Earnings summaries and quarterly performance for Kenvue.

Executive leadership at Kenvue.

Kirk Perry

Interim Chief Executive Officer

Amit Banati

Chief Financial Officer

Anindya Dasgupta

Group President, Asia Pacific

Bernardo Tavares

Chief Technology & Data Officer

Carlton Lawson

Group President, EMEA & Latin America

Caroline Tillett

Chief Scientific Officer

Charmaine England

Chief Growth Officer

Jan Meurer

Group President, North America

Luani Alvarado

Chief People Officer

Matthew Orlando

General Counsel

Meredith Stevens

Chief Operations Officer

Russell Dyer

Chief Corporate Affairs Officer

Board of directors at Kenvue.

Betsy Holden

Director

Erica Mann

Director

Jeffrey Smith

Director

Kathleen Pawlus

Director

Larry Merlo

Independent Chair of the Board

Melanie Healey

Director

Michael Sneed

Director

Richard Allison

Director

Sarah Hofstetter

Director

Seemantini Godbole

Director

Vasant Prabhu

Director

Research analysts who have asked questions during Kenvue earnings calls.

Andrea Teixeira

JPMorgan Chase & Co.

5 questions for KVUE

Bonnie Herzog

Goldman Sachs

5 questions for KVUE

Filippo Falorni

Citigroup Inc.

5 questions for KVUE

Peter Grom

UBS Group

5 questions for KVUE

Anna Lizzul

Bank of America Corporation

3 questions for KVUE

Javier Escalante Manzo

Evercore ISI

3 questions for KVUE

Korinne Wolfmeyer

Piper Sandler & Co.

3 questions for KVUE

Lauren Lieberman

Barclays

3 questions for KVUE

Nik Modi

RBC Capital Markets

3 questions for KVUE

Steve Powers

Deutsche Bank

3 questions for KVUE

Keith Devas

Jefferies Financial Group Inc.

2 questions for KVUE

Jeremy Fialko

HSBC

1 question for KVUE

Stephen Powers

Deutsche Bank

1 question for KVUE

Stephen Robert Powers

Deutsche Bank

1 question for KVUE

Recent press releases and 8-K filings for KVUE.

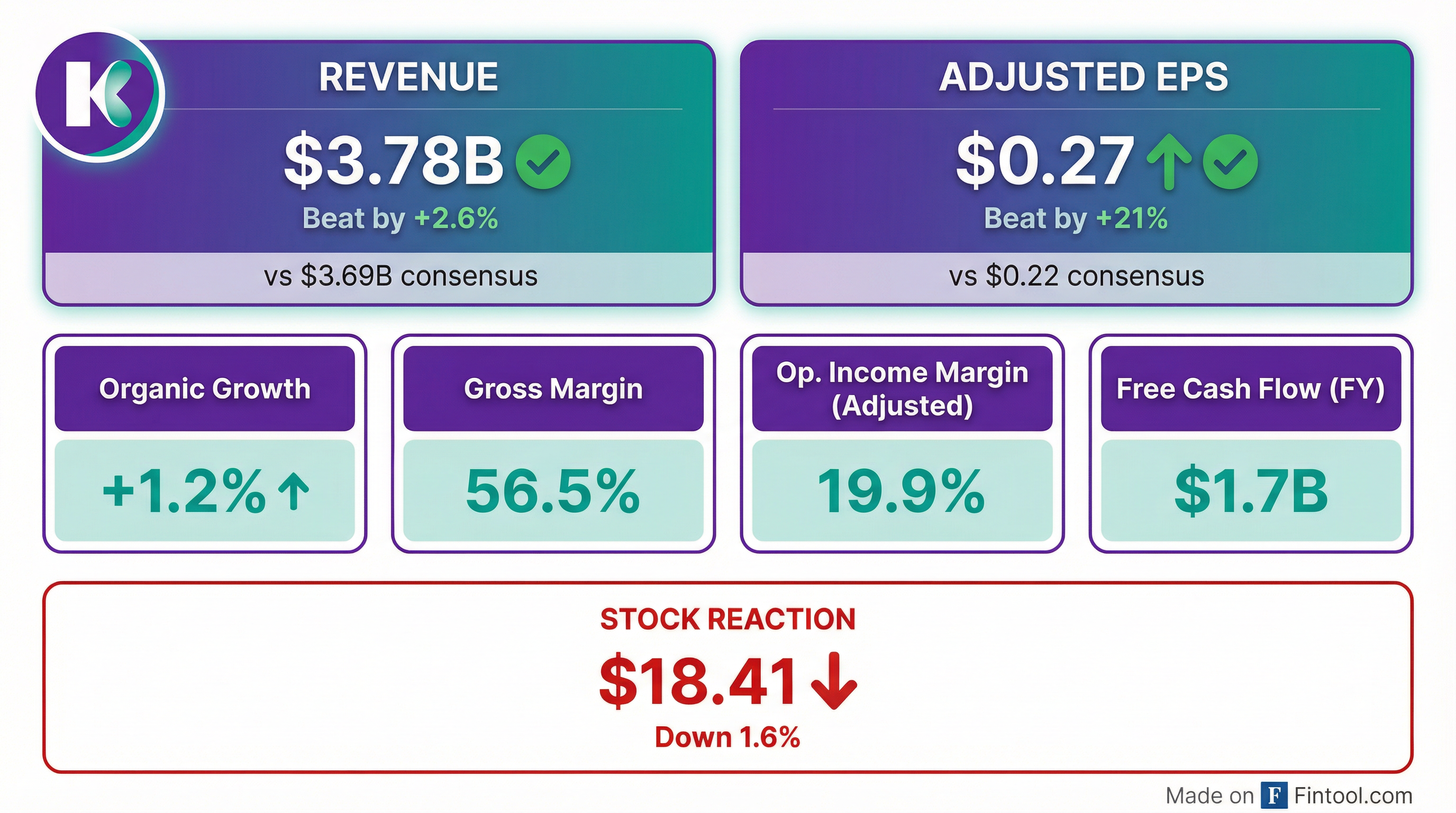

- Revenue of $3.78 billion, up 3.2% year-over-year, with organic sales growth of 1.2%; adjusted EPS of $0.27, missing consensus estimates of $4.11 billion revenue and $0.33 EPS

- By segment, Essential Health led with 6.1% net-sales growth, Skin Health & Beauty grew 2.9%, and Self Care rose 1.5%

- Full fiscal year 2025 net sales fell 2.1% and adjusted diluted EPS was $1.08 versus $1.14 a year earlier

- No forward guidance provided due to a pending acquisition approved by shareholders and HSR clearance; deal expected to close in H2 2026

- Q4 2025 net sales rose 3.2%, including 1.2% organic growth; FY 2025 net sales fell 2.1% (organic -2.2%)

- Q4 2025 diluted EPS was $0.17, adjusted EPS $0.27; FY 2025 diluted EPS was $0.76, adjusted EPS $1.08

- Q4 gross profit margin was 56.5% (adjusted 58.8%) and operating income margin was 14.2% (adjusted 19.9%); FY gross profit margin was 58.1% (adjusted 60.2%) and operating income margin was 16.0% (adjusted 21.0%)

- Kenvue will not provide forward guidance due to its pending cash-and-stock acquisition by Kimberly-Clark, expected to close in H2 2026 pending approvals

- In Q4 2025, net sales rose 3.2% YOY, driven by 1.2% organic sales growth; diluted EPS was $0.17 and adjusted EPS was $0.27.

- For FY 2025, net sales declined 2.1%, with organic sales down 2.2%; diluted EPS stood at $0.76, adjusted EPS at $1.08.

- Full year 2025 operating cash flow reached $2.2 billion, generating $1.7 billion in free cash flow, and total debt was $8.5 billion as of December 28, 2025.

- Kenvue did not provide 2026 guidance due to its pending acquisition by Kimberly-Clark, expected to close in H2 2026.

- 99% of votes cast at Kenvue’s January 29, 2026 Special Meeting approved the Merger Agreement, representing 77% of all outstanding shares.

- 96% of votes cast at Kimberly-Clark’s Special Meeting approved the issuance of KMB shares for the transaction.

- The transaction is expected to close in the second half of 2026, subject to regulatory approvals and customary closing conditions.

- Final vote results remain subject to certification and will be filed in separate Form 8-Ks.

- 1,499,451,317 shares (78.2%) of Kenvue common stock participated, constituting a quorum at the Jan 29, 2026 special meeting.

- Shareholders approved the Agreement and Plan of Merger with Kimberly-Clark, as unanimously recommended by Kenvue’s board.

- The Advisory Compensation Proposal tied to the merger also passed following a non-binding vote.

- Final vote results will be reported in a Form 8-K filed with the SEC.

- Kenvue held a special meeting of stockholders on January 29, 2026 with 1,499,451,317 shares (78.2%) present, constituting a quorum.

- Shareholders approved the Merger Proposal to adopt an Agreement and Plan of Merger with Kimberly-Clark, as unanimously recommended by the board.

- The Advisory Compensation Proposal related to the transaction received non-binding shareholder approval.

- The Adjournment Proposal was not put to vote following the Merger’s approval; final vote results will be filed on Form 8-K.

- Kenvue held a special meeting on January 29, 2026 with 1,499,451,317 shares (78.2%) represented, establishing a quorum for voting.

- The Board unanimously recommended approval of the Merger Agreement with Kimberly-Clark, the Advisory Compensation Proposal, and the Adjournment Proposal.

- Preliminary results show the Merger Proposal and Advisory Compensation Proposal were approved, rendering the Adjournment vote unnecessary; final results will be filed on Form 8-K.

- Kimberly-Clark agreed to acquire Kenvue for an enterprise value of ~$48.7 billion, with Kenvue shareholders receiving $3.50 cash plus 0.14625 K-C shares per share (total consideration of $21.01/share).

- Post-close, K-C shareholders will own ~54% and Kenvue shareholders ~46% of the combined company.

- The deal carries a headline multiple of 14.3x Kenvue LTM Adjusted EBITDA (8.8x effective post-synergies), with fully committed financing targeting ~2.0x net leverage within 24 months.

- Expected synergies of ~$2.1 billion—including $1.9 billion in cost synergies and $0.2 billion in margin flow—drive value creation.

- Transaction is targeted to close in 2H 2026 subject to customary closing conditions and approvals.

- Combines Kimberly-Clark and Kenvue into a global health and wellness leader with pro forma annual revenues of $32 billion and $7 billion EBITDA.

- Deal valued at $48.7 billion, with Kenvue shareholders receiving $3.50 cash plus 0.14625 Kimberly-Clark shares per share (total $21.01), representing 4.3× LTM EBITDA (or 8.8× with $2.1 billion synergies).

- Targets $1.9 billion in cost synergies and $500 million in revenue synergies (net $2.1 billion EBITDA after reinvesting $300 million), to be achieved over 3-4 years, with one-time integration costs of $2.5 billion.

- Expected to close in H2 2026, subject to approvals; pro forma shareholders own 54% Kimberly-Clark and 46% Kenvue, with a leverage ratio goal of ~2× EBITDA within 24 months post-close.

- Kimberly-Clark and Kenvue will combine to form a $32 billion health and wellness leader generating approximately $7 billion in EBITDA pre-synergies and uniting 10 billion-dollar brands serving over a billion consumers globally.

- The transaction values Kenvue at about $48.7 billion, with Kenvue shareholders receiving $3.50 in cash plus 0.14625 Kimberly-Clark shares per Kenvue share (total consideration of $21.01 per share).

- The companies expect to unlock $2.1 billion of annual EBITDA synergies net of reinvestment, including $1.9 billion in cost and $500 million in revenue synergies, reinvesting $300 million; cost synergies to be realized within three years and revenue synergies within four years.

- Financing is structured with the majority in stock, supplemented by $1.8 billion of net proceeds from the Suzano JV to fund the cash component; the combined company targets a ~2× leverage ratio within 24 months and expects mid-single-digit EPS dilution in year one, turning accretive in year two.

- The deal is expected to close in H2 2026 subject to regulatory and shareholder approvals; pro forma ownership will be ~54% Kimberly-Clark and ~46% Kenvue, with three Kenvue directors joining Kimberly-Clark’s board.

Quarterly earnings call transcripts for Kenvue.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more