Earnings summaries and quarterly performance for Keurig Dr Pepper.

Executive leadership at Keurig Dr Pepper.

Timothy Cofer

Chief Executive Officer

Anthony Shoemaker

Chief Legal Officer, General Counsel and Secretary

Eric Gorli

President, U.S. Refreshment Beverages

Justin Whitmore

President, KDP Energy

Mary Beth DeNooyer

Chief Human Resources Officer

Patrick Minogue

President, U.S. Coffee

Roger Johnson

Chief Supply Chain Officer

Sudhanshu Priyadarshi

Chief Financial Officer and President, International

Board of directors at Keurig Dr Pepper.

Research analysts who have asked questions during Keurig Dr Pepper earnings calls.

Filippo Falorni

Citigroup Inc.

9 questions for KDP

Peter Grom

UBS Group

9 questions for KDP

Christopher Carey

Wells Fargo & Company

7 questions for KDP

Lauren Lieberman

Barclays

7 questions for KDP

Kaumil Gajrawala

Jefferies

6 questions for KDP

Steve Powers

Deutsche Bank

6 questions for KDP

Dara Mohsenian

Morgan Stanley

5 questions for KDP

Peter Galbo

Bank of America

5 questions for KDP

Andrea Teixeira

JPMorgan Chase & Co.

3 questions for KDP

Chris Carey

Wells Fargo Securities

3 questions for KDP

Kevin Grundy

BNP Paribas

2 questions for KDP

Michael Lavery

Piper Sandler & Co.

2 questions for KDP

Robert Moskow

TD Cowen

2 questions for KDP

Robert Ottenstein

Evercore ISI

2 questions for KDP

Bonnie Herzog

Goldman Sachs

1 question for KDP

Brett Cooper

Consumer Edge Research

1 question for KDP

Nik Modi

RBC Capital Markets

1 question for KDP

Stephen Robert Powers

Deutsche Bank

1 question for KDP

Recent press releases and 8-K filings for KDP.

- The Extraordinary General Meeting of JDE Peet’s adopted all proposals related to Keurig Dr Pepper’s recommended public offer, including Post-Closing Restructuring Measures, Board appointments and amendments to the Articles of Association.

- The Acceptance Threshold for the Offer was reduced from 95% to 80% of the Company’s outstanding capital as at the Tender Closing Date.

- The Offer Period expires on 27 March 2026 at 17:40 CET (unless extended); shareholders should contact their financial intermediary for tender deadlines.

- Voting results will be published on JDE Peet’s website, and draft minutes of the EGM will be released within three months of the meeting date.

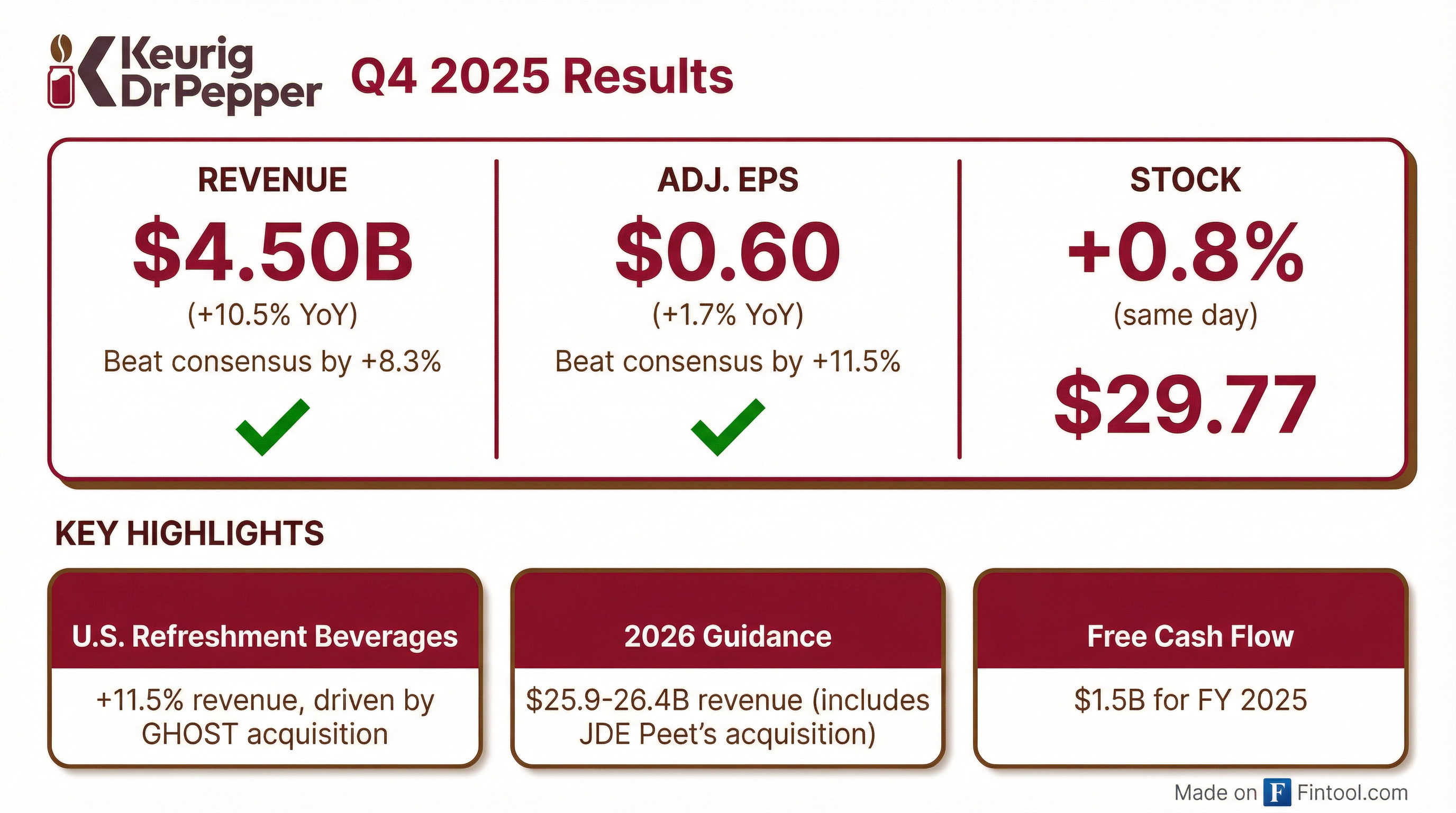

- 2025 results: On a constant currency basis, full-year net sales +8.6%, operating income +4.9%, and EPS +7.3%; Q4 net sales +9.9% and EPS of $0.60 (+1.7%).

- U.S. Refreshment Beverages drove growth with Q4 net sales +11.5% and operating income +8.7%, while U.S. Coffee net sales rose 3.9% but operating income declined 8.8% due to cost pressures.

- JDE Peet’s acquisition on track with tender offer launched and expected close in early April 2026; planning steps under way to separate into Beverage Co. and Global Coffee Co. by end of 2026.

- 2026 guidance: standalone KDP net sales +4–6% and EPS +4–6% (constant currency); Q1 EPS of $0.36–0.37 vs. $0.42 prior; free cash flow forecast of $2 billion.

- 2025 net sales increased 8.6% (constant currency); Q4 net sales grew 9.9% and EPS was $0.60, up 1.7% year-over-year; free cash flow was $1.519 billion

- 2026 guidance includes net sales of $25.9 billion–$26.4 billion (inc. $8.5 billion–$8.7 billion from JDE Peet’s) and low double-digit EPS growth in constant currency; standalone net sales and EPS growth are guided at 4%–6%

- Acquisition of JDE Peet’s is set to close in early April, with regulatory approvals secured; the combined company will be separated into Beverage Co. and Global Coffee Co. by end-2026

- Financing plan includes $4.5 billion convertible preferred equity for the beverage company, a $4 billion Coffee Co. pod manufacturing JV and debt funding; standalone free cash flow is expected to rise to ~$2 billion in 2026

- FY 2025 net sales rose 8.6% (constant currency) and EPS grew 7.3%, driven by base business strength and a 4-point contribution from GHOST brands.

- Q4 2025 net sales increased 9.9%, with net price realization adding 6 pp and volume/mix 3.9 pp (3.6 pp from GHOST); operating income up 4.8% and EPS +1.7% to $0.60.

- U.S. Refreshment Beverages net sales climbed 11.5% and operating income +8.7%; U.S. Coffee net sales +3.9% (pod shipments down 2.8%); international net sales grew mid-teens cc with operating income +20%.

- 2026 guidance: Combined net sales of $25.9 – $26.4 B; low double-digit EPS growth; standalone KDP net sales and EPS +4 – 6% cc; Q1 EPS of $0.36 – $0.37 vs. $0.42 LY.

- JDE Peet’s acquisition expected to close in early April with integration planning underway and a target separation into Beverage Co. and Global Coffee Co. by end 2026.

- Q4 net sales of $4.5 B (+9.9% YoY), adjusted operating income $1.2 B (+4.8%), and adjusted EPS $0.60 (+1.7%).

- FY 2025 net sales of $16.6 B (+8.6%), adjusted operating income $4.2 B (+4.9%), and adjusted EPS $2.05 (+7.3%).

- On track to close JDE Peet’s acquisition in early April, with integration workstreams advancing and separation readiness targeted by end 2026.

- 2026 outlook: net sales of $25.9–$26.4 B; low-double-digit adjusted EPS growth, including 4–6% standalone KDP growth and $8.5–$8.7 B from JDE Peet’s; interest expense $1.07–$1.12 B.

- 2025 results: On a constant-currency basis, net sales grew 8.6%, operating income 4.9%, and EPS 7.3%; Q4 net sales rose 9.9% and EPS was $0.60 (+1.7%).

- 2026 guidance: Combined net sales of $25.9–$26.4 billion with low double-digit EPS growth (including a 6–7 pp JDE Peet’s contribution); standalone KDP sees 4–6% net sales and EPS growth. Q1 EPS is guided to $0.36–$0.37 vs $0.42 year-ago.

- JDE Peet’s acquisition: Tender offer launched, with closing targeted for early April 2026, adding $8.5–$8.7 billion to net sales and ~10% EPS accretion in the first year post-acquisition.

- Financing structure: Beverage Co. convertible preferred upsized to $4.5 billion, Global Coffee Co. Pod Manufacturing JV of $4 billion, with the balance funded by debt; existing KDP debt stays with Beverage Co..

- Q4 2025 net sales rose 9.9%, FY 2025 net sales grew 8.6%, operating income +4.9%, EPS +7.3%; free cash flow was $1,519 million

- 2026 outlook inclusive of JDE Peet’s: net sales of $25.9–$26.4 billion, standalone KDP net sales +4–6% and EPS +4–6%; JDE Peet’s to add $8.5–$8.7 billion to net sales and 6–7 pts to EPS

- Plan to raise $4.5 billion of convertible preferred equity for Beverage Co., finalize a $4 billion Pod Manufacturing JV, and issue $9 billion of debt; targeting separation into two pure-play companies by end 2026

- Governance changes: Pam Path to assume board chair in Q1; adding two independent directors; splitting Nominating & Governance and Compensation Committees to support separation

- 2025 net sales rose 8.6% on a constant-currency basis and EPS increased 7.3% for the full year.

- Q4 net sales grew 9.9%, driven by pricing (+6 pts) and volume/mix (+3.9 pts), and EPS reached $0.60, up 1.7% year-over-year.

- 2026 outlook (including JDE Peet’s from Q2): net sales of $25.9 B–$26.4 B and low double-digit EPS growth; standalone KDP sees 4%–6% net sales and 4%–6% EPS growth, with Q1 EPS at $0.36–$0.37.

- The JDE Peet’s acquisition is on track to close in early April, with integration plans and a separation into Beverage Co. and Global Coffee Co. by end-2026 underway.

- Net sales rose 10.5% to $4.50 bn in Q4 and 8.2% to $16.60 bn for FY 2025; adjusted diluted EPS was $0.60 (+1.7% YoY) in Q4 and $2.05 (+7.3% YoY) for the full year.

- Operating cash flow reached $712 m in Q4 and nearly $2 bn for the full year; free cash flow was $564 m in Q4 and $1.52 bn for FY 2025.

- 2026 guidance calls for $25.9–26.4 bn net sales and low-double-digit constant currency adjusted EPS growth, including the anticipated contribution from JDE Peet’s.

- Board chair to transition from Bob Gamgort to Pamela Patsley at the end of Q1 2026.

- Keurig Dr Pepper delivered Q4 net sales of $4.50 B, up 10.5%, and full-year net sales of $16.60 B, up 8.2%; adjusted EPS was $0.60 in Q4 (+1.7%) and $2.05 for FY 2025 (+7.3%).

- Operating cash flow reached $1.99 B and free cash flow was $1.52 B in 2025, supporting strong liquidity.

- The Board Chair role will transition from Bob Gamgort to Pamela Patsley at the end of Q1 2026, with Gamgort stepping off the Board on that date.

- For 2026, KDP expects net sales of $25.9–26.4 B and low-double-digit constant currency adjusted EPS growth, including the anticipated contribution from JDE Peet’s.

Fintool News

In-depth analysis and coverage of Keurig Dr Pepper.

Quarterly earnings call transcripts for Keurig Dr Pepper.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more