CHURCH & DWIGHT CO INC /DE/ (CHD)·Q4 2025 Earnings Summary

Church & Dwight Beats Q4, Unveils $2B-to-$3B Arm & Hammer Growth Plan

January 30, 2026 · by Fintool AI Agent

Church & Dwight (NYSE: CHD) delivered a strong Q4 2025 while unveiling an ambitious multi-year growth strategy at its Analyst Day. The company reported Adjusted EPS of $0.86, up 12% year-over-year, driven by gross margin expansion and share gains in power brands. The stock surged 4.0% to $95.65 as investors reacted positively to both the earnings beat and the new growth framework targeting $6B+ in revenue expansion.

CEO Rick Dierker opened with confidence: "We grew faster than all of our categories across all three divisions. That is quite the accomplishment in a tough and rugged 2025."

Did Church & Dwight Beat Earnings?

Yes — decisively. Q4 results exceeded the company's outlook across all key metrics:

The organic sales miss (0.7% vs 1.5% outlook) was driven by the now-exited VMS (vitamin) business and softer category growth. Excluding VMS, organic growth was a healthier 1.8%.

CFO Lee McChesney noted: "Take out the VMS business in the fourth quarter, organic sales are 1.8%. So some really nice momentum as you start thinking about 2026."

Full-year 2025 highlights:

- FY 2025 Adjusted EPS: $3.53 (+2.6% YoY)

- FY 2025 Cash from Operations: $1.215B

- Free Cash Flow Conversion: 127%

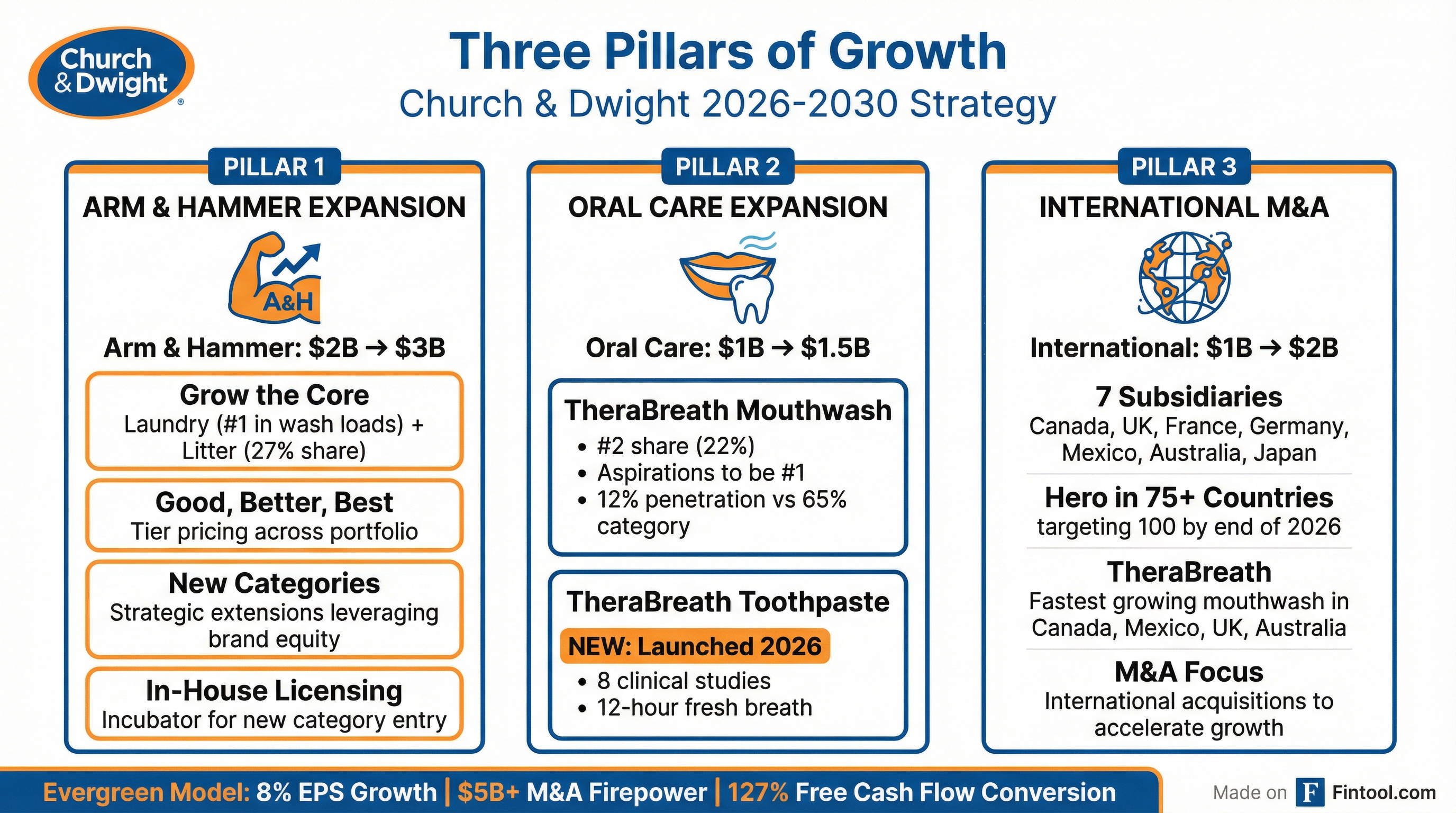

What's the New Growth Strategy?

This wasn't just an earnings call — it was an Analyst Day where management unveiled a three-pillar strategy to drive accelerated growth through 2030:

Pillar 1: Grow Arm & Hammer from $2B to $3B

The flagship brand has four levers for expansion:

-

Grow the Core: Arm & Hammer Laundry is now #1 in wash loads with a record 14.5% share. Cat litter holds 27% share in traditional weight.

-

Good, Better, Best: Rounding out pricing tiers across sub-brands. Laundry already spans basic Arm & Hammer (good), Plus OxiClean (better), and Deep Clean (best).

-

New Categories: Leverage the brand's unique extensibility. "It's in more aisles of the grocery store than almost any other brand... There are over a hundred uses of baking soda."

-

In-House Licensing: Use licensing partnerships as an incubator for category exploration, then acquire back at scale.

Dierker emphasized the brand's competitive moat: "Arm & Hammer has a halo effect on advertising. If we advertise cat litter, baking soda and laundry benefit. If we advertise laundry, Arm & Hammer toothpaste benefits."

Pillar 2: Oral Care Expansion ($1B → $1.5B)

TheraBreath is the centerpiece:

- Mouthwash: Now #2 share at 22%, with aspirations to be #1. Only 12% household penetration vs. 65% category — "tremendous headroom"

- Toothpaste: Just launched with 8 clinical studies showing 12-hour bad breath protection. Nearly 90% of TheraBreath consumers expressed interest in buying

"We have aspirations to be the number one mouthwash." — Chuck Butler, Chief Marketing Officer

Pillar 3: International Expansion ($1B → $2B)

International delivered 5.5% organic growth in 2025, averaging 8% CAGR over three years.

Key highlights:

- 7 subsidiaries: Canada, UK, France, Germany, Mexico, Australia, and Japan (acquired Graphico in 2024)

- Hero: Now in 75+ countries, targeting 100 by end of 2026. #1 in acne patches across all track subsidiaries

- TheraBreath: Fastest growing mouthwash in Canada, Mexico, UK, and Australia

- Touchland: Expanded to Canada and Middle East with strong results

Dierker confirmed: "We're doubling down on M&A within our international business. It's an and, not an or."

What Did Management Guide?

Church & Dwight provided robust 2026 guidance reflecting the transformed portfolio:

Q1 2026 Outlook:

- Organic sales: ~+3%

- Reported sales: ~-1% (due to 2025 exits)

- Adjusted EPS: $0.92 (slightly ahead of Q1 2025's $0.91)

Importantly, the 100 basis points of gross margin improvement is double the Evergreen Model's typical 25-50 bps, driven by portfolio reshaping, productivity, and acquisition mix benefits.

Brand-by-Brand Performance

Arm & Hammer Laundry: Record Share

"Arm & Hammer brand is now number one in wash loads."

- Record 14.5% share in a competitive environment

- Value segment is the only segment gaining share — exactly where Arm & Hammer plays

- Launching Baking Soda Fresh detergent (10x baking soda) and upgrading sheets to Better tier with OxiClean

On Tide Evo competition: "That does nothing but bring more awareness to a different form in the laundry category. Fantastic. We are gonna be a value to Tide Evo in a big way."

Cat Litter: Hardball Momentum

- 20 bps of share gains, outpacing category by 1%

- Hardball (premium lightweight) has a 48% repeat rate — 14 points above category average

- Launching Dual Defense with Microban antimicrobial technology

Hero: #1 Acne Brand

- Grew at 3x the category rate in 2025

- Now #1 in acne (not just patches) with 19% record share

- Only 1/3 of category penetration — significant runway

- Launching Mighty Shield (liquid patch) and cleanser line in 2026

TheraBreath: Double-Digit Growth

- #2 mouthwash with 22% share, up from #4 several years ago

- 12% household penetration vs. 65% category

- Toothpaste launch has 4.7-star rating with 8 clinical studies

Batiste: Turnaround Needed

- Lost 2.5 share points in 2025, but remains #1 in share and loyalty

- Plans for 2026: stronger innovation (powders, fragrance-free), price-pack architecture, and brand recharge

Touchland: Premium Hand Sanitizer Phenomenon

Andrea Lisbona, founder and CEO of Touchland, presented the brand's growth story:

- Power Mist ranked #2 in sales on Sephora.com

- 1.2M+ social media followers

- Named to Time 100 Most Influential Companies 2025

- Premium distribution: Sephora, Ulta Beauty, TikTok Shop

"We have been the only brand that has been able to premiumize at a scale hand sanitizer category."

On distribution strategy, management confirmed they're being "very careful and selective" — no mass channel expansion planned in the near term, preserving brand cachet.

E-Commerce: From Laggard to Leader

Surbhi Pokhriyal, Chief Digital Officer, highlighted the digital transformation:

- Online penetration: 2% → 24% in under a decade

- 14%+ growth across all power brands online

- TikTok Shop emerging as major growth driver — "bigger in the U.S. in terms of GMV, ahead of a couple of large beauty retailers already"

The company is leaning into AI for:

- Content generation and retail media optimization

- Discovery via Walmart's Sparky and Amazon's Rufus AI agents

- Emerging brand identification for M&A targets globally

Portfolio Transformation Impact

The VMS divestiture fundamentally improved the portfolio:

"We're going to look back in a few years, and I think one of the biggest strategic pivot points in our company history is when we acknowledged that we couldn't turn the vitamin business around."

The freed management attention is now redirected to high-growth opportunities.

How Did the Stock React?

Church & Dwight shares surged 4.0% to $95.65 on the combination of earnings beat and strategic clarity:

The positive reaction was driven by:

- Adjusted EPS beat (+11.7% YoY)

- Gross margin expansion (+90 bps with 100 bps guided for 2026)

- Clear three-pillar growth strategy

- Strong free cash flow and M&A optionality

Financial Firepower

CFO Lee McChesney emphasized the company's capital allocation flexibility:

- Debt to EBITDA: 1.5x (unchanged despite Touchland acquisition and $900M buybacks)

- M&A Firepower: Over $5B available

- Free Cash Flow Conversion: 127% in 2025

- Priority #1: TSR-accretive acquisitions (domestic and international)

On dividend: 4.2% increase to $0.3075/share quarterly, marking the 125th consecutive year of paying dividends and 30th consecutive year of increases.

Key Management Quotes

"Our tariff mitigation and response wasn't just industry-leading, I would say it's just leading. I was super impressed with how the company reacted." — Rick Dierker, CEO

"We have the highest sales per employee in the industry... It's about having the agility, speed of decision-making, being able to be nimble in a complex world." — Rick Dierker, CEO

"In 2025, if you look at almost every metric, it got better year-over-year in the second half than the first half, and that's our entry point." — Lee McChesney, CFO

"The E in e-commerce has become silent, and we are just in the business of doing commerce." — Surbhi Pokhriyal, Chief Digital Officer

Risks and Concerns

-

Category Deceleration: Categories grew just 1.8% in 2025 vs. 3%+ historical average. Management expects ~2% in 2026.

-

Consumer Sentiment: Five-year lows in consumer confidence continue to pressure discretionary spending.

-

Reported Sales Decline: FY 2026 reported sales will be down 0.5%-1.5% due to $400M of exited businesses.

-

First-Half EPS Headwinds: H1 EPS growth will lag H2 due to Touchland SG&A/amortization and front-loaded marketing.

-

ERP Transition: SAP S/4 go-live in progress, though management expressed confidence as it's an upgrade, not greenfield.

Q&A Highlights

On Promotional Environment: "Brands matter. You just can't promote your way to growth... Arm & Hammer Laundry was the only one who grew share, and we're not outspending the category at all."

On Value vs. Premium Mix: The portfolio shifted from 40/60 value/premium to 36/64, driven by higher-margin personal care acquisitions — a structural tailwind for gross margins.

On Touchland Distribution: "Sephora and Ulta have been great partners... There is no plan in the near term to go into mass." The Costco holiday test performed well without cannibalizing specialty retail.

On Arm & Hammer International: It's actually the largest international brand, with strong litter presence in China and rapidly growing baking soda globally.

Forward Catalysts

- Q1 2026 Earnings: Expect ~$0.92 Adjusted EPS (late April)

- TheraBreath Toothpaste: Distribution expansion through 2026

- Hero Cleansers: Mid-2026 launch into $4B+ category

- Touchland International: Expanding regulatory approvals for additional markets

- M&A Activity: Management actively pursuing domestic and international targets with $5B+ firepower

Innovation Pipeline Summary

View the full earnings transcript and company profile for more details.