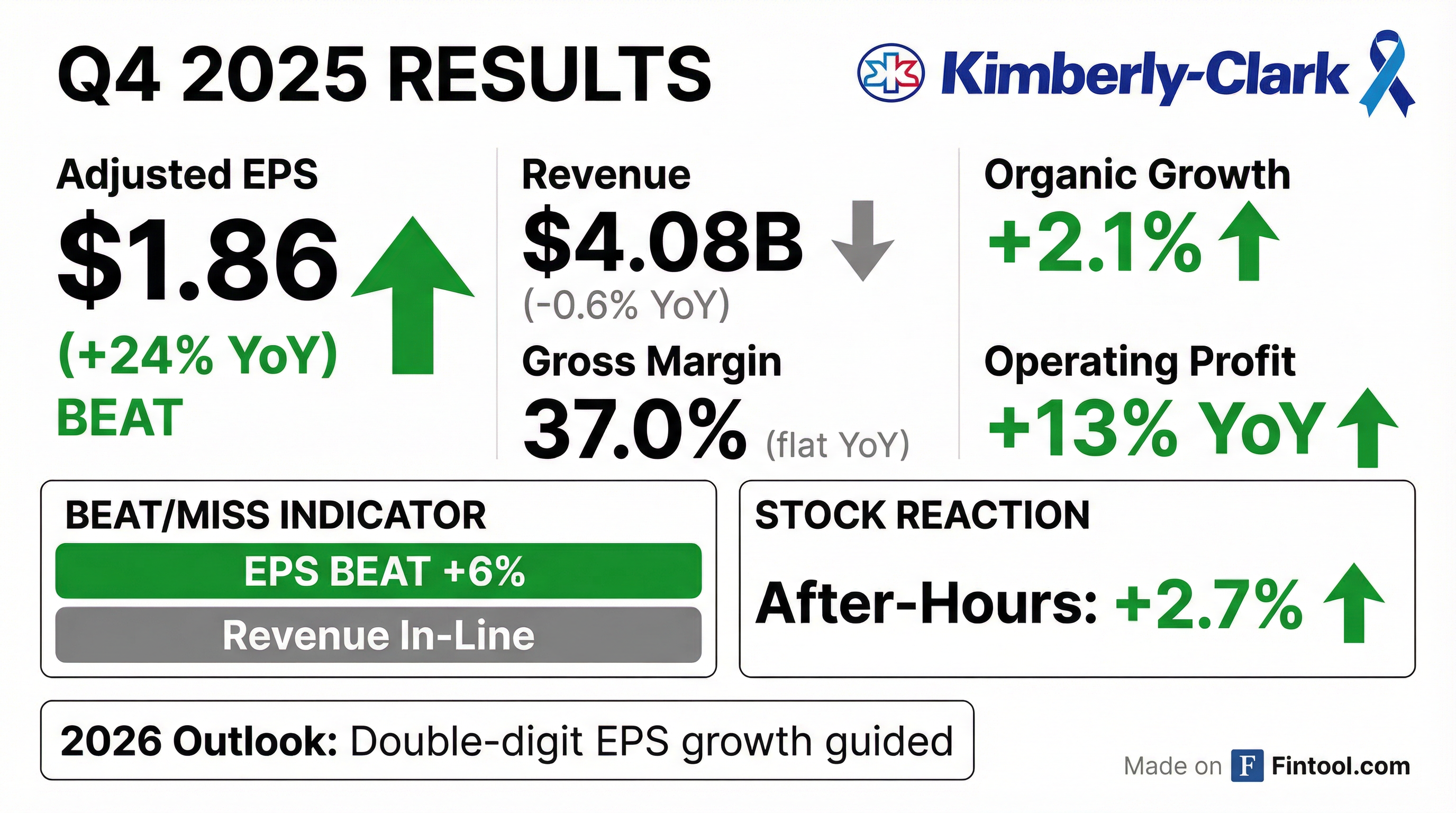

Earnings summaries and quarterly performance for KIMBERLY CLARK.

Executive leadership at KIMBERLY CLARK.

Michael D. Hsu

Chairman of the Board and Chief Executive Officer

Jeffrey Melucci

Chief Business, Strategy and Transformation Officer

Nelson Urdaneta

Senior Vice President and Chief Financial Officer

Russell Torres

President, North America

Zackery Hicks

Chief Digital and Technology Officer

Board of directors at KIMBERLY CLARK.

Christa S. Quarles

Director

Deeptha Khanna

Director

Deirdre A. Mahlan

Director

Dunia A. Shive

Director

Jaime A. Ramirez

Director

John W. Culver

Director

Joseph Romanelli

Director

Mae C. Jemison

Director

Mark T. Smucker

Director

S. Todd Maclin

Director

Sherilyn S. McCoy

Lead Independent Director

Sylvia M. Burwell

Director

Research analysts who have asked questions during KIMBERLY CLARK earnings calls.

Lauren Lieberman

Barclays

8 questions for KMB

Nik Modi

RBC Capital Markets

7 questions for KMB

Bonnie Herzog

Goldman Sachs

6 questions for KMB

Anna Lizzul

Bank of America Corporation

5 questions for KMB

Chris Carey

Wells Fargo Securities

4 questions for KMB

Javier Escalante Manzo

Evercore ISI

4 questions for KMB

Peter Grom

UBS Group

3 questions for KMB

Robert Moskow

TD Cowen

3 questions for KMB

Steve Powers

Deutsche Bank

3 questions for KMB

Christopher Carey

Wells Fargo & Company

2 questions for KMB

Dara Mohsenian

Morgan Stanley

2 questions for KMB

Edward Lewis

Redburn Atlantic

2 questions for KMB

Mike Lavery

Piper Sandler

2 questions for KMB

Kevin Grundy

BNP Paribas

1 question for KMB

Korinne Wolfmeyer

Piper Sandler & Co.

1 question for KMB

Michael Lavery

Piper Sandler & Co.

1 question for KMB

Stephen Robert Powers

Deutsche Bank

1 question for KMB

Recent press releases and 8-K filings for KMB.

- At the 2026 CAGNY Conference, Kimberly-Clark detailed how its Powering Care transformation and agile operating model will drive innovation-led growth and create generational value through the pending acquisition of Kenvue.

- Since launching Powering Care in 2024, the company achieved volume-plus-mix led growth, with market share up or even in two-thirds of its country/category combinations and innovation contributing to over 75% of growth in 2025.

- Kimberly-Clark’s R&D reorganization has produced its strongest pipeline ever, focusing on science-backed solutions to deliver top-tier personal care products at the lowest cost.

- The company’s brand-building blueprint, enhanced by best-in-class creative and digital capabilities, aims to capitalize on mid-to-high single digit demographic growth in baby care, women’s health, and active aging, especially with Kenvue’s brands.

- A culture of operating excellence has driven gross productivity improvements of approximately 6% of COGS over the past two years, positioning Kimberly-Clark to integrate Kenvue efficiently.

- The “Powering Care” model drove 2.6% organic volume + mix growth in 2025 and share gains in two-thirds of key markets, underpinned by accelerated innovation and execution.

- Over 75% of 2025 volume + mix growth originated from innovation, with new product launches delivering 285 bps of margin accretion, and the FY 2026–2028 pipeline is 160% the size of 2020 and 670 bps accretive.

- The company achieved 6% productivity gains for the second consecutive year, is 50% toward its $3 billion productivity goal, and has reinvested savings into $150 million higher A&P spend and $1.3 billion of capital expenditure planned for 2026.

- Kimberly-Clark remains on track to close the Kenvue acquisition in H2 2026, targeting $2.1 billion of net synergies across supply chain optimization, SG&A efficiencies, and expanded distribution.

- CEO Mike Hsu presented the Powering Care strategy, a virtuous cycle of innovation-led volume and mix growth, industry-leading productivity, and a globally wired operating model for agility and scale.

- Over 75% of 2025’s volume plus mix-led growth was driven by innovation, with launches delivering 285 bps of margin accretion, and the FY 2026–28 pipeline is 160% the size of 2020’s, with 670 bps of expected margin uplift.

- The company has achieved two consecutive years of 6% productivity gains, is 50% toward its $3 billion productivity target, and is optimizing its global network (e.g., the new Warren, Ohio mega-plant) to drive further cost reductions.

- Kimberly-Clark’s pending Kenvue acquisition, expected to close in H2 2026, has secured U.S. approval and targets $2.1 billion of net synergies through a joint Global Integration Management Office.

- Powering Care delivered 2.6% volume plus mix growth in 2025 with 8 consecutive quarters of organic growth, while achieving 6% productivity gains for two years and reaching 50% of its $3 billion productivity target ahead of schedule.

- Kimberly-Clark’s pending acquisition of Kenvue is on track to close in H2 2026, with integration planning across 30+ workstreams, U.S. regulatory clearance secured, and a target of $2.1 billion in net synergies from supply chain, SG&A and IT harmonization.

- Digital commerce strength drives performance: e-commerce volumes exceed twice those of brick-and-mortar, contributing to +890 bps Huggies share gains and +260 bps Kotex gains since 2019.

- Powering Care’s innovation-led strategy has delivered two consecutive years of broad-based volume plus mix growth, outpacing ~2% category growth and positioning for acceleration in faster-growing Kenvue categories.

- $16B+ net sales ex International Family Care forecast in 2025, with 2.6% volume + mix growth in FY25, marking 8 consecutive quarters of volume + mix-led performance and share gains or holds in 2/3 country-category combinations

- Adjusted operating margin expanded to 16.6% (up 180 bps) and adjusted gross margin to 37.3%, underpinned by the 2024 Transformation Initiative

- “Powering Care” strategy driving >60% of net sales from innovation, supported by accelerated digital engagement and rapid global scaling of premium features

- Pending mergers with Kenvue (est. ~$32B revenue, ~$7B EBITDA pre-synergies) and the International Family Care joint venture with Suzano to enhance consumer-centric care offerings

- On January 29, 2026, shareholders of both Kimberly-Clark and Kenvue voted overwhelmingly to approve Kimberly-Clark’s acquisition of Kenvue, with approximately 96% approval at Kimberly-Clark’s Special Meeting and 99% approval at Kenvue’s Special Meeting (representing 77% of all outstanding Kenvue shares).

- At Kimberly-Clark’s meeting, 239,054,286 shares voted in favor of issuing common stock to Kenvue holders, 8,439,618 against and 683,100 abstained, with 74.8% of shares present or represented, constituting a quorum.

- The transaction is expected to close in the second half of 2026, subject to regulatory approvals and other customary closing conditions.

- At Special Meetings on Jan. 29, 2026, 96% of Kimberly-Clark shares and 99% of Kenvue shares present voted to approve the transaction (the latter representing ~77% of Kenvue’s outstanding shares).

- The deal is expected to close in the second half of 2026, subject to regulatory approvals and customary closing conditions.

- The combination aims to create a global health and wellness leader by uniting Kimberly-Clark’s and Kenvue’s consumer health portfolios.

- At the Jan 29, 2026 special meeting, shareholders approved the issuance of new common shares under the merger agreement with Kenvue dated Nov 2, 2025.

- The only proposal presented was the share issuance; an adjournment proposal was deemed unnecessary as votes met the requirement.

- Final voting results will be reported via Form 8-K within four business days of the meeting.

- Kimberly-Clark held a virtual special meeting, confirmed a quorum, and put to vote the issuance of common shares under the merger agreement dated November 2, 2025, with Kenvue and related entities (issuance proposal).

- The board recommended a vote for the issuance proposal, and preliminary results indicate shareholders have approved the share issuance for the merger.

- Final voting results will be disclosed in a Form 8-K filing within four business days of the meeting adjournment.

- In Q4 2025, volume-plus-mix growth extended to eight consecutive quarters, with North America volume-mix up 1.7% (3.6% two-year stack) and full-year up 2.1% (4.1% two-year), driven by tiered innovation and marketing.

- The company gained enterprise-weighted share and delivered its strongest productivity quarter, marking a second straight year of industry-leading productivity.

- For 2026, Kimberly-Clark expects organic sales growth in line with or ahead of ~2% global category growth, with volumes set to accelerate in the second half and input costs largely flat.

- Gross margins are projected to expand in 2026, driven by ~6% productivity savings, flat input costs, and disciplined SG&A, advancing toward 40% adjusted gross margin and 18–20% operating margin by 2030 (ex-Kenvue).

- The Kenvue acquisition, subject to a Jan 29 shareholder vote, remains on track for an H2 2026 close, while the IFP divestiture is set for mid-2026.

Fintool News

In-depth analysis and coverage of KIMBERLY CLARK.

Quarterly earnings call transcripts for KIMBERLY CLARK.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more