Earnings summaries and quarterly performance for EDGEWELL PERSONAL CARE.

Research analysts who have asked questions during EDGEWELL PERSONAL CARE earnings calls.

Peter Grom

UBS Group

7 questions for EPC

Susan Anderson

Canaccord Genuity Group

7 questions for EPC

Chris Carey

Wells Fargo Securities

4 questions for EPC

Christopher Carey

Wells Fargo & Company

4 questions for EPC

Olivia Tong

Raymond James

4 questions for EPC

Olivia Tong Cheang

Raymond James Financial, Inc.

4 questions for EPC

Nick Modi

RBC Capital Markets

2 questions for EPC

Nik Modi

RBC Capital Markets

2 questions for EPC

William Chappell

Truist Securities

2 questions for EPC

Dara Mohsenian

Morgan Stanley

1 question for EPC

Kate Grafstein

Barclays

1 question for EPC

Lauren Lieberman

Barclays

1 question for EPC

Recent press releases and 8-K filings for EPC.

- Edgewell Personal Care delivered a solid start to the first quarter of fiscal year 2026, with results modestly ahead of expectations, reporting consolidated organic net sales decline of 30 basis points, adjusted EPS of $0.03, and adjusted EBITDA of $38 million.

- The company successfully closed the sale of its Fem Care business, which was growth and margin dilutive and capital intensive, with proceeds directed towards debt reduction to lower leverage from approximately 4x to 3x by year-end.

- The full-year fiscal 2026 outlook for continuing operations remains unchanged, with adjusted EPS expected between $1.70-$2.10 (including a $0.44 headwind from the divestiture) and adjusted EBITDA projected from $245 million-$265 million (including a $44 million headwind).

- Edgewell is now focused on shave, sun, skincare, and grooming, and anticipates returning to organic net sales growth, driven by mid-single-digit growth in international markets starting in Q2, supported by 240 basis points of gross productivity savings in Q1.

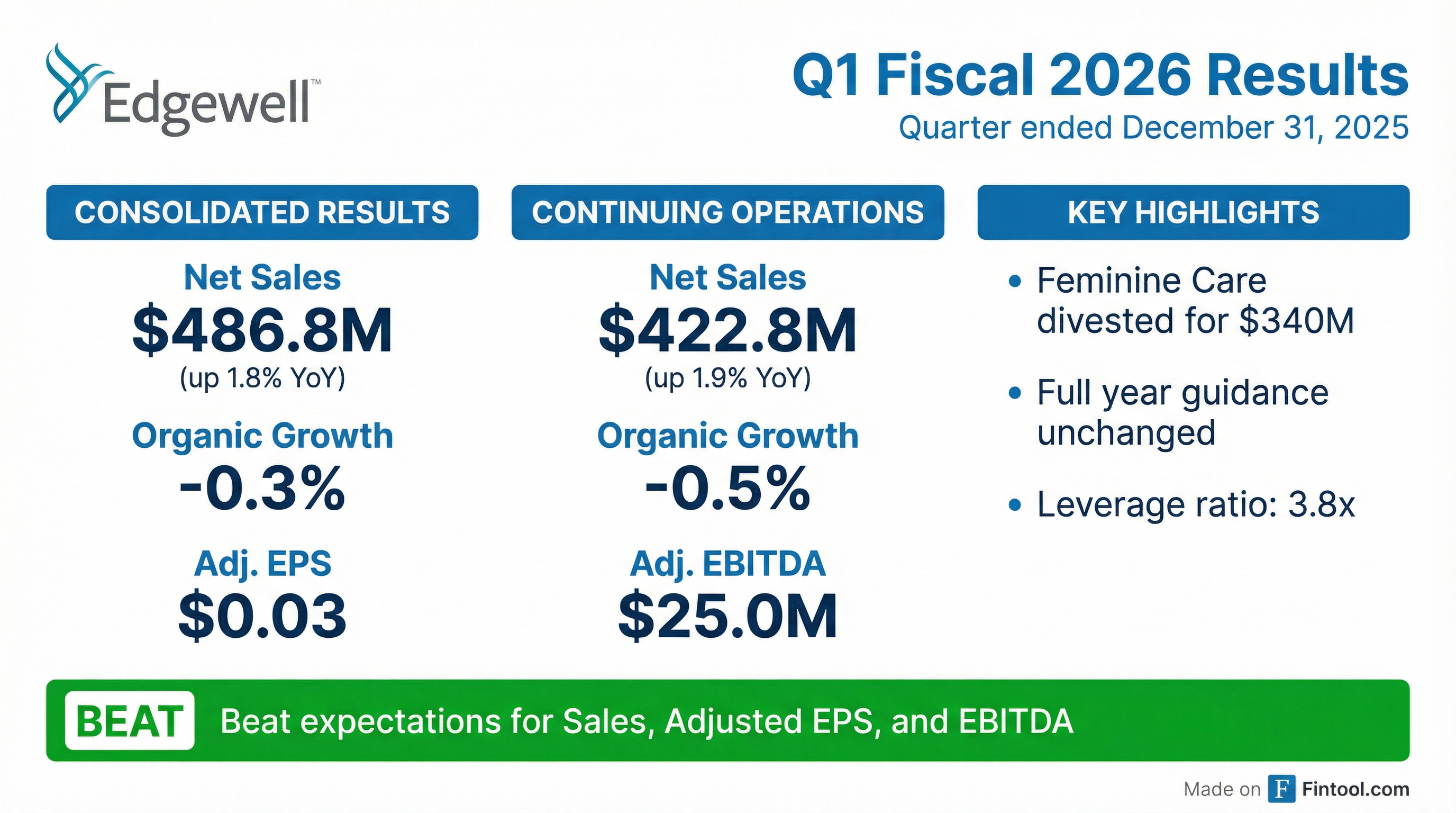

- Edgewell Personal Care reported Q1 fiscal year 2026 results for continuing operations, with organic net sales decreasing 50 basis points, an adjusted EPS loss of $0.16, and adjusted EBITDA of $25 million.

- The divestiture of the feminine care business closed on February 2, 2026, and is expected to create a $0.44 headwind to adjusted EPS and a $44 million headwind to adjusted EBITDA for fiscal year 2026.

- The fiscal year 2026 outlook for continuing operations remains unchanged, projecting organic net sales growth between down 1% and up 2%, adjusted EPS in the range of $1.70-$2.10, and adjusted EBITDA between $245 million-$265 million.

- The company anticipates 60 basis points of year-over-year total gross margin rate accretion for fiscal year 2026, with margin rate growth expected to return in the second half.

- Edgewell Personal Care delivered a solid start to fiscal Q1 2026, with results modestly ahead of expectations, reporting an adjusted EPS loss of $0.16 and adjusted EBITDA of $25 million.

- The company successfully closed the sale of its Fem Care business on February 2, 2026, which is now classified as discontinued operations. This divestiture is expected to result in an approximate $0.44 headwind to adjusted EPS and a $44 million headwind to adjusted EBITDA for fiscal year 2026.

- For fiscal year 2026, the outlook for continuing operations remains unchanged, with organic net sales growth anticipated to be in the range of down 1% to up 2%, adjusted EPS between $1.70-$2.10, and adjusted EBITDA between $245 million-$265 million. The company also expects 60 basis points of gross margin rate accretion.

- Proceeds from the FemCare divestiture are being directed towards debt reduction, aiming to lower leverage from around 4x to approximately 3x by year-end. The company also declared a quarterly dividend of $0.15 per share.

- Edgewell Personal Care Company reported Q1 fiscal 2026 results, with consolidated net sales of $486.8 million, an increase of 1.8%, and consolidated adjusted EPS of $0.03.

- The company successfully completed the divestiture of its Feminine Care business for $340 million, which is expected to have a favorable annualized impact on its previous outlook and strengthens its balance sheet.

- For continuing operations, Q1 fiscal 2026 net sales were $422.8 million, up 1.9%, and adjusted EPS was $(0.16).

- The full-year fiscal 2026 outlook for continuing operations remains consistent with the prior outlook, projecting adjusted EPS in the range of $1.70 to $2.10 and adjusted EBITDA between $245 million and $265 million.

- Edgewell Personal Care announced first fiscal quarter 2026 net sales from continuing operations of $422.8 million, an increase of 1.9%, and adjusted EPS from continuing operations of $(0.16), compared to $(0.10) in the prior year quarter.

- The company successfully completed the divestiture of its Feminine Care business for $340 million, which is expected to be favorable to its previous outlook on an annualized basis.

- The full-year fiscal 2026 outlook for continuing operations remains consistent with the prior outlook for sales, adjusted EPS, adjusted EBITDA, and free cash flow, with Adjusted EPS expected to be in the range of $1.70 to $2.10 and Adjusted EBITDA in the range of $245 to $265 million.

- The Board of Directors declared a quarterly cash dividend of $0.15 per common share for the first fiscal quarter of fiscal 2026, and $100.0 million remains available for share repurchase under the Board's 2025 authorization.

- Edgewell Personal Care Company (EPC) completed the sale of its Feminine Care business to Essity for $340 million on February 2, 2026.

- The company plans to use the net proceeds primarily to strengthen its balance sheet and pay down the $140.0 million outstanding balance of its U.S. revolving credit facility as of September 30, 2025.

- This divestiture is intended to simplify Edgewell's portfolio, allowing it to focus resources on shave, sun and skin care, and grooming, positioning the company to be more focused and agile.

- Edgewell Personal Care (EPC) completed the sale of its feminine care business to Essity for $340 million on February 2, 2026.

- The company intends to use the net proceeds primarily to strengthen its balance sheet and pay down its U.S. revolving credit facility.

- This divestiture is a strategic move to simplify Edgewell's portfolio, allowing it to focus resources on its core shave, sun and skin care, and grooming businesses.

- Edgewell expects to provide unaudited pro forma financial information reflecting the sale as a discontinued operation in a Form 8-K by February 6, 2026, with additional supplemental information during its Q1 Fiscal 2026 earnings call on February 9, 2026.

- Edgewell Personal Care (EPC) has implemented significant organizational changes, including a North American commercial reset with new leadership and a streamlined structure, and a global move to a regional hub model. The company is prioritizing winning in shave globally (especially the U.S.) and expanding its Sun Care and Grooming business internationally.

- EPC divested its Fem Care business for $340 million, aiming to shed a growth-dilutive, margin-dilutive, and capital-intensive asset. The proceeds will primarily be used to strengthen the balance sheet and pay down debt, with $90 million already repurchased in fiscal 2025.

- The company maintains a strong track record of cost productivity, expecting 300 basis points of total productivity savings in fiscal 2026. EPC is also increasing its A&P spending from 10% of sales in fiscal 2024 to 12% in fiscal 2026, particularly in the U.S., to drive brand building and growth.

- While North America's organic net sales declined 4.5% in fiscal 2025, the company exited Q4 at -1% and anticipates -1% to flat for fiscal 2026, with low single-digit growth in the latter half. The international business, comprising 40% of sales, has consistently delivered mid-single-digit growth for four years and is projected to continue this trend.

- Edgewell is undergoing a significant strategic transformation, including the divestiture of its FemCare business for $340 million, with 80% expected to convert to cash for debt reduction. This move allows for greater focus on core categories and removes a growth-dilutive asset.

- The company is implementing a commercial reset in North America, expecting organic net sales to improve from -4.5% in fiscal 2025 to -1% to flat in fiscal 2026, with low single-digit growth in the back half of fiscal 2026. This includes new leadership and increased brand investment.

- Edgewell's international business, representing 40% of its portfolio, has consistently delivered mid-single-digit growth for four years and is projected to continue this trend in fiscal 2026.

- Advertising and promotion (A&P) spending is planned to increase from 10% of sales in fiscal 2024 to 12% in fiscal 2026, supporting new campaigns and long-term business health.

- The company maintains a strong focus on cost productivity, consistently achieving 200-300 basis points of cost of goods sold productivity annually, with 300 basis points of total productivity savings expected in fiscal 2026.

- For Q4 2025, EPC reported 2.5% organic net sales growth, driven by international markets and robust growth in sun care, skin care, and grooming, but adjusted earnings per share (EPS) was $0.68, down from $0.72 in the prior quarter, impacted by lower gross margins, FX headwinds, and increased brand investments. Fiscal year 2025 organic net sales decreased 1.3%.

- For fiscal 2026, the company anticipates a return to organic net sales growth, with gross margin expected to increase despite $25 million (or $0.55 in pre-tax EPS) in tariff headwinds. Adjusted EPS is projected to be in the range of $2.15-$2.55, and adjusted EBITDA is expected between $290 million-$310 million.

- EPC is undergoing a transformation, including the planned divestiture of its feminine care segment, with proceeds to be directed towards debt repayment. The company is also optimizing its North American wet shave business and increasing investment in key brands like Schick, Billie, Hawaiian Tropic, Banana Boat, and Cremo.

Quarterly earnings call transcripts for EDGEWELL PERSONAL CARE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more