Earnings summaries and quarterly performance for COLGATE PALMOLIVE.

Executive leadership at COLGATE PALMOLIVE.

Noel Wallace

Chairman, President and Chief Executive Officer

Jennifer Daniels

Chief Legal Officer and Secretary

John Hazlin

Chief Growth Officer

Panagiotis Tsourapas

Chief Operating Officer, Europe, Asia Pacific, Africa Eurasia, Skin Health & Global Customer Development

Shane Grant

Chief Operating Officer, Americas

Stanley Sutula

Chief Financial Officer

Board of directors at COLGATE PALMOLIVE.

Brian Newman

Director

John Bilbrey

Director

John Cahill

Director

Kimberly Nelson

Director

Lisa Edwards

Director

Lorrie Norrington

Lead Independent Director

Martin Harris

Director

Martina Hund-Mejean

Director

Steven Cahillane

Director

Research analysts who have asked questions during COLGATE PALMOLIVE earnings calls.

Andrea Teixeira

JPMorgan Chase & Co.

6 questions for CL

Bonnie Herzog

Goldman Sachs

6 questions for CL

Dara Mohsenian

Morgan Stanley

6 questions for CL

Filippo Falorni

Citigroup Inc.

6 questions for CL

Kaumil Gajrawala

Jefferies

6 questions for CL

Kevin Grundy

BNP Paribas

6 questions for CL

Lauren Lieberman

Barclays

6 questions for CL

Christopher Carey

Wells Fargo & Company

5 questions for CL

Peter Grom

UBS Group

5 questions for CL

Robert Moskow

TD Cowen

5 questions for CL

Olivia Tong Cheang

Raymond James Financial, Inc.

4 questions for CL

Robert Ottenstein

Evercore ISI

4 questions for CL

Bryan Spillane

Bank of America

3 questions for CL

Korinne Wolfmeyer

Piper Sandler & Co.

3 questions for CL

Mark Astrachan

Stifel

3 questions for CL

Peter Galbo

Bank of America

3 questions for CL

Stephen Robert Powers

Deutsche Bank

3 questions for CL

Edward Lewis

Redburn Atlantic

2 questions for CL

Michael Lavery

Piper Sandler & Co.

2 questions for CL

Nik Modi

RBC Capital Markets

2 questions for CL

Olivia Tong

Raymond James

2 questions for CL

Rob Ottenstein

Evercore

2 questions for CL

Chris Carey

Wells Fargo Securities

1 question for CL

Sergio Matsumoto

TD Cowen

1 question for CL

Steve Powers

Deutsche Bank

1 question for CL

Recent press releases and 8-K filings for CL.

- Colgate closed 2025 with dollar sales growth, dollar EPS growth, organic growth and record cash flow, setting up momentum for 2026.

- The company launched its 2030 strategic plan centered on global reach, accelerated innovation, data/AI capabilities, omnichannel execution and productivity enhancements.

- From 2020–2025, Colgate invested $1 billion in incremental advertising to boost brand penetration, driving EPS expansion and total shareholder return outperformance.

- Advanced data analytics and AI tools now cover 80% of sales, including a Promo AI tool that delivered $4 million of incremental margin, and expansion of clean-room partnerships for hyper-personalization.

- Despite tariff headwinds, gross margin remained above 60%; Colgate generated record cash flow in 2025 and marked 63 consecutive years of dividend increases.

- 2025 net sales rose 1.4%, with organic sales up 1.4% (including a 0.7% drag from the exit of private-label pet business).

- 2025 Base Business EPS increased 3%, reflecting solid bottom-line growth in a challenging environment.

- Delivered record free cash flow of $3.6 billion and raised dividends to $2.06 per share, marking the 63rd consecutive year of dividend increases.

- 2026 organic sales growth is guided to 1–4%, supporting long-term growth targets.

- Launched a three-year productivity program expected to incur $200–300 million of cumulative pre-tax charges to fund strategic initiatives for 2030.

- 2030 strategic plan built on five pillars—global reach, brand innovation, data & AI, culture, and productivity—aimed at delivering consistent top-line and dollar EPS growth

- Major innovation investments include new product launches under Suavitel (odor-targeted softener), Palmolive Dishliquid with pump and spray offerings, and a core relaunch of Science Diet wet and prescription lines to address dual-morbidity in pets

- Data analytics & AI scaled across the business with marketing mix modeling covering ~80% of sales, proprietary Promo AI tools, and expansion of retailer clean rooms driving up to 16% sales uplift in Hill’s segment

- Focus on productivity & cash generation, including supply-chain reorganization and Funding the Growth initiatives, yielded record cash flow in 2025, low leverage, ~3% capex run rate, and 63 consecutive years of dividend increases

- Colgate delivered 2025 results: dollar sales and EPS growth, organic growth, record cash flow, and accelerated momentum despite a 70 bps headwind from exiting non-strategic private label.

- Launched 2030 strategic plan built on five pillars—global reach, market-leading innovation, productivity, data/AI-driven commercial excellence, and culture—to drive sustainable top- and bottom-line growth.

- Demonstrated AI-powered innovation with faster concept-to-scale pipelines across oral care (e.g., purple toothpaste, dual-chamber whitening) and adjacent categories, plus a major Hill’s Science Diet relaunch.

- Rolled out Omni-Demand Generation and expanded data/AI capabilities—80% of sales covered by marketing mix models, proprietary Promo AI for optimized promotions, and a Hill’s data clean room doubling media conversion rates.

- Reinforced culture as a competitive asset with 97% participation in the Colgate Connect survey and 2 billion beneficiaries of Bright Smiles, Bright Futures educational programs.

- Delivered organic sales, net sales, gross profit, base EPS and free cash flow growth in 2025 despite low category growth, raw material inflation and higher tariffs.

- Exited Q4 with organic sales growth above 3%, excluding private label, and saw sequential improvement in all divisions except North America.

- Announced a wider range for 2026 net sales and organic sales growth guidance to reflect ongoing category uncertainty.

- Emerging markets grew 4.5% organically in Q4, led by high-single-digit growth in Latin America and sequential improvement in Asia.

- Achieved record 2025 operating cash flow of $4.2 billion, low leverage and strong cash conversion, providing flexibility for capex, dividends, buybacks and disciplined M&A.

- Delivered organic sales, net sales, gross profit, base business EPS, and free cash flow growth for full-year 2025; achieved modest Q4 volume growth excluding the Prime100 acquisition and private label exit.

- Exited Q4 with improved organic sales momentum in three of four divisions, led by Latin America, Asia, and Hill’s, and sequential growth in most regions amid category stabilization.

- Provided 2026 guidance of 1%–4% organic sales growth—low end if categories worsen, mid-range if stable, high end if strengthen—and anticipated FX to add a low-single-digit benefit to revenue, mainly in H1.

- Launched new 2030 strategy and Strategic Growth & Productivity Program to drive brand-led growth, omni-channel demand generation, AI/data analytics, supply-chain optimization, and an organizational shift to a unified commercial model.

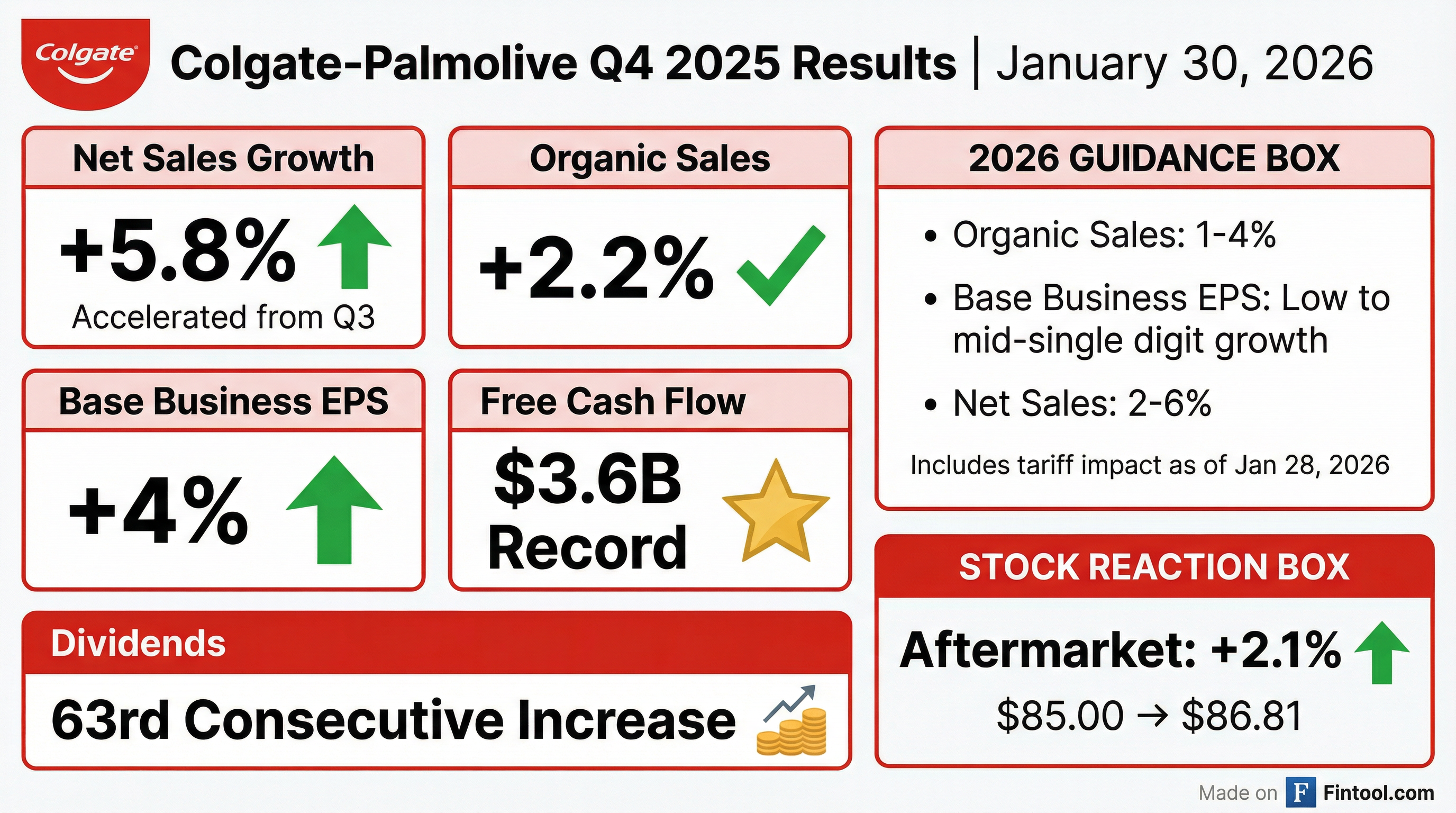

- Q4 net sales rose 5.8%; organic sales increased 2.2% (including a 0.9% drag from private-label pet exit), and Base Business EPS grew 4%.

- For full year 2025, net sales up 1.4%, organic sales up 1.4% (0.7% impact from pet exit), Base Business EPS +3%; delivered record operating cash flow and returned $2.9 billion to shareholders; dividends raised for the 63rd consecutive year.

- 2026 guidance: Net sales growth expected 2–6% (incl. low-single-digit FX benefit); organic sales growth 1–4%; Base Business EPS projected to rise low to mid-single digits.

- Strong 2025 performance amid volatility: organic sales, net sales, gross profit, base business EPS, and free cash flow all grew; management highlighted the resilience of its operating model.

- Exited Q4 with improved momentum: organic sales growth in all four categories with sequential improvement vs Q3 in every division except North America; completed the 2025 strategy adding $5 billion in sales and launched the 2030 strategy focusing on brands, innovation, omni-channel, digital/AI, supply chain, and culture.

- 2026 outlook: guidance of 1–4% organic sales growth, with category growth stabilizing at 1.5–2.5%, ongoing volatility, and FX expected to be a low-single-digit revenue tailwind (primarily H1 2026).

- Capital allocation strengthened by a record $4.2 billion operating cash flow in 2025, low leverage, prioritizing reinvestment, shareholder returns, and disciplined M&A; impairment on the skin health business noted but long-term value intact.

- Q4 2025 net sales rose 5.8% to $5,230 million; organic sales grew 2.2%.

- Q4 GAAP EPS declined 106% to $(0.05), driven by skin health goodwill and intangible asset impairments; Base Business EPS* increased 4% to $0.95.

- Full-year 2025 net sales were $20,382 million, up 1.4%, while GAAP EPS fell 25% to $2.63; Base Business EPS* rose 3% to $3.69.

- The company recorded a $919 million pre-tax non-cash impairment charge on goodwill and intangible assets related to its skin health business in Q4.

- Full-year net cash from operations reached a record $4,198 million, and Colgate returned $2.9 billion to shareholders through dividends and share repurchases.

- Full Year 2025 net sales up 1.4%, organic sales up 1.4%; GAAP EPS down 25% to $2.63, Base Business EPS up 3% to $3.69

- Fourth Quarter net sales up 5.8%, organic sales up 2.2%; GAAP EPS of $(0.05) vs. $0.90; Base Business EPS rose 4% to $0.95

- Record FY2025 operating cash flow of $4.198 billion; returned $2.9 billion to shareholders via dividends and share repurchases

- Colgate maintained leadership with 41.3% global toothpaste market share and 32.4% manual toothbrush share year-to-date

Quarterly earnings call transcripts for COLGATE PALMOLIVE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more