Earnings summaries and quarterly performance for Mondelez International.

Executive leadership at Mondelez International.

Dirk Van de Put

Chief Executive Officer

Gustavo Valle

Executive Vice President and President, North America

Laura Stein

Executive Vice President, Corporate & Legal Affairs; General Counsel and Corporate Secretary

Luca Zaramella

Executive Vice President and Chief Financial Officer

Stephanie Lilak

Executive Vice President and Chief People Officer

Volker Kuhn

Executive Vice President and President, Europe

Board of directors at Mondelez International.

Brian J. McNamara

Director

Cees 't Hart

Director

Ertharin Cousin

Director

Jane Hamilton Nielsen

Director

Jorge S. Mesquita

Director

Michael A. Todman

Director

Nancy McKinstry

Director

Patrick T. Siewert

Lead Independent Director

Paula A. Price

Director

Research analysts who have asked questions during Mondelez International earnings calls.

Andrew Lazar

Barclays PLC

9 questions for MDLZ

Peter Galbo

Bank of America

9 questions for MDLZ

David Palmer

Evercore ISI

7 questions for MDLZ

Megan Clapp

Morgan Stanley

6 questions for MDLZ

Chris Carey

Wells Fargo Securities

4 questions for MDLZ

Kenneth Goldman

JPMorgan Chase & Co.

3 questions for MDLZ

Alexia Howard

AllianceBernstein

2 questions for MDLZ

Christopher Carey

Wells Fargo & Company

2 questions for MDLZ

Max Gumport

BNP Paribas

2 questions for MDLZ

Michael Lavery

Piper Sandler & Co.

2 questions for MDLZ

Robert Moskow

TD Cowen

2 questions for MDLZ

Scott Marks

Jefferies

2 questions for MDLZ

Thomas Palmer

Citigroup Inc.

2 questions for MDLZ

Tom Palmer

JPMorgan Chase & Co.

2 questions for MDLZ

John Baumgartner

Mizuho Securities

1 question for MDLZ

Max Andrew Gumport

BNP Paribas

1 question for MDLZ

Megan Christine Alexander

Morgan Stanley

1 question for MDLZ

Recent press releases and 8-K filings for MDLZ.

- $1.5 billion 364-day revolving credit agreement effective February 18, 2026, maturing February 17, 2027, with option to extend to February 17, 2028.

- JPMorgan Chase Bank, N.A. appointed administrative agent, alongside Bank of America, Citibank and HSBC as co-syndication agents, with a broad syndicate of global banks as joint lead arrangers.

- Facility fee accrues at 0.035%–0.090% per annum based on S&P/Moody’s ratings, plus a 0.50% term-out fee on loans outstanding at termination.

- Covenants include maintaining minimum shareholders’ equity of $25 billion, adherence to anti-corruption laws, and quarterly and annual financial reporting.

- Mondelēz presents a proven growth model at CAGNY 2026 underpinned by four strategic pillars, targeting 3–5% organic net revenue growth, high-single-digit adjusted EPS growth (constant FX), and $3 billion+ free cash flow.

- Revenue mix aims to shift toward core snacks, increasing from 59% in 2012 to 80% in 2025, with core categories leading global positions (e.g., #1 biscuits at 17.0% share).

- The global footprint balances 40% emerging markets growing at +13.4% vs. 60% developed markets at +5.0%, positioning the company to capture higher-growth regions.

- Execution focuses on region-specific initiatives: in North America, strengthening US biscuits via distribution expansion and supply chain optimization; in Europe, accelerating chocolate growth through pricing, portfolio expansion, and cocoa resilience; in emerging markets, driving volume-led growth with a local-first model.

- Mondelēz reaffirms its long-term algorithm targeting 3%–5% organic net revenue growth, high-single-digit adjusted EPS growth, and >$3 billion in free cash flow.

- North America delivered 4% CAGR over the past five years with $11 billion in 2025 net revenue; plans include expanding value-priced packs, premium offerings, and a supply chain upgrade yielding benefits by early 2027.

- Europe achieved 8% CAGR over the past five years with $15 billion in 2025 net revenue and ≈20% market share; strategic actions focus on right-price architecture, premium innovations, and channel expansion.

- Emerging markets now represent a $15 billion+ business (≈40% of 2025 revenues), growing at a 13.4% CAGR over five years, driven by a local-first model and prioritized expansion in China, India, Brazil, and Mexico.

- The company is targeting >$4 billion in free cash flow going forward and has returned >$30 billion to shareholders over the past eight years through dividends and share repurchases.

- Mondelēz reaffirmed its long-term growth algorithm—3–5% organic net revenue growth, high-single-digit adjusted EPS growth, and over $3 billion free cash flow—with its 2026 outlook unchanged.

- North America plan centers on six growth platforms: affordable price points, premium and health-focused innovations, on-the-go formats, enhanced in-store presence, e-commerce expansion, and a supply chain upgrade to drive share gains and margin improvement by early 2027.

- Europe strategy features a five-pillar chocolate playbook: right price-pack architecture, premium segment and adjacency expansion (e.g., Biscoff co-brands), channel diversification, disruptive in-store activations, and strengthened cocoa supply-chain resilience amid input-cost volatility.

- Emerging Markets are positioned as a volume-led growth engine, targeting mid-to-high-single-digit growth through route-to-market expansion, digital commerce, and scaling in China, India, Brazil, and Mexico with core snacks leadership.

- Core focus on chocolate, biscuits, and baked snacks (≈80% of net revenues), targeting 3%–5% organic net revenue growth, reinvesting half of gross profit growth, and generating > $3 billion free cash flow annually.

- North America delivered ≈4% CAGR over the past five years with 2025 net revenue of $11 billion, activating six consumer-centric growth platforms and a multi-year supply chain upgrade to deliver cost benefits by early 2027.

- Europe achieved ≈8% CAGR over five years with 2025 net revenue of $15 billion, executing price-pack architecture refinements, premium and on-the-go innovations, under-indexed channel expansion, and cocoa supply-chain resilience measures to restore volume growth amid input-cost deflation.

- Emerging markets (≈40% of 2025 revenues; > $15 billion business) aim for mid- to high-single-digit volume growth by doubling distribution in China and India, scaling multi-category leadership in Brazil and Mexico, and leveraging bolt-on acquisitions for further market penetration.

- Capital allocation is anchored on >$4 billion free cash flow in 2026, continued double-digit dividend growth, $15 billion share repurchase since 2018, and targeted bolt-on M&A to expand core and adjacent categories.

- Mondelēz reaffirmed its long-term growth algorithm of 3–5% organic net revenue growth, high-single-digit adjusted EPS growth and > $3 billion free cash flow.

- Despite unprecedented cocoa cost inflation, the company achieved ~$38.5 billion in 2025 net revenues, underscoring portfolio resilience.

- Core categories—chocolate, biscuits and baked snacks—now account for ~80% of net revenues, with a target of 90% over time.

- Strategy emphasizes reaccelerating Developed Markets (U.S. biscuits, Europe chocolate) and scaling volume-led growth in Emerging Markets (China, India, Brazil, Mexico).

- Focus on unlocking value through strong cash generation and disciplined capital allocation for brand reinvestment and bolt-on M&A.

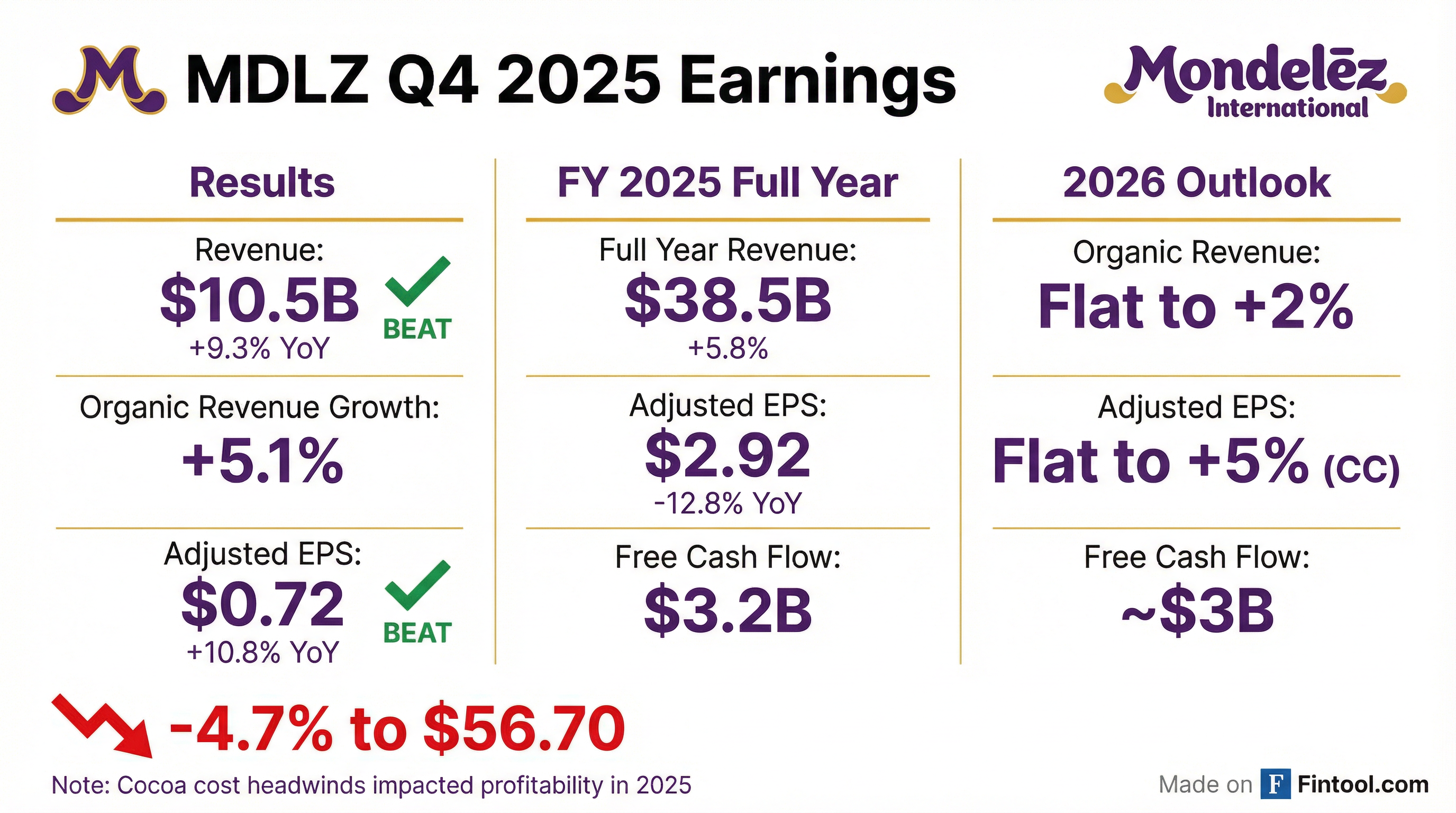

- Q4 revenue of $10.5 billion and adjusted EPS of $0.72 topped estimates.

- 2026 guidance: organic revenue flat to 2% and adjusted EPS flat to up 5%, with a one-time $1 billion inventory accounting adjustment weighing on Q1.

- Cocoa costs largely hedged at higher prices, so spot-price declines won’t yield near-term savings; expects chocolate margins to recover materially in 2027.

- Noted weakness in U.S. biscuit volumes (down ~4% over three months) amid muted demand; plans to boost advertising and consumer investment after 2025 cuts.

- Mondelēz executed its chocolate price-pack architecture playbook in 2025 but saw higher than expected elasticity in northern Europe, prompting repricing, renewed innovation (notably Biscoff), and increased brand investments for 2026; with cocoa prices having fallen sharply, the company expects a significant margin uplift in 2027 as earlier‐locked costs roll off.

- The 2026 guidance calls for 0–2% organic net revenue growth with flat chocolate pricing, and includes a $500 million Q1 headwind from inventory revaluation as 2026 cocoa pipeline costs reset lower than 2025 exit levels; flexibility is built in for potential competitor reactions to the cocoa price decline.

- In North America, consumer confidence near historic lows has driven shoppers toward value channels and multi-packs, causing biscuit volumes to fall; Mondelēz plans to boost media spend, optimize promotions, expand into under-indexed channels, and modernize its supply chain to restore volume and margin growth.

- Emerging markets delivered high-single-digit growth in 2025, and while Argentina’s economic turmoil masked regional performance, Mondelēz expects Latin America and EMEA to sustain volume momentum in 2026 through mix improvements and reduced elasticity from prior price increases.

- 2026 guidance embeds 0–2% organic sales growth, with prudence for U.S. biscuit softness and European chocolate stability amid customer negotiations; includes a $500 million Q1 headwind from cocoa inventory revaluation as pipeline costs lock above spot.

- Cocoa prices plunged unexpectedly, pressuring short-term margins but positioning for significant margin expansion in 2027; the company is fully covered for 2026 at higher costs and maintains flexibility depending on competitor reactions.

- Chocolate strategy for 2026 emphasizes price‐point adjustments, stepped-up brand investments and innovation-led initiatives (notably Biscoff collaborations), plus in-store activations to rebuild consumption frequency and volume.

- North America faces low consumer confidence and a −4% biscuit volume decline in Q4; the response focuses on targeted promotions, channel expansion, premium snacking growth (e.g., Perfect Bar, Tate’s) and supply‐chain modernization, without broad-based price cuts.

- Mondelēz delivered Q4 2025 organic net revenue growth of +5.1%, led by cocoa-driven pricing (+9.9pp) offset by volume/mix declines (-4.8pp).

- Q4 adjusted EPS was $0.72, up 4.6% at constant currency, driven by cost discipline and lapping high cocoa costs.

- Full-year free cash flow reached $3.2 B, and the company deployed $4.9 B in dividends and share repurchases in 2025.

- For 2026, Mondelēz expects organic net revenue growth flat to +2%, adjusted EPS growth flat to +5%, and free cash flow of about $3 B.

Fintool News

In-depth analysis and coverage of Mondelez International.

Quarterly earnings call transcripts for Mondelez International.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more