Earnings summaries and quarterly performance for STARBUCKS.

Executive leadership at STARBUCKS.

Board of directors at STARBUCKS.

Andy Campion

Director

Beth Ford

Director

Dambisa Moyo

Director

Daniel Servitje

Director

Jørgen Vig Knudstorp

Lead Independent Director

Marissa Mayer

Director

Mike Sievert

Director

Neal Mohan

Director

Ritch Allison

Director

Wei Zhang

Director

Research analysts who have asked questions during STARBUCKS earnings calls.

David Palmer

Evercore ISI

9 questions for SBUX

David Tarantino

Robert W. Baird & Co.

9 questions for SBUX

Jeffrey Bernstein

Barclays

9 questions for SBUX

John Ivankoe

JPMorgan Chase & Co.

9 questions for SBUX

Brian Harbour

Morgan Stanley

8 questions for SBUX

Danilo Gargiulo

AllianceBernstein

8 questions for SBUX

Lauren Silberman

Deutsche Bank

8 questions for SBUX

Sara Senatore

Bank of America

8 questions for SBUX

Andrew Charles

TD Cowen

7 questions for SBUX

Christine Cho

Goldman Sachs Group

5 questions for SBUX

Jon Tower

Citigroup

5 questions for SBUX

Peter Saleh

BTIG

5 questions for SBUX

Chris O'cull

Stifel Financial Corp

4 questions for SBUX

Andrew Barish

Jefferies

2 questions for SBUX

Chris O'Cull

Stifel

2 questions for SBUX

Christopher O'Cull

Stifel, Nicolaus & Company

2 questions for SBUX

Gregory Francfort

Guggenheim Securities

2 questions for SBUX

Hyun Jin Cho

Goldman Sachs

2 questions for SBUX

Zach Fadem

Wells Fargo

2 questions for SBUX

Katherine Griffin

Bank of America

1 question for SBUX

Sharon Zackfia

William Blair & Company

1 question for SBUX

Zachary Fadem

Wells Fargo

1 question for SBUX

Recent press releases and 8-K filings for SBUX.

- Tata Starbucks, the 50:50 JV between Starbucks and Tata Group, now operates over 500 stores across more than 80 cities in India, a market ranked among Starbucks’ top five globally.

- Operational losses nearly doubled to ₹1.5 billion (~$16.5 million) in the year to March, even as revenue and same-store sales showed modest improvement.

- The unit remains cash positive but is prioritizing footprint expansion, targeting 1,000 stores by 2028 and rolling out nine drive-through and transit-led formats.

- Launching premium Starbucks Reserve outlets (second Delhi location opened in November) and local menu innovations (e.g., protein-foam, cold-brew) to attract younger consumers.

- Starbucks will launch a three-tier Rewards program (Green, Gold, Reserve) on March 10, covering 35.5 million active U.S. members to drive personalization and frequency.

- Earning rates adjust to 1 Star/$1 (Green), 1.2 Stars/$1 (Gold) and 1.7 Stars/$1 (Reserve); status requires 500 Stars for Gold or 2,500 Stars for Reserve within 12 months.

- New redemption options include a 60-Star $2-off choice, retained reward levels up to 400 Stars, Free Mod Mondays for Green members, and extended birthday grace periods.

- Star expiration rules change so Green Stars last six months (renewable monthly), while Gold and Reserve Stars never expire if status is maintained; shares fell about 1.5% on the announcement.

- Unveiled fiscal 2028 financial framework targeting 5%+ consolidated net revenue growth, 3%+ comparable store sales, 13.5–15% non-GAAP operating margin, $3.35–$4.00 EPS, and 2,000+ net new stores.

- Reported early turnaround progress in Q1 FY 2026 with same-store sales growth across all major markets and full rollout of Green Apron Service, achieving average peak throughput under 4 minutes.

- Announced a reimagined Starbucks Rewards program launching March 10 with three tiers (Green, Gold, Reserve) and enhanced benefits, noting Rewards drove nearly 60% of U.S. company-operated revenue in FY 2025.

- Detailed global expansion plans including up to 5,000 new U.S. stores, doubling the international footprint toward 40,000 locations—with 15,000–20,000 new stores in China—and shifting to an asset-light licensed model in its China JV.

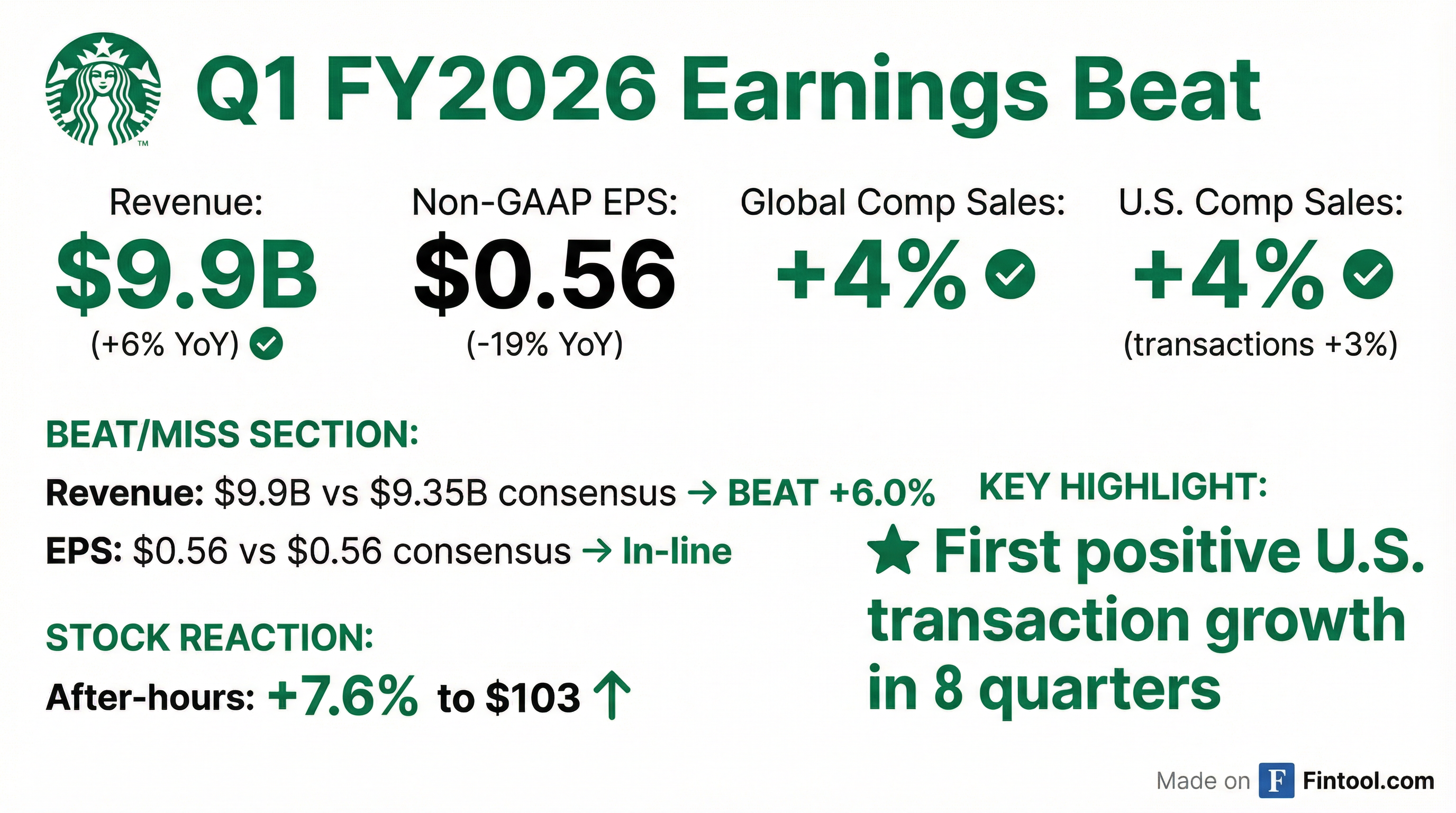

- Starbucks posted $9.9 billion in consolidated net revenues for Q1 FY26, up about 6% year-over-year; global comparable-store sales rose roughly 4% (5% internationally) and the company opened 128 net new stores.

- GAAP EPS declined to $0.26, while North America operating income fell to $867 million and the segment margin dropped to 11.9% from 16.7% a year earlier.

- CEO Brian Niccol outlined operational fixes—including menu revamps and digital upgrades—and set long-term targets of at least 3% comparable-store growth through FY28 and an operating margin of 13.5%–15%.

- Management reaffirmed guidance for roughly 3% consolidated and U.S. comp-store growth in FY26, projected FY26 diluted EPS of $2.15–$2.40, and longer-range goals of 5%+ net-revenue growth and annual EPS of $3.35–$4.00 by FY28.

- Back to Starbucks turnaround focuses on the core coffeehouse experience—streamlined operations via Green Apron Service, Third Place revitalization, and expanded digital and delivery channels to deepen customer engagement.

- Targets 3%+ comp growth annually and 5%+ net revenue growth by fiscal 2028, with operating margins of 13.5%–15% and EPS of $3.35–$4.00.

- Plans to open >2,000 net new stores in FY 2028 (≈400 U.S. company-operated, 150–200 U.S. licensed, and ≥1,500 international) by optimizing store design and reducing build costs.

- International JV in China shifts to a licensed model, lifting segment margins to the high teens immediately and targeting >20% by FY 2028.

- Established fiscal 2028 targets of 5%+ consolidated net revenue growth, 13.5%–15% operating margin and $3.35–$4.00 EPS.

- Plans to open 2,000 net new coffeehouses globally by FY 2028, including ramping to 400 net new U.S. company-operated stores annually.

- China joint venture with Boyu shifts ~8,000 stores to a licensed model, trimming International revenue to ~$5 billion but boosting segment margins to the high teens and targeting >20% by FY 2028.

- Launching Reimagine Rewards on March 10 with three membership tiers, aimed at a $150 million revenue lift, alongside app enhancements like scheduled ordering and an AI ordering companion.

- Starbucks outlined a three-year financial framework through fiscal 2028, targeting at least 3% global and U.S. comp growth, 5%+ consolidated net revenue growth, 13.5–15% operating margins, and $3.35–4.00 EPS.

- The “Back to Starbucks” plan reinforces store fundamentals with investments in Green Apron Service, AI-enabled tools (Smart Queue, Green Assist), $500 million+ in labor, and 25,000 additional seats in U.S. stores by fiscal 2026.

- International growth is driven by an asset-light model—over 22,000 stores in 88 markets—and a China JV with Boyu shifting 8,000 China stores to a licensed model, boosting international operating margin from 13% toward the high teens.

- Disciplined cost and capital allocation includes CapEx at ~5% of revenues, 90+ cost-saving initiatives across the P&L, maintaining a BBB+ rating, prioritizing deleveraging over buybacks, and growing dividends toward a 50% payout ratio.

- Global same-store sales rose 4% (U.S. +4%; international ~5%; China ~7%), marking the first U.S. comparable-sales gain in eight quarters.

- Revenue increased to $9.9 billion, and management reinstated full-year targets with a forecast of at least 3% same-store growth for fiscal 2026 under CEO Brian Niccol.

- Profit margins compressed sharply, falling from about 16.7% to 11.9% as adjusted EPS and net income missed estimates due to labor investments, store upgrades, higher coffee costs and tariffs.

- The ongoing Starbucks Workers United strike, involving roughly 11,000 workers across about 550 stores, poses a headwind to margin recovery.

- Q1 consolidated revenue $9.9 billion (+5%), global comp store sales +4%, 128 net new coffeehouses; operating margin 10.1%, EPS $0.56 (–19%)

- North America revenue $7.3 billion (+3%), U.S. comps +4% (transactions +3%); Starbucks Rewards 90-day active members reached 35.5 million

- International net revenue $2.1 billion (+10%), comp store sales +5%, led by China comps +7%

- Margin contraction driven by North America (–420 bps) from investments and cost inflation (tariffs, coffee); consolidated G&A down 7%, effective tax rate 26.8%

- Announced JV with Boyu Capital (Boyu acquires up to 60% of China retail, Starbucks retains 40%, closing expected spring) and FY2026 guidance: >3% global comps, 600–650 net new coffeehouses, slight margin expansion, EPS $2.15–$2.40

- Starbucks reported $9.9 billion in global net revenue, up 5% YoY on a constant currency basis.

- Global comparable sales increased 4%, with 4% in North America and 5% internationally (7% in China).

- Global operating margin declined by 180 bps to 10.1% YoY.

- Diluted net EPS was $0.56, down 19% YoY.

- Global store count reached 41,118, a 1% increase YoY.

Fintool News

In-depth analysis and coverage of STARBUCKS.

Starbucks Unveils $4 EPS Target for FY28 at First Investor Day Under CEO Niccol

Starbucks Posts First U.S. Sales Growth in Two Years as Niccol's 'Back to Starbucks' Plan Gains Traction

Starbucks Delivers First Transaction Growth in Two Years as 'Back to Starbucks' Strategy Gains Traction

Quarterly earnings call transcripts for STARBUCKS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more