Earnings summaries and quarterly performance for PEPSICO.

Executive leadership at PEPSICO.

Ramon Laguarta

Chairman and Chief Executive Officer

David Flavell

Executive Vice President, General Counsel and Corporate Secretary

Rebecca Schmitt

Executive Vice President and Chief People Officer

Silviu Popovici

Chief Executive Officer, Europe, Middle East and Africa

Stephen Schmitt

Executive Vice President and Chief Financial Officer

Steven Williams

Chief Executive Officer, North America

Board of directors at PEPSICO.

Alberto Weisser

Director

Cesar Conde

Director

Daniel Vasella

Director

David Page

Director

Dina Dublon

Director

Edith Cooper

Director

Ian Cook

Presiding Director

Jennifer Bailey

Director

Michelle Gass

Director

Robert Pohlad

Director

Segun Agbaje

Director

Sir Dave Lewis

Director

Susan Diamond

Director

Research analysts who have asked questions during PEPSICO earnings calls.

Dara Mohsenian

Morgan Stanley

8 questions for PEP

Filippo Falorni

Citigroup Inc.

8 questions for PEP

Kaumil Gajrawala

Jefferies

8 questions for PEP

Lauren Lieberman

Barclays

8 questions for PEP

Peter Grom

UBS Group

8 questions for PEP

Andrea Teixeira

JPMorgan Chase & Co.

7 questions for PEP

Bonnie Herzog

Goldman Sachs

7 questions for PEP

Michael Lavery

Piper Sandler & Co.

7 questions for PEP

Robert Moskow

TD Cowen

7 questions for PEP

Robert Ottenstein

Evercore ISI

7 questions for PEP

Kevin Grundy

BNP Paribas

6 questions for PEP

Peter Galbo

Bank of America

5 questions for PEP

Steve Powers

Deutsche Bank

5 questions for PEP

Chris Carey

Wells Fargo Securities

4 questions for PEP

Christopher Carey

Wells Fargo & Company

4 questions for PEP

Bryan Spillane

Bank of America

3 questions for PEP

Stephen Robert Powers

Deutsche Bank

2 questions for PEP

Charlie Higgs

Redburn Atlantic

1 question for PEP

Drew Levine

JPMorgan Chase & Co.

1 question for PEP

Gregory Melich

Evercore ISI

1 question for PEP

Stephen Powers

Deutsche Bank

1 question for PEP

Recent press releases and 8-K filings for PEP.

- PepsiCo acquired poppi for $1.95 billion in March 2025.

- Post-acquisition, co-founders Allison and Stephen Ellsworth signed with SolComms to manage executive communications, including storytelling, media relations, and thought leadership.

- The duo will focus on advising consumer brands, angel investing, and public speaking following the sale.

- Delivered 5% net revenue growth to DKK 15,723 m and 12% EBIT increase, lifting the margin by 90 bps to 14.0% in 2025.

- Adjusted EPS rose 25% to DKK 31.4, ROIC improved to 13%, and financial leverage stood at NIBD/EBITDA 2.0x at year-end.

- Proposed ordinary dividend of DKK 16.00 per share and launched a DKK 400 m share buy-back program running through August 14, 2026.

- 2026 outlook: 6–10% organic EBIT growth with net revenue broadly flat versus 2025, supported by operational efficiencies and revenue‐quality initiatives.

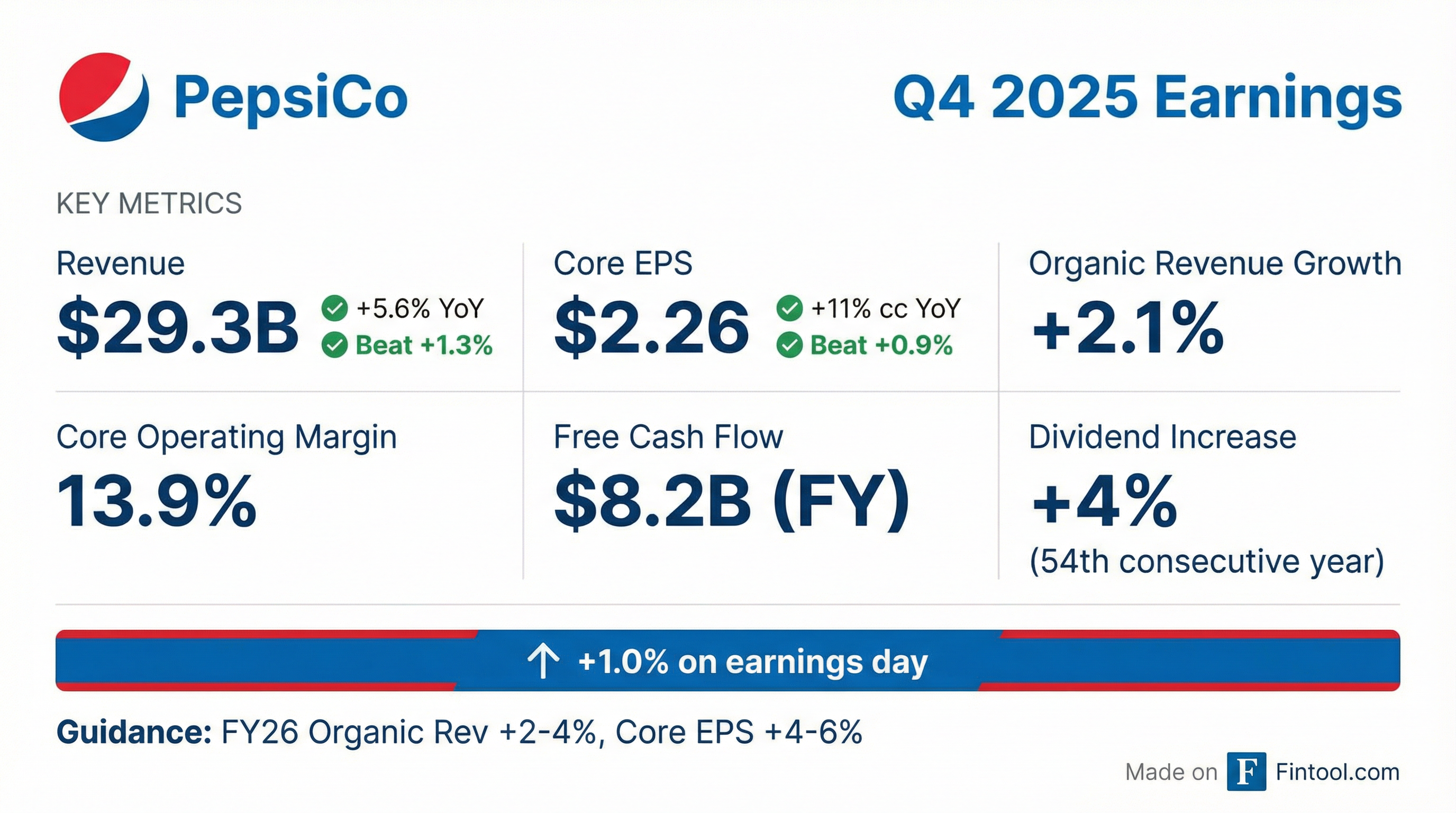

- $94 billion in revenue and $15 billion in operating profit in FY 2025; accelerating net revenue growth through restaging of top brands (Lay’s, Tostitos, Gatorade, Quaker) and innovation across fiber, hydration, protein, and energy segments

- Emphasis on expanding away-from-home occasions via crafted beverage concepts and mini-meals, backed by a multi-year productivity push using technology such as digital twins and automated ordering

- Q4 momentum saw net revenue growth improve from –2% to 5.5%, organic net revenue growth from ~1% to >2%, core operating margin up over 100 bps, and double-digit EPS growth

- Capital allocation priorities include ~5% of net revenue in capex, free cash flow conversion target >90% by 2027 (post-TCJA), a 4% dividend increase marking the 54th consecutive year, and selective M&A

- PepsiCo is restaging four flagship brands (Lay’s, Tostitos, Gatorade, Quaker) with simpler ingredients, alternative cooking oils and fresh‐look packaging globally—leveraging events like FIFA to drive trial and share gains.

- The company targets a multi-year productivity acceleration, delivering record savings to fund strategic investments and achieve +100 bps operating-margin improvement over three years through scale and tech adoption.

- Innovation priorities include zero/low-sugar, no-artificial products by 2027, plus expansion in fiber, hydration, protein and energy segments via new offerings like Propel powders and Doritos Protein.

- PepsiCo is expanding away-from-home distribution and new consumption occasions, with concepts such as DRIPS by Pepsi (crafted beverages) and mini-meals to capture out-of-home growth.

- Q4 momentum saw organic net-revenue growth rise from 1% to >2%, total net-revenue up 5.5%, double-digit EPS growth, and >100 bps operating-margin expansion—while marking the 54th consecutive year of dividend increases.

- Accelerating growth through portfolio transformation and away-from-home expansion, with a focus on innovation in core brands and creating new consumption occasions outside the home.

- Restaging four $15 billion brands (Lay’s, Tostitos, Gatorade, Quaker) globally by introducing simple, natural ingredients, alternative cooking oils, reduced sugar and no artificial colors/flavors by end-2027.

- Developing mini-meal and D2C concepts such as Doritos Loaded, Sabra and Siete meal kits, and testing store-within-a-store and restaurant-powered delivery in Europe to capture on-the-go occasions.

- Targeting at least 100 bps of core operating margin improvement over three years, capping capital expenditures below 5%, and achieving ~90% free cash flow conversion in 2027 after the final TCJA payment.

- Maintaining long-term financial algorithm of mid-single-digit organic revenue growth, high single-digit EPS growth and a rising dividend, while acknowledging 2026 guidance will ramp through the year to these goals.

- On February 4, 2026, PepsiCo issued four tranches totaling €2,500 million: €500 million floating-rate notes due 2028, €650 million 3.300% notes due 2034, €850 million 3.700% notes due 2038 and €500 million 4.150% notes due 2047.

- The offering generated net proceeds of €2,482 million, which will be used for general corporate purposes, including repayment of commercial paper.

- Joint book-running managers for the deal were BNP Paribas, Goldman Sachs, Mizuho International and Morgan Stanley.

- PepsiCo will cut suggested retail prices on popular snacks—Lay’s, Doritos, Cheetos and Tostitos—by up to 15%, including roughly 14% off an 8-oz bag of Lay’s and an $0.80 cut on a 9.25-oz bag of Doritos, starting this week ahead of Super Bowl shopping.

- Price reductions are described as “selective and surgical”, focusing on products where price is the biggest barrier; actual in-store prices may vary by retailer.

- The move forms part of measures under an agreement with activist investor Elliott Investment Management, under which PepsiCo has agreed to cut its North American product lineup by about 20%.

- Alongside the price cuts, PepsiCo reported stronger-than-expected Q4 results, noting a 1% decline in North American food volumes and saw its stock rise 5% on the announcement.

- Affordability initiatives in Frito-Lay North America to drive volume, sales, and op margins early in 2026, funded by productivity gains; expecting double-digit shelf-space gains at resets.

- 2026 guidance sees organic sales strengthening in H2, with balanced first-half and second-half EPS; international mid-single-digit growth and acceleration from North America foods and beverages.

- Restaging of core brands (Lay’s, Tostitos, Gatorade, Quaker) and targeted perimeter innovations (e.g., Naked, protein, fiber) to simplify ingredients and capture new consumer segments.

- Anticipates broader GLP-1 adoption; focusing on portion control, hydration (Gatorade, Propel), fiber and protein innovations to meet evolving consumer needs.

- Piloting integrated food and beverage distribution in Texas and Florida, showing initial cost-efficiency and service benefits; further roll-out plans by year-end.

- Frito-Lay will grow volume, net revenue and operating margin in 2026, funded by productivity gains to accelerate affordability initiatives, with average shelf space gains in resets running in double digits.

- Company-wide sales are expected to strengthen in 2H 2026, with EPS growth balanced between first and second halves, and organic growth boosted by integrations of Poppi, Siete and Alani Nu.

- Health-focused innovation and portion control (single-serve, fiber, protein) are key to address broader GLP-1 adoption, preserving category relevance through smaller packs and functional beverages.

- Beverage margins to continue improving, leveraging the energy segment via Celsius and Alani Nu partnerships with growing distribution and brand-building investments.

- Guidance assumes a stretched low-income US consumer, mid-single digit growth in international markets (notably Mexico, China, Middle East) and caution in Western Europe, forming the basis for the 2026 outlook.

- Frito-Lay unit forecast: expects PFMA volume, net revenue and operating margin expansion in 2026, driven by targeted affordability investments funded by productivity gains and anticipated double-digit shelf-space gains in retail resets starting March/April.

- Organic sales guidance: projects international segment to grow mid-single digits (19-quarter trend), with further acceleration in North America beverages and foods in H2 2026; EPS to be balanced between H1 and H2.

- Brand innovation: major relaunches of Lay’s, Tostitos, Gatorade and Quaker featuring simpler ingredients and enhanced functionality, alongside peripheral launches (e.g., Naked, Pepsi prebiotics) to attract younger consumers.

- GLP-1 response: plans to address rising adoption of weight-loss drugs via portion-controlled formats, expanded hydration (Gatorade, Propel), fiber and protein offerings to maintain category relevance.

Fintool News

In-depth analysis and coverage of PEPSICO.

Quarterly earnings call transcripts for PEPSICO.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more