Earnings summaries and quarterly performance for CHURCH & DWIGHT CO INC /DE/.

Executive leadership at CHURCH & DWIGHT CO INC /DE/.

Richard Dierker

President and Chief Executive Officer

Brian Buchert

Executive Vice President of Strategy, M&A and Business Partnerships

Carlen Hooker

Executive Vice President, Chief Commercial Officer

Carlos Linares

Executive Vice President, Chief Technology Officer & Global New Product Innovation

Carlos Ruiz Rabago

Executive Vice President, Chief Supply Chain Officer

Joseph Longo

Vice President, Controller and Chief Accounting Officer

Kevin Gokey

Executive Vice President, Chief Information Officer

Lee McChesney

Executive Vice President, Chief Financial Officer

Michael Read

Executive Vice President, International

Patrick de Maynadier

Executive Vice President, General Counsel and Secretary

Rene Hemsey

Executive Vice President, Chief Human Resources Officer

Surabhi Pokhriyal

Executive Vice President, Chief Digital Growth Officer

Board of directors at CHURCH & DWIGHT CO INC /DE/.

Arthur Winkleblack

Director

Bradlen Cashaw

Director

Bradley Irwin

Director

Janet Vergis

Director

Laurie Yoler

Director

Michael Smith

Director

Penry Price

Director

Ravichandra Saligram

Chair of the Board

Robert Shearer

Director

Susan Saideman

Director

Research analysts who have asked questions during CHURCH & DWIGHT CO INC /DE/ earnings calls.

Andrea Teixeira

JPMorgan Chase & Co.

6 questions for CHD

Anna Lizzul

Bank of America Corporation

6 questions for CHD

Rupesh Parikh

Oppenheimer & Co. Inc.

6 questions for CHD

Bonnie Herzog

Goldman Sachs

5 questions for CHD

Filippo Falorni

Citigroup Inc.

5 questions for CHD

Christopher Carey

Wells Fargo & Company

4 questions for CHD

Dara Mohsenian

Morgan Stanley

4 questions for CHD

Kevin Grundy

BNP Paribas

4 questions for CHD

Lauren Lieberman

Barclays

4 questions for CHD

Olivia Tong Cheang

Raymond James Financial, Inc.

4 questions for CHD

Peter Grom

UBS Group

4 questions for CHD

Javier Escalante Manzo

Evercore ISI

3 questions for CHD

Robert Moskow

TD Cowen

3 questions for CHD

Stephen Robert Powers

Deutsche Bank

3 questions for CHD

Chris Carey

Wells Fargo Securities

2 questions for CHD

Nik Modi

RBC Capital Markets

2 questions for CHD

Olivia Tong

Raymond James

2 questions for CHD

Jefferies Analyst

Jefferies Financial Group Inc.

1 question for CHD

Karen Wolfe

Piper Sandler

1 question for CHD

Kaumil Gajrawala

Jefferies

1 question for CHD

Korinne Wolfmeyer

Piper Sandler & Co.

1 question for CHD

Mark Astrachan

Stifel

1 question for CHD

Philip Gorham

Citi

1 question for CHD

Steve Powers

Deutsche Bank

1 question for CHD

William Chappell

Truist Securities

1 question for CHD

Recent press releases and 8-K filings for CHD.

- 2025 recap: Church & Dwight grew faster than its categories despite volatility, reduced a $190 million tariff impact to $28 million, and reshaped its portfolio by divesting Spinbrush, the vitamin business, Flawless and the Waterpik shower head, resulting in 1% consumption growth (or 3.5% excluding divested brands).

- Balanced portfolio: A $6.2 billion company with seven Power Brands (ARM & HAMMER, TheraBreath, Hero, Touchland, Waterpik, Batiste, OxiClean), 75% U.S. sales, 18% international, 25% e-commerce, and 5% private-label exposure post-portfolio actions.

- Growth initiatives: Targeting to grow ARM & HAMMER from $2 billion to $3 billion, expand TheraBreath from $1 billion to $1.5 billion, and scale international from $1 billion to $2 billion through organic innovation and M&A.

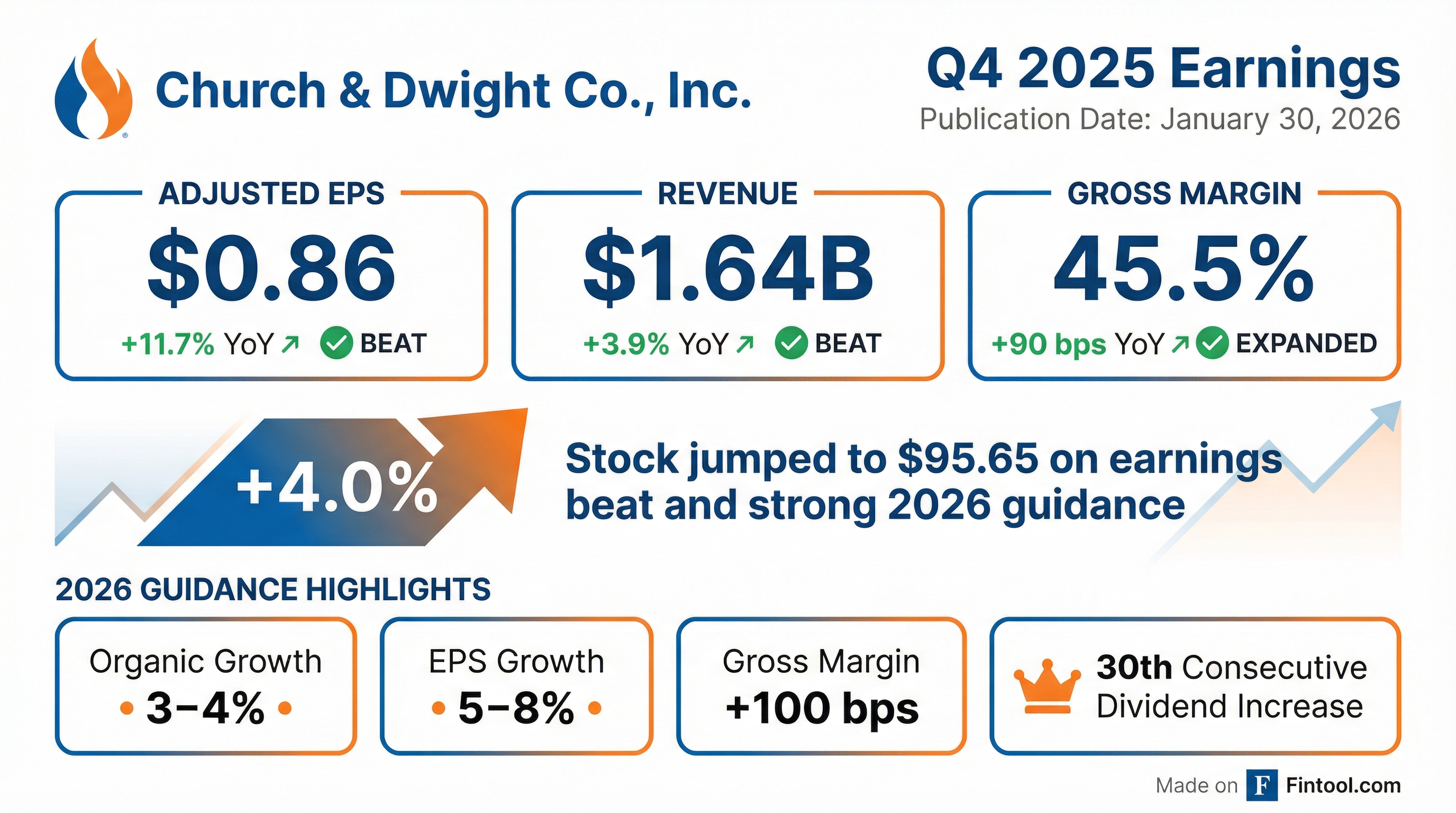

- 2026 guidance: Organic growth of 3–4%, total sales down 1.5–0.5% due to divestitures, 100 bps gross-margin improvement, 5–8% EPS growth, and $1.15 billion in free cash flow.

- In 2025, Church & Dwight grew faster than its categories, reduced tariff impact from $190 M to $28 M through portfolio actions and supply-chain moves, generated record $1.2 B free cash flow and returned $900 M to shareholders.

- For 2026, management reaffirmed its Evergreen Model with 3–4% organic growth, –1.5– –0.5% total sales impact from divestitures, 100 bp gross margin expansion and 5–8% adjusted EPS growth.

- Key growth initiatives target scaling ARM & HAMMER from $2 B to $3 B, TheraBreath from $1 B to $1.5 B, and international sales from $1 B to $2 B, driven by innovation and M&A.

- Recent portfolio reshaping includes divesting Spinbrush, the vitamin business, Flawless and Waterpik shower heads, alongside the acquisition of Touchland to bolster the core portfolio.

- The company emphasizes an asset-light, low-headcount model to maintain agility and a disciplined M&A pipeline to enhance shareholder returns.

- 2026 Guidance Update: Organic growth of 3%–4%, total sales down 1.5%–0.5% due to portfolio exits, 100 bp gross margin expansion, 5%–8% EPS growth, and $1.15 billion free cash flow.

- Growth Initiatives: Plans to expand ARM & HAMMER from $2 billion to $3 billion, TheraBreath from $1 billion to $1.5 billion, and international sales from $1 billion to $2 billion.

- Portfolio & Cost Actions: Mitigated $190 million in tariffs down to $28 million and completed divestitures of Spinbrush, the vitamin business, Flawless, and Waterpik shower heads to sharpen focus.

- 2025 Performance: Outpaced category growth in all three segments, delivered a record $1.2 billion cash flow, returned $900 million to shareholders, and ended with 1.5x net leverage.

- In 2025 CHD grew faster than its categories across all three divisions, gained share in 4 of 8 power brands, and closed strategic acquisitions including Touchland.

- The company ended FY 2025 as a $6.2 billion enterprise (77% domestic, 18% international, 5% SPD) with 1.5× leverage, over $5 billion in liquidity, and announced a 4.2% dividend increase.

- For 2026 CHD targets 3% US organic growth, aiming to expand Arm & Hammer from $2 billion to $3 billion, TheraBreath from $1 billion to $1.5 billion, and double international sales to $2 billion.

- Innovation drives ~50% of growth with 1.5–2% incremental net sales targets, while e-commerce has risen from 2% to 24% of sales via omni-channel and AI initiatives.

- Q4 sales of $1.6 billion were up 3.9%, with organic growth of 0.7% (1.8% ex-VMS), gross margin +90 bps, and EPS of $0.86, +12% YoY.

- Full-year 2025 organic sales grew 0.7% (2.0% ex-VMS), with record cash flow of $1.2 billion and tariff exposure cut from $190 million to $25 million.

- 2026 guidance: 3–4% organic growth, reported sales down 1.5–0.5% (portfolio exits), gross margin +100 bps, EPS +5–8%, and FCF of $1.15 billion.

- Shareholder returns include a 4.2% dividend increase (125th consecutive year) and continued share buybacks, with leverage at 1.5× EBITDA.

- Q4 2025 sales rose 3.9%, with organic growth of 0.7% (or 1.8% ex-VMS), gross margin up 90 bps, and EPS of $0.86, +12% y/y.

- FY 2025 highlights: $6.2 billion in revenue, 0.7% organic growth (2% ex-VMS), $1.2 billion in free cash flow, 1.5x leverage, and a 4.2% dividend increase for 2026.

- 2026 guidance: organic growth of 3–4%, reported sales down 1.5 to 0.5% (due to divestitures), +100 bps in gross margin, marketing spend at 11%, EPS growth of 5–8%, and $1.15 billion in free cash flow.

- Strategic priorities include expanding Arm & Hammer from $2 billion to $3 billion via a Good-Better-Best portfolio, targeting #1 share in mouthwash and launching TheraBreath toothpaste, sustaining 1.5–2% incremental net-sales growth from innovation, and doubling down on international M&A.

- Q4 2025 net sales of $1,644.2 M (+3.9% YoY; organic +0.7%), adjusted gross margin of 45.5%, adjusted EPS of $0.86 (+11.7%), and cash from operations of $363.4 M.

- FY 2025 net sales of $6,203.2 M (+1.6%; organic +0.7%), adjusted EPS of $3.53 (+2.6%), cash from operations of $1.215 B, and a 4% dividend increase to $1.18 per share.

- 2026 outlook: organic sales growth of 3–4%, adjusted EPS growth of 5–8%, and operating cash flow of $1.15 B, with capex around $130 M.

- Q4 net sales rose 3.9% to $1,644.2 M, with organic sales up 0.7%, adjusted EPS of $0.86 (+11.7%), and cash from operations of $363.4 M

- Full-year 2025 net sales grew 1.6% to $6,203.2 M; adjusted EPS reached $3.53 (+2.6%), and operating cash flow was $1.215 B (+5.1%)

- 2026 outlook targets 3–4% organic sales growth, a 1.5% to 0.5% reported sales decline (exit impact), 100 bps gross margin expansion, and 5–8% adjusted EPS growth

- Q1 2026 guidance projects adjusted EPS of $0.92 per share, with organic sales growth of ~3%

- On December 9, 2025, Church & Dwight announced a definitive agreement to sell its VitaFusion® and L’il Critters® brands, including related trademarks and manufacturing and distribution facilities in Vancouver and Ridgefield, WA, to Piping Rock Health Products, Inc.

- The transaction is subject to customary closing conditions and is expected to close before the end of 2025.

- The VMS brands represent less than 5% of Church & Dwight’s anticipated 2025 net sales.

- Church & Dwight expects to incur a one-time, after-tax charge of $40–45 million in Q4 2025, net of proceeds, impairment, and transaction costs.

- This divestiture will enable Church & Dwight to focus on its core power brands, strengthening its portfolio and growth initiatives.

- Church & Dwight has entered a definitive agreement to sell the VitaFusion and L’il Critters brands to Piping Rock Health Products, including relevant trademarks, licenses and the Vancouver and Ridgefield manufacturing and distribution facilities.

- The transaction, subject to customary closing conditions, is expected to close before the end of 2025.

- These VMS brands account for less than 5% of the company's anticipated 2025 net sales, and the company expects a one-time, after-tax charge of $40–45 million in Q4 2025 for non-cash impairment and transition and transaction costs.

- The divestiture is aimed at strengthening focus on Church & Dwight’s remaining power brands to drive market-leading performance and growth initiatives.

Quarterly earnings call transcripts for CHURCH & DWIGHT CO INC /DE/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more