Earnings summaries and quarterly performance for COCA COLA.

Executive leadership at COCA COLA.

James Quincey

Chief Executive Officer

Henrique Braun

Executive Vice President and Chief Operating Officer

Jennifer Mann

Executive Vice President and President, North America operating unit

John Murphy

President and Chief Financial Officer

Manuel Arroyo

Executive Vice President and Global Chief Marketing Officer

Monica Howard Douglas

Executive Vice President and Global General Counsel

Board of directors at COCA COLA.

Amity Millhiser

Director

Ana Botín

Director

Bela Bajaria

Director

Caroline Tsay

Director

Carolyn Everson

Director

Christopher Davis

Director

David Weinberg

Lead Independent Director

Herb Allen

Director

Maria Elena Lagomasino

Director

Max Levchin

Director

Thomas Gayner

Director

Research analysts who have asked questions during COCA COLA earnings calls.

Andrea Teixeira

JPMorgan Chase & Co.

6 questions for KO

Dara Mohsenian

Morgan Stanley

6 questions for KO

Filippo Falorni

Citigroup Inc.

6 questions for KO

Kaumil Gajrawala

Jefferies

6 questions for KO

Lauren Lieberman

Barclays

6 questions for KO

Charlie Higgs

Redburn Atlantic

5 questions for KO

Peter Grom

UBS Group

5 questions for KO

Bonnie Herzog

Goldman Sachs

4 questions for KO

Carlos Laboy

HSBC

4 questions for KO

Christopher Carey

Wells Fargo & Company

4 questions for KO

Robert Moskow

TD Cowen

4 questions for KO

Robert Ottenstein

Evercore ISI

4 questions for KO

Bryan Spillane

Bank of America

3 questions for KO

Michael Lavery

Piper Sandler & Co.

3 questions for KO

Peter Galbo

Bank of America

3 questions for KO

Stephen Robert Powers

Deutsche Bank

3 questions for KO

William Chappell

Truist Securities

3 questions for KO

Chris Carey

Wells Fargo Securities

2 questions for KO

Kevin Grundy

BNP Paribas

2 questions for KO

Rob Ottenstein

Evercore

2 questions for KO

Stephen Powers

Deutsche Bank

2 questions for KO

Nik Modi

RBC Capital Markets

1 question for KO

Steve Powers

Deutsche Bank

1 question for KO

Recent press releases and 8-K filings for KO.

- Q4 net sales rose 17.6% to $2.13 billion; operating income increased 42.3% to $542.6 million.

- Q4 net income grew 65.9% to $449.2 million; diluted EPS rose 64.9% to $0.46.

- FY2025 net sales increased 10.7% to $8.29 billion; net income rose 26.3% to $1.91 billion; diluted EPS was $1.94.

- Effective Feb. 25, 2026, Rob Gehring was named CEO, Americas; Guy Carling CEO, EMEA & OSP; and Emelie Tirre Chief Strategy Officer.

- FEMSA consolidated Q4 revenues grew 5.7% and income from operations increased 8.5% year-on-year.

- Proximity Americas unit saw Q4 revenues up 5.3% and operating income climb 7.7% versus 4Q24.

- Spin by OXXO active users reached 10.5 million (+22.0%) and Spin Premia loyalty users hit 28.1 million (+13.8%), with OXXO Mexico tender at 49.3% (vs. 40.7% in 4Q24).

- Coca-Cola FEMSA delivered Q4 revenue growth of 2.9% and a 13.3% rise in operating income year-over-year.

- 2026 guidance targets 4–5% organic revenue growth, 7–8% comparable EPS growth, and ~$12.2 B free cash flow (Non-GAAP).

- Since 2017, Coca-Cola has delivered 7% average organic revenue growth vs. 4% for CPG peers, generated 2.1× cash flow vs. 1.1× peers, expanded comparable operating margin by +5 pts vs. –3 pts peers, and achieved 23% ROIC vs. 12% peers in 2025.

- Free cash flow has risen from $9.7 B in 2023 to $11.4 B in 2025 (ex-fairlife payment) with a 2026 outlook of ~$12.2 B.

- The long-term growth algorithm targets 4–6% organic revenue growth, 6–8% operating income growth, 7–9% EPS growth, and 90–95% adjusted FCF conversion.

- Henrique Braun, CEO-elect, highlighted three enduring strengths—industry opportunity, 32 billion-dollar brands, and a unique bottler system—and three guiding principles for the next chapter: consumer-centricity, local “Must Win Missions,” and digital integration.

- The company has pruned its brand portfolio from 400+ to fewer than 170 brands, improved innovation success rates, and will accelerate insight-driven, locally sourced ideas with global scale potential.

- CFO John Murphy reaffirmed 2026 targets: organic revenue growth within the long-term algorithm, high single-digit EPS growth, continued brand and market investments, and sustained free cash flow generation.

- The operating model remains focused on top-line growth; margin expansion via cross-enterprise procurement and modern marketing; cash flow; balance-sheet optimization through refranchising; and a new “Fuel Life 360” tool to optimize end-to-end spending with bottler partners.

- Coca-Cola introduced Henrique Braun as COO and CEO-elect, succeeding James Quincey, and highlighted three enduring strengths: vast industry opportunity, the ability to build and grow billion-dollar brands, and an unmatched bottler system for global scale.

- The company will pursue three new growth principles—enhanced consumer-centricity via the “4 I’s” (Insights, Innovation, Intimacy, Integration), agile local-to-global “Must Win Missions” for rapid innovation, and embedding digital in every connection—to accelerate its next chapter.

- CFO John Murphy reaffirmed 2026 targets: organic revenue growth in line with its long-term algorithm and high single-digit EPS growth, bolstered by currency tailwinds, continued brand and market investments, and strong free cash flow.

- Strategic financial priorities include further margin expansion through gross-margin discipline, more efficient modern marketing, an optimized asset-light model, and a new “Fuel Life 360” platform for end-to-end resource allocation and spend effectiveness.

- Highlighted three enduring strengths: belief in the beverage industry’s long-term opportunity, growth of billion-dollar brands from 30 to 32, and an unparalleled bottling system driving a multiplying effect with aligned partners.

- Introduced three new principles to accelerate growth: enhanced consumer-centricity via the “4 Is” (insights, innovation, intimacy, integration), embedding digital in every system connection, and a constructive discontent mindset to continually improve.

- Launched a “Must Win Missions” framework to align local market development stages with brand priorities and tailored incentives, aiming to scale new billion-dollar brands more rapidly.

- CFO reaffirmed 2026 financial targets: organic revenue growth within the long-term algorithm and high single-digit EPS growth, aided by currency tailwinds and robust underlying cash flow generation.

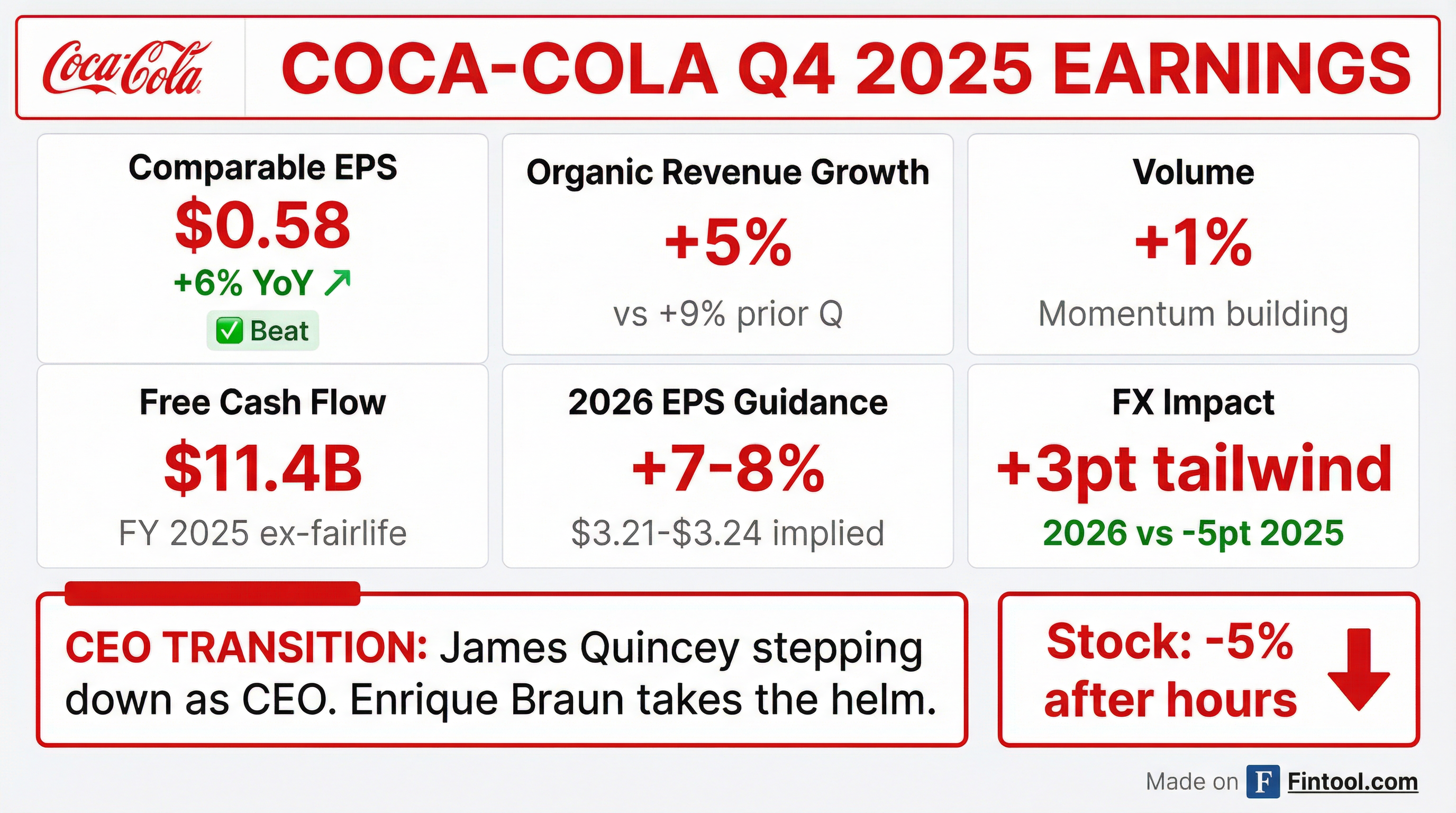

- Q4 2025 financials: organic revenues +5%, unit case volume +1%, price/mix +1%, comparable EPS $0.58 (+6% YoY), free cash flow $11.4 B, and net debt leverage 1.6×.

- 2026 guidance: organic revenue growth of 4–5%, comparable EPS growth of 7–8% to a base of $3 in 2025, and free cash flow of ~$12.2 B with ~$2.2 B in capital investments.

- Leadership change: James Quincey steps down with Q4 call as CEO, transitioning to Executive Chair; Enrique Braun named next CEO of The Coca-Cola Company.

- Capital allocation emphasizes long-term investment and shareholder returns: 63 years of consecutive dividend increases (2025 payout ratio 73% of adj. FCF), disciplined share buybacks, and growth-oriented capex including bottler investments.

- Strategic positioning includes a portfolio of 32 billion-dollar brands (75% outside sparkling), 7% avg. organic revenue growth since 2017, and focus on digitization, franchising, and consumer engagement.

- Consolidated gross margin for Q4 2025 was 60.0% GAAP (60.0% comparable non-GAAP), with underlying margin expanding ~120 bps driven by organic revenue growth, offset by currency headwinds and divestiture impacts.

- Consolidated operating margin for Q4 2025 was 15.6% GAAP, down due to an impairment of the BODYARMOR® trademark and economic hedging, while comparable non-GAAP operating margin rose to 24.4% with underlying expansion of ~210 bps.

- Items impacting comparability primarily reflect economic hedging activities and trademark impairment, and the acquisitions/divestitures tailwind was mainly from the sale of finished-product operations in Nigeria.

- In Q4 2025, Coca-Cola delivered 5% organic revenue growth, driven by 1% unit case growth and underlying 4% pricing, despite a 3-point mix headwind, and achieved comparable EPS of $0.58, up 6% year-over-year amid a 5-point currency headwind.

- For full-year 2025, volume was flat, comparable EPS grew 4%, free cash flow was $11.4 billion (93% conversion), and net debt leverage stood at 1.6× EBITDA, below target.

- 2026 guidance includes 4–5% organic revenue growth, 7–8% comparable EPS growth (currency-neutral, excluding acquisitions/divestitures), and $12.2 billion of free cash flow, with continued dividend growth.

- Leadership transition: Henrique Braun to become CEO (from COO), with James Quincey moving to Executive Chair; focus areas include talent recruitment, innovation pipeline, and digital-first consumer engagement.

- CEO transition: James Quincey will move to Chairman and COO Henrique Braun is named CEO-elect, reflecting a planned leadership succession.

- 2025 performance: Delivered on top- and bottom-line guidance with organic revenue growth in line with its long-term algorithm, flat unit case volume that improved in Q4, strong comparable operating margin expansion, and 4% comparable EPS growth despite a 5-point currency headwind and a 2-point tax rate increase.

- Q4 financials: Organic revenues rose 5%, unit case growth 1%, and price/mix growth 1%; comparable Q4 EPS was $0.58 (+6% YoY); full-year free cash flow was $11.4 billion with 93% conversion and net debt leverage of 1.6×.

- 2026 guidance: Forecasts 4–5% organic revenue growth, 5–6% comparable currency-neutral EPS growth (7–8% including divestiture impacts vs $3 in 2025), and approximately $12.2 billion free cash flow.

Fintool News

In-depth analysis and coverage of COCA COLA.

Quarterly earnings call transcripts for COCA COLA.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more