

- In calendar year 2025, Capitol Federal Financial, Inc. repurchased 2,994,893 shares for a total of $20,153,438 and paid $44,207,366 in regular quarterly dividends.

- At its Annual Meeting on January 27, 2026, stockholders elected two directors, approved executive compensation on an advisory basis, approved the 2026 Omnibus Incentive Plan, and ratified KPMG LLP as the independent auditors for fiscal year 2026.

Jan 29, 2026, 4:09 PM

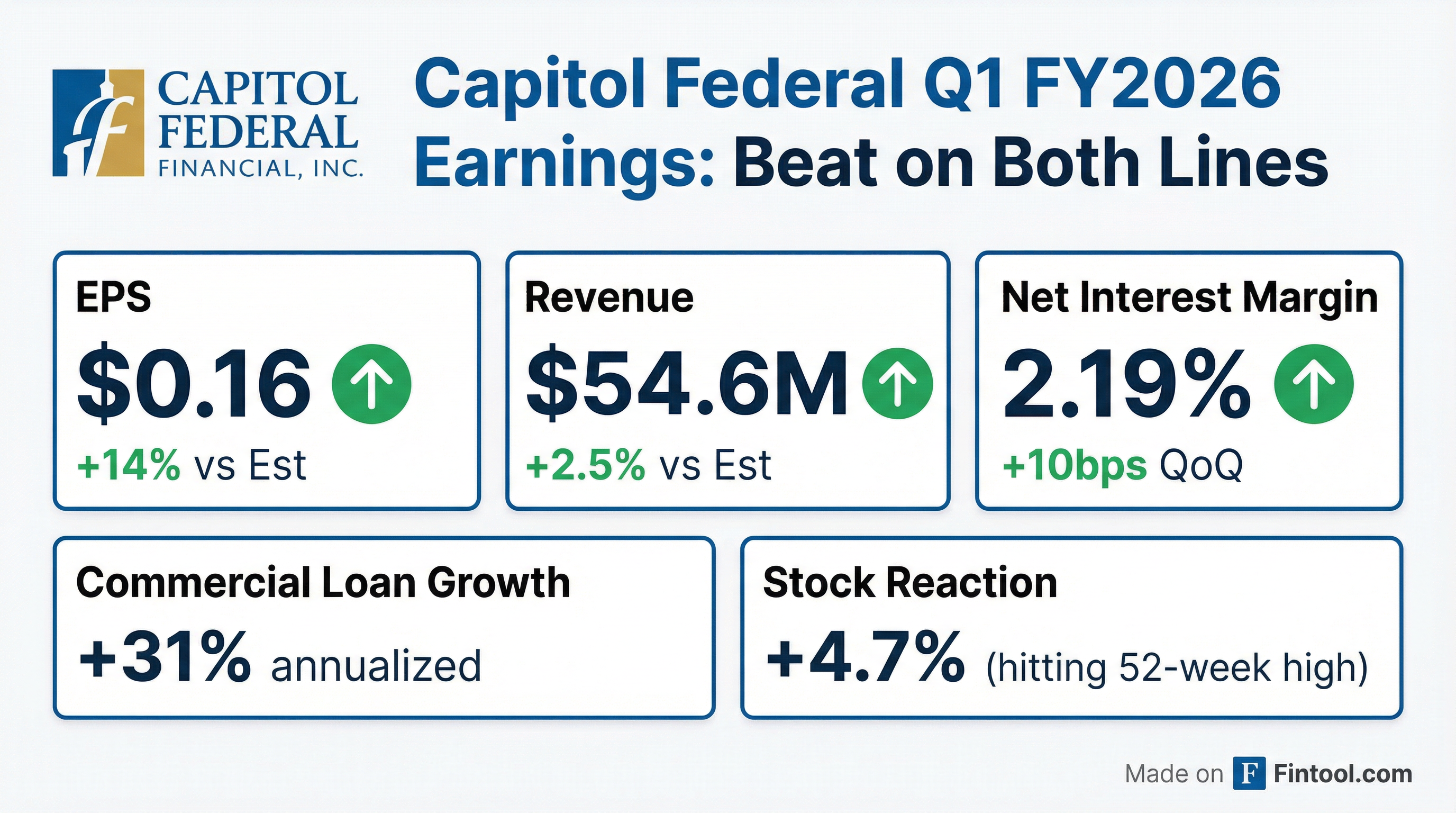

Capitol Federal Financial, Inc. Reports Strong Q1 2026 Results with Increased Net Income and Strategic Growth

CFFN

Earnings

Dividends

Share Buyback

- Capitol Federal Financial, Inc. reported net income of $20.3 million and basic and diluted earnings per share of $0.16 for the quarter ended December 31, 2025, an increase from $18.8 million and $0.14, respectively, in the prior quarter.

- The company's strategic shift towards commercial banking continues to show results, with the commercial loan portfolio growing by $162.6 million to $2.28 billion and commercial deposits growing by $19.5 million to $527.7 million during the quarter.

- Key financial metrics improved, including a net interest margin increase to 2.19% from 2.09% and an efficiency ratio improvement to 53.66% from 56.84% in the prior quarter.

- CFFN demonstrated a continued commitment to shareholder returns by repurchasing 2,376,633 shares of common stock at an average price of $6.86 per share and paying a regular quarterly dividend of $0.085 per share, along with a special cash dividend of $0.04 per share.

Jan 28, 2026, 4:35 PM

Capitol Federal Financial, Inc. Reports Q1 2026 Results with Improved Net Interest Margin and Strong Capital Position

CFFN

Earnings

Dividends

Share Buyback

- Capitol Federal Financial, Inc. (CFFN) reported net income of $20,304 thousand and earnings per share of $0.16 for Q1 2026, ending December 31, 2025.

- The company's Net Interest Margin (NIM) improved to 2.19% in Q1 2026, following a securities restructuring in October 2023 that led to an approximate 60 basis points increase in NIM in fiscal year 2024.

- CFFN maintains a strong capital position, with a Tier 1 Leverage ratio of 10.0% and a CET1 ratio of 16.5% as of December 25, 2025.

- The company has returned over $2 billion to stockholders through share repurchases and dividends since 2010, and anticipates making earnings distributions in fiscal year 2026.

- Strategic initiatives are focused on expanding into a full-service commercial bank, with the commercial loan portfolio reaching $2,000,000 thousand by December 2025.

Jan 28, 2026, 1:00 PM

Capitol Federal Financial, Inc. Highlights Strategic Shift to Commercial Banking and Strong Financial Performance

CFFN

New Projects/Investments

Revenue Acceleration/Inflection

Dividends

- Capitol Federal Financial, Inc. (CFFN) is a community-oriented financial institution with $9.8 billion in assets and a $884 million market capitalization, operating for over 130 years through 44 traditional and two in-store branches.

- The company is strategically transforming into a full-service commercial bank, focusing on commercial lending, treasury management, digital banking, and wealth management to diversify its balance sheet and expand income streams.

- A securities restructuring completed in October 2023 significantly improved the net interest margin (NIM), which increased by approximately 60 basis points in fiscal year 2024, and reached 2.19% as of December 31, 2025.

- For the quarter ended December 31, 2025, CFFN reported net income of $20,304 and earnings per share of $0.16.

- CFFN maintains a strong capital position with a Tier 1 Leverage ratio of 10.0% and CET1 of 16.5% as of December 2025, having returned over $2 billion to shareholders through share repurchases and dividends since 2010.

Jan 28, 2026, 12:00 PM

Capitol Federal Financial, Inc. Announces Special Dividend and Stock Buyback Update

CFFN

Dividends

Share Buyback

- Capitol Federal Financial, Inc. (CFFN) announced a special cash dividend of $0.04 per share on its outstanding common stock.

- This dividend is payable on January 23, 2026, to stockholders of record as of the close of business on January 9, 2026.

- Between October 1, 2025, and December 16, 2025, the company repurchased 1,577,853 shares of common stock at an average cost of $6.72 per share.

Dec 17, 2025, 9:31 PM

Capitol Federal Financial, Inc. Reports Q4 and FY 2025 Results

CFFN

Earnings

Dividends

Share Buyback

- Capitol Federal Financial, Inc. reported net income of $18.8 million for the fourth quarter of fiscal year 2025, with basic and diluted earnings per share of $0.14. For the full fiscal year 2025, net income was $68.0 million and earnings per share were $0.52, significantly up from $38.0 million and $0.29, respectively, in the prior year.

- The company's Board of Directors declared a quarterly cash dividend of $0.085 per share, payable on November 21, 2025, and intends to pay a total of $0.34 per share for fiscal year 2026.

- Total assets reached $9.78 billion and stockholders' equity was $1.05 billion at the end of fiscal year 2025, both showing growth from the previous fiscal year.

- The net interest margin increased to 2.09% in Q4 2025 from 1.98% in the prior quarter, and for the full fiscal year 2025, it was 1.96%, an increase of 19 basis points from 1.77% in the prior year. Additionally, commercial loans grew by $607.0 million, or 40.2%, during fiscal year 2025, now comprising 26% of the loan portfolio.

Oct 29, 2025, 1:21 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more